Cheniere Energy March 2013

Forward Looking Statements 2 This presentation contains certain statements that are, or may be deemed to be, “forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended”. All statements, other than statements of historical facts, included herein are “forward-looking statements.” Included among “forward-looking statements” are, among other things: statements regarding our ability to pay distributions to our unitholders; statements regarding our expected receipt of cash distributions from Cheniere Energy Partners, L.P., Sabine Pass LNG, L.P. or Sabine Pass Liquefaction, LLC; statements that we expect to commence or complete construction of our proposed LNG terminal or our proposed pipelines, liquefaction facilities or other projects, or any expansions thereof, by certain dates or at all; statements regarding future levels of domestic and international natural gas production, supply or consumption or future levels of liquefied natural gas (“LNG”) imports into or exports from North America and other countries worldwide, regardless of the source of such information, or the transportation or demand for and prices related to natural gas, LNG or other hydrocarbon products; statements regarding any financing transactions or arrangements, or ability to enter into such transactions; statements relating to the construction of our Trains, including statements concerning the engagement of any engineering, procurement and construction ("EPC") contractor or other contractor and the anticipated terms and provisions of any agreement with any EPC or other contractor, and anticipated costs related thereto; statements regarding any arrangement to be entered into or performed substantially in the future, including any revenues anticipated to be received and the anticipated timing thereof, and statements regarding the amounts of total LNG regasification, liquefaction or storage capacities that are, or may become, subject to contracts; statements regarding counterparties to our commercial contracts, construction contracts and other contracts; statements regarding the anticipated drop down of the Creole Trail Pipeline from Cheniere Energy, Inc. to Cheniere Energy Partners, L.P.; statements regarding our planned construction of additional Trains, including the financing of such trains; statements that our Trains, when completed, will have certain characteristics, including amounts of liquefaction capacities; statements regarding any business strategy, our strengths, our business and operation plans or any other plans, forecasts, projections or objectives, including anticipated revenues and capital expenditures, any or all of which are subject to change; statements regarding projections of revenues, expenses, earnings or losses, working capital or other financial items; statements regarding legislative, governmental, regulatory, administrative or other public body actions, requirements, permits, investigations, proceedings or decisions; statements regarding our anticipated LNG and natural gas marketing activities; and any other statements that relate to non-historical or future information. These forward-looking statements are often identified by the use of terms and phrases such as “achieve,” “anticipate,” “believe,” “contemplate,” “develop,” “estimate,” “example,” “expect,” “forecast,” “opportunities,” “plan,” “potential,” “project,” “propose,” “subject to,” “strategy,” and similar terms and phrases. Although we believe that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in “Risk Factors” in the Cheniere Energy, Inc. and Cheniere Energy Partners, L.P. Annual Reports on Form 10-K filed with the SEC on February 22, 2013, each as amended by Amendment No. 1 on Form 10-K/A filed with the SEC on March 1, 2013, which are incorporated by reference into this presentation. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these ”Risk Factors”. These forward-looking statements are made as of the date of this presentation, and we undertake no obligation to publicly update or revise any forward-looking statements.

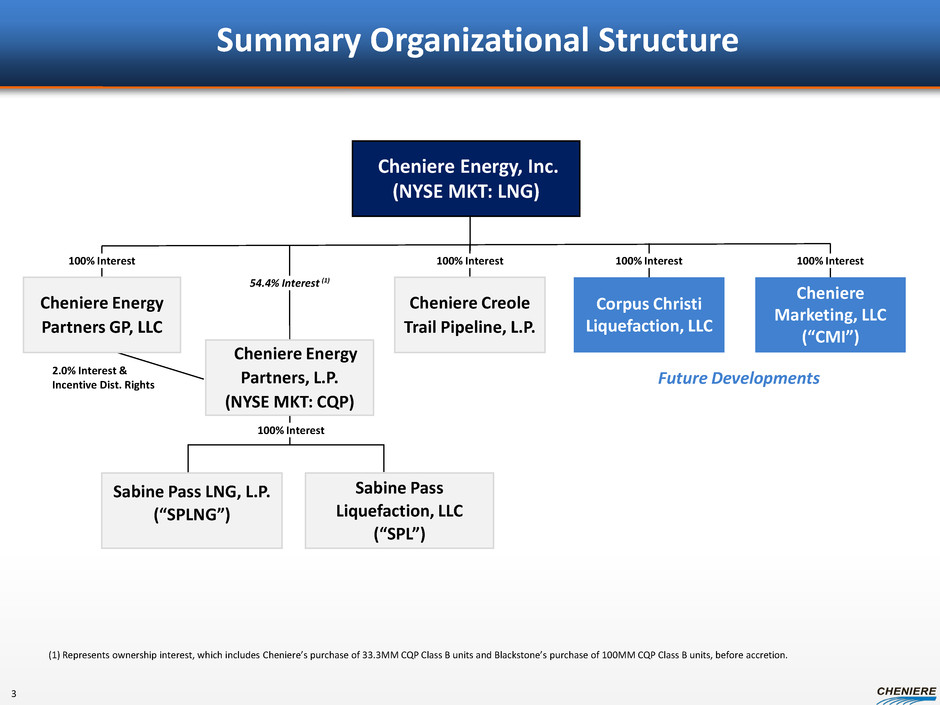

2.0% Interest & Incentive Dist. Rights Cheniere Energy, Inc. (NYSE MKT: LNG) Sabine Pass LNG, L.P. (“SPLNG”) Sabine Pass Liquefaction, LLC (“SPL”) Cheniere Energy Partners, L.P. (NYSE MKT: CQP) Cheniere Creole Trail Pipeline, L.P. Corpus Christi Liquefaction, LLC Cheniere Marketing, LLC (“CMI”) Cheniere Energy Partners GP, LLC 54.4% Interest (1) 100% Interest 100% Interest 100% Interest 100% Interest 100% Interest (1) Represents ownership interest, which includes Cheniere’s purchase of 33.3MM CQP Class B units and Blackstone’s purchase of 100MM CQP Class B units, before accretion. Future Developments Summary Organizational Structure 3

Operating Assets Sabine Pass LNG Terminal Creole Trail Pipeline 4

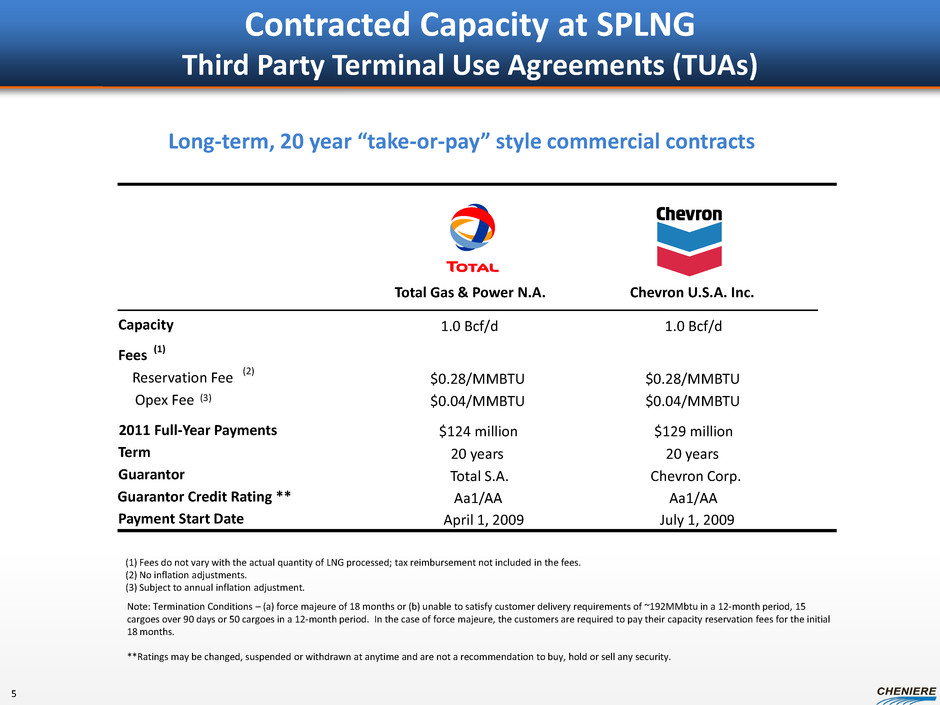

Contracted Capacity at SPLNG Third Party Terminal Use Agreements (TUAs) Long-term, 20 year “take-or-pay” style commercial contracts Total Gas & Power N.A. Chevron U.S.A. Inc. Capacity 1.0 Bcf/d 1.0 Bcf/d Fees (1) Reservation Fee (2) $0.28/MMBTU $0.28/MMBTU Opex Fee (3) $0.04/MMBTU $0.04/MMBTU 2011 Full-Year Payments $124 million $129 million Term 20 years 20 years Guarantor Total S.A. Chevron Corp. Guarantor Credit Rating ** Aa1/AA Aa1/AA Payment Start Date April 1, 2009 July 1, 2009 (1) Fees do not vary with the actual quantity of LNG processed; tax reimbursement not included in the fees. (2) No inflation adjustments. (3) Subject to annual inflation adjustment. Note: Termination Conditions – (a) force majeure of 18 months or (b) unable to satisfy customer delivery requirements of ~192MMbtu in a 12-month period, 15 cargoes over 90 days or 50 cargoes in a 12-month period. In the case of force majeure, the customers are required to pay their capacity reservation fees for the initial 18 months. **Ratings may be changed, suspended or withdrawn at anytime and are not a recommendation to buy, hold or sell any security. 5

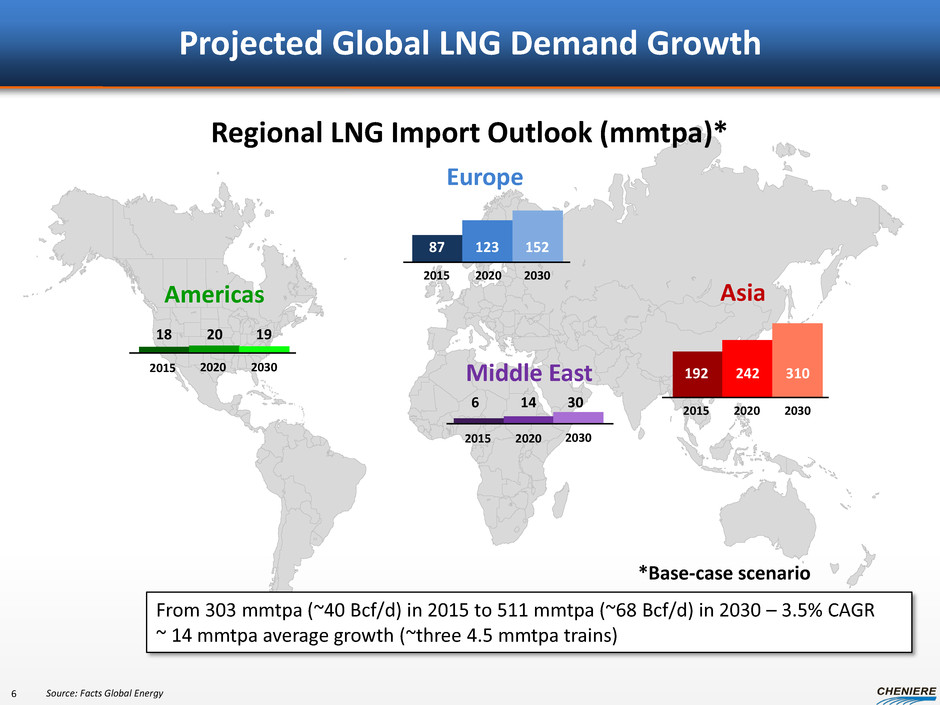

Projected Global LNG Demand Growth Regional LNG Import Outlook (mmtpa)* Source: Facts Global Energy 18 20 19 2015 2020 2030 2015 2020 2030 6 14 30 2015 2020 2030 2015 2020 2030 Americas Europe Asia Middle East *Base-case scenario 192 242 310 87 123 152 From 303 mmtpa (~40 Bcf/d) in 2015 to 511 mmtpa (~68 Bcf/d) in 2030 – 3.5% CAGR ~ 14 mmtpa average growth (~three 4.5 mmtpa trains) 6

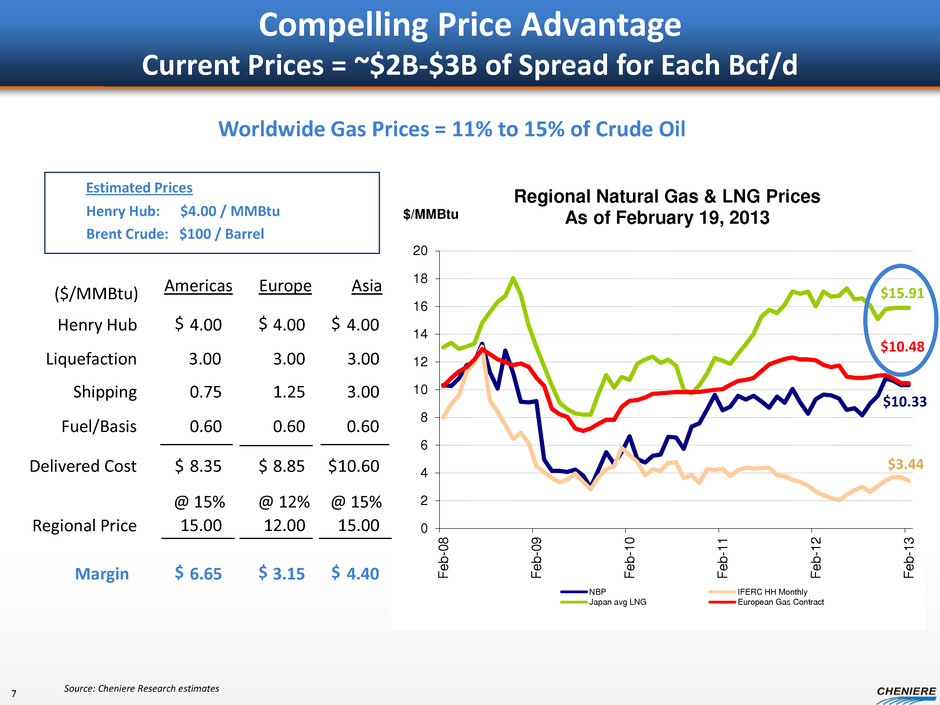

0 2 4 6 8 10 12 14 16 18 20 F e b -0 8 F e b -0 9 F e b -1 0 F e b -1 1 F e b -1 2 F e b -1 3 $/MMBtu Regional Natural Gas & LNG Prices As of February 19, 2013 NBP IFERC HH Monthly Japan avg LNG European Gas Contract Estimated Prices Henry Hub: $4.00 / MMBtu Brent Crude: $100 / Barrel ($/MMBtu) Americas Europe Asia Henry Hub 4.00 $ 4.00 4.00 Fuel/Basis Shipping 0.75 1.25 3.00 0.60 0.60 0.60 $ 8.35 8.85 10.60 4.40 Regional Price @ 15% 15.00 12.00 15.00 Margin 6.65 $ 3.15 Liquefaction 3.00 3.00 3.00 Delivered Cost Source: Cheniere Research estimates Compelling Price Advantage Current Prices = ~$2B-$3B of Spread for Each Bcf/d @ 12% @ 15% $ $ $ $ $ $ Worldwide Gas Prices = 11% to 15% of Crude Oil $3.44 $10.33 $15.91 $10.48 7

Sabine Pass LNG Terminal Trains 1-2 Under Construction; Trains 3-4 EPC Obtained Significant infrastructure in place including storage, marine and pipeline interconnection facilities; pipeline quality natural gas to be sourced from U.S. pipeline network Liquefaction Trains 3 & 4 2 trains, each 4.5 mmtpa nameplate capacity LSTK EPC contract w/ Bechtel Construction estimated to start 2013 Operations estimated 2016-2017 Liquefaction Expansion - Trains 5 & 6 Bechtel commenced preliminary engineering Initiated permitting process Current Facility ~1,000 acres in Cameron Parish, LA 40 ft ship channel 3.7 miles from coast 2 berths; 4 dedicated tugs 5 LNG storage tanks (~17 Bcf of storage) 5.3 Bcf/d of pipeline interconnection Liquefaction Trains 1 & 2 2 trains, each 4.5 mmtpa nameplate capacity LSTK EPC contract w/ Bechtel Operations estimated 2015-2016 8

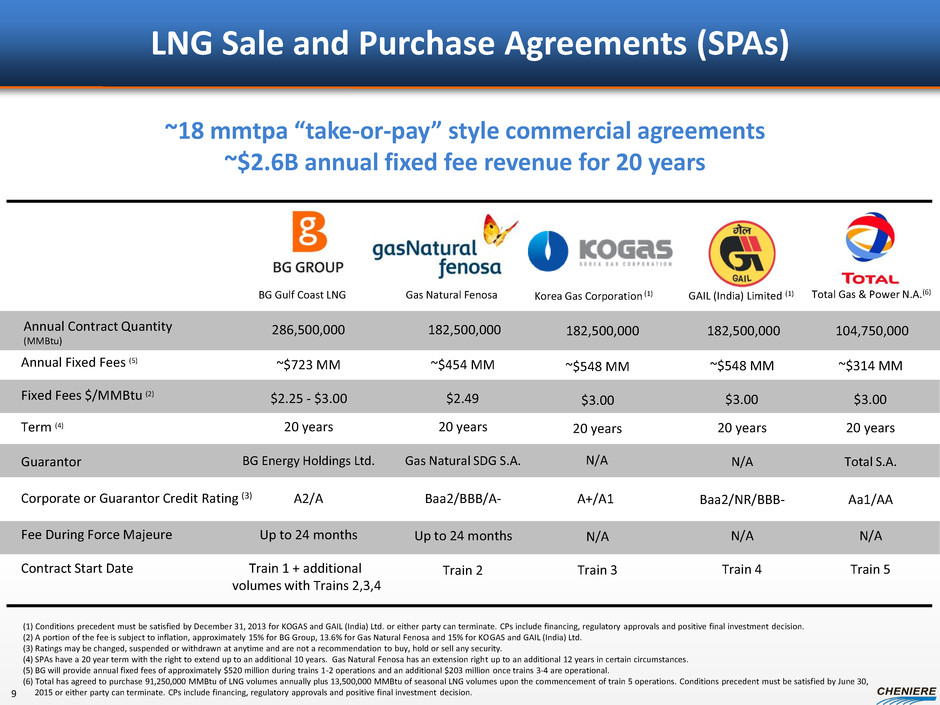

LNG Sale and Purchase Agreements (SPAs) (1) Conditions precedent must be satisfied by December 31, 2013 for KOGAS and GAIL (India) Ltd. or either party can terminate. CPs include financing, regulatory approvals and positive final investment decision. (2) A portion of the fee is subject to inflation, approximately 15% for BG Group, 13.6% for Gas Natural Fenosa and 15% for KOGAS and GAIL (India) Ltd. (3) Ratings may be changed, suspended or withdrawn at anytime and are not a recommendation to buy, hold or sell any security. (4) SPAs have a 20 year term with the right to extend up to an additional 10 years. Gas Natural Fenosa has an extension right up to an additional 12 years in certain circumstances. (5) BG will provide annual fixed fees of approximately $520 million during trains 1-2 operations and an additional $203 million once trains 3-4 are operational. (6) Total has agreed to purchase 91,250,000 MMBtu of LNG volumes annually plus 13,500,000 MMBtu of seasonal LNG volumes upon the commencement of train 5 operations. Conditions precedent must be satisfied by June 30, 2015 or either party can terminate. CPs include financing, regulatory approvals and positive final investment decision. BG Gulf Coast LNG Gas Natural Fenosa Annual Contract Quantity (MMBtu) 286,500,000 Fixed Fees $/MMBtu (2) Annual Fixed Fees (5) ~$723 MM ~$454 MM Term (4) Guarantor 20 years BG Energy Holdings Ltd. Gas Natural SDG S.A. Corporate or Guarantor Credit Rating (3) A2/A Baa2/BBB/A- Fee During Force Majeure Up to 24 months Up to 24 months 20 years GAIL (India) Limited (1) ~$548 MM 20 years Baa2/NR/BBB- N/A ~18 mmtpa “take-or-pay” style commercial agreements ~$2.6B annual fixed fee revenue for 20 years N/A Contract Start Date Train 1 + additional volumes with Trains 2,3,4 Train 2 Train 4 $2.25 - $3.00 $2.49 $3.00 182,500,000 182,500,000 20 years N/A N/A A+/A1 Train 3 $3.00 ~$548 MM Korea Gas Corporation (1) 182,500,000 ~$314 MM 20 years Aa1/AA N/A Total S.A. Train 5 $3.00 104,750,000 Total Gas & Power N.A.(6) 9

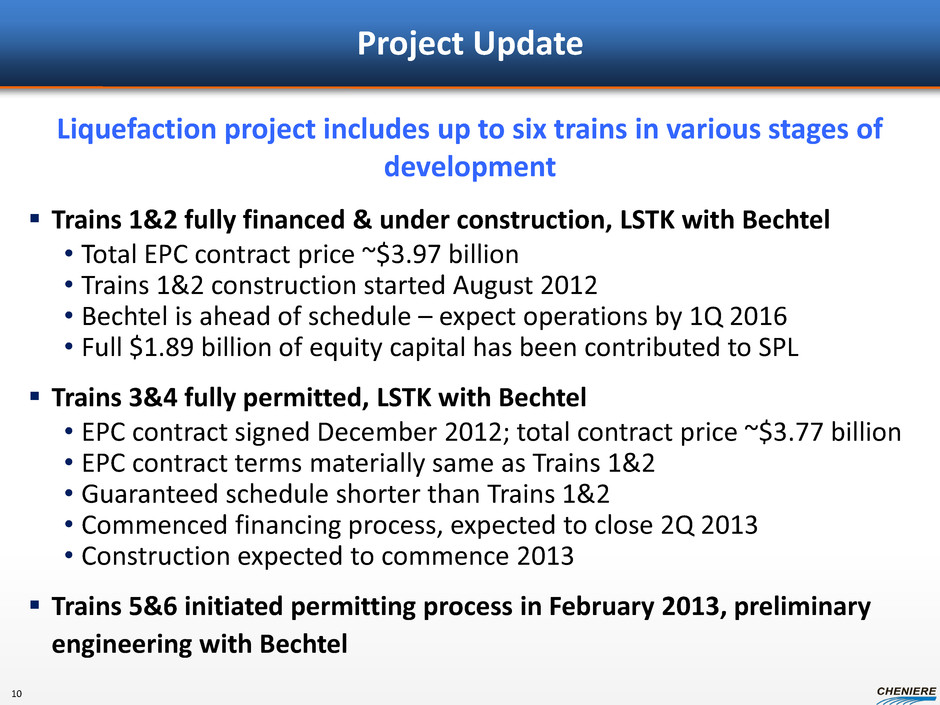

Project Update Trains 1&2 fully financed & under construction, LSTK with Bechtel • Total EPC contract price ~$3.97 billion • Trains 1&2 construction started August 2012 • Bechtel is ahead of schedule – expect operations by 1Q 2016 • Full $1.89 billion of equity capital has been contributed to SPL Trains 3&4 fully permitted, LSTK with Bechtel • EPC contract signed December 2012; total contract price ~$3.77 billion • EPC contract terms materially same as Trains 1&2 • Guaranteed schedule shorter than Trains 1&2 • Commenced financing process, expected to close 2Q 2013 • Construction expected to commence 2013 Trains 5&6 initiated permitting process in February 2013, preliminary engineering with Bechtel Liquefaction project includes up to six trains in various stages of development 10

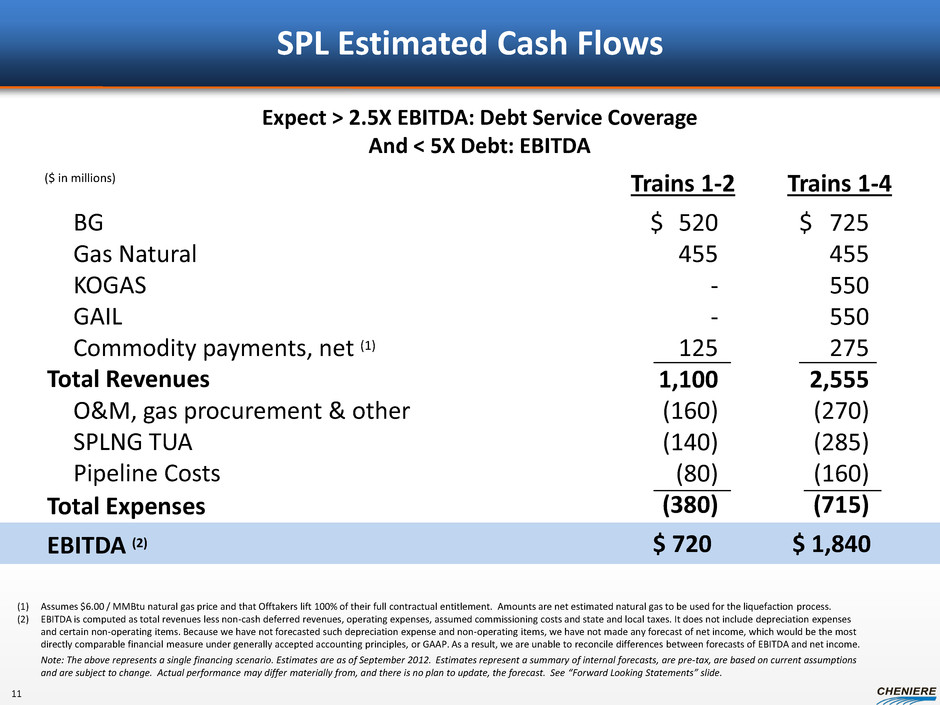

SPL Estimated Cash Flows Trains 1-4 Total Revenues Trains 1-2 BG Gas Natural KOGAS GAIL Commodity payments, net (1) O&M, gas procurement & other SPLNG TUA Pipeline Costs 520 455 - - 125 1,100 (160) (140) (80) (380) EBITDA (2) 725 455 550 550 275 2,555 (270) (285) (160) (715) $ 1,840 $ 720 $ $ ($ in millions) Total Expenses (1) Assumes $6.00 / MMBtu natural gas price and that Offtakers lift 100% of their full contractual entitlement. Amounts are net estimated natural gas to be used for the liquefaction process. (2) EBITDA is computed as total revenues less non-cash deferred revenues, operating expenses, assumed commissioning costs and state and local taxes. It does not include depreciation expenses and certain non-operating items. Because we have not forecasted such depreciation expense and non-operating items, we have not made any forecast of net income, which would be the most directly comparable financial measure under generally accepted accounting principles, or GAAP. As a result, we are unable to reconcile differences between forecasts of EBITDA and net income. Note: The above represents a single financing scenario. Estimates are as of September 2012. Estimates represent a summary of internal forecasts, are pre-tax, are based on current assumptions and are subject to change. Actual performance may differ materially from, and there is no plan to update, the forecast. See “Forward Looking Statements” slide. Expect > 2.5X EBITDA: Debt Service Coverage And < 5X Debt: EBITDA 11

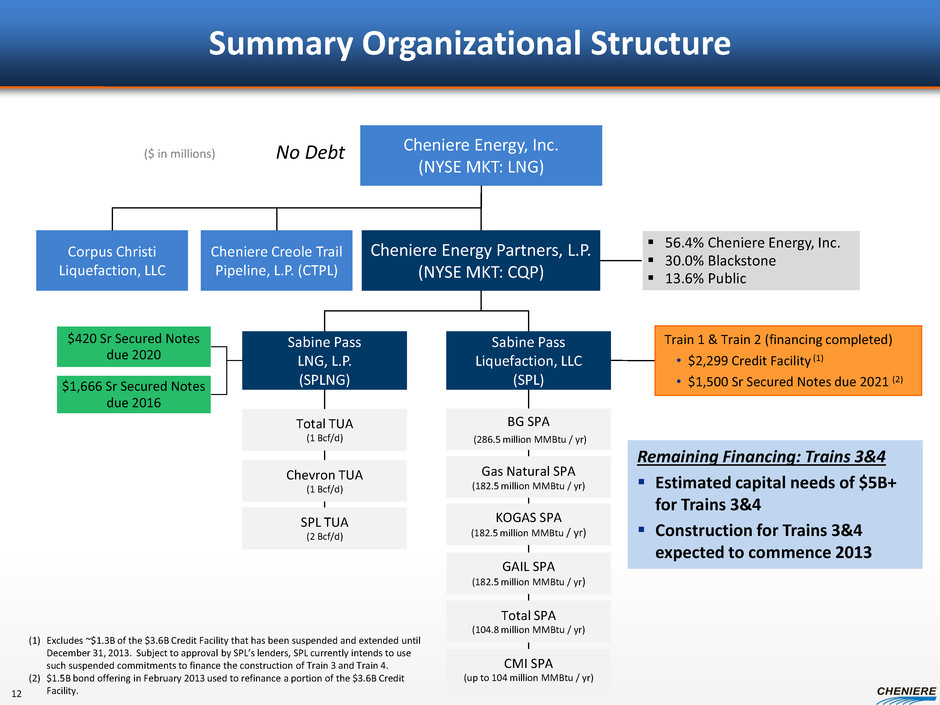

Summary Organizational Structure Cheniere Energy, Inc. (NYSE MKT: LNG) Cheniere Energy Partners, L.P. (NYSE MKT: CQP) Sabine Pass LNG, L.P. (SPLNG) BG SPA (286.5 million MMBtu / yr) Gas Natural SPA (182.5 million MMBtu / yr) KOGAS SPA (182.5 million MMBtu / yr) GAIL SPA (182.5 million MMBtu / yr) Total TUA (1 Bcf/d) Chevron TUA (1 Bcf/d) SPL TUA (2 Bcf/d) $420 Sr Secured Notes due 2020 $1,666 Sr Secured Notes due 2016 ($ in millions) No Debt Cheniere Creole Trail Pipeline, L.P. (CTPL) Corpus Christi Liquefaction, LLC Train 1 & Train 2 (financing completed) • $2,299 Credit Facility (1) • $1,500 Sr Secured Notes due 2021 (2) CMI SPA (up to 104 million MMBtu / yr) Total SPA (104.8 million MMBtu / yr) Sabine Pass Liquefaction, LLC (SPL) Remaining Financing: Trains 3&4 Estimated capital needs of $5B+ for Trains 3&4 Construction for Trains 3&4 expected to commence 2013 (1) Excludes ~$1.3B of the $3.6B Credit Facility that has been suspended and extended until December 31, 2013. Subject to approval by SPL’s lenders, SPL currently intends to use such suspended commitments to finance the construction of Train 3 and Train 4. (2) $1.5B bond offering in February 2013 used to refinance a portion of the $3.6B Credit Facility. 56.4% Cheniere Energy, Inc. 30.0% Blackstone 13.6% Public 12

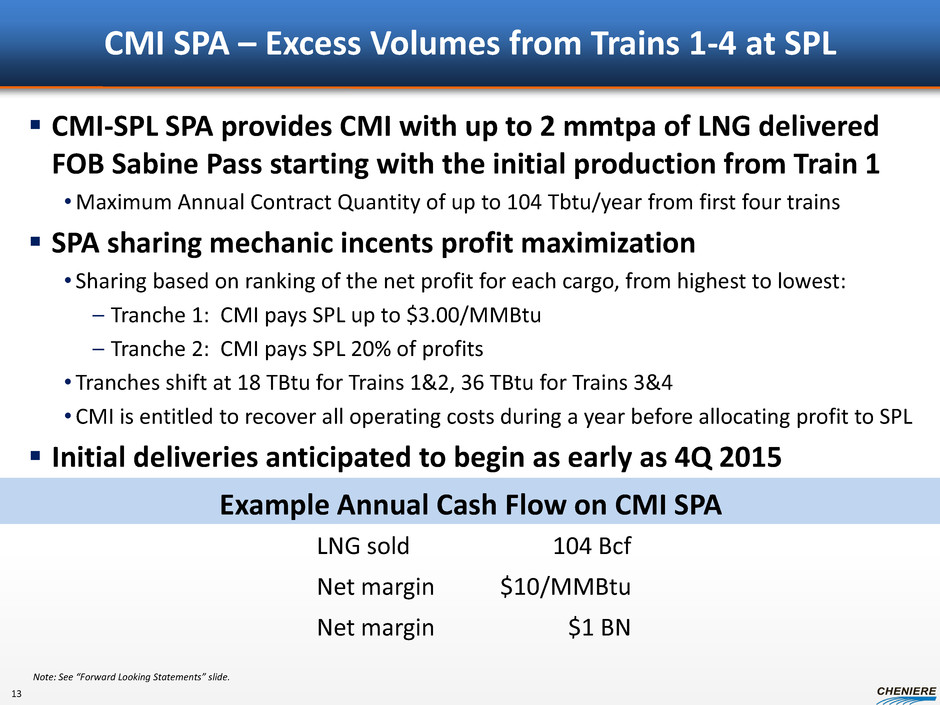

CMI SPA – Excess Volumes from Trains 1-4 at SPL CMI-SPL SPA provides CMI with up to 2 mmtpa of LNG delivered FOB Sabine Pass starting with the initial production from Train 1 •Maximum Annual Contract Quantity of up to 104 Tbtu/year from first four trains SPA sharing mechanic incents profit maximization • Sharing based on ranking of the net profit for each cargo, from highest to lowest: – Tranche 1: CMI pays SPL up to $3.00/MMBtu – Tranche 2: CMI pays SPL 20% of profits • Tranches shift at 18 TBtu for Trains 1&2, 36 TBtu for Trains 3&4 • CMI is entitled to recover all operating costs during a year before allocating profit to SPL Initial deliveries anticipated to begin as early as 4Q 2015 Note: See “Forward Looking Statements” slide. LNG sold 104 Bcf Net margin $10/MMBtu Net margin $1 BN Example Annual Cash Flow on CMI SPA 13

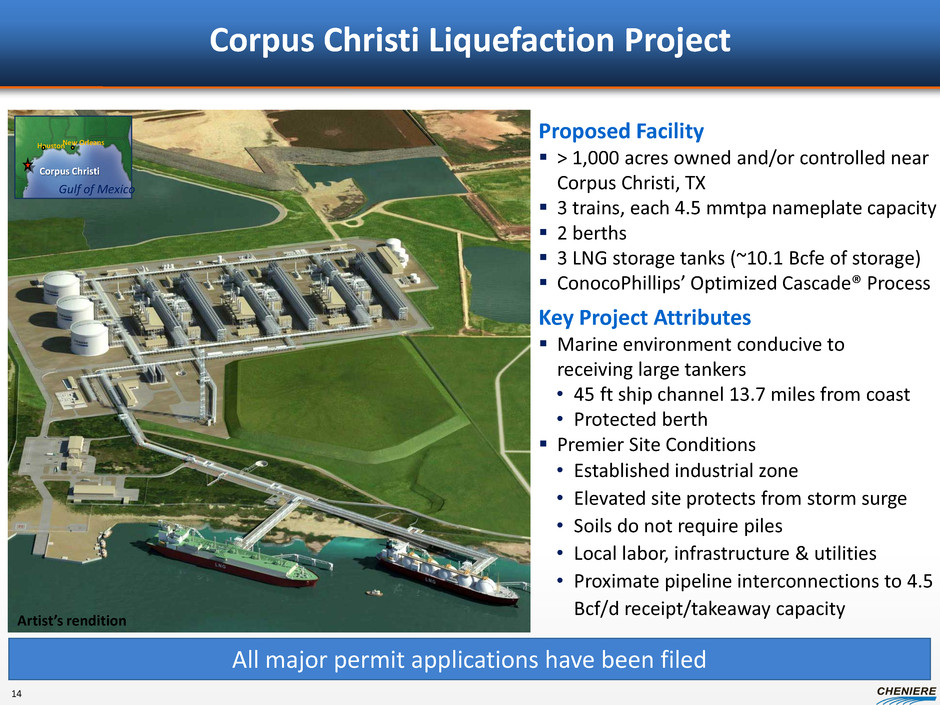

Corpus Christi Liquefaction Project Proposed Facility > 1,000 acres owned and/or controlled near Corpus Christi, TX 3 trains, each 4.5 mmtpa nameplate capacity 2 berths 3 LNG storage tanks (~10.1 Bcfe of storage) ConocoPhillips’ Optimized Cascade® Process Key Project Attributes Marine environment conducive to receiving large tankers • 45 ft ship channel 13.7 miles from coast • Protected berth Premier Site Conditions • Established industrial zone • Elevated site protects from storm surge • Soils do not require piles • Local labor, infrastructure & utilities • Proximate pipeline interconnections to 4.5 Bcf/d receipt/takeaway capacity Houston New Orleans Gulf of Mexico Corpus Christi All major permit applications have been filed 14 Artist’s rendition

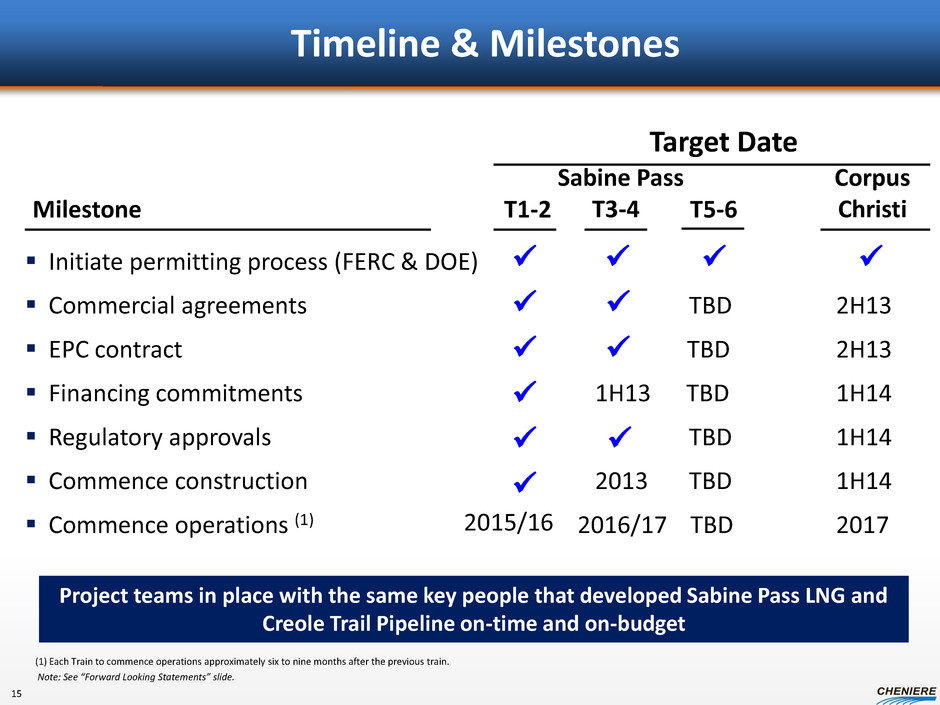

Timeline & Milestones Initiate permitting process (FERC & DOE) Commercial agreements TBD 2H13 EPC contract TBD 2H13 Financing commitments 1H13 TBD 1H14 Regulatory approvals TBD 1H14 Commence construction 2013 TBD 1H14 Commence operations (1) 2016/17 TBD 2017 Milestone Corpus Christi (1) Each Train to commence operations approximately six to nine months after the previous train. Note: See “Forward Looking Statements” slide. T3-4 T1-2 Target Date 2015/16 Project teams in place with the same key people that developed Sabine Pass LNG and Creole Trail Pipeline on-time and on-budget Sabine Pass T5-6 15

Appendix

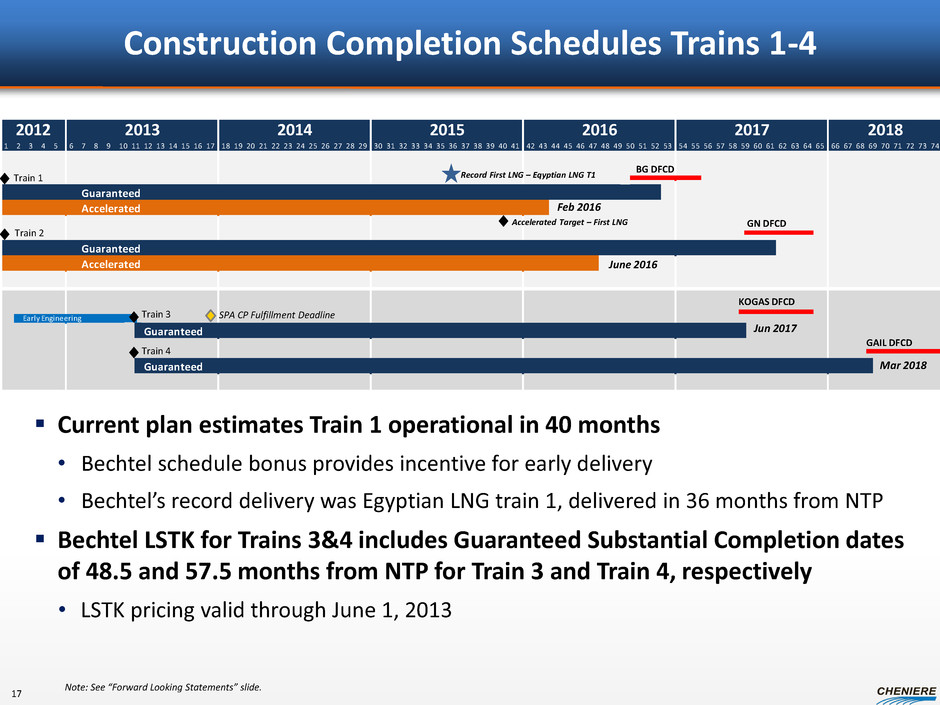

2012 2013 2014 2015 2016 2017 2018 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 Guaranteed Accelerated Guaranteed Accelerated Early Engineering Guaranteed Guaranteed Construction Completion Schedules Trains 1-4 Note: See “Forward Looking Statements” slide. Current plan estimates Train 1 operational in 40 months • Bechtel schedule bonus provides incentive for early delivery • Bechtel’s record delivery was Egyptian LNG train 1, delivered in 36 months from NTP Bechtel LSTK for Trains 3&4 includes Guaranteed Substantial Completion dates of 48.5 and 57.5 months from NTP for Train 3 and Train 4, respectively • LSTK pricing valid through June 1, 2013 BG DFCD GN DFCD KOGAS DFCD GAIL DFCD Record First LNG – Eqyptian LNG T1 Accelerated Target – First LNG Train 1 Train 2 Train 3 Train 4 SPA CP Fulfillment Deadline Feb 2016 June 2016 Jun 2017 Mar 2018 17

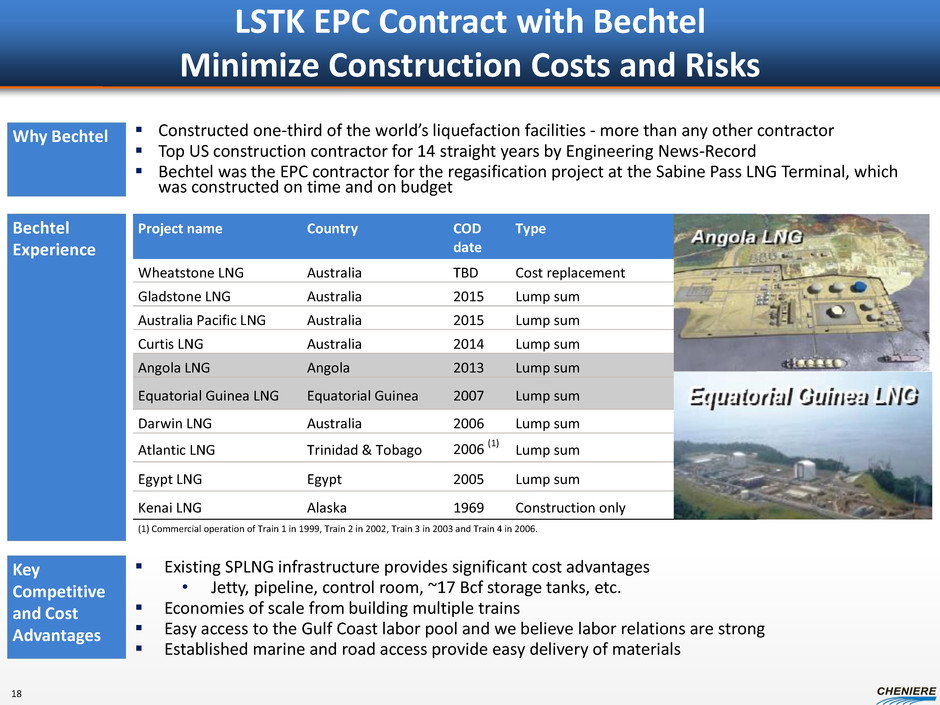

Why Bechtel Constructed one-third of the world’s liquefaction facilities - more than any other contractor Top US construction contractor for 14 straight years by Engineering News-Record Bechtel was the EPC contractor for the regasification project at the Sabine Pass LNG Terminal, which was constructed on time and on budget Bechtel Experience Key Competitive and Cost Advantages Existing SPLNG infrastructure provides significant cost advantages • Jetty, pipeline, control room, ~17 Bcf storage tanks, etc. Economies of scale from building multiple trains Easy access to the Gulf Coast labor pool and we believe labor relations are strong Established marine and road access provide easy delivery of materials Project name Country COD date Type Wheatstone LNG Australia TBD Cost replacement Gladstone LNG Australia 2015 Lump sum Australia Pacific LNG Australia 2015 Lump sum Curtis LNG Australia 2014 Lump sum Angola LNG Angola 2013 Lump sum Equatorial Guine LNG Equatorial Guinea 2007 Lump sum Darwin LNG Australia 2006 Lump sum Atlantic LNG Trinidad & Tobago 2006 (1) Lump sum Egypt LNG Egypt 2005 Lump sum Kenai LNG Alaska 1969 Construction only (1) Commercial operation of Train 1 in 1999, Train 2 in 2002, Train 3 in 2003 and Train 4 in 2006. LSTK EPC Contract with Bechtel Minimize Construction Costs and Risks 18

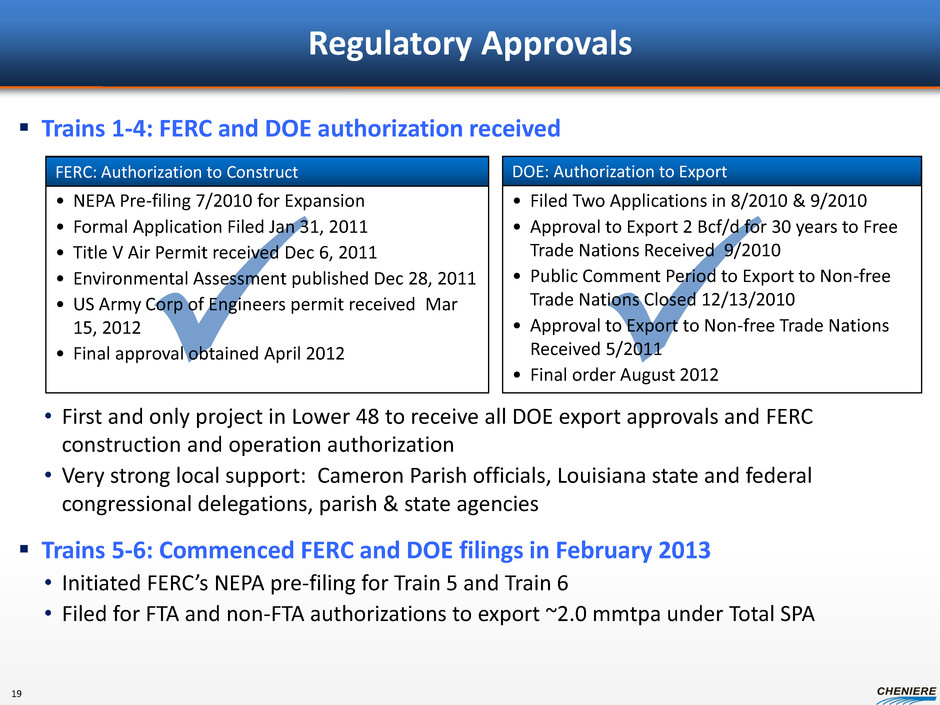

• NEPA Pre-filing 7/2010 for Expansion • Formal Application Filed Jan 31, 2011 • Title V Air Permit received Dec 6, 2011 • Environmental Assessment published Dec 28, 2011 • US Army Corp of Engineers permit received Mar 15, 2012 • Final approval obtained April 2012 • Filed Two Applications in 8/2010 & 9/2010 • Approval to Export 2 Bcf/d for 30 years to Free Trade Nations Received 9/2010 • Public Comment Period to Export to Non-free Trade Nations Closed 12/13/2010 • Approval to Export to Non-free Trade Nations Received 5/2011 • Final order August 2012 Regulatory Approvals FERC: Authorization to Construct DOE: Authorization to Export • First and only project in Lower 48 to receive all DOE export approvals and FERC construction and operation authorization • Very strong local support: Cameron Parish officials, Louisiana state and federal congressional delegations, parish & state agencies Trains 1-4: FERC and DOE authorization received Trains 5-6: Commenced FERC and DOE filings in February 2013 • Initiated FERC’s NEPA pre-filing for Train 5 and Train 6 • Filed for FTA and non-FTA authorizations to export ~2.0 mmtpa under Total SPA 19

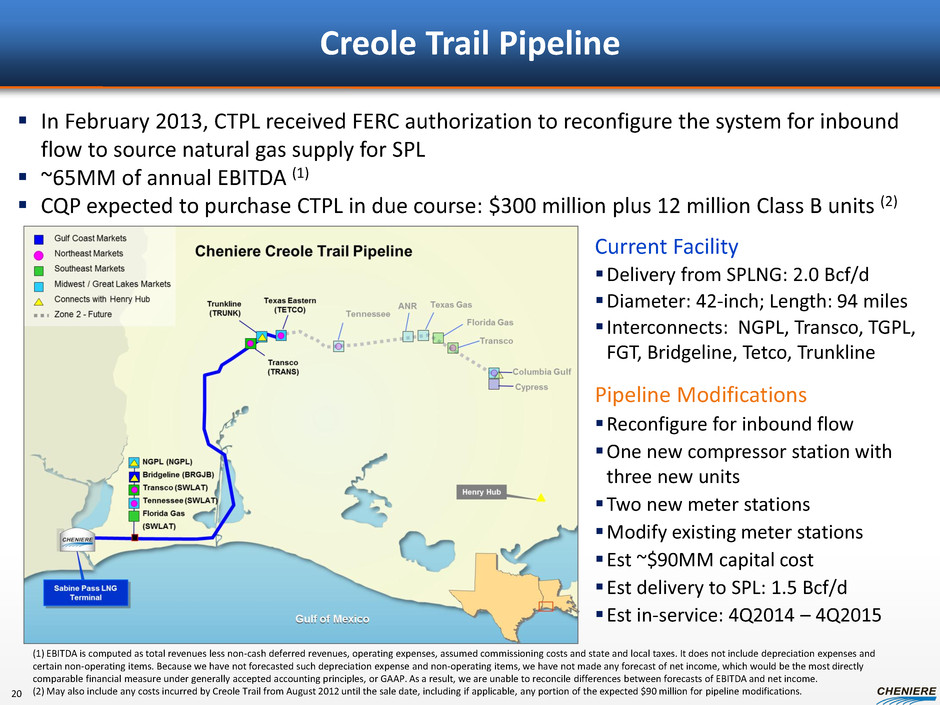

Current Facility Delivery from SPLNG: 2.0 Bcf/d Diameter: 42-inch; Length: 94 miles Interconnects: NGPL, Transco, TGPL, FGT, Bridgeline, Tetco, Trunkline Pipeline Modifications Reconfigure for inbound flow One new compressor station with three new units Two new meter stations Modify existing meter stations Est ~$90MM capital cost Est delivery to SPL: 1.5 Bcf/d Est in-service: 4Q2014 – 4Q2015 Creole Trail Pipeline In February 2013, CTPL received FERC authorization to reconfigure the system for inbound flow to source natural gas supply for SPL ~65MM of annual EBITDA (1) CQP expected to purchase CTPL in due course: $300 million plus 12 million Class B units (2) (1) EBITDA is computed as total revenues less non-cash deferred revenues, operating expenses, assumed commissioning costs and state and local taxes. It does not include depreciation expenses and certain non-operating items. Because we have not forecasted such depreciation expense and non-operating items, we have not made any forecast of net income, which would be the most directly comparable financial measure under generally accepted accounting principles, or GAAP. As a result, we are unable to reconcile differences between forecasts of EBITDA and net income. (2) May also include any costs incurred by Creole Trail from August 2012 until the sale date, including if applicable, any portion of the expected $90 million for pipeline modifications. 20

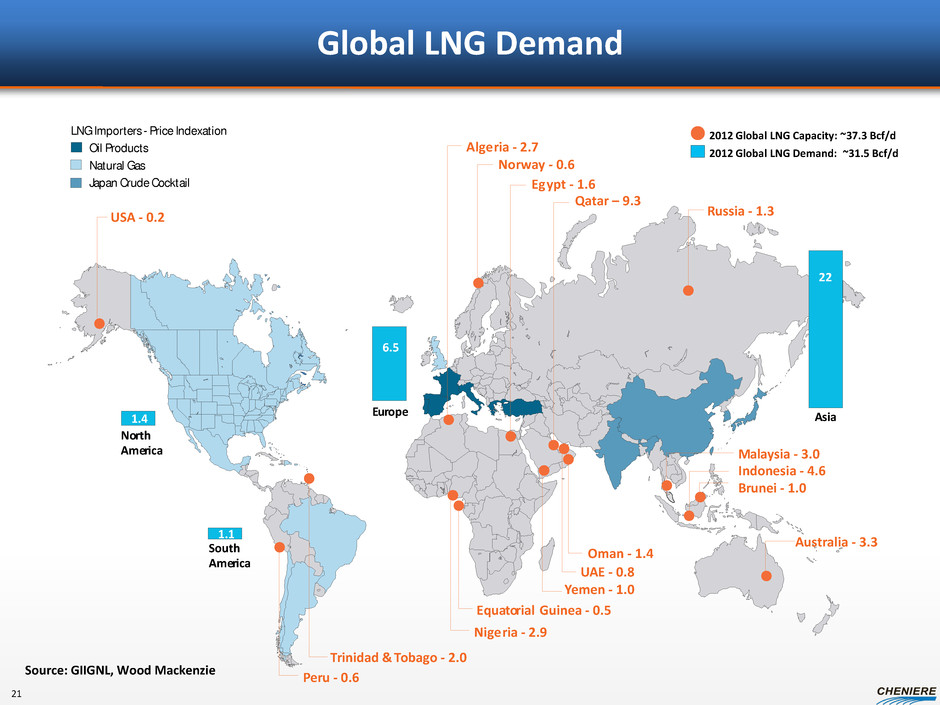

Global LNG Demand 2012 Global LNG Capacity: ~37.3 Bcf/d Natural Gas Oil Products LNG Importers - Price Indexation Japan Crude Cocktail 2012 Global LNG Demand: ~31.5 Bcf/d No r th Ame r ica S outh Ame r ica E u r ope A sia 6.5 1.4 1.1 22 A ust r alia - 3.3 B r unei - 1.0 Indonesia - 4.6 M al a y sia - 3.0 A lge r ia - 2.7 N o r w a y - 0.6 Q a tar – 9.3 R ussia - 1.3 E g ypt - 1.6 Y emen - 1.0 Nige r ia - 2.9 T r inidad & T obago - 2.0 E qua t o r ial G uinea - 0.5 Oman - 1.4 U AE - 0.8 USA - 0.2 P e r u - 0.6 Source: GIIGNL, Wood Mackenzie 21

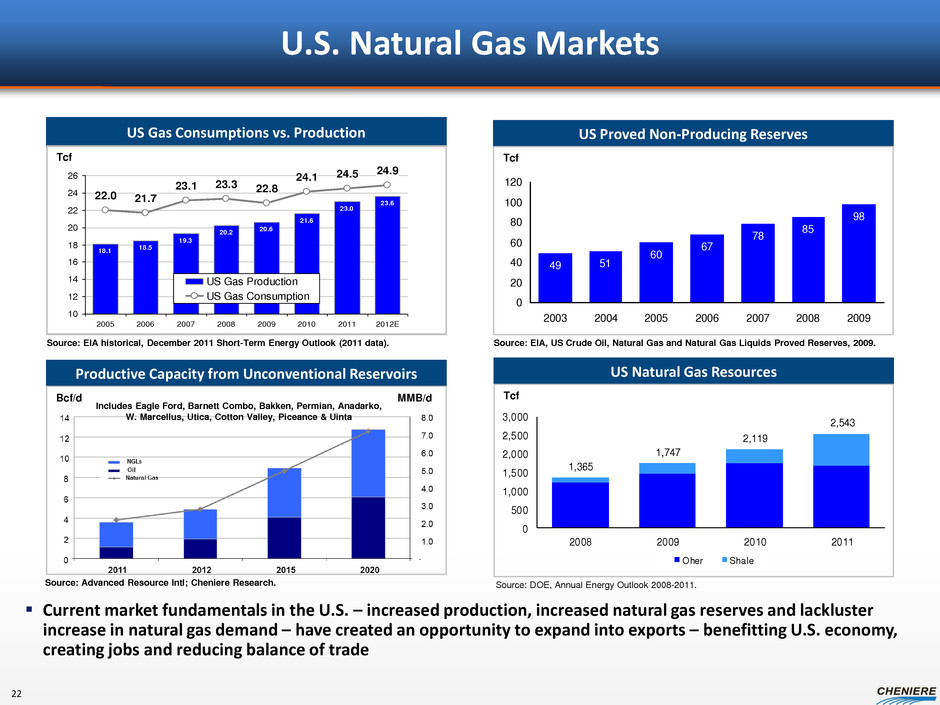

US Gas Consumptions vs. Production US Proved Non-Producing Reserves Productive Capacity from Unconventional Reservoirs Tcf Bcf/d MMB/d Current market fundamentals in the U.S. – increased production, increased natural gas reserves and lackluster increase in natural gas demand – have created an opportunity to expand into exports – benefitting U.S. economy, creating jobs and reducing balance of trade Source: EIA historical, December 2011 Short-Term Energy Outlook (2011 data). 49 51 60 67 78 85 98 0 20 40 60 80 100 120 2003 2004 2005 2006 2007 2008 2009 Source: EIA, US Crude Oil, Natural Gas and Natural Gas Liquids Proved Reserves, 2009. Source: Advanced Resource Intl; Cheniere Research. U.S. Natural Gas Markets 18.1 18.5 19.3 20.2 20.6 21.6 23.0 23.6 22.0 21.7 23.1 23.3 22.8 24.1 24.5 24.9 10 12 14 16 18 20 22 24 26 2005 2006 2007 2008 2009 2010 2011 2012E US Gas Production US Gas Consumption Tcf Includes Eagle Ford, Barnett Combo, Bakken, Permian, Anadarko, W. Marcellus, Utica, Cotton Valley, Piceance & Uinta US Natural Gas Resources Tcf 1,365 1,747 2,119 2,543 0 500 1,000 1,500 2,000 2,500 3,000 2008 2009 2010 2011 Oher Shale Source: DOE, Annual Energy Outlook 2008-2011. 22

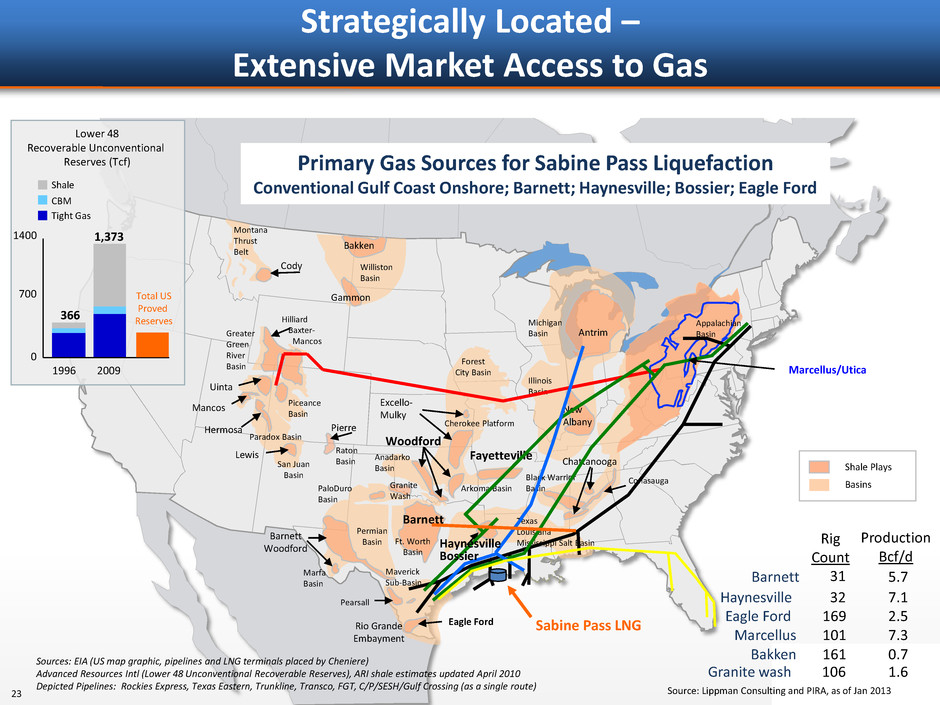

Montana Thrust Belt Cody Gammon Hilliard Baxter- Mancos Greater Green River Basin Forest City Basin Pierre Illinois Basin Piceance Basin Lewis San Juan Basin Raton Basin Anadarko Basin PaloDuro Basin Permian Basin Barnett Woodford Pearsall Eagle Ford Rio Grande Embayment Barnett Woodford Michigan Basin Antrim New Albany Chattanooga Texas Louisiana Mississippi Salt Basin Fayetteville Ft. Worth Basin Arkoma Basin Conasauga Black Warrior Basin Marfa Basin Paradox Basin Maverick Sub-Basin Hermosa Mancos Cherokee Platform Excello- Mulky Appalachian Basin Marcellus/Utica Shale Plays Basins 366 1,373 Lower 48 Recoverable Unconventional Reserves (Tcf) 0 700 1400 1996 2009 Shale CBM Tight Gas Total US Proved Reserves Sabine Pass LNG Haynesville Bossier Granite Wash Williston Basin Bakken Primary Gas Sources for Sabine Pass Liquefaction Conventional Gulf Coast Onshore; Barnett; Haynesville; Bossier; Eagle Ford Sources: EIA (US map graphic, pipelines and LNG terminals placed by Cheniere) Advanced Resources Intl (Lower 48 Unconventional Recoverable Reserves), ARI shale estimates updated April 2010 Depicted Pipelines: Rockies Express, Texas Eastern, Trunkline, Transco, FGT, C/P/SESH/Gulf Crossing (as a single route) Rig Count Production Bcf/d Barnett 31 5.7 Haynesville 32 7.1 Eagle Ford 169 2.5 Granite wash 106 1.6 Bakken 161 0.7 Marcellus 101 7.3 Source: Lippman Consulting and PIRA, as of Jan 2013 Uinta Strategically Located – Extensive Market Access to Gas 23

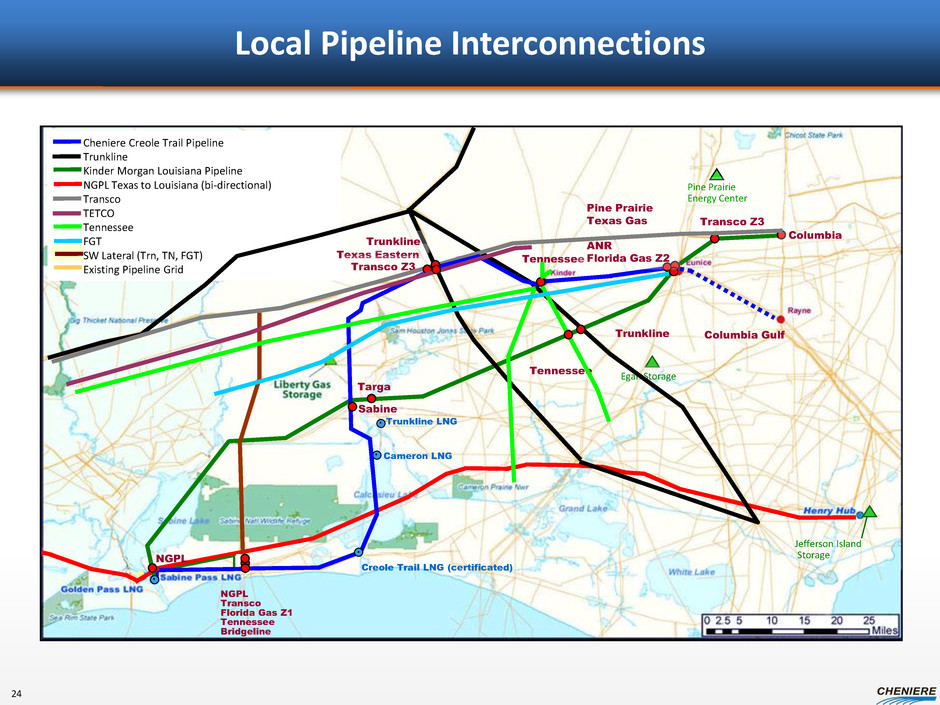

Local Pipeline Interconnections Targa Columbia Gulf Tennessee Cheniere Creole Trail Pipeline Trunkline Kinder Morgan Louisiana Pipeline NGPL Texas to Louisiana (bi-directional) Transco TETCO Tennessee FGT SW Lateral (Trn, TN, FGT) Existing Pipeline Grid Transco Z3 Sabine Pine Prairie Energy Center Egan Storage Jefferson Island Storage Creole Trail LNG (certificated) Pine Prairie Texas Gas ANR Florida Gas Z2 . Cameron LNG . Tennessee Trunkline Columbia Trunkline LNG . NGPL Transco Florida Gas Z1 Tennessee Bridgeline . NGPL Texas Eastern Trunkline Transco Z3 24

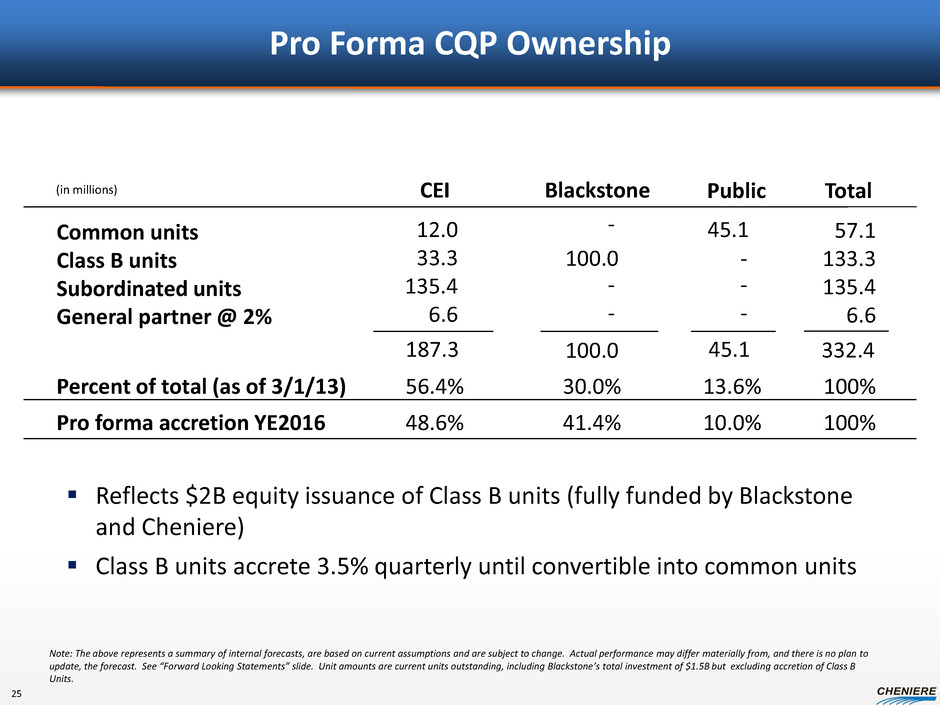

Pro Forma CQP Ownership Common units Class B units Subordinated units General partner @ 2% 45.1 12.0 33.3 135.4 6.6 Public CEI 45.1 187.3 (in millions) 57.1 133.3 135.4 6.6 332.4 Total 56.4% 13.6% 100% Percent of total (as of 3/1/13) - - - Blackstone 30.0% 100.0 - - - 100.0 Reflects $2B equity issuance of Class B units (fully funded by Blackstone and Cheniere) Class B units accrete 3.5% quarterly until convertible into common units 48.6% 10.0% 100% Pro forma accretion YE2016 41.4% Note: The above represents a summary of internal forecasts, are based on current assumptions and are subject to change. Actual performance may differ materially from, and there is no plan to update, the forecast. See “Forward Looking Statements” slide. Unit amounts are current units outstanding, including Blackstone’s total investment of $1.5B but excluding accretion of Class B Units. 25

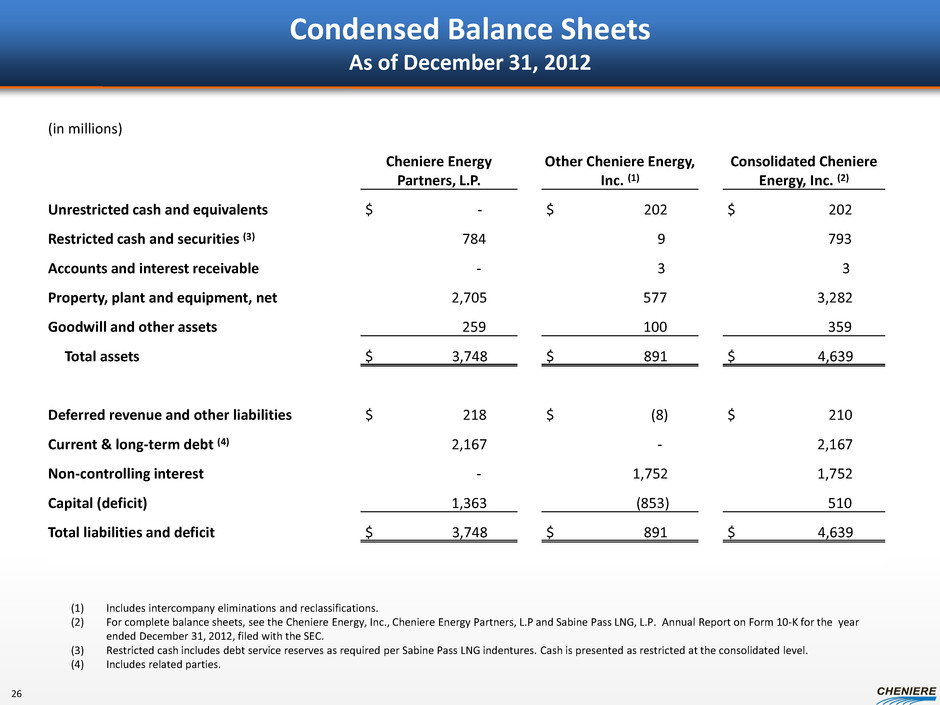

Condensed Balance Sheets As of December 31, 2012 (1) Includes intercompany eliminations and reclassifications. (2) For complete balance sheets, see the Cheniere Energy, Inc., Cheniere Energy Partners, L.P and Sabine Pass LNG, L.P. Annual Report on Form 10-K for the year ended December 31, 2012, filed with the SEC. (3) Restricted cash includes debt service reserves as required per Sabine Pass LNG indentures. Cash is presented as restricted at the consolidated level. (4) Includes related parties. (in millions) Cheniere Energy Partners, L.P. Other Cheniere Energy, Inc. (1) Consolidated Cheniere Energy, Inc. (2) Unrestricted cash and equivalents $ - $ 202 $ 202 Restricted cash and securities (3) 784 9 793 Accounts and interest receivable - 3 3 Property, plant and equipment, net 2,705 577 3,282 Goodwill and other assets 259 100 359 Total assets $ 3,748 $ 891 $ 4,639 Deferred revenue and other liabilities $ 218 $ (8) $ 210 Current & long-term debt (4) 2,167 - 2,167 Non-controlling interest - 1,752 1,752 Capital (deficit) 1,363 (853) 510 Total liabilities and deficit $ 3,748 $ 891 $ 4,639 26

Nancy Bui: Director, Investor Relations – (713) 375-5280, nancy.bui@cheniere.com Christina Burke: Manager, Investor Relations – (713) 375-5104, christina.burