Cheniere Energy J.P. Morgan Global High Yield & Leveraged Credit Conference 2013

Forward Looking Statements 2 This presentation contains certain statements that are, or may be deemed to be, “forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended”. All statements, other than statements of historical facts, included herein are “forward-looking statements.” Included among “forward-looking statements” are, among other things: • statements regarding our ability to pay distributions to our unitholders; • statements regarding our expected receipt of cash distributions from Sabine Pass LNG, L.P. or Sabine Pass Liquefaction, LLC; • statements that we expect to commence or complete construction of our proposed LNG terminal or our proposed pipelines, liquefaction facilities or other projects or any expansions thereof, by certain dates or at all; • statements regarding future levels of domestic and international natural gas production, supply or consumption or future levels of liquefied natural gas imports (“LNG”) into or exports from North America and other countries worldwide, regardless of the source of such information, or the transportation or demand for and prices related to natural gas, LNG or other hydrocarbon products; • statements regarding any financing transactions or arrangements, or ability to enter into such transactions; • statements relating to the construction of our Trains, including statements concerning the engagement of any engineering, procurement and construction ("EPC") contractor or other contractor and the anticipated terms and provisions of any agreement with any EPC or other contractor, and anticipated costs related thereto; • statements regarding any arrangement, to be entered into or performed substantially in the future, including any revenues anticipated to be received and the anticipated timing thereof, and statements regarding the amounts of total LNG regasification, liquefaction or storage capacities that are, or may become, subject to contracts; • statements regarding counterparties to our commercial contracts, construction contracts and other contracts; • Statements regarding our planned construction of additional Trains, including the financing of such trains • Statements that our Trains, when completed, will have certain characteristics, including amounts of liquefaction capacities; • statements regarding any business strategy, our strengths, our business and operation plans or any other plans, forecasts, projections or objectives, including anticipated revenues and capital expenditures, any or all of which are subject to change; • statements regarding projections of revenues, expenses, earnings or losses, working capital or other financial items; • statements regarding legislative, governmental, regulatory, administrative or other public body actions, requirements, permits, investigations, proceedings or decisions; • statements regarding our anticipated LNG and natural gas marketing activities; and • any other statements that relate to non-historical or future information. These forward-looking statements are often identified by the use of terms and phrases such as “achieve,” “anticipate,” “believe,” “contemplate,” “develop,” “estimate,” “example,” “expect,” “forecast,” “opportunities,” “plan,” “potential,” “project,” “propose,” “subject to,” “strategy,” and similar terms and phrases. Although we believe that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in “Risk Factors” in the Cheniere Energy Partners, L.P. Annual Report on Form 10-K filed with the SEC on February [22], 2013, which are incorporated by reference into this presentation. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these ”Risk Factors”. These forward-looking statements are made as of the date of this presentation, and we undertake no obligation to publicly update or revise any forward-looking statements.

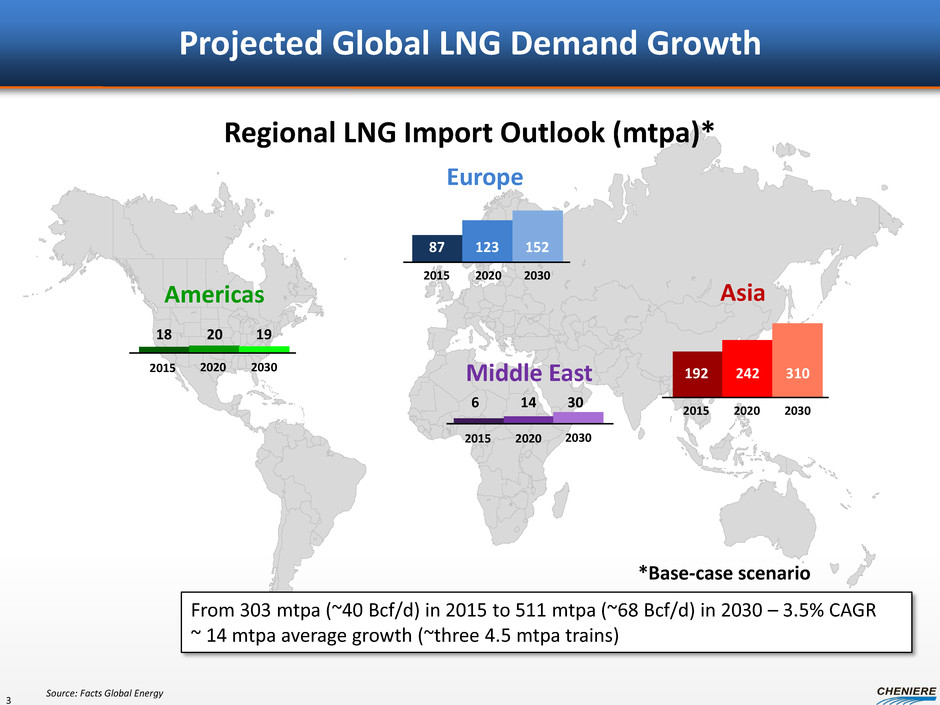

Projected Global LNG Demand Growth 3 Regional LNG Import Outlook (mtpa)* Source: Facts Global Energy 18 20 19 2015 2020 2030 2015 2020 2030 6 14 30 2015 2020 2030 2015 2020 2030 Americas Europe Asia Middle East *Base-case scenario 192 242 310 87 123 152 From 303 mtpa (~40 Bcf/d) in 2015 to 511 mtpa (~68 Bcf/d) in 2030 – 3.5% CAGR ~ 14 mtpa average growth (~three 4.5 mtpa trains)

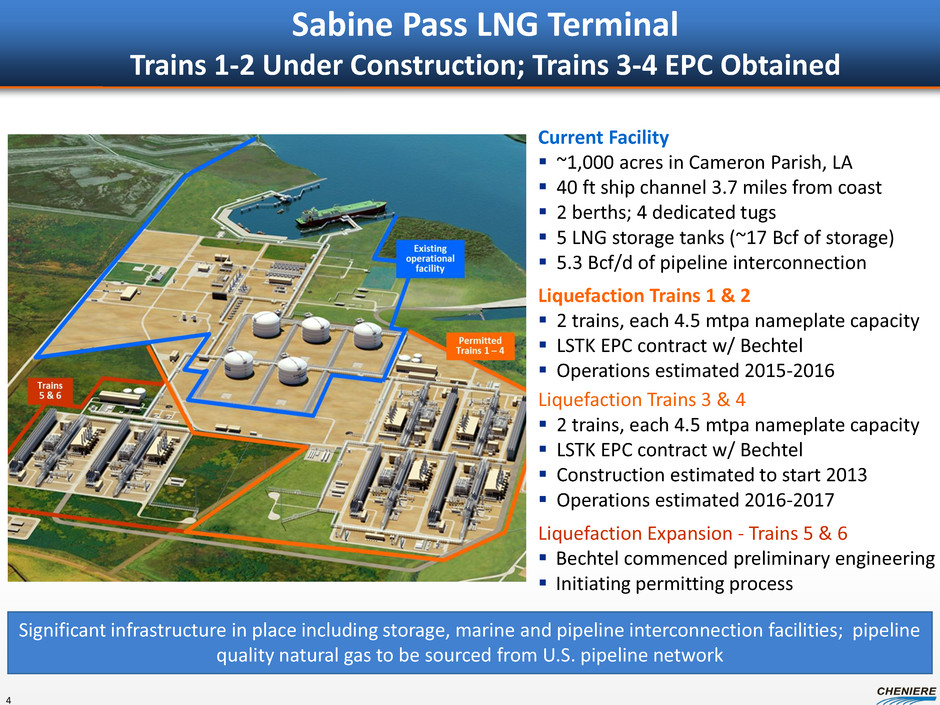

Sabine Pass LNG Terminal Trains 1-2 Under Construction; Trains 3-4 EPC Obtained Significant infrastructure in place including storage, marine and pipeline interconnection facilities; pipeline quality natural gas to be sourced from U.S. pipeline network 4 Liquefaction Trains 3 & 4 2 trains, each 4.5 mtpa nameplate capacity LSTK EPC contract w/ Bechtel Construction estimated to start 2013 Operations estimated 2016-2017 Liquefaction Expansion - Trains 5 & 6 Bechtel commenced preliminary engineering Initiating permitting process Current Facility ~1,000 acres in Cameron Parish, LA 40 ft ship channel 3.7 miles from coast 2 berths; 4 dedicated tugs 5 LNG storage tanks (~17 Bcf of storage) 5.3 Bcf/d of pipeline interconnection Liquefaction Trains 1 & 2 2 trains, each 4.5 mtpa nameplate capacity LSTK EPC contract w/ Bechtel Operations estimated 2015-2016

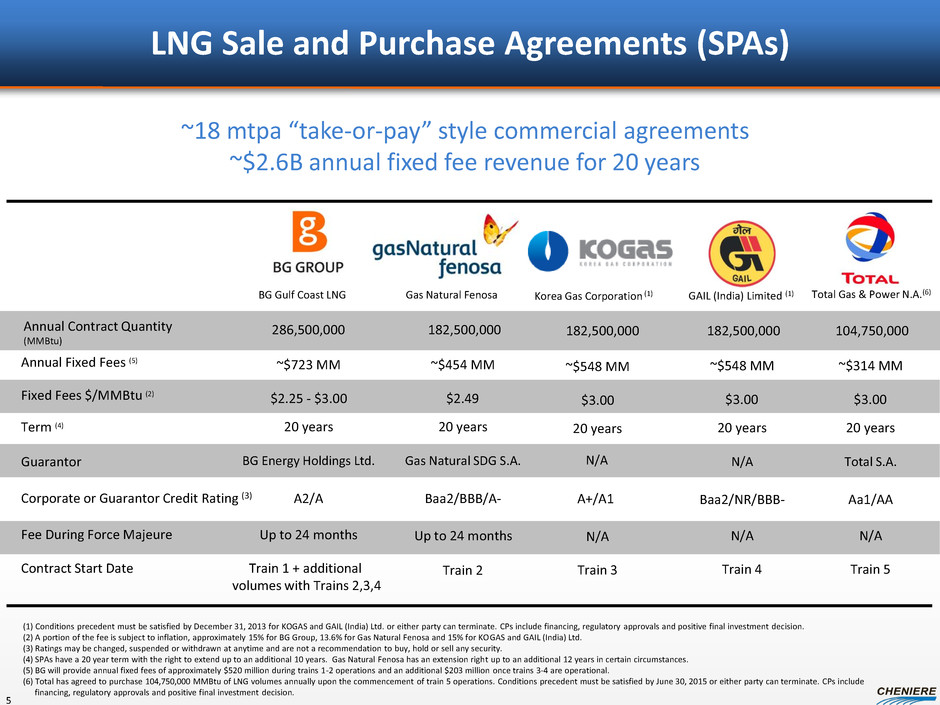

LNG Sale and Purchase Agreements (SPAs) (1) Conditions precedent must be satisfied by December 31, 2013 for KOGAS and GAIL (India) Ltd. or either party can terminate. CPs include financing, regulatory approvals and positive final investment decision. (2) A portion of the fee is subject to inflation, approximately 15% for BG Group, 13.6% for Gas Natural Fenosa and 15% for KOGAS and GAIL (India) Ltd. (3) Ratings may be changed, suspended or withdrawn at anytime and are not a recommendation to buy, hold or sell any security. (4) SPAs have a 20 year term with the right to extend up to an additional 10 years. Gas Natural Fenosa has an extension right up to an additional 12 years in certain circumstances. (5) BG will provide annual fixed fees of approximately $520 million during trains 1-2 operations and an additional $203 million once trains 3-4 are operational. (6) Total has agreed to purchase 104,750,000 MMBtu of LNG volumes annually upon the commencement of train 5 operations. Conditions precedent must be satisfied by June 30, 2015 or either party can terminate. CPs include financing, regulatory approvals and positive final investment decision. BG Gulf Coast LNG Gas Natural Fenosa Annual Contract Quantity (MMBtu) 286,500,000 Fixed Fees $/MMBtu (2) Annual Fixed Fees (5) ~$723 MM ~$454 MM Term (4) Guarantor 20 years BG Energy Holdings Ltd. Gas Natural SDG S.A. Corporate or Guarantor Credit Rating (3) A2/A Baa2/BBB/A- Fee During Force Majeure Up to 24 months Up to 24 months 20 years GAIL (India) Limited (1) ~$548 MM 20 years Baa2/NR/BBB- N/A ~18 mtpa “take-or-pay” style commercial agreements ~$2.6B annual fixed fee revenue for 20 years N/A Contract Start Date Train 1 + additional volumes with Trains 2,3,4 Train 2 Train 4 $2.25 - $3.00 $2.49 $3.00 182,500,000 182,500,000 20 years N/A N/A A+/A1 Train 3 $3.00 ~$548 MM Korea Gas Corporation (1) 182,500,000 5 ~$314 MM 20 years Aa1/AA N/A Total S.A. Train 5 $3.00 104,750,000 Total Gas & Power N.A.(6)

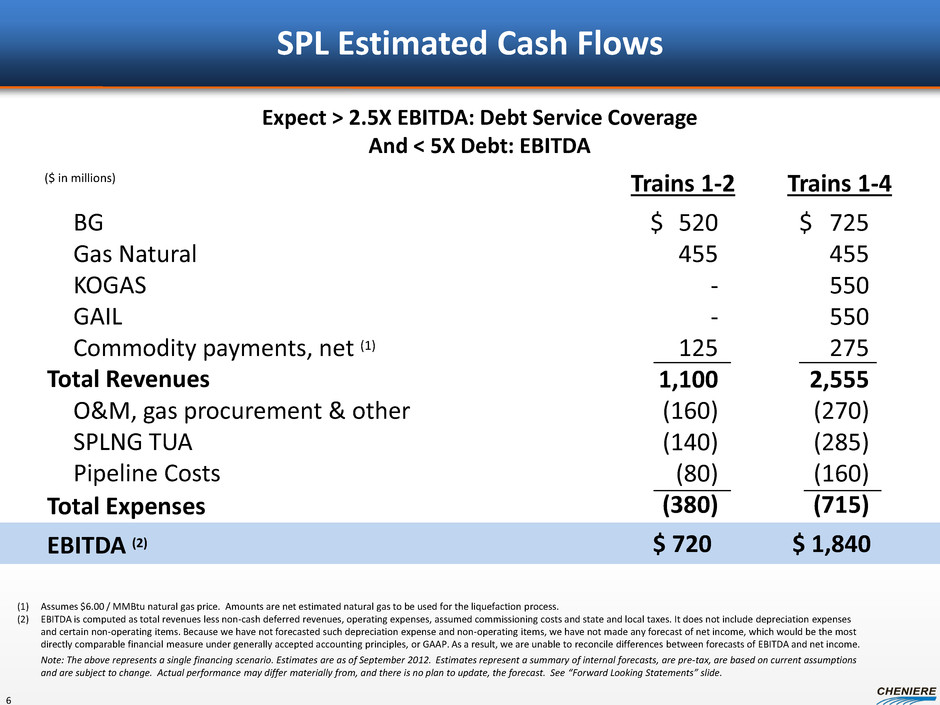

SPL Estimated Cash Flows Trains 1-4 Total Revenues Trains 1-2 BG Gas Natural KOGAS GAIL Commodity payments, net (1) O&M, gas procurement & other SPLNG TUA Pipeline Costs 520 455 - - 125 1,100 (160) (140) (80) (380) EBITDA (2) 725 455 550 550 275 2,555 (270) (285) (160) (715) $ 1,840 $ 720 $ $ ($ in millions) Total Expenses (1) Assumes $6.00 / MMBtu natural gas price. Amounts are net estimated natural gas to be used for the liquefaction process. (2) EBITDA is computed as total revenues less non-cash deferred revenues, operating expenses, assumed commissioning costs and state and local taxes. It does not include depreciation expenses and certain non-operating items. Because we have not forecasted such depreciation expense and non-operating items, we have not made any forecast of net income, which would be the most directly comparable financial measure under generally accepted accounting principles, or GAAP. As a result, we are unable to reconcile differences between forecasts of EBITDA and net income. Note: The above represents a single financing scenario. Estimates are as of September 2012. Estimates represent a summary of internal forecasts, are pre-tax, are based on current assumptions and are subject to change. Actual performance may differ materially from, and there is no plan to update, the forecast. See “Forward Looking Statements” slide. 6 Expect > 2.5X EBITDA: Debt Service Coverage And < 5X Debt: EBITDA

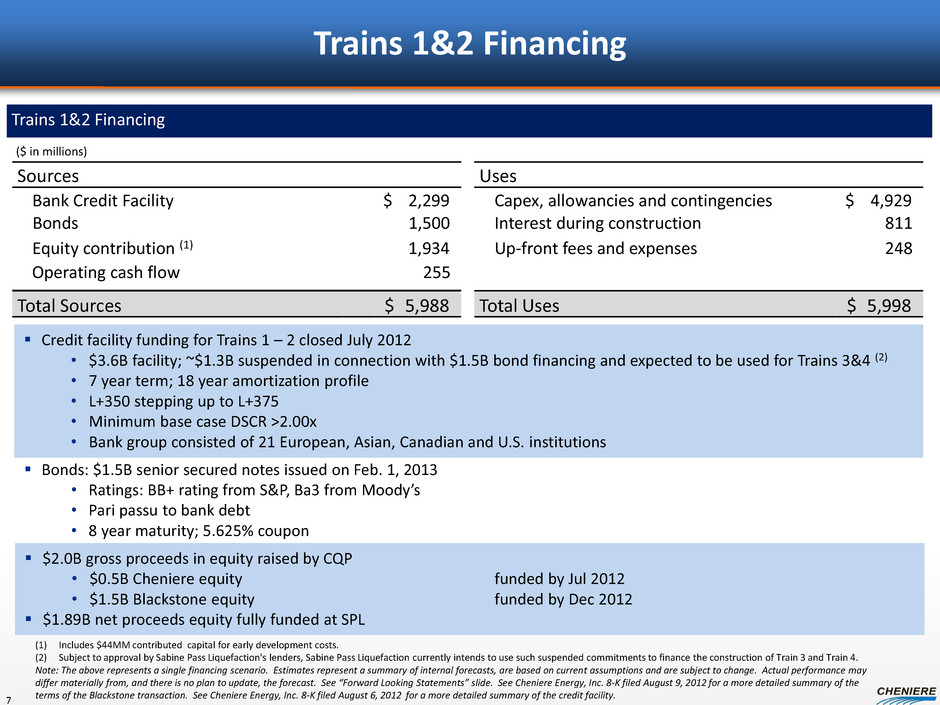

Trains 1&2 Financing Trains 1&2 Financing Sources Uses Bank Credit Facility 2,299 $ Capex, allowancies and contingencies 4,929 $ Equity contribution (1) 1,934 Operating cash flow 255 Up-front fees and expenses 248 Total Sources 5,988 $ Total Uses 5,998 $ ($ in millions) 7 (1) Includes $44MM contributed capital for early development costs. (2) Subject to approval by Sabine Pass Liquefaction's lenders, Sabine Pass Liquefaction currently intends to use such suspended commitments to finance the construction of Train 3 and Train 4. Note: The above represents a single financing scenario. Estimates represent a summary of internal forecasts, are based on current assumptions and are subject to change. Actual performance may differ materially from, and there is no plan to update, the forecast. See “Forward Looking Statements” slide. See Cheniere Energy, Inc. 8-K filed August 9, 2012 for a more detailed summary of the terms of the Blackstone transaction. See Cheniere Energy, Inc. 8-K filed August 6, 2012 for a more detailed summary of the credit facility. Bonds: $1.5B senior secured notes issued on Feb. 1, 2013 • Ratings: BB+ rating from S&P, Ba3 from Moody’s • Pari passu to bank debt • 8 year maturity; 5.625% coupon Credit facility funding for Trains 1 – 2 closed July 2012 • $3.6B facility; ~$1.3B suspended in connection with $1.5B bond financing and expected to be used for Trains 3&4 (2) • 7 year term; 18 year amortization profile • L+350 stepping up to L+375 • Minimum base case DSCR >2.00x • Bank group consisted of 21 European, Asian, Canadian and U.S. institutions Bonds 1,500 Interest during construction 811 $2.0B gross proceeds in equity raised by CQP • $0.5B Cheniere equity funded by Jul 2012 • $1.5B Blackstone equity funded by Dec 2012 $1.89B net proceeds equity fully funded at SPL

