UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of

1934

Date

of

Report (Date of earliest event reported): November 14,

2007

|

CHENIERE

ENERGY PARTNERS, L.P.

|

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

1-33366

|

|

20-5913059

|

|

(State

or other jurisdiction of incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S.

Employer Identification No.)

|

| |

|

700

Milam Street

Suite

800

Houston,

Texas

|

77002

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

| |

|

Registrant’s

telephone number, including area code: (713)

375-5000

|

Check

the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

□ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

□ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

□

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.14d-2(b))

|

|

□

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

|

Item

7.01. Regulation FD

Disclosure.

On

November 14, 2007, Cheniere Energy Partners, L.P. presented its corporate

presentation. The corporate presentation is attached as Exhibit 99.1

to this report and is incorporated by reference into this Item

7.01.

The

information included in this Item 7.01 of this Current Report on Form 8-K shall

not be deemed "filed" for purposes of Section 18 of the Securities Exchange

Act

of 1934, as amended (the "Exchange Act"), or incorporated by reference in any

filing under the Securities Act of 1933, as amended, or the Exchange Act, except

as shall be expressly set forth by specific reference in such

filing.

Item

9.01 Financial Statements and

Exhibits.

d) Exhibits

|

Exhibit

Number

|

Description |

|

99.1

|

Corporate

presentation, dated November 14,

2007.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant

has

duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

CHENIERE

ENERGY PARTNERS, L.P.

|

|

| |

|

|

| |

By:

Cheniere Energy Partners GP, LLC,

|

|

| |

|

|

|

|

|

|

/s/

Don A. Turkleson

|

|

| |

|

Name:

Don A. Turkleson

|

|

| |

|

Title: Senior

Vice President and Chief Financial Officer

|

|

| |

|

|

|

|

Exhibit

Number

|

Description |

|

99.1

|

Corporate

presentation, dated November 14,

2007.*

|

Cheniere

Energy Partners November 2007 CHENIERE ENERGY PARTNERS ,L

.P. Corpus Christi LNG, LLC Cheniere Energy, Inc. 100% Artist’s

Rendition Creole Trail LNG, L.P. Cheniere Energy, Inc.

100% Freeport LNG Development, L.P. Cheniere Energy, Inc.

30% Sabine Pass LNG, L.P. Cheniere Energy Partners,

L.P. Cheniere Energy, Inc. 91%

2 This

presentation contains certain statements that are, or may be deemed to be,

“forward-looking statements” within the meaning of Section 27A of the Securities

Act and Section 21E of the Securities Exchange Act of 1934, as amended, or

the Exchange Act. All statements, other than statements of historical facts,

included herein are “forwardlooking statements.” Included among

“forward-looking statements” are, among other things: statements

that we expect to commence or complete construction of each or any of our

proposed liquefied natural gas, or LNG, receiving terminals by certain

dates, or at all; statements that we expect to receive authorization

from the Federal Energy Regulatory Commission, or FERC, to construct and operate

proposed LNG receiving terminals by a certain date, or at all;

statements regarding future levels of domestic natural gas production and

consumption, or the future level of LNG imports into North America, or regarding

projected future capacity of liquefaction or regasification, liquifaction

utilization or total monthly LNG trade facilities worldwide, regardless of

the

source of such information statements regarding any financing

transactions or arrangements, whether on the part of Cheniere or at the project

level; statements relating to the construction of our proposed LNG

receiving terminals, including statements concerning estimated costs, and

the engagement of any EPC contractor; statements regarding any

Terminal Use Agreement, or TUA, or other commercial arrangements presently

contracted, optioned, marketed or potential arrangements to be performed

substantially in the future, including any cash distributions and revenues

anticipated to be received; statements regarding the commercial terms and

potential revenues from activities described in this presentation;

statements regarding the commercial terms or potential revenue from any

arrangements which may arise from the marketing of uncommitted capacity

from any of the terminals, including the Creole Trail and Corpus Christi

terminals which do not currently have contractual commitments;

statements regarding the commercial terms or potential revenue from any

arrangement relating to the proposed contracting for excess or

expansion capacity for the Sabine Pass LNG Terminal or the Indexed Purchase

Agreement (“IPA”) or LNG spot purchase examples described in this

presentation; statements that our proposed LNG receiving terminals,

when completed, will have certain characteristics, including amounts of

regasification and storage capacities, a number of storage tanks and docks

and pipeline interconnections; statements regarding Cheniere and

Cheniere Marketing forecasts, and any potential revenues and capital

expenditures which may be derived from any of Cheniere business

groups; statements regarding Cheniere Pipeline Company, and the

capital expenditures and potential revenues related to this business group;

statements regarding our proposed LNG receiving terminals’ access to

existing pipelines, and their ability to obtain transportation capacity on

existing pipelines; statements regarding the Louisiana Natural Gas Header,

and its potential business opportunities statements regarding

possible expansions of the currently projected size of any of our proposed

LNG

receiving terminals; statements regarding the payment by Cheniere

Energy Partners, L.P. of cash distributions; statements regarding

our business strategy, our business plan or any other plans, forecasts,

examples, models, or objectives; any or all of which are subject to

change; statements regarding estimated corporate overhead expenses;

and any other statements that relate to non-historical

information. These forward-looking statements are often identified by the

use of terms and phrases such as “achieve,” “anticipate,” “believe,” “estimate,”

“example,” “expect,” “forecast,” “opportunities,” “plan,” “potential,”

