|

|

600 Travis, Suite 4200

Houston, Texas 77002

713.220.4200 Phone

713.220.4285 Fax

andrewskurth.com

Meredith S. Mouer

mmouer@andrewskurth.com

|

September 17, 2010

H. Christopher Owings

Assistant Director

Securities and Exchange Commission

100 F Street NE

Washington, D.C. 20549

|

Re:

|

Cheniere Energy Partners, L.P.

|

|

|

Registration Statement on Form S-3

|

Dear Mr. Owings:

On behalf of Cheniere Energy Partners, L.P., a Delaware limited partnership (the “Registrant”), we enclose the responses of the Registrant to comments received from the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”) by letter dated September 15, 2010, with respect to the Registrant’s Form S-3 filed on August 19, 2010 (File No. 333-168942) (the “Filing”). For your convenience, the responses are prefaced by the exact text of the Staff’s corresponding comment. Also for your convenience, we are hand delivering five copies of Amendment No. 1 to the Registration Statement (the “Amendment”) to you.

The Registrant acknowledges the following: (i) should the Commission or the Staff, acting pursuant to delegated authority, declare the filing effective, it does not foreclose the Commission from taking any action with respect to the filing; (ii) the action of the Commission or the Staff acting pursuant to delegated authority in declaring the filing effective does not relieve the Registrant from its full responsibility for the adequacy and accuracy of the disclosures in the filing; and (iii) the Registrant may not assert Staff comments and the declaration of the effectiveness as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

Please let us know if you have any questions or if we can provide additional information or otherwise be of assistance in expediting the review process.

| |

|

|

| |

|

Sincerely, |

|

|

|

|

|

|

| |

|

/s/ Meredith S. Mouer |

|

| |

|

Meredith S. Mouer |

|

| |

|

|

|

cc: Meg A. Gentle (Cheniere Energy Partners, L.P.)

Austin Beijing Dallas Houston London New York The Woodlands Washington, DC

Cheniere Energy Partners, L.P.

Form S-3 (File No. 333-168942)

Registrant's Responses to

SEC Comment Letter dated September 15, 2010

General

|

1.

|

We note that you are registering a total of 10,891,351 shares of common units in this offering on behalf of Cheniere Common Units Holding, LLC, which appears to be the parent of you. Given their relationship to you, it appears that Form S-3 is not available to you for purposes of conducting a secondary offering because the offering may not be made on a shelf basis pursuant to Rule 415(a)(1)(i); refer to question 212.15 of the Securities Act Rules Compliance and Disclosure Interpretations. Accordingly, please revise to identify the selling stockholder as an underwriter within the meaning of Section 2(11) of the Securities Act and otherwise revise your prospectus to reflect that this is a primary offering. Alternatively, please tell us why you believe you are able to conduct a secondary offering pursuant to Rule 415(a)(1)(i) on Form S-3.

|

Response:

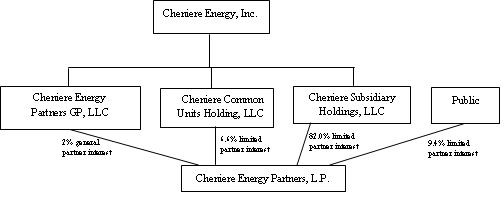

Pursuant to Rule 415(a)(1)(i), an offering of securities may be made if they are “offered or sold solely by or on behalf of a person or persons other than the registrant, a subsidiary of the registrant or a person of which the registrant is a subsidiary.” The selling unitholder is Cheniere Common Units Holding, LLC (the “Selling Unitholder”), which is not a parent or subsidiary of the registrant, Cheniere Energy Partners, L.P. (the “Registrant”). The following graphic illustrates the organizational structure of the applicable entities:

In Compliance and Disclosure Interpretation (“C&DI”) 612.09, the Staff has set forth certain factors that it considers in determining whether an offering styled as a secondary offering should be recharacterized as a primary offering on behalf of an issuer:

|

·

|

how long the selling unitholder has held the common units;

|

|

·

|

the circumstances under which the selling unitholder received the common units;

|

|

·

|

the relationship of the selling unitholder to the issuer;

|

|

·

|

the number of common units being sold;

|

Cheniere Energy Partners, L.P.

Form S-3 (File No. 333-168942)

Registrant's Responses to

SEC Comment Letter dated September 15, 2010

|

·

|

whether the selling unitholder is in the business of underwriting securities; and

|

|

·

|

whether under all of the circumstances it appears that the selling unitholder is acting as a conduit for the issuer.

|

For the reasons set forth below, the Registrant believes that the offering of securities to be registered pursuant to the Registration Statement on behalf of the Selling Unitholder is clearly a secondary offering and not a primary offering and is eligible to be made under Rule 415(a)(1)(i) under the Securities Act of 1933, as amended (the “Securities Act”), as contemplated by the Registration Statement.

Ownership of Common Units

The Registrant’s common units (which represent limited partner interests in the Registrant) that the Selling Unitholder proposes to register were originally issued in March 2007 in connection with the Registrant’s initial public offering. These common units were originally issued to Cheniere LNG Holdings, LLC, an indirect subsidiary of Cheniere Energy, Inc., and subsequently contributed to the Selling Unitholder, a wholly-owned subsidiary of Cheniere LNG Holdings, LLC, in April 2008. Accordingly, the Selling Unitholder has owned all of the common units that it proposes to register on the Registration Statement for more than two years.

The Registrant has included the common units held by the Selling Unitholder in the Registration Statement pursuant to contractual registration rights that the Selling Unitholder has under Section 7.12(c) of the Registrant’s First Amended and Restated Agreement of Limited Partnership, which was entered into more than three years ago. The decision to exercise these registration rights at this time, and the decision to require that all of the Selling Unitholder’s common units be registered with the SEC, were both decisions made by the Selling Unitholder and not by the Registrant. From the point of view of the Registrant, filing the resale shelf portion of the Registration Statement entails incremental legal, accounting and printing costs and filing fees and no offsetting benefits, and the Registrant would not be filing the resale shelf portion of the Registration Statement in the absence of the Selling Unitholder’s exercise of its contractual registration rights. The Registrant will not receive any proceeds, directly or indirectly, from any sale of common units by the Selling Unitholder.

Cheniere Energy Partners, L.P.

Form S-3 (File No. 333-168942)

Registrant's Responses to

SEC Comment Letter dated September 15, 2010

Relationship of the Selling Unitholder to the Registrant

As mentioned above, the Selling Unitholder is neither a parent nor a subsidiary of the Registrant. Although the Selling Unitholder may be considered an “affiliate” of the Registrant through common ownership by Cheniere Energy, Inc., the Staff has taken a no-action position to permit a secondary offering pursuant to Rule 415(a)(1)(i) by shareholders who may be deemed to be affiliates of the issuer. See National Capital Real Estate Trust, SEC No-Action Letter (Oct. 13, 1987). The Staff has also indicated in C&DI 212.15 that affiliates of issuers may make secondary offerings of the issuer’s securities because they are not necessarily treated as being the alter egos of the issuers. In this case, the Selling Unitholder, as a limited partner, has no control over the Registrant. The Registrant has a general partner, with its own board of directors (including independent directors), and the general partner controls the Registrant. The Selling Unitholder has no ownership interest in or control over the general partner.

Number of Common Units Being Sold

Although the Selling Unitholder is registering a large number of common units, this is only one of the factors cited in C&DI 612.09 to be considered when determining whether a secondary offering should be considered a primary offering on behalf of the registrant. Where an offering otherwise constitutes a secondary offering, there is nothing inherent in the registration of a large number of common units by a selling unitholder that transmutes a secondary offering into a primary offering–the number of securities registered is just one possible indicator that an offering styled as a secondary offering might instead be a primary transaction. For the reasons set forth in this response, we believe that the common units being registered for resale by the Selling Unitholder are clearly being registered for the benefit of the Selling Unitholder, which has held its common units for over two years, and not for the benefit of, or otherwise on behalf of, the Registrant.

The Registrant also notes that it is eligible to use Form S-3 itself for offering common units for its own account. The Registrant is aware of the Staff’s concern that, in other situations, investors have acquired restricted securities and have sought to dispose of such securities in a secondary offering registered on Form S-3 although the issuer itself it not eligible to use Form S-3. Here, the Registrant is eligible and the Selling Unitholder has held the common units to be registered for over two years. Thus, this case does not involve the type of situation with which the Staff has been concerned. On the contrary, in this case, if the proposed offering by the Selling Unitholder was registered for sale on the Registrant’s behalf, the Registrant believes that investors could be misled or mistakenly infer that the number of outstanding common units would be increased by the sale of the common units held by the Selling Unitholder or that the Registrant would receive the proceeds from that offering. In fact, the proposed sale by the Selling Unitholder would have no effect on the number of outstanding common units or, importantly, on the ability of the Registrant to continue its current level of distributions on each common unit. Likewise, the proposed sale by the Selling Unitholder would not

Cheniere Energy Partners, L.P.

Form S-3 (File No. 333-168942)

Registrant's Responses to

SEC Comment Letter dated September 15, 2010

result in any cash proceeds to the Registrant, now or at any time in the future, either directly or indirectly. Unlike a subsidiary that receives funding from its parent, the Registrant does not receive any funding from the Selling Unitholder, whether in the form of capital contributions or loans, and does not expect to do so at any time in the future.

Business of Underwriting

The Selling Unitholder is not an “underwriter.” The term underwriter under Section 2(11) of the Securities Act includes any person who has purchased securities from an issuer with a view to the distribution of the securities. As described above, the Selling Unitholder has held the common units for more than two years. It acquired the common units with investment intent and not with a view to distribute such common units. As described above, the registration of the common units is solely for the account of the Selling Unitholder and not for the benefit of the Registrant. Accordingly, the Registrant believes that the Selling Unitholder is not an “underwriter” as defined in the Securities Act.

Conduit for the Issuer

In light of the fact that the Selling Unitholder has held the common units for more than two years and the units were originally issued by the Registrant more than three years ago, the Selling Unitholder clearly made a long-term investment in the Registrant. The Registrant will receive no proceeds or any benefit from the sale of the common units held by the Selling Unitholder. The Selling Unitholder is in no sense the alter ego of the Registrant or acting as a conduit for the Registrant. The proposed resale shelf registration has none of the indicia of abuse on which the Staff has focused in the past when evaluating whether secondary offerings are actually disguised primary offerings. The decision to exercise the Selling Unitholder’s contractual registration rights and file the resale portion of the Registration Statement was made by the Selling Unitholder and not by the Registrant.

Conclusion

For the reasons discussed above, the Registrant respectfully submits that the offering by the Selling Unitholder should be viewed as a secondary offering pursuant to Rule 415(a)(1)(i) of Regulation C.

Cheniere Energy Partners, L.P.

Form S-3 (File No. 333-168942)

Registrant's Responses to

SEC Comment Letter dated September 15, 2010

Material Tax Consequences, page 47

|

2.

|

Please provide, in this section, the disclosures set forth in Guide 5 under Item 12G Tax Liabilities in Later Years and Item 12K Liquidation or Termination of the Partnership or tell us why it is not appropriate for you to do so.

|

Response:

In response to this comment, we have enhanced the disclosure on page 50 of the Amendment.

Item 17, Undertakings, page II-2

|

3.

|

Please provide the undertakings in Item 20 of Guide 5 - Preparation of Registration Statements Relating to Interests in Real Estate Limited Partnerships that apply to you. Please refer to Securities Act Release 33-6900 (June 17, 1991).

|

Response:

In response to this comment, we have revised the undertakings accordingly on page II-4 of the Amendment.

Exhibit 5.1

|

4.

|

The legal opinion states on page 5 that “[t]his legal opinion is expressed as of the date hereof, and we disclaim any undertaking to advise you of any subsequent changes of the facts stated or assumed herein or any subsequent changes in applicable law…” Please be advised that in order for your registration statement to be declared effective, it will be necessary for counsel to file an opinion dated as of the effective date. Alternatively, counsel should remove the limitations from the opinion at least at it relates to the opinion rendered as to the Secondary Common Units.

|

Response:

In response to this comment, we have revised the referenced sentence in Exhibit 5.1 filed with the Amendment to clarify that the opinion will be current as of the effective date of the registration statement.

Cheniere Energy Partners, L.P.

Form S-3 (File No. 333-168942)

Registrant's Responses to

SEC Comment Letter dated September 15, 2010

|

5.

|

We also note the assumption you included in the final sentence of the final paragraph. Please either remove this assumption or advise why it is not appropriate for you to do so and revise the statement to make it clear what you are assuming.

|

Response:

In response to this comment, we have removed the referenced assumption in Exhibit 5.1 filed with the Amendment.

Exhibit 8.1

|

6.

|

We note that tax opinion states on page 2 that “[o]ur opinion is rendered as of the date hereof and we assume no obligation to update or supplement this opinion or any matter related to this opinion to reflect any change of fact, circumstances, or law after the effective date of the Registration Statement.” Please be advised that in order for you to become effective, it will be necessary for counsel to file an opinion dated as of the effective date. Alternatively, counsel should remove this limitation from the opinion.

|

Response:

In response to this comment, we have revised the referenced sentence in Exhibit 8.1 filed with the Amendment to clarify that the opinion will be current as of the effective date of the registration statement.