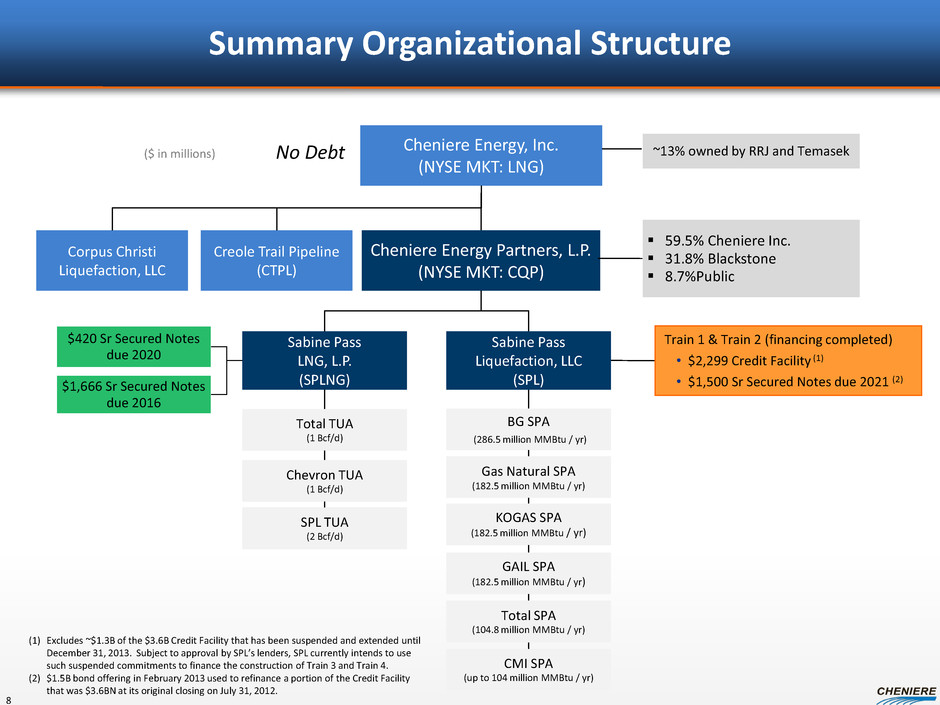

Summary Organizational Structure Cheniere Energy, Inc. (NYSE MKT: LNG) Cheniere Energy Partners, L.P. (NYSE MKT: CQP) Sabine Pass LNG, L.P. (SPLNG) 59.5% Cheniere Inc. 31.8% Blackstone 8.7%Public BG SPA (286.5 million MMBtu / yr) Gas Natural SPA (182.5 million MMBtu / yr) KOGAS SPA (182.5 million MMBtu / yr) GAIL SPA (182.5 million MMBtu / yr) Total TUA (1 Bcf/d) Chevron TUA (1 Bcf/d) SPL TUA (2 Bcf/d) $420 Sr Secured Notes due 2020 $1,666 Sr Secured Notes due 2016 ($ in millions) No Debt Creole Trail Pipeline (CTPL) Corpus Christi Liquefaction, LLC 8 Train 1 & Train 2 (financing completed) • $2,299 Credit Facility (1) • $1,500 Sr Secured Notes due 2021 (2) CMI SPA (up to 104 million MMBtu / yr) Total SPA (104.8 million MMBtu / yr) Sabine Pass Liquefaction, LLC (SPL) (1) Excludes ~$1.3B of the $3.6B Credit Facility that has been suspended and extended until December 31, 2013. Subject to approval by SPL’s lenders, SPL currently intends to use such suspended commitments to finance the construction of Train 3 and Train 4. (2) $1.5B bond offering in February 2013 used to refinance a portion of the Credit Facility that was $3.6BN at its original closing on July 31, 2012. ~13% owned by RRJ and Temasek

Sabine Pass Liquefaction Facilities Trains 5 and 6 – initiating permitting process Future Developments/Opportunities Cheniere Marketing 2.0 mtpa LNG to be sold from SPL FOB and DES basis Corpus Christi LNG Exports – 13.5 mtpa project Under development – in permitting stage 9

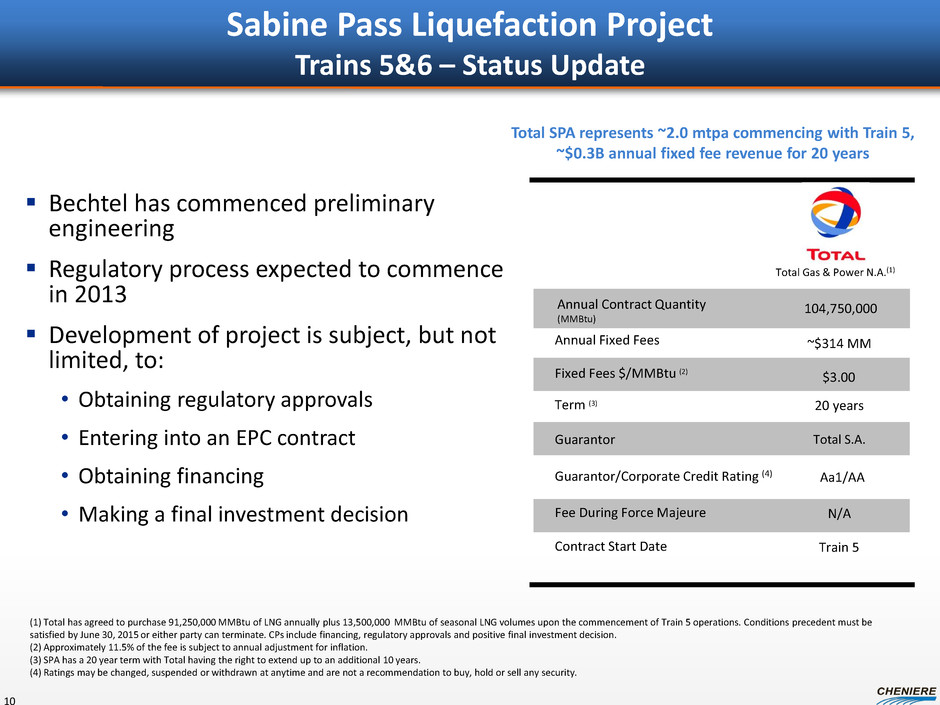

Sabine Pass Liquefaction Project Trains 5&6 – Status Update 10 Annual Contract Quantity (MMBtu) Fixed Fees $/MMBtu (2) Annual Fixed Fees Term (3) Guarantor Guarantor/Corporate Credit Rating (4) Fee During Force Majeure Contract Start Date ~$314 MM 20 years Aa1/AA N/A Total S.A. Train 5 $3.00 104,750,000 Total Gas & Power N.A.(1) Bechtel has commenced preliminary engineering Regulatory process expected to commence in 2013 Development of project is subject, but not limited, to: • Obtaining regulatory approvals • Entering into an EPC contract • Obtaining financing • Making a final investment decision Total SPA represents ~2.0 mtpa commencing with Train 5, ~$0.3B annual fixed fee revenue for 20 years (1) Total has agreed to purchase 91,250,000 MMBtu of LNG annually plus 13,500,000 MMBtu of seasonal LNG volumes upon the commencement of Train 5 operations. Conditions precedent must be satisfied by June 30, 2015 or either party can terminate. CPs include financing, regulatory approvals and positive final investment decision. (2) Approximately 11.5% of the fee is subject to annual adjustment for inflation. (3) SPA has a 20 year term with Total having the right to extend up to an additional 10 years. (4) Ratings may be changed, suspended or withdrawn at anytime and are not a recommendation to buy, hold or sell any security.

CMI SPA – Excess Volumes from Trains 1-4 at SPL CMI-SPL SPA provides CMI with up to 2 mtpa of LNG delivered FOB Sabine Pass starting with the initial production from Train 1 •Maximum Annual Contract Quantity of up to 104 Tbtu/year from first four trains SPA sharing mechanic incents profit maximization • Sharing based on ranking of the net profit for each cargo, from highest to lowest: – Tranche 1: CMI pays SPL up to $3.00/MMBtu – Tranche 2: CMI pays SPL 20% of profits • Tranches shift at 18 TBtu for T1&T2, 36 TBtu for T3&T4 • CMI is entitled to recover all operating costs during a year before allocating profit to SPL Initial deliveries anticipated to begin as early as 4Q 2015 11 Note: See “Forward Looking Statements” slide. LNG sold 104 Bcf Net margin $10/MMBtu Net margin $1 BN Example Annual Cash Flow on CMI SPA

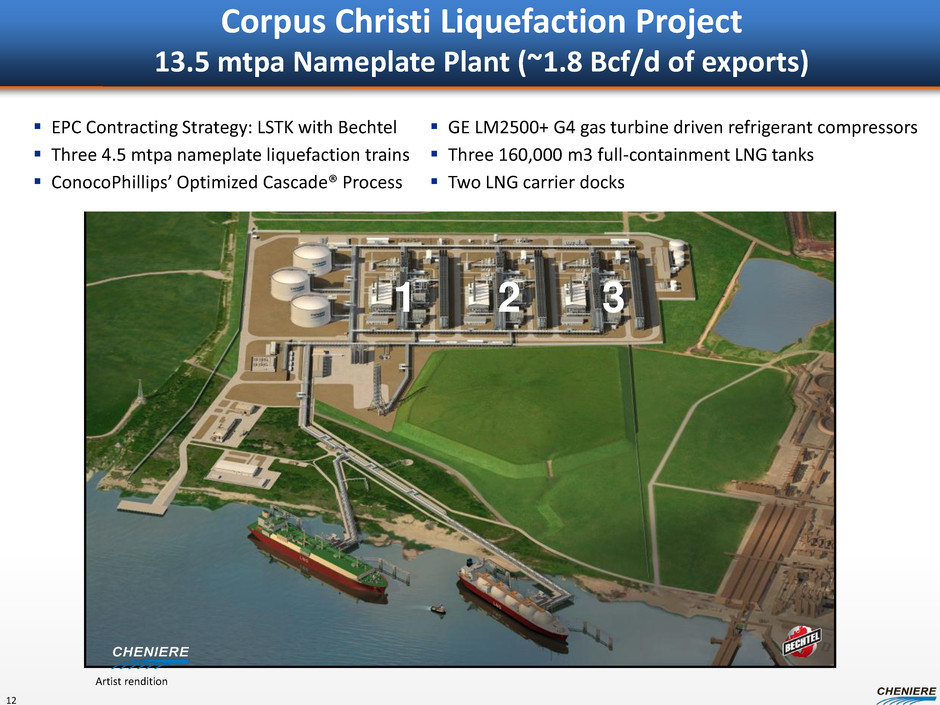

1 2 3 EPC Contracting Strategy: LSTK with Bechtel Three 4.5 mtpa nameplate liquefaction trains ConocoPhillips’ Optimized Cascade® Process Corpus Christi Liquefaction Project 13.5 mtpa Nameplate Plant (~1.8 Bcf/d of exports) 12 GE LM2500+ G4 gas turbine driven refrigerant compressors Three 160,000 m3 full-containment LNG tanks Two LNG carrier docks Artist rendition

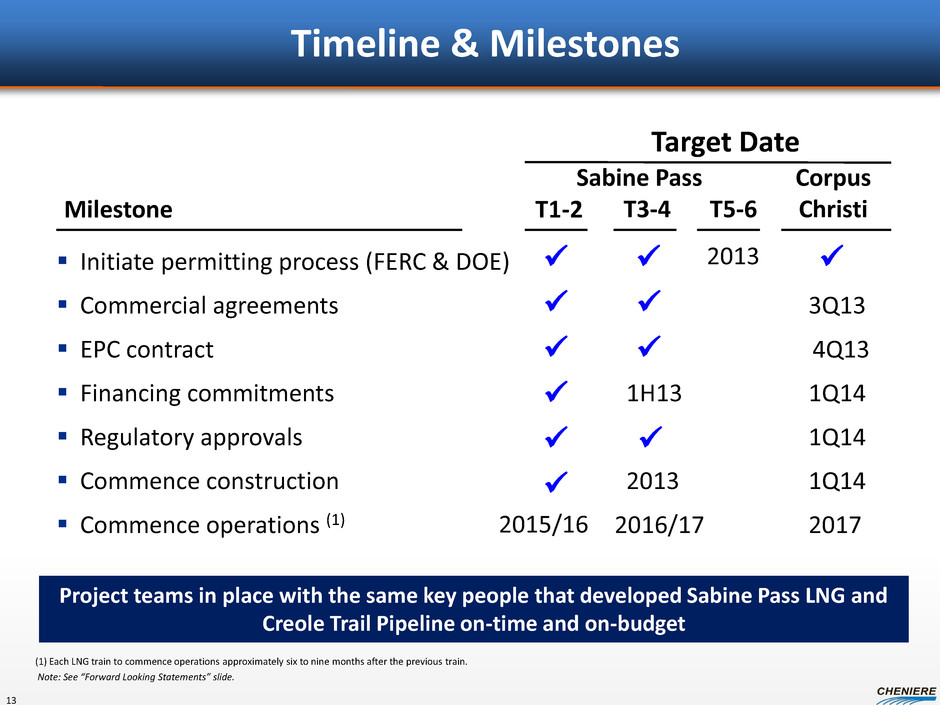

Timeline & Milestones Initiate permitting process (FERC & DOE) Commercial agreements 3Q13 EPC contract 4Q13 Financing commitments 1H13 1Q14 Regulatory approvals 1Q14 Commence construction 2013 1Q14 Commence operations (1) 2016/17 2017 Milestone Corpus Christi (1) Each LNG train to commence operations approximately six to nine months after the previous train. Note: See “Forward Looking Statements” slide. 13 Target Date 2015/16 Project teams in place with the same key people that developed Sabine Pass LNG and Creole Trail Pipeline on-time and on-budget Sabine Pass T1-2 T5-6 T3-4 2013

Appendix

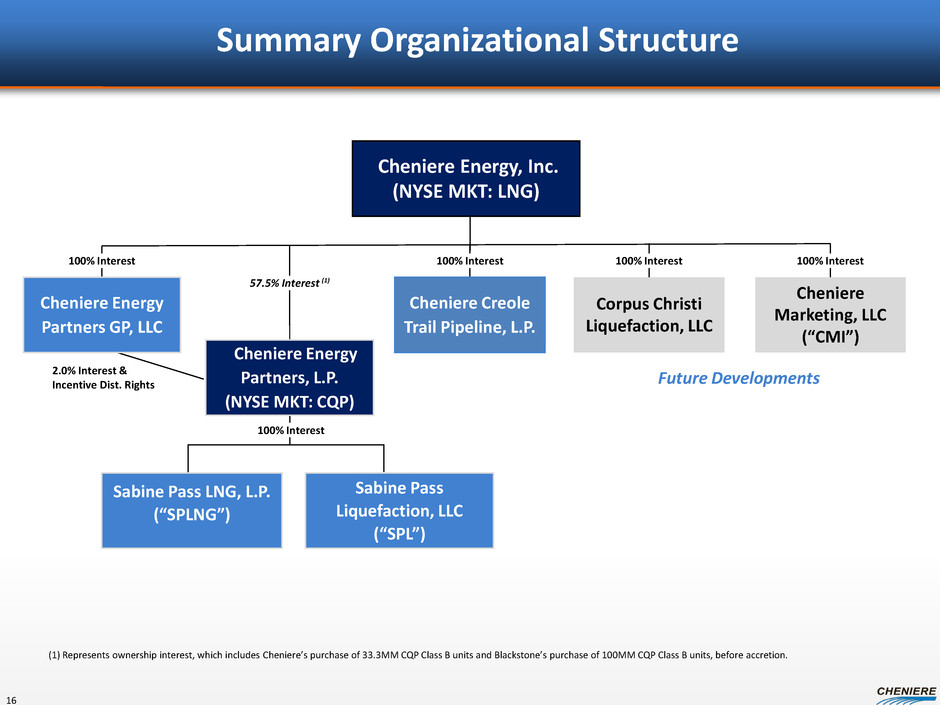

2.0% Interest & Incentive Dist. Rights Cheniere Energy, Inc. (NYSE MKT: LNG) Sabine Pass LNG, L.P. (“SPLNG”) Sabine Pass Liquefaction, LLC (“SPL”) Cheniere Energy Partners, L.P. (NYSE MKT: CQP) Cheniere Creole Trail Pipeline, L.P. Corpus Christi Liquefaction, LLC Cheniere Marketing, LLC (“CMI”) Cheniere Energy Partners GP, LLC 57.5% Interest (1) 100% Interest 100% Interest 100% Interest 100% Interest 100% Interest (1) Represents ownership interest, which includes Cheniere’s purchase of 33.3MM CQP Class B units and Blackstone’s purchase of 100MM CQP Class B units, before accretion. Future Developments Summary Organizational Structure 16

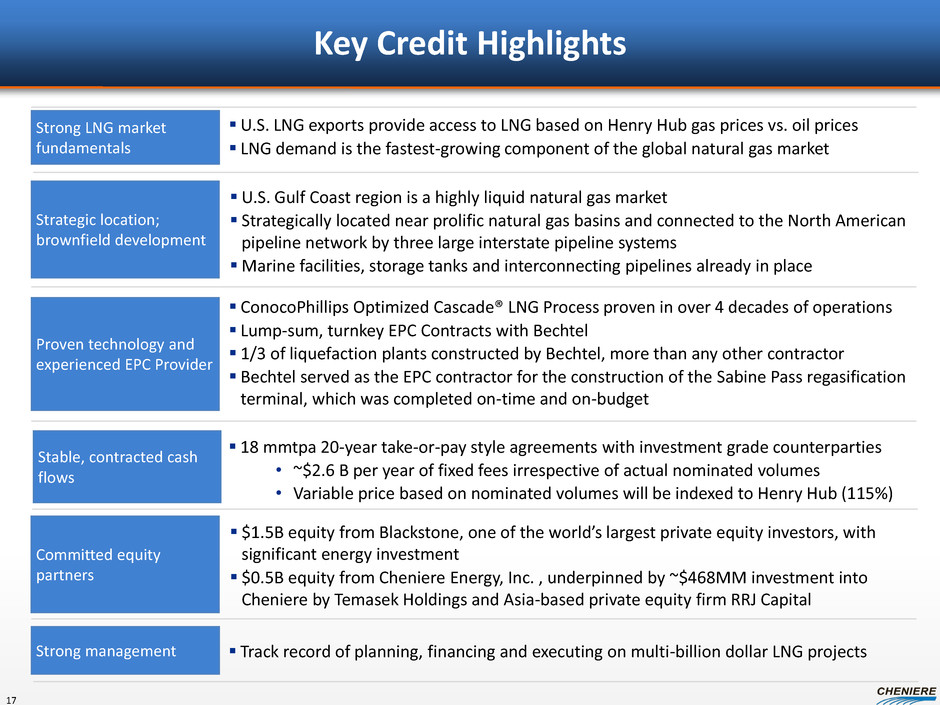

Key Credit Highlights Strong LNG market fundamentals Strategic location; brownfield development U.S. Gulf Coast region is a highly liquid natural gas market Strategically located near prolific natural gas basins and connected to the North American pipeline network by three large interstate pipeline systems Marine facilities, storage tanks and interconnecting pipelines already in place U.S. LNG exports provide access to LNG based on Henry Hub gas prices vs. oil prices LNG demand is the fastest-growing component of the global natural gas market Stable, contracted cash flows 18 mmtpa 20-year take-or-pay style agreements with investment grade counterparties • ~$2.6 B per year of fixed fees irrespective of actual nominated volumes • Variable price based on nominated volumes will be indexed to Henry Hub (115%) Proven technology and experienced EPC Provider ConocoPhillips Optimized Cascade® LNG Process proven in over 4 decades of operations Lump-sum, turnkey EPC Contracts with Bechtel 1/3 of liquefaction plants constructed by Bechtel, more than any other contractor Bechtel served as the EPC contractor for the construction of the Sabine Pass regasification terminal, which was completed on-time and on-budget Committed equity partners $1.5B equity from Blackstone, one of the world’s largest private equity investors, with significant energy investment $0.5B equity from Cheniere Energy, Inc. , underpinned by ~$468MM investment into Cheniere by Temasek Holdings and Asia-based private equity firm RRJ Capital Strong management Track record of planning, financing and executing on multi-billion dollar LNG projects 17

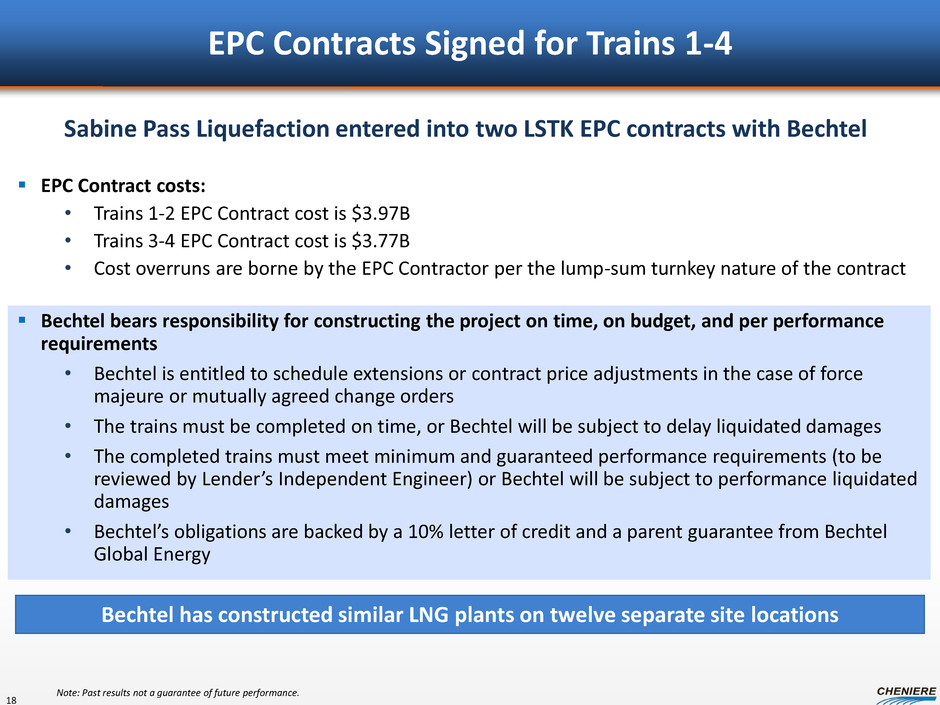

EPC Contracts Signed for Trains 1-4 EPC Contract costs: • Trains 1-2 EPC Contract cost is $3.97B • Trains 3-4 EPC Contract cost is $3.77B • Cost overruns are borne by the EPC Contractor per the lump-sum turnkey nature of the contract Sabine Pass Liquefaction entered into two LSTK EPC contracts with Bechtel Note: Past results not a guarantee of future performance. 18 Bechtel has constructed similar LNG plants on twelve separate site locations Bechtel bears responsibility for constructing the project on time, on budget, and per performance requirements • Bechtel is entitled to schedule extensions or contract price adjustments in the case of force majeure or mutually agreed change orders • The trains must be completed on time, or Bechtel will be subject to delay liquidated damages • The completed trains must meet minimum and guaranteed performance requirements (to be reviewed by Lender’s Independent Engineer) or Bechtel will be subject to performance liquidated damages • Bechtel’s obligations are backed by a 10% letter of credit and a parent guarantee from Bechtel Global Energy

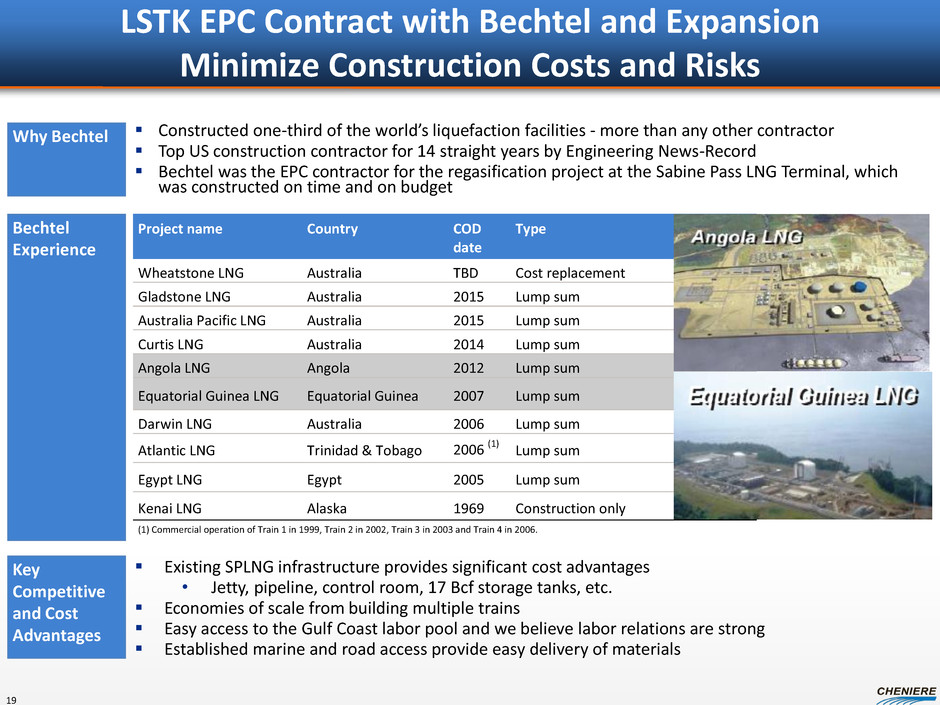

Why Bechtel Constructed one-third of the world’s liquefaction facilities - more than any other contractor Top US construction contractor for 14 straight years by Engineering News-Record Bechtel was the EPC contractor for the regasification project at the Sabine Pass LNG Terminal, which was constructed on time and on budget Bechtel Experience Key Competitive and Cost Advantages Existing SPLNG infrastructure provides significant cost advantages • Jetty, pipeline, control room, 17 Bcf storage tanks, etc. Economies of scale from building multiple trains Easy access to the Gulf Coast labor pool and we believe labor relations are strong Established marine and road access provide easy delivery of materials Project name Country COD date Type Wheatstone LNG Australia TBD Cost replacement Gladstone LNG Australia 2015 Lump sum Australia Pacific LNG Australia 2015 Lump sum Curtis LNG Australia 2014 Lump sum Angola LNG Angola 2012 Lump sum Equatorial Guine LNG Equatorial Guinea 2007 Lump sum Darwin LNG Australia 2006 Lump sum Atlantic LNG Trinidad & Tobago 2006 (1) Lump sum Egypt LNG Egypt 2005 Lump sum Kenai LNG Alaska 1969 Construction only (1) Commercial operation of Train 1 in 1999, Train 2 in 2002, Train 3 in 2003 and Train 4 in 2006. LSTK EPC Contract with Bechtel and Expansion Minimize Construction Costs and Risks 19

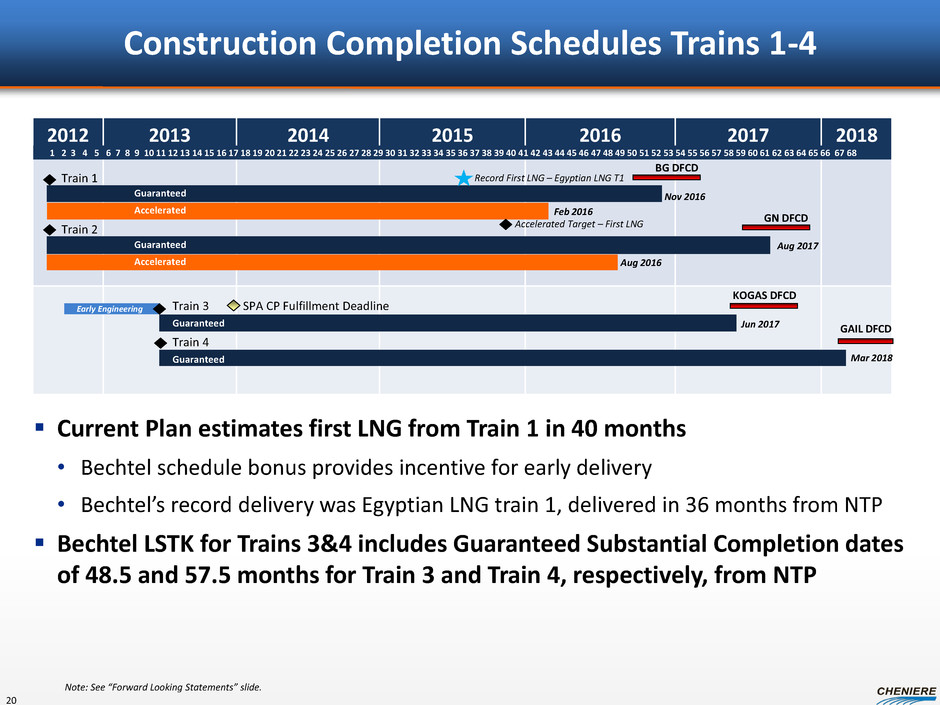

Construction Completion Schedules Trains 1-4 20 Note: See “Forward Looking Statements” slide. 2012 2013 2014 2015 2016 2017 2018 BG DFCD GN DFCD KOGAS DFCD GAIL DFCD Train 1 Train 2 Train 3 Train 4 SPA CP Fulfillment Deadline Accelerated Target – First LNG Record First LNG – Egyptian LNG T1 Current Plan estimates first LNG from Train 1 in 40 months • Bechtel schedule bonus provides incentive for early delivery • Bechtel’s record delivery was Egyptian LNG train 1, delivered in 36 months from NTP Bechtel LSTK for Trains 3&4 includes Guaranteed Substantial Completion dates of 48.5 and 57.5 months for Train 3 and Train 4, respectively, from NTP Early Engineering Accelerated Guaranteed Accelerated Guaranteed Guaranteed Guaranteed Feb 2016 Aug 2016 Mar 2018 Jun 2017 Nov 2016 Aug 2017 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68

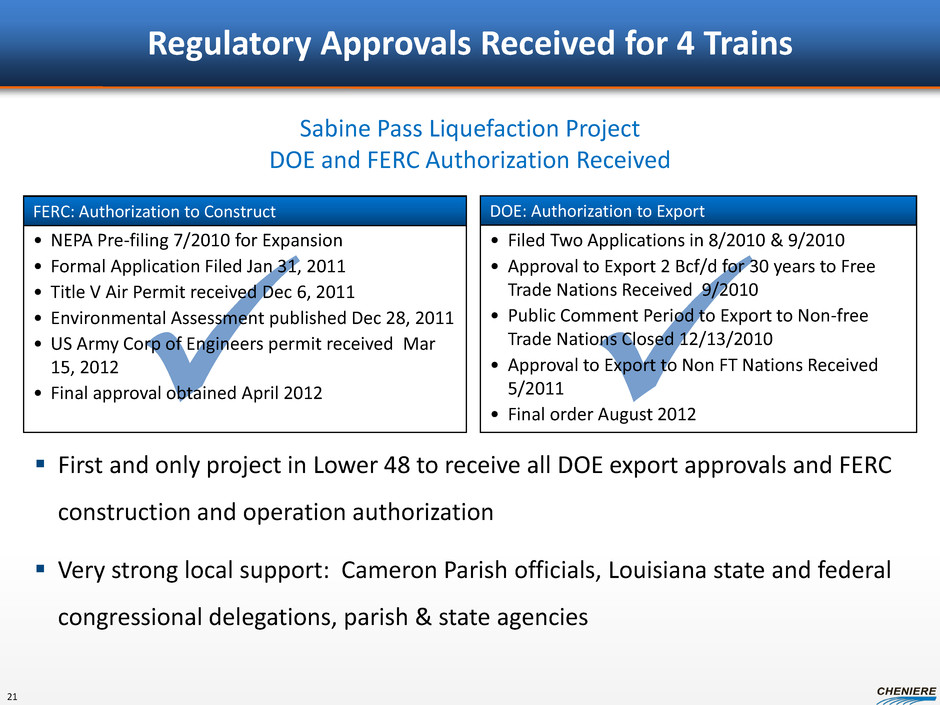

• NEPA Pre-filing 7/2010 for Expansion • Formal Application Filed Jan 31, 2011 • Title V Air Permit received Dec 6, 2011 • Environmental Assessment published Dec 28, 2011 • US Army Corp of Engineers permit received Mar 15, 2012 • Final approval obtained April 2012 • Filed Two Applications in 8/2010 & 9/2010 • Approval to Export 2 Bcf/d for 30 years to Free Trade Nations Received 9/2010 • Public Comment Period to Export to Non-free Trade Nations Closed 12/13/2010 • Approval to Export to Non FT Nations Received 5/2011 • Final order August 2012 Regulatory Approvals Received for 4 Trains FERC: Authorization to Construct DOE: Authorization to Export First and only project in Lower 48 to receive all DOE export approvals and FERC construction and operation authorization Very strong local support: Cameron Parish officials, Louisiana state and federal congressional delegations, parish & state agencies Sabine Pass Liquefaction Project DOE and FERC Authorization Received 21

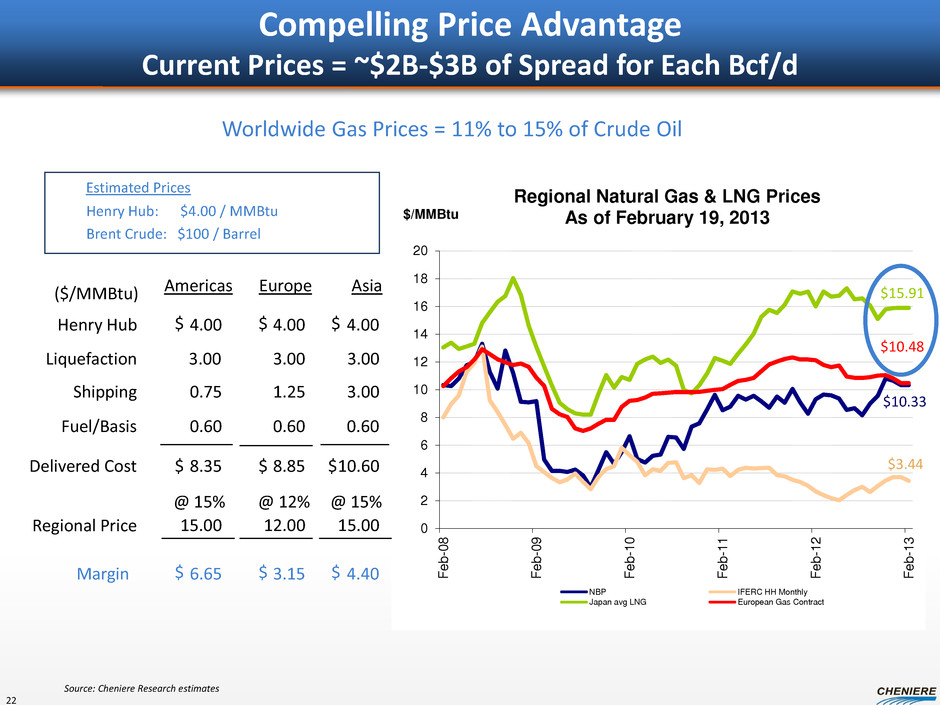

0 2 4 6 8 10 12 14 16 18 20 F e b -0 8 F e b -0 9 F e b -1 0 F e b -1 1 F e b -1 2 F e b -1 3 $/MMBtu Regional Natural Gas & LNG Prices As of February 19, 2013 NBP IFERC HH Monthly Japan avg LNG European Gas Contract Estimated Prices Henry Hub: $4.00 / MMBtu Brent Crude: $100 / Barrel ($/MMBtu) Americas Europe Asia Henry Hub 4.00 $ 4.00 4.00 Fuel/Basis Shipping 0.75 1.25 3.00 0.60 0.60 0.60 $ 8.35 8.85 10.60 4.40 Regional Price @ 15% 15.00 12.00 15.00 Margin 6.65 $ 3.15 Liquefaction 3.00 3.00 3.00 Delivered Cost Source: Cheniere Research estimates Compelling Price Advantage Current Prices = ~$2B-$3B of Spread for Each Bcf/d @ 12% @ 15% $ $ $ $ $ $ Worldwide Gas Prices = 11% to 15% of Crude Oil 22 $3.44 $10.33 $15.91 $10.48

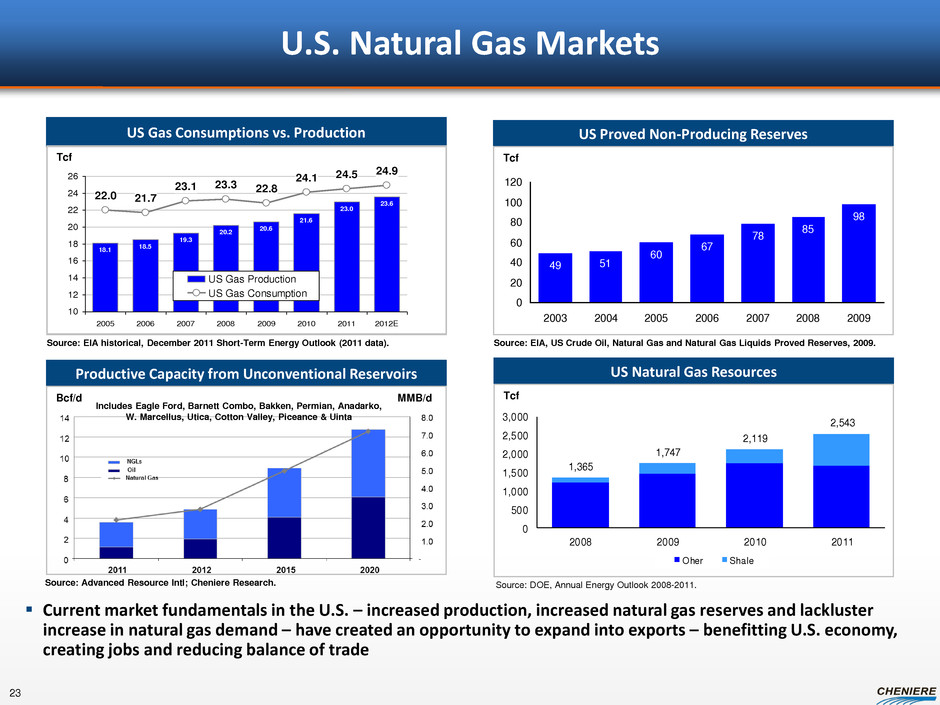

US Gas Consumptions vs. Production US Proved Non-Producing Reserves Productive Capacity from Unconventional Reservoirs Tcf Bcf/d MMB/d Current market fundamentals in the U.S. – increased production, increased natural gas reserves and lackluster increase in natural gas demand – have created an opportunity to expand into exports – benefitting U.S. economy, creating jobs and reducing balance of trade Source: EIA historical, December 2011 Short-Term Energy Outlook (2011 data). 49 51 60 67 78 85 98 0 20 40 60 80 100 120 2003 2004 2005 2006 2007 2008 2009 Source: EIA, US Crude Oil, Natural Gas and Natural Gas Liquids Proved Reserves, 2009. Source: Advanced Resource Intl; Cheniere Research. U.S. Natural Gas Markets 18.1 18.5 19.3 20.2 20.6 21.6 23.0 23.6 22.0 21.7 23.1 23.3 22.8 24.1 24.5 24.9 10 12 14 16 18 20 22 24 26 2005 2006 2007 2008 2009 2010 2011 2012E US Gas Production US Gas Consumption Tcf 23 Includes Eagle Ford, Barnett Combo, Bakken, Permian, Anadarko, W. Marcellus, Utica, Cotton Valley, Piceance & Uinta US Natural Gas Resources Tcf 1,365 1,747 2,119 2,543 0 500 1,000 1,500 2,000 2,500 3,000 2008 2009 2010 2011 Oher Shale Source: DOE, Annual Energy Outlook 2008-2011.

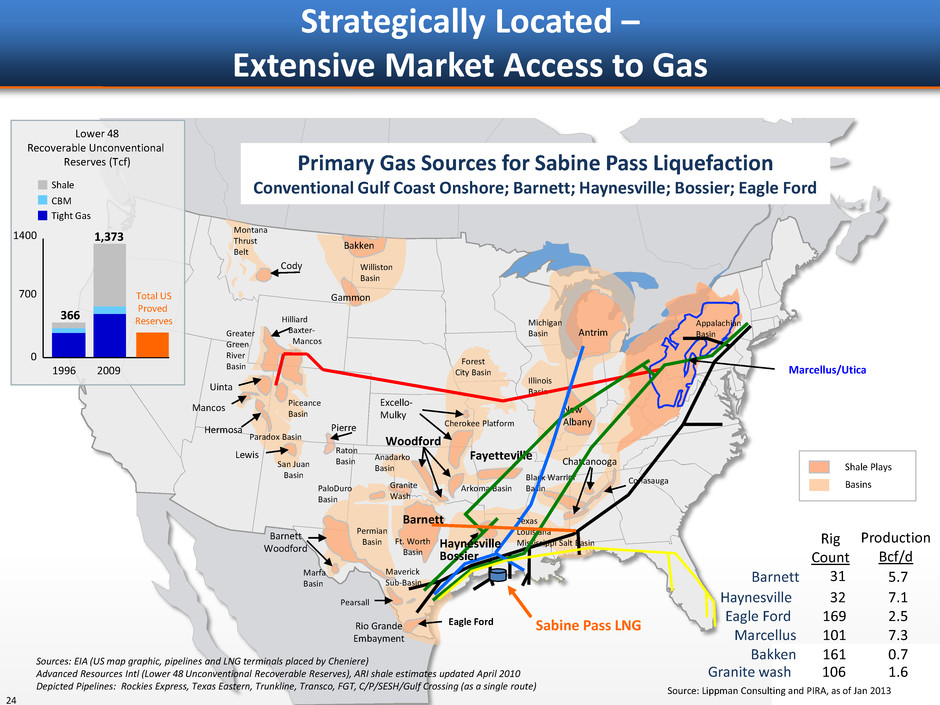

Montana Thrust Belt Cody Gammon Hilliard Baxter- Mancos Greater Green River Basin Forest City Basin Pierre Illinois Basin Piceance Basin Lewis San Juan Basin Raton Basin Anadarko Basin PaloDuro Basin Permian Basin Barnett Woodford Pearsall Eagle Ford Rio Grande Embayment Barnett Woodford Michigan Basin Antrim New Albany Chattanooga Texas Louisiana Mississippi Salt Basin Fayetteville Ft. Worth Basin Arkoma Basin Conasauga Black Warrior Basin Marfa Basin Paradox Basin Maverick Sub-Basin Hermosa Mancos Cherokee Platform Excello- Mulky Appalachian Basin Marcellus/Utica Shale Plays Basins 366 1,373 Lower 48 Recoverable Unconventional Reserves (Tcf) 0 700 1400 1996 2009 Shale CBM Tight Gas Total US Proved Reserves Sabine Pass LNG Haynesville Bossier Granite Wash Williston Basin Bakken Primary Gas Sources for Sabine Pass Liquefaction Conventional Gulf Coast Onshore; Barnett; Haynesville; Bossier; Eagle Ford Sources: EIA (US map graphic, pipelines and LNG terminals placed by Cheniere) Advanced Resources Intl (Lower 48 Unconventional Recoverable Reserves), ARI shale estimates updated April 2010 Depicted Pipelines: Rockies Express, Texas Eastern, Trunkline, Transco, FGT, C/P/SESH/Gulf Crossing (as a single route) Rig Count Production Bcf/d Barnett 31 5.7 Haynesville 32 7.1 Eagle Ford 169 2.5 Granite wash 106 1.6 Bakken 161 0.7 Marcellus 101 7.3 Source: Lippman Consulting and PIRA, as of Jan 2013 Uinta Strategically Located – Extensive Market Access to Gas 24

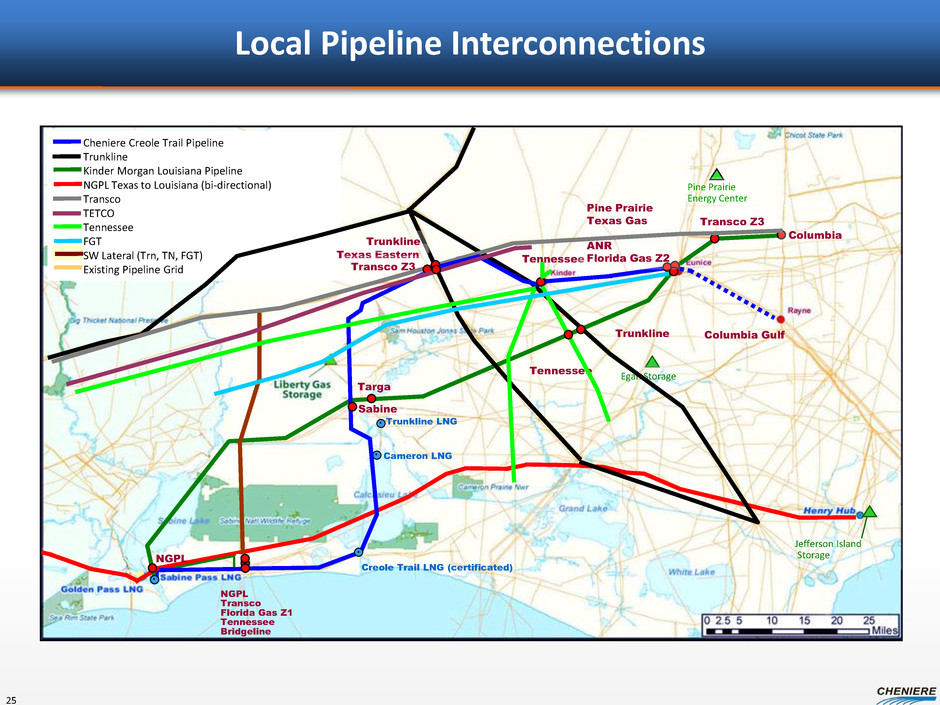

Local Pipeline Interconnections Targa Columbia Gulf Tennessee Cheniere Creole Trail Pipeline Trunkline Kinder Morgan Louisiana Pipeline NGPL Texas to Louisiana (bi-directional) Transco TETCO Tennessee FGT SW Lateral (Trn, TN, FGT) Existing Pipeline Grid Transco Z3 Sabine Pine Prairie Energy Center Egan Storage Jefferson Island Storage Creole Trail LNG (certificated) Pine Prairie Texas Gas ANR Florida Gas Z2 . Cameron LNG . Tennessee Trunkline Columbia Trunkline LNG . NGPL Transco Florida Gas Z1 Tennessee Bridgeline . NGPL Texas Eastern Trunkline Transco Z3 25

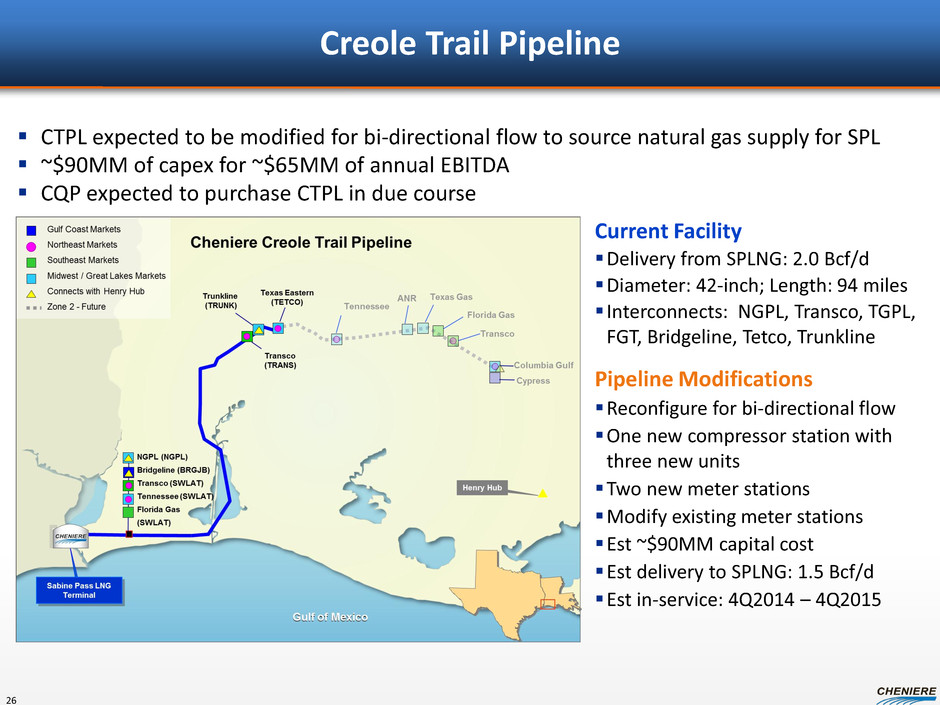

Current Facility Delivery from SPLNG: 2.0 Bcf/d Diameter: 42-inch; Length: 94 miles Interconnects: NGPL, Transco, TGPL, FGT, Bridgeline, Tetco, Trunkline Pipeline Modifications Reconfigure for bi-directional flow One new compressor station with three new units Two new meter stations Modify existing meter stations Est ~$90MM capital cost Est delivery to SPLNG: 1.5 Bcf/d Est in-service: 4Q2014 – 4Q2015 Creole Trail Pipeline CTPL expected to be modified for bi-directional flow to source natural gas supply for SPL ~$90MM of capex for ~$65MM of annual EBITDA CQP expected to purchase CTPL in due course 26

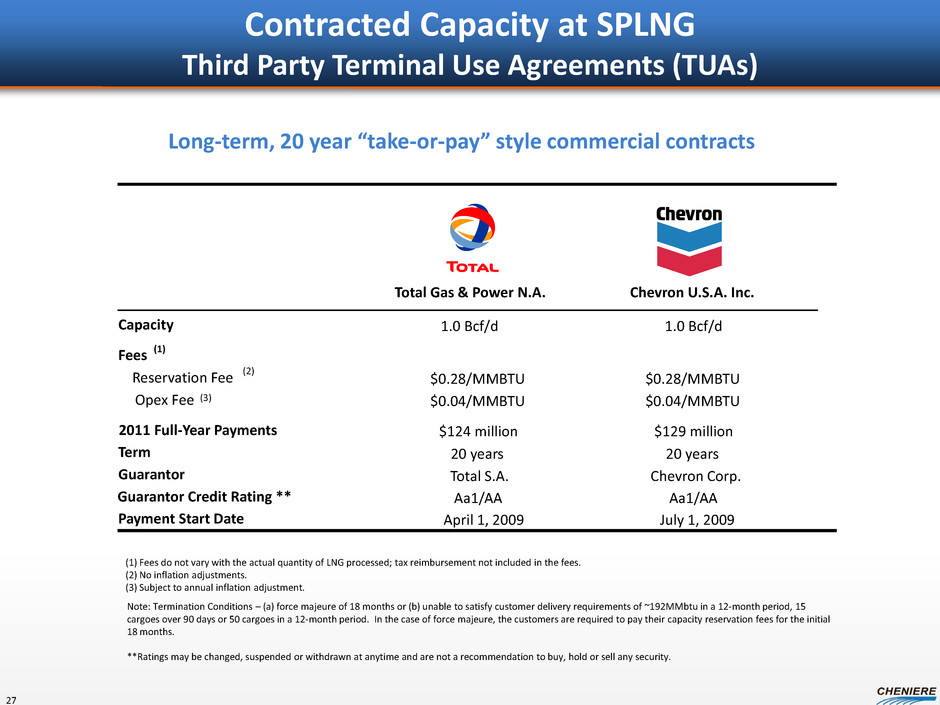

Contracted Capacity at SPLNG Third Party Terminal Use Agreements (TUAs) Long-term, 20 year “take-or-pay” style commercial contracts Total Gas & Power N.A. Chevron U.S.A. Inc. Capacity 1.0 Bcf/d 1.0 Bcf/d Fees (1) Reservation Fee (2) $0.28/MMBTU $0.28/MMBTU Opex Fee (3) $0.04/MMBTU $0.04/MMBTU 2011 Full-Year Payments $124 million $129 million Term 20 years 20 years Guarantor Total S.A. Chevron Corp. Guarantor Credit Rating ** Aa1/AA Aa1/AA Payment Start Date April 1, 2009 July 1, 2009 (1) Fees do not vary with the actual quantity of LNG processed; tax reimbursement not included in the fees. (2) No inflation adjustments. (3) Subject to annual inflation adjustment. Note: Termination Conditions – (a) force majeure of 18 months or (b) unable to satisfy customer delivery requirements of ~192MMbtu in a 12-month period, 15 cargoes over 90 days or 50 cargoes in a 12-month period. In the case of force majeure, the customers are required to pay their capacity reservation fees for the initial 18 months. **Ratings may be changed, suspended or withdrawn at anytime and are not a recommendation to buy, hold or sell any security. 27

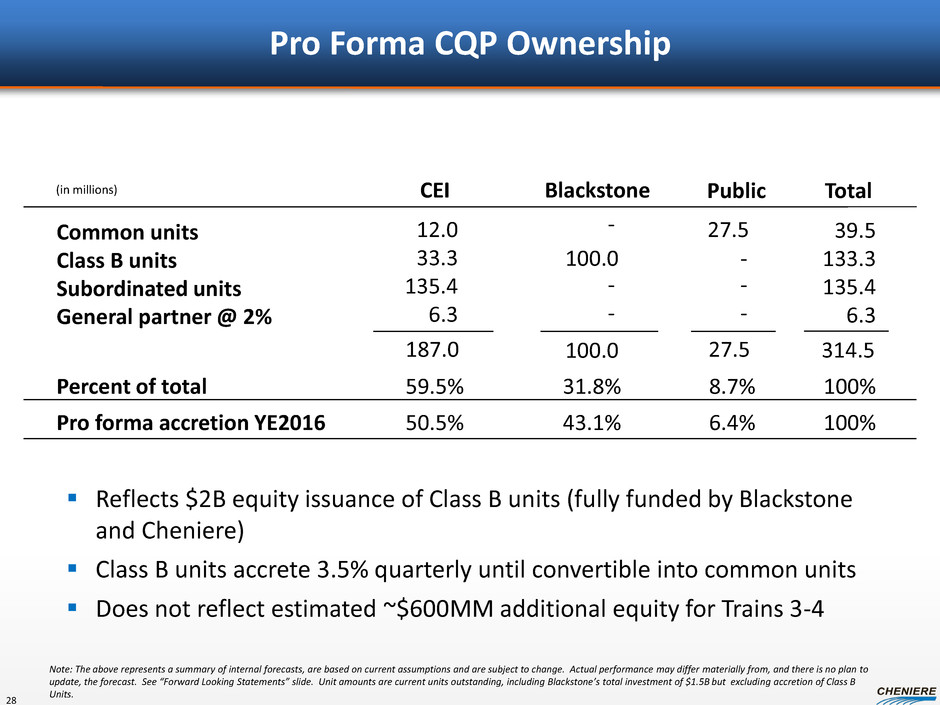

Pro Forma CQP Ownership Common units Class B units Subordinated units General partner @ 2% 27.5 12.0 33.3 135.4 6.3 Public CEI 27.5 187.0 (in millions) 39.5 133.3 135.4 6.3 314.5 Total 59.5% 8.7% 100% Percent of total - - - Blackstone 31.8% 100.0 - - - 100.0 Reflects $2B equity issuance of Class B units (fully funded by Blackstone and Cheniere) Class B units accrete 3.5% quarterly until convertible into common units Does not reflect estimated ~$600MM additional equity for Trains 3-4 50.5% 6.4% 100% Pro forma accretion YE2016 43.1% Note: The above represents a summary of internal forecasts, are based on current assumptions and are subject to change. Actual performance may differ materially from, and there is no plan to update, the forecast. See “Forward Looking Statements” slide. Unit amounts are current units outstanding, including Blackstone’s total investment of $1.5B but excluding accretion of Class B Units. 28

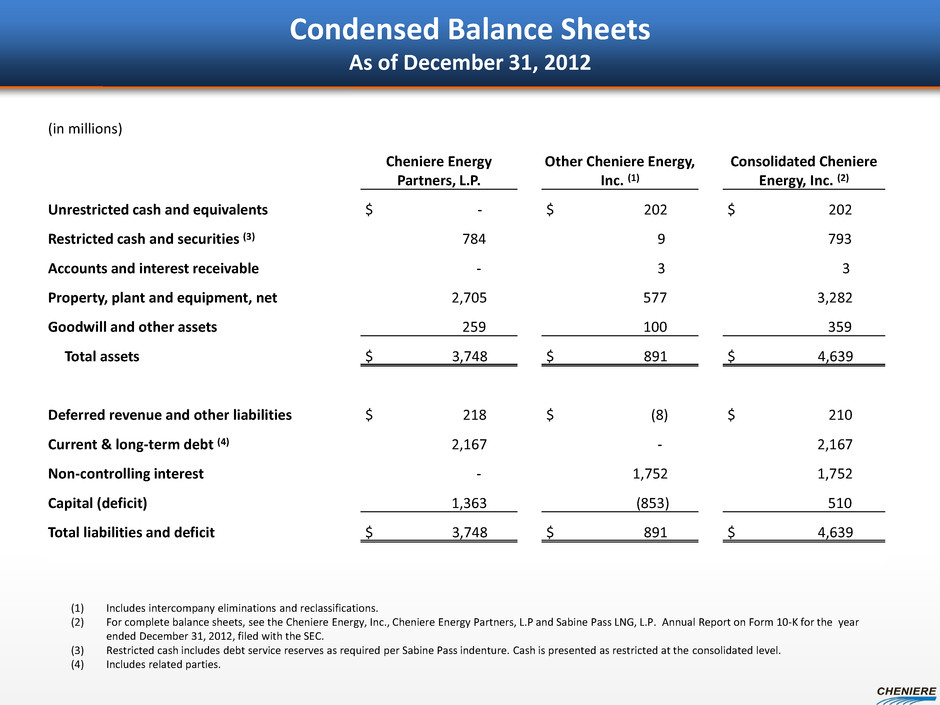

Condensed Balance Sheets As of December 31, 2012 (1) Includes intercompany eliminations and reclassifications. (2) For complete balance sheets, see the Cheniere Energy, Inc., Cheniere Energy Partners, L.P and Sabine Pass LNG, L.P. Annual Report on Form 10-K for the year ended December 31, 2012, filed with the SEC. (3) Restricted cash includes debt service reserves as required per Sabine Pass indenture. Cash is presented as restricted at the consolidated level. (4) Includes related parties. (in millions) Cheniere Energy Partners, L.P. Other Cheniere Energy, Inc. (1) Consolidated Cheniere Energy, Inc. (2) Unrestricted cash and equivalents $ - $ 202 $ 202 Restricted cash and securities (3) 784 9 793 Accounts and interest receivable - 3 3 Property, plant and equipment, net 2,705 577 3,282 Goodwill and other assets 259 100 359 Total assets $ 3,748 $ 891 $ 4,639 Deferred revenue and other liabilities $ 218 $ (8) $ 210 Current & long-term debt (4) 2,167 - 2,167 Non-controlling interest - 1,752 1,752 Capital (deficit) 1,363 (853) 510 Total liabilities and deficit $ 3,748 $ 891 $ 4,639

Nancy Bui: Director, Investor Relations – (713) 375-5280, nancy.bui@cheniere.com Christina Burke: Manager, Investor Relations – (713) 375-5104, christina.burke@cheniere.com Investor Relations Contacts: