“Derivative Instrument” with respect to a Person, means any contract, instrument or other right to

receive payment or delivery of cash or other assets to which such Person or any Affiliate of such Person that is acting in concert with such Person in connection with such Person’s investment in the notes (other than a Screened Affiliate) is a

party (whether or not requiring further performance by such Person), the value and/or cash flows of which (or any material portion thereof) are materially affected by the value and/or performance of the notes and/or the creditworthiness of CQP or

any Subsidiary Guarantor.

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and any successor statute.

“Fitch” means Fitch Ratings Inc. or any successor to the rating agency business thereof.

“GAAP” means generally accepted accounting principles in the United States, applied on a consistent basis and set forth in the opinions and

pronouncements of the Accounting Principles Board of the American Institute of Certified Public Accountants, the opinions and pronouncements of the Public Company Accounting Oversight Board and in the statements and pronouncements of the Financial

Accounting Standards Board or in such other statements by such other entity as have been approved by a significant segment of the accounting profession, which are in effect from time to time, but excluding the effect of ASC 842.

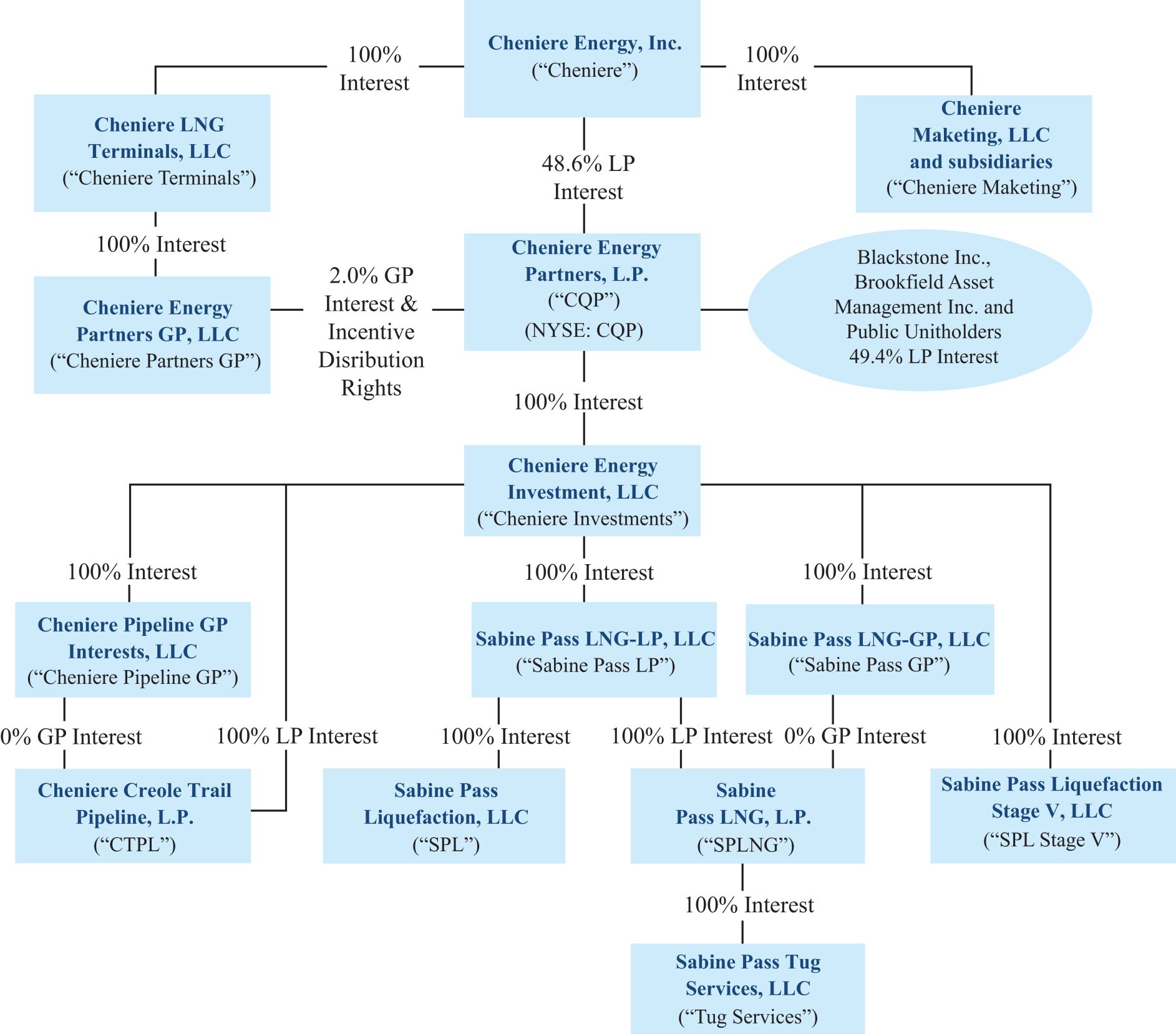

“General Partner” means Cheniere Energy Partners GP, LLC, a Delaware limited liability company, and its successors and permitted assigns as general

partner of CQP or as the business entity with the ultimate authority to manage the business and operations of CQP.

“Hedging Obligations” of any

Person means the obligations of such Person under (1) any agreement providing for options, swaps, floors, caps, collars, forward sales or forward purchases involving interest rates, commodities or commodity prices, equities, currencies, bonds,

or indexes based on any of the foregoing, (2) any option, futures or forward contract traded on an exchange and (3) any other derivative agreement or other similar agreement or arrangement.

“Indebtedness” means, with respect to any Person, any obligation created or assumed by such Person for the repayment of borrowed money or any

guarantee thereof, if and to the extent such obligation would appear as a liability upon a balance sheet of the specified Person prepared in accordance with GAAP.

“Issue Date” means the first date on which notes were issued under the indenture.

“Legal Holiday” means a Saturday, a Sunday or a day on which banking institutions in the City of New York or at a place of payment are authorized by

law, regulation or executive order to remain closed.

“Lien” means, with respect to any asset, any mortgage, lien, pledge, charge, security

interest or similar encumbrance of any kind in respect of such asset, regardless of whether filed, recorded or otherwise perfected under applicable law.

“Long Derivative Instrument” means a Derivative Instrument (i) the value of which generally increases, and/or the payment or delivery

obligations under which generally decrease, with positive changes to CQP or any Subsidiary Guarantor and/or (ii) the value of which generally decreases, and/or the payment or delivery obligations under which generally increase, with negative

changes to CQP or any Subsidiary Guarantor.

“Moody’s” means Moody’s Investors Service, Inc. or any successor to the rating agency

business thereof.

“Net Short” means, with respect to a Holder or beneficial owner of notes, as of a date of determination, either (i) the

value of its Short Derivative Instruments exceeds the sum of (x) the value of its notes, plus (y) the value of its Long Derivative Instruments as of such date of determination or (ii) it is reasonably expected that such would have

been the case were a Failure to Pay or Bankruptcy Credit Event (each as defined in the 2014 ISDA Credit Derivatives Definitions) to have occurred with respect to CQP or any Subsidiary Guarantor immediately prior to such date of determination.

49