“project,” “propose,” “subject to,” and similar terms and phrases. Although we

believe that the expectations reflected in these forwardlooking statements

are reasonable, they do involve assumptions, risks and uncertainties, and these

expectations may prove to be incorrect. You should not place undue reliance

on these forward-looking statements, which speak only as of the date of this

presentation. Our actual results could differ materially from those anticipated

in these forward-looking statements as a result of a variety of factors,

including those discussed in “Risk Factors” in the Cheniere Energy, Inc. Annual

Report on Form 10-K for the year ended December 31, 2006, which are

incorporated by reference into this presentation. All forward-looking statements

attributable to us or persons acting on our behalf are expressly qualified

in their entirety by these ”Risk Factors”. These forward-looking statements are

made as of the date of this presentation, and we undertake no obligation

to publicly update or revise any forward-looking

statements. Safe Harbor Act

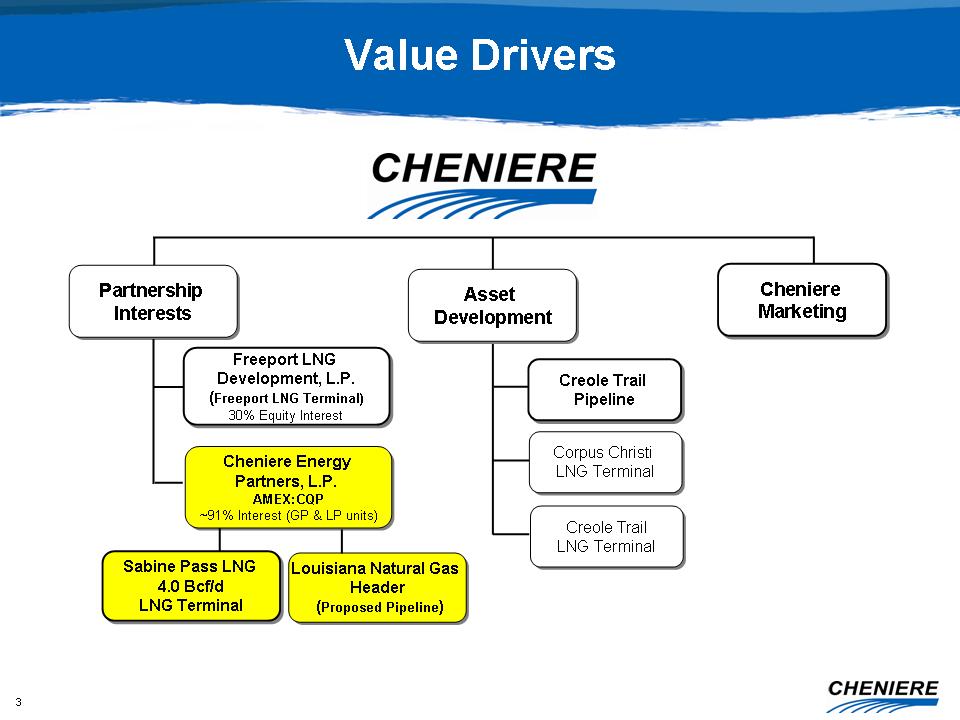

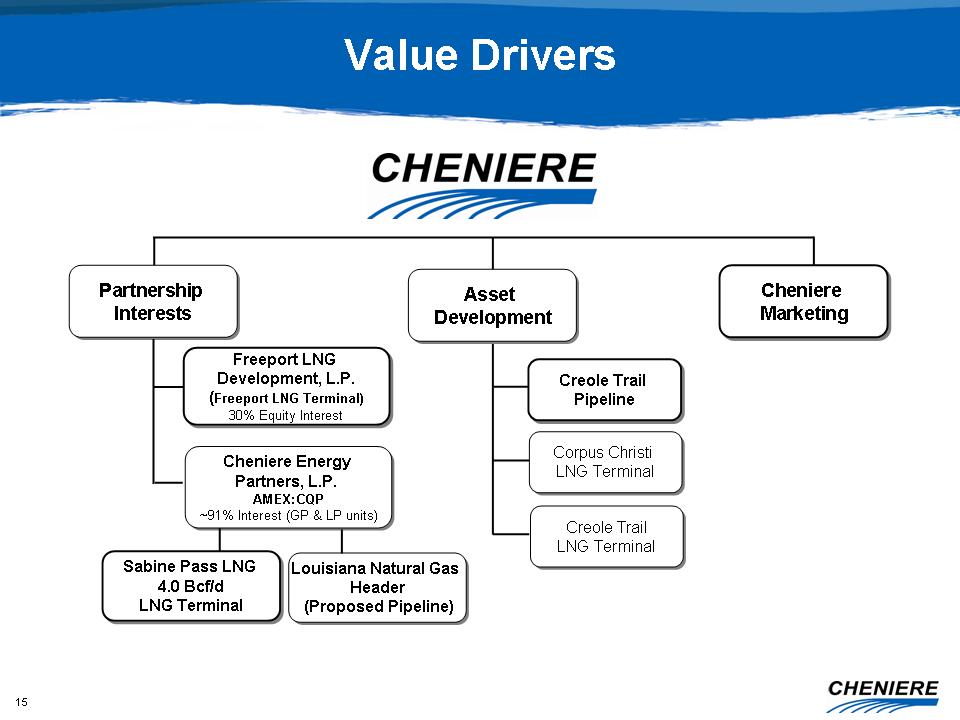

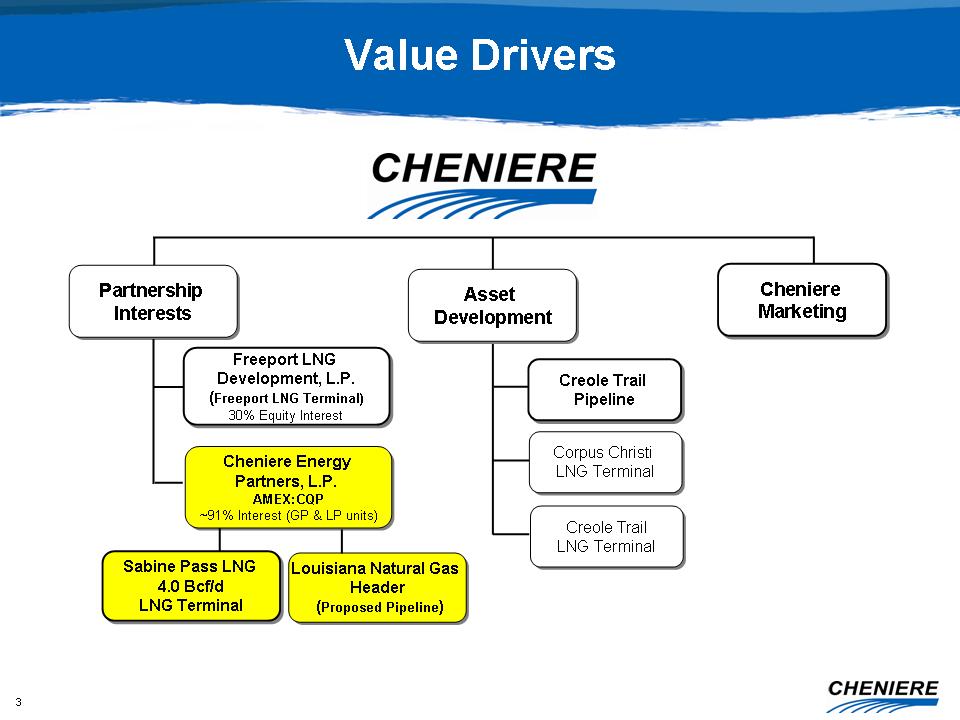

3 Value

Drivers Cheniere Marketing Cheniere Marketing Asset Development Asset Development Partnership Interests Partnership Interests Sabine

Pass LNG 4.0 Bcf/d LNG Terminal Sabine Pass LNG 4.0

Bcf/d LNG Terminal Cheniere Energy Partners,

L.P. AMEX:CQP 91% Interest (GP & LP units) Cheniere

Energy Partners, L.P. AMEX:CQP 91% Interest (GP & LP

units) Creole Trail LNG Terminal Creole Trail LNG

Terminal Creole Trail Pipeline Creole

Trail Pipeline Corpus Christi LNG Terminal Corpus

Christi LNG Terminal Freeport LNG Development,

L.P. (Freeport LNG Terminal) 30% Equity Interest Freeport

LNG Development, L.P. (Freeport LNG Terminal) 30% Equity

Interest Louisiana Natural Gas Header (Proposed

Pipeline) Louisiana Natural Gas Header (Proposed

Pipeline)

4 CQP

Investment Highlights Stable, 20-year cash flows under take-or-pay

contracts Strong natural gas fundamentals support increased LNG

imports Largest LNG receiving terminal in North America when

complete Fully-funded construction costs; leading EPC

contractors Focusing on strategic development projects

Strong sponsorship from parent supported by 90% ownership

Experienced management team

5 Sabine

Pass LNG 4 Bcf/d Receiving Terminal Sabine Pass Construction Site

– November 2007 Land – 853 acres in Cameron Parish, LA

Accessibility – Deep Water Ship Channel – Sabine River Channel dredged to

40 feet Proximity – 3.7 nautical miles from coast – 22.8

nautical miles from outer buoy Berthing/Unloading – 2

docks – LNGCs up to 265,000 cm – 4 dedicated tugs

Storage – Phase I: 3 x 160,000 cm (10.1 Bcfe) – Phase II: 2 x 160,000

cm (6.7 Bcfe) Vaporization – Phase I: 2.6 Bcf/d – Phase

II: 1.4 Bcf/d Potential Pipeline Access (Interstate) – Access

to NE, MW, SE, & Mid-Atlantic markets – 14 Bcf/d Within 150

Miles Regional Market - Strong Gas Demand – Port Arthur,

Beaumont, Orange, Lake Charles

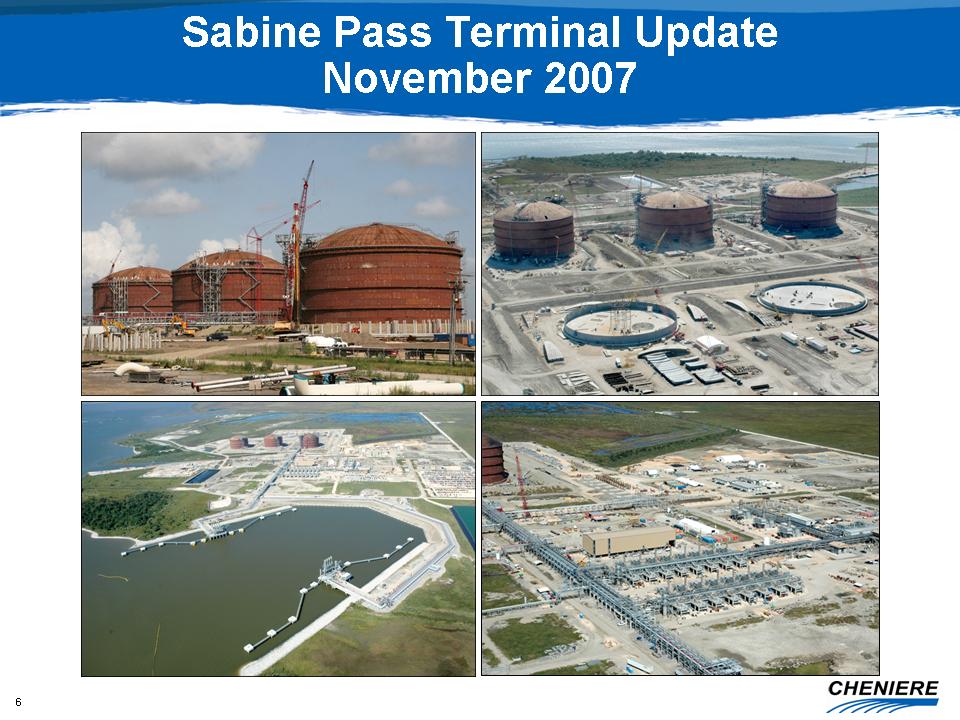

6 Sabine Pass

Terminal Update November 2007

7 Key

Milestones Q3 2008 Expected completion of Phase 1 (2.6

Bcf/d) April 2009 Expected start of Total

TUA payments ( $125 million per year) July

2009 Expected start of Chevron TUA payments ( $125

million per year) Q2 2008 Expected start of

Cheniere Marketing TUA payments ($5 million

per month) 2008 January 2009 Expected start of full

Cheniere Marketing TUA payments ( $250 million per

year) Q2 2008 Expected start of Phase

1 commercial operation Q3

2009 Expected completion of Phase 2 – Stage 1 (4.0

Bcf/d) 2009 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1

8 Agreements

Provide Stable Cash Flows (1) Fees do not vary with the actual quantity of

LNG processed; tax reimbursement not included in the fees. (2) No inflation

adjustments. (3) Subject to annual inflation adjustment. (4) Subject

to terminal completion. (5) Cheniere Marketing TUA payments for 2008 will

be $5.0 million per month and will increase to $0.32/MMBtu starting

1/1/09. 20-year Terminal Use Agreements provide visibility for cash

distributions. Total LNG Chevron USA Cheniere Marketing Capacity 1.0

Bcf/d 1.0 Bcf/d 2.0 Bcf/d Fees(1) Reservation Fee(2) $0.28/MMBTU

$0.28/MMBTU $0.28/MMBTU Opex Fee(3) $0.04/MMBTU $0.04/MMBTU

$0.04/MMBTU 2010 Full-Year Revenues $126 million $130 million

$256 million Term 20 years 20 years 20 years Guarantor Total

S.A. Chevron Corp. Cheniere Guarantor Credit Rating Aa1/AA Aa2/AA

NR/B Payment Start Date April 1, 2009(4) July 1, 2009(4) April 1, 2008

(4)(5)

9 Estimated

CQP Cash Flow Summary Phase 1 Completed Phase

2 Completed (1) Twelve months ended June 30, 2010. (US$ Millions)

For the twelve months ended December 31, 2007e 2008e 2009e 2010e

(1) Revenue $0 $48 $415 $511 EBITDA (13) 9 369 461 Cash Received

from Sabine Pass 0 0 257 308 Annual Distributions to Unit Holders 34

46 257 281 Reserve Account Balance $66 $22 -- -- Quarterly Cash

Distributions per Unit $0.425 $0.425 $0.425 $0.425

10 Target

Market Access Midwest Markets Midwest Midwest Markets

Markets Northeast Markets Northeast Northeast Markets

Markets Southeast Markets Southeast Southeast Markets

Markets Gulf Coast Markets Gulf Coast Gulf

Coast Markets Markets Mexican Markets Mexican

Mexican Markets Markets

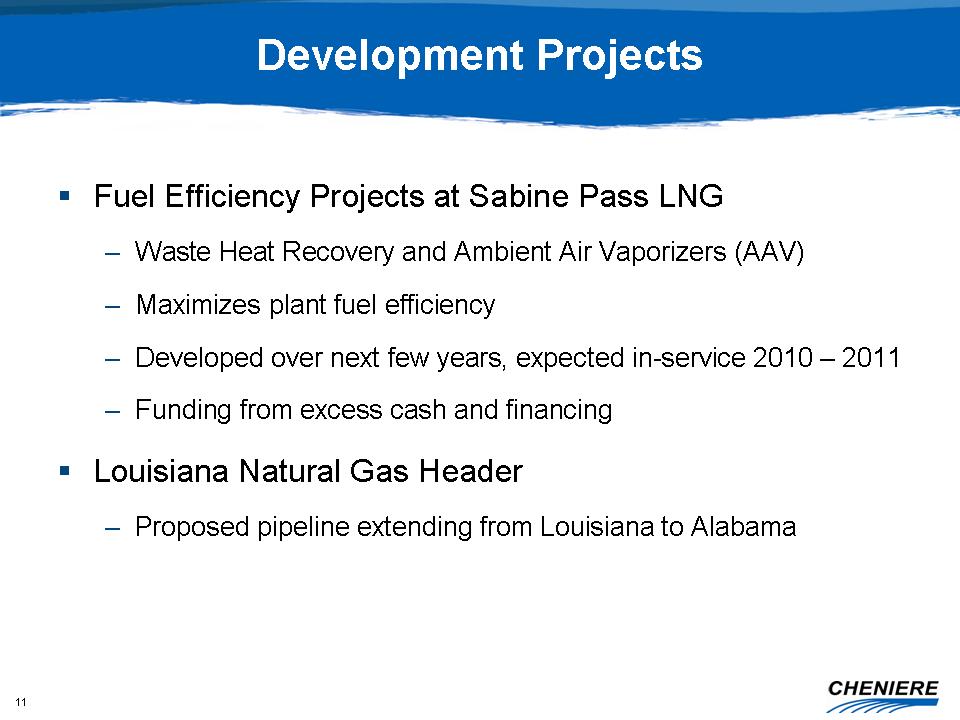

11 Development

Projects Fuel Efficiency Projects at Sabine Pass LNG – Waste

Heat Recovery and Ambient Air Vaporizers (AAV) – Maximizes plant fuel

efficiency – Developed over next few years, expected in-service 2010 –

2011 – Funding from excess cash and financing Louisiana

Natural Gas Header – Proposed pipeline extending from Louisiana to

Alabama

12 Louisiana

Natural Gas Header Proposed Pipeline After construction

completion it will provide supply diversity – Access to new and existing

LNG gas supply in and around Louisiana; nearly 10 Bcf/d regas capacity by

2010 – Access to traditional offshore, onshore and recently developed

unconventional supply Connect to growing Southeast demand

markets – Natural gas demand expected to increase driven by electric

generation – Incremental natural gas necessary to satisfy new electric

generation in Florida alone is estimated at

1Bcf/d 330-mile long proposed interstate pipeline system

comprised of both 42-inch and 36-inch diameter pipeline

Expected in-service date as early as mid 2010 Non-binding open

season held from November 15 to January 15 to gauge prospective shipper

interest

13 Dq SESH

- Lucedale SONAT Gulf South FGT 11 Tennessee

Dequincy TGC, TETCO, Transco 45, Sempra, Liberty

Storage Cheniere Sabine Pass LNG Johnson Bayou NGPL,

Bridgeline, SWLateral TETCO FGT Tennessee Scale -

Approximate 0 40 60 miles 20 FGT 9 Am LIG Louisiana Natural

Gas Header Gulfstream Eunice ANR, TxGas, Egan

Storage, Pine Prairie Storage Transco 65 Louisiana

Natural Gas Header Creole Trail – Under Construction Creole

Trail – FERC Authorized

14 Cheniere

Energy, Inc.

15 Value

Drivers Cheniere Marketing Cheniere Marketing Asset Development Asset Development Partnership Interests Partnership Interests Sabine

Pass LNG 4.0 Bcf/d LNG Terminal Sabine Pass LNG 4.0

Bcf/d LNG Terminal Cheniere Energy Partners,

L.P. AMEX:CQP 91% Interest (GP & LP units) Cheniere

Energy Partners, L.P. AMEX:CQP 91% Interest (GP & LP

units) Creole Trail LNG Terminal Creole Trail LNG

Terminal Creole Trail Pipeline Creole

Trail Pipeline Corpus Christi LNG Terminal Corpus

Christi LNG Terminal Freeport LNG Development,

L.P. (Freeport LNG Terminal) 30% Equity Interest Freeport

LNG Development, L.P. (Freeport LNG Terminal) 30% Equity

Interest Louisiana Natural Gas Header (Proposed

Pipeline) Louisiana Natural Gas Header (Proposed

Pipeline)

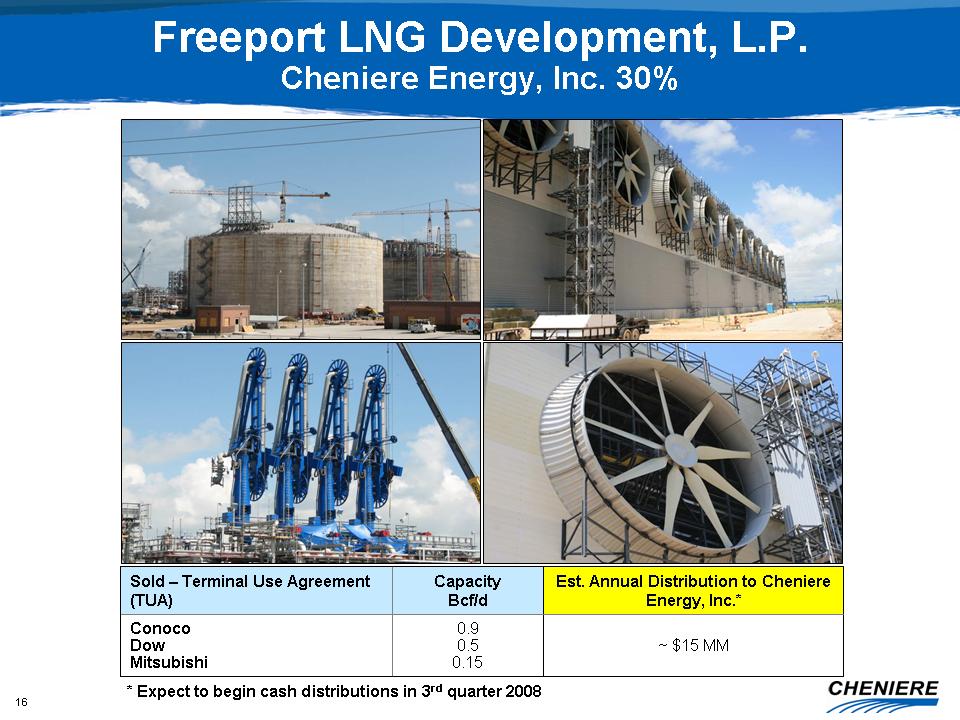

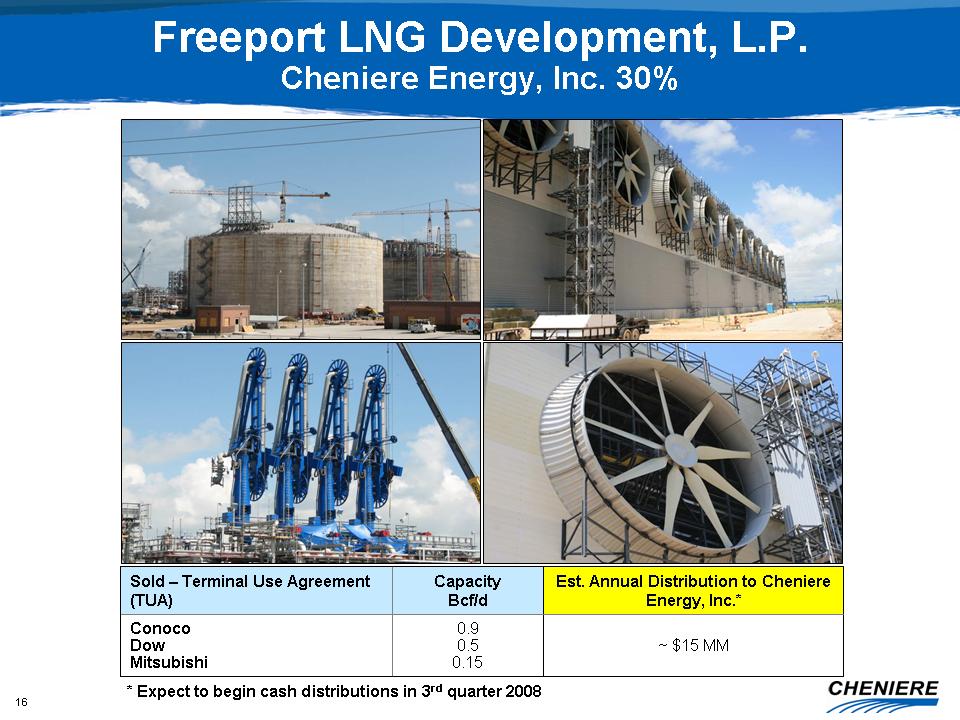

16 Freeport

LNG Development, L.P. Cheniere Energy, Inc.

30% 0.9 0.5 0.15 Capacity Bcf/d $15

MM Conoco Dow Mitsubishi Est. Annual Distribution to

Cheniere Energy, Inc. Sold – Terminal Use Agreement (TUA)

Expect to begin cash distributions in 3rd quarter 2008

17 Sabine

PL Targa Transco Gulf South Trunkline Jefferson

Island Storage Sabine Pass LNG Terminal Phase I – 2Q

2008 Phase II – 2Q 2009 Sabine Pass LNG Terminal Phase I –

2Q 2008 Phase II – 2Q 2009 Creole Trail LNG Terminal Creole

Trail LNG Terminal Henry

Hub Varibus NGPL Transco Bridgeline Tennessee Florida

Gas Creole Trail

Pipeline Liberty Storage Starks Storage Hackberry Storage Texas

Eastern Gulf Coast Markets Northeast Markets Southeast

Markets Midwest / Great Lakes Markets Connects with Henry

Hub Gulf of Mexico Gulf of Mexico 4Q 2007 ANR Texas

Gas Transco Florida Gas Columbia

Gulf Cypress Egan Storage Pine Prairie Energy

Center Tennessee 2Q 2008 M.P. 58 Creole Trail – MP

58 Creole Trail – Phase II Potential Pipeline

Interconnects:

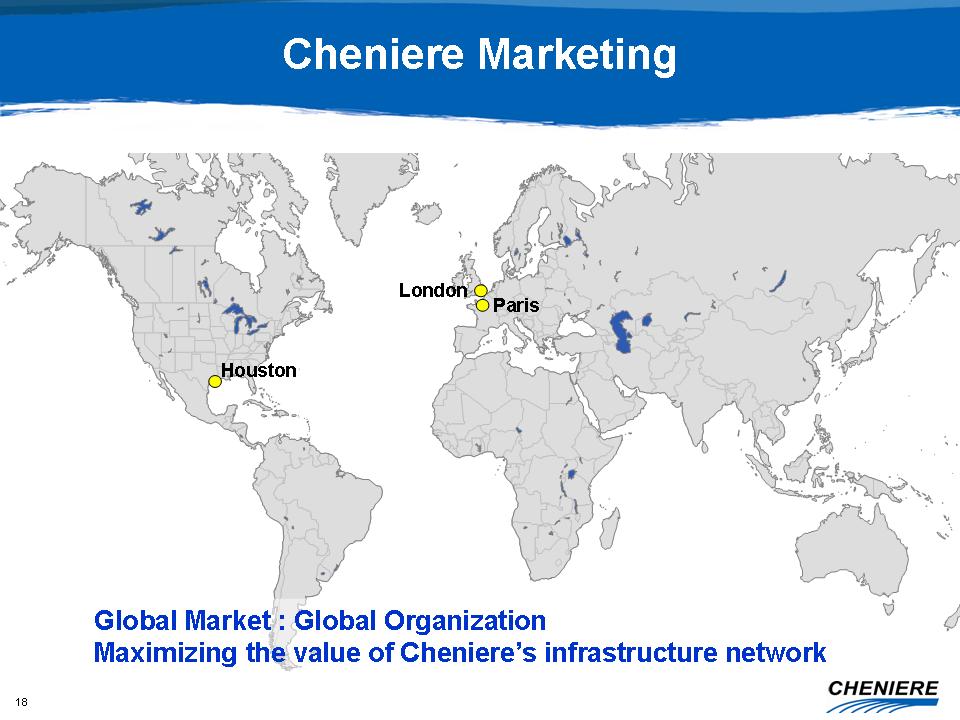

18 Cheniere

Marketing Houston London Paris Global Market : Global

Organization Maximizing the value of Cheniere’s infrastructure

network

19 Everett

Everett Cove Point Cove Point Elba Island Elba

Island Lake Charles Lake Charles Sabine Pass Sabine

Pass Freeport Freeport Golden Pass Golden Pass Cameron

Cameron Costa Azúl Costa Azúl Canaport

Canaport Existing Under Construction Altamira

Altamira Source: Websites of Terminal Owners, Wood Mackenzie Limited, Poten

& Partners Altamira 700 Shell, Total Costa Azul

1,000 Shell, Sempra Canaport 1,000 Irving, Repsol Total

16,800 Golden Pass 2,000 ExxonMobil, ConocoPhillips, QP Cameron

1,500 Sempra, ENI Sabine Pass 4,000 Total, Chevron,

Cheniere Freeport 1,500 ConocoPhillips, Dow Lake Charles - BG

1,800 Elba Island 800 BG, Marathon, Shell Cove Point

1,800 BP, Statoil, Shell Everett - Suez

700 Baseload Sendout (MMcf/d) Terminal Capacity

Holder North America Onshore Regasification Capacity By 2010 15.8

Bcf/d North American Atlantic Basin capacity @ 65% utilization =

10.3 Bcf/d

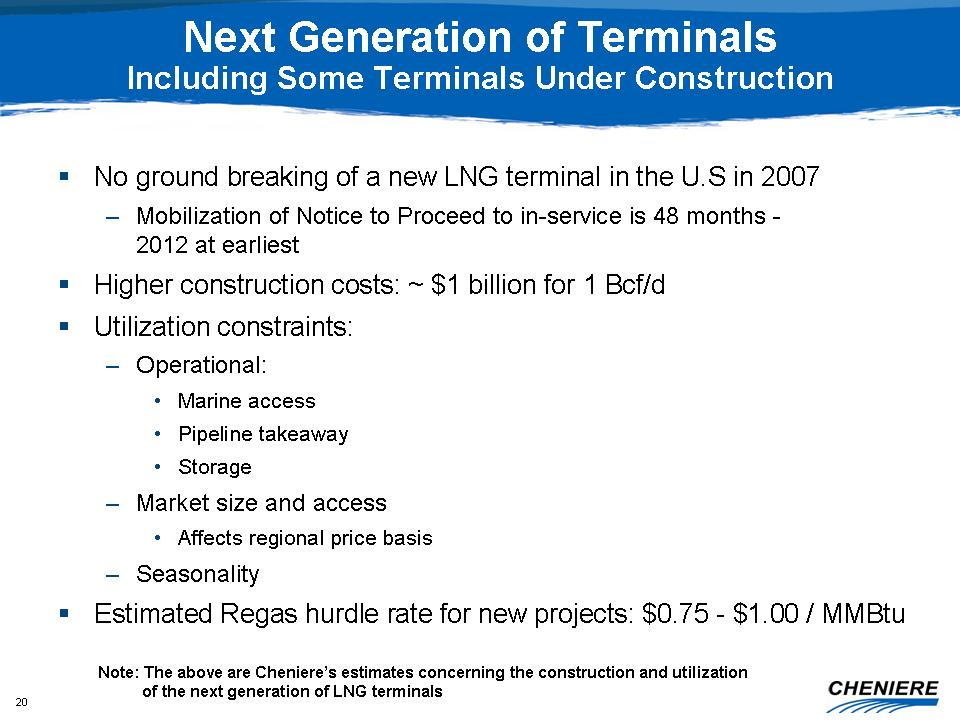

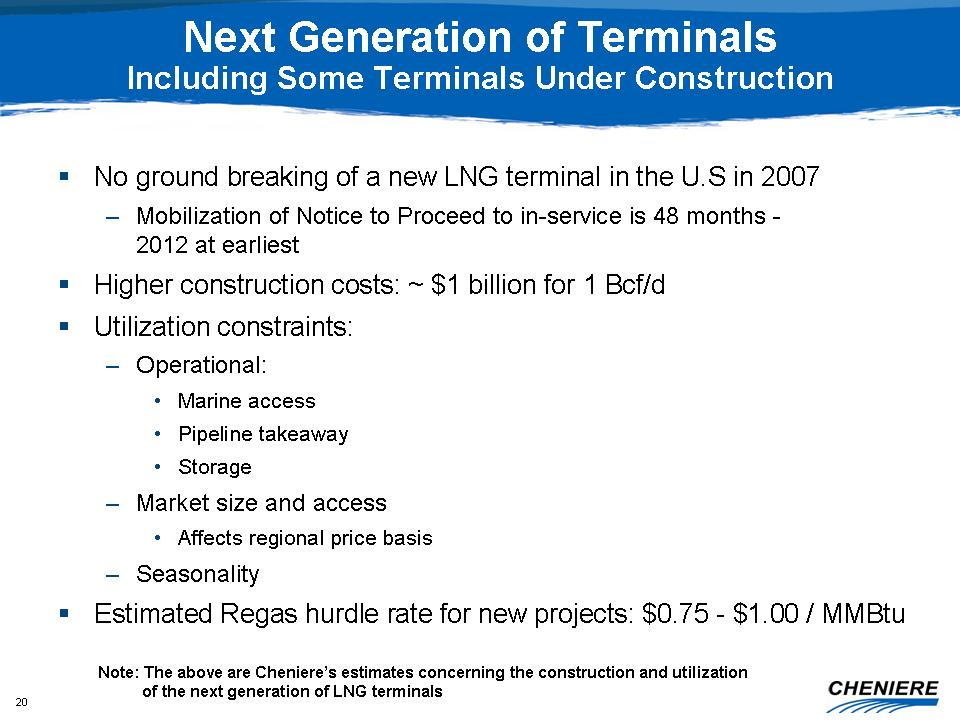

20 Next

Generation of Terminals Including Some Terminals Under

Construction No ground breaking of a new LNG terminal in the U.S in

2007 – Mobilization of Notice to Proceed to in-service is 48 months

- 2012 at earliest Higher construction costs: $1 billion

for 1 Bcf/d Utilization constraints: – Operational:

Marine access Pipeline takeaway Storage – Market size and

access Affects regional price basis – Seasonality

Estimated Regas hurdle rate for new projects: $0.75 - $1.00 / MMBtu Note:

The above are Cheniere’s estimates concerning the construction and

utilization of the next generation of LNG terminals

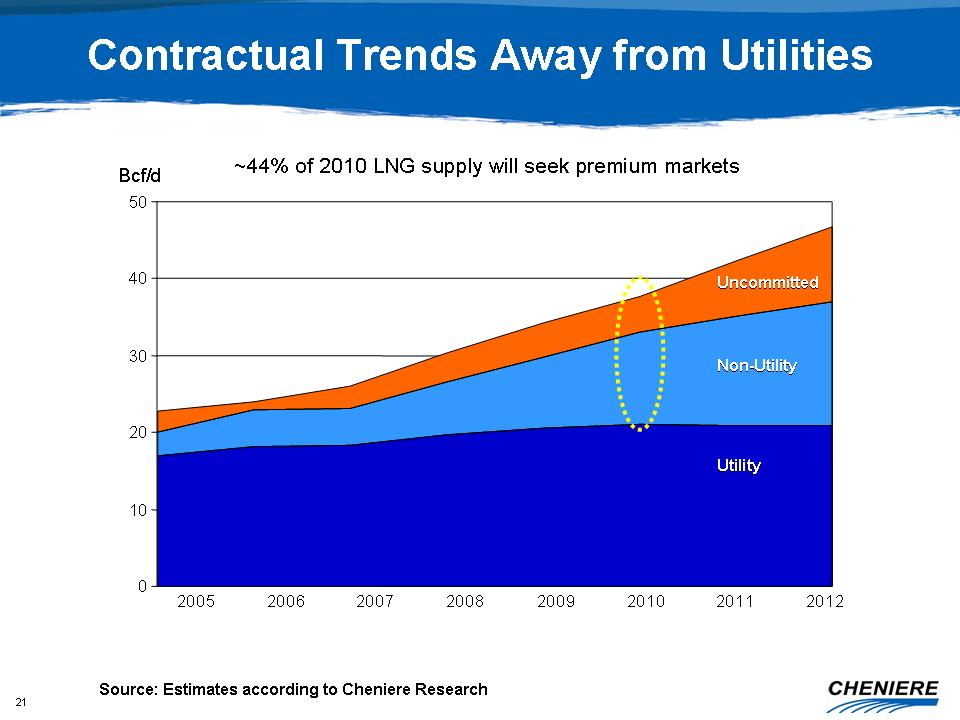

21 Contractual

Trends Away from

Utilities 0 10 20 30 40 50 Bcf/d 2005

2006 2007 2008 2009 2010 2011 2012 Non-Utility Non-Utility Uncommitted

Uncommitted Utility Utility 44% of 2010 LNG supply will seek premium

markets Source: Estimates according to Cheniere Research

22 Demand

Seasonality Gas demand is growing in seasonal markets that cannot service

their swing with storage The U.S. Gulf Coast provides a complementary

market to baseload European LNG buyers Source: IEA 2006 Demand -

Bcf/d 0 5 10 15 20 25 30 Jan Feb Mar Apr

May Jun Jul Aug Sep Oct Nov

Dec Belgium Spain France UK US GC

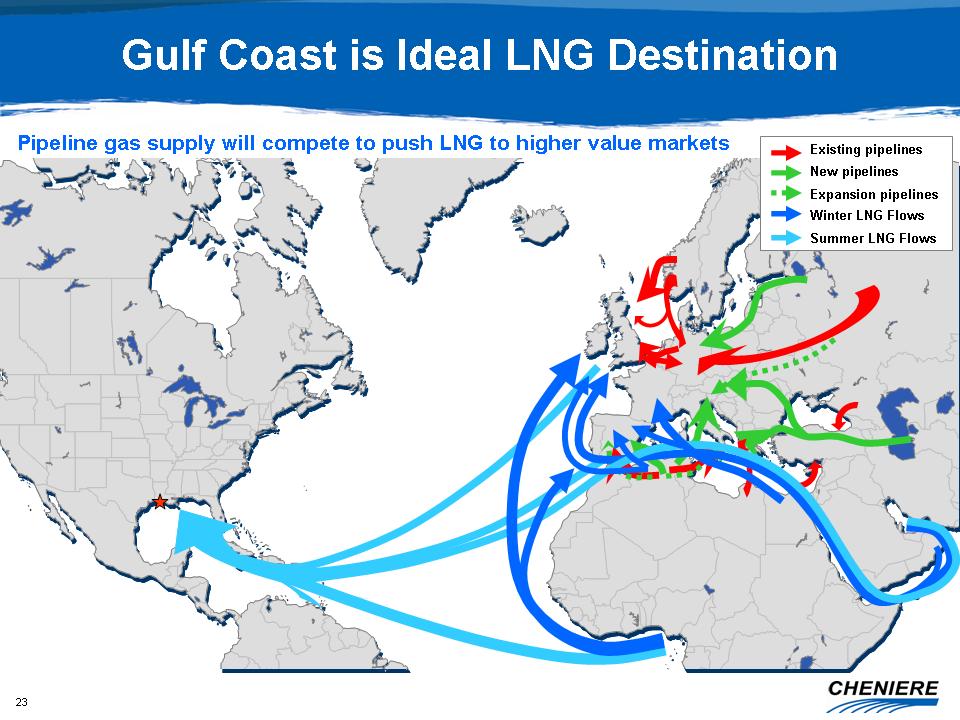

23 Gulf Coast

is Ideal LNG Destination Pipeline gas supply will compete to push LNG to

higher value markets Existing pipelines New pipelines Expansion

pipelines Winter LNG Flows Summer LNG Flows

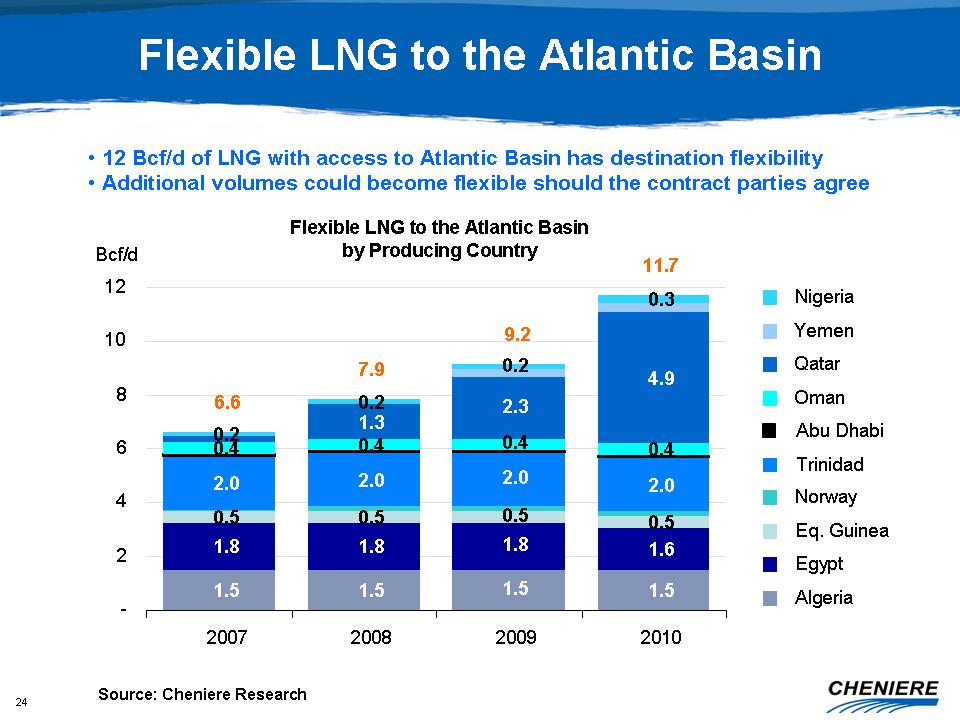

24 1.5

1.5 1.5 1.5 1.8 1.8 1.8 1.6 0.5 0.5 0.5 0.5 2.0 2.0 2.0

2.0 0.4 0.4 0.4

0.4 1.3 2.3 4.9 0.2 0.2 0.2 0.3 9.2 11.7 7.9 6.6 - 2 4 6 8 10 12 2007

2008 2009 2010 Bcf/d Nigeria Yemen Qatar Oman Abu

Dhabi Trinidad Norway Eq.

Guinea Egypt Algeria Flexible LNG to the Atlantic

Basin Flexible LNG to the Atlantic Basin by Producing Country 12

Bcf/d of LNG with access to Atlantic Basin has destination

flexibility Additional volumes could become flexible should the contract

parties agree Source: Cheniere Research

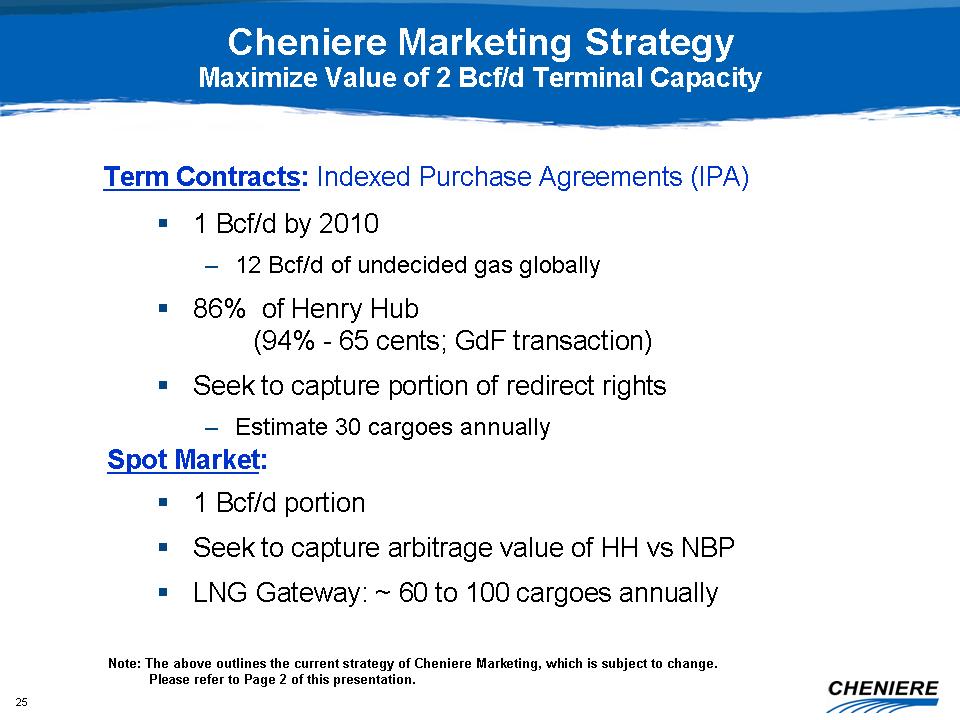

25

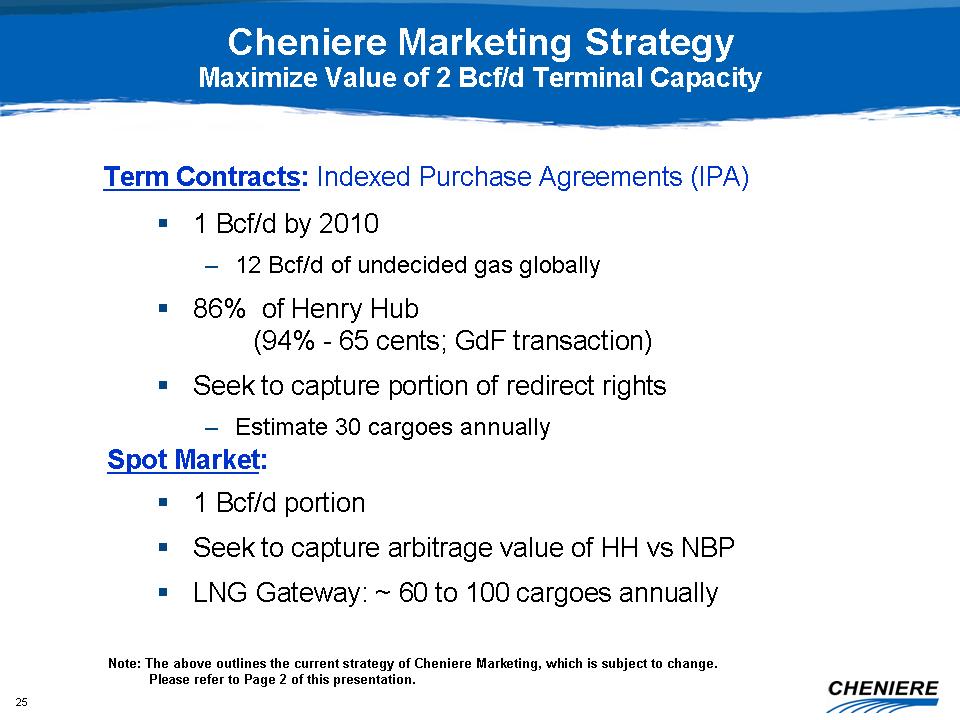

1 Bcf/d by 2010 – 12 Bcf/d of undecided gas globally 86% of

Henry Hub (94% - 65 cents; GdF transaction) Seek to capture

portion of redirect rights – Estimate 30 cargoes annually Cheniere

Marketing Strategy Maximize Value of 2 Bcf/d Terminal Capacity Term

Contracts: Indexed Purchase Agreements (IPA) Spot Market: 1

Bcf/d portion Seek to capture arbitrage value of HH vs

NBP LNG Gateway: 60 to 100 cargoes annually Note: The

above outlines the current strategy of Cheniere Marketing, which is subject

to

change. Please refer to Page 2 of this presentation.

26 Conclusion

Stable, 20-year cash flows under take-or-pay contracts Strong

natural gas fundamentals support increased LNG imports Largest LNG

receiving terminal in North America when complete Fully-funded

construction costs; leading EPC contractors Focusing on strategic

development projects Strong sponsorship from parent supported by

90% ownership Experienced management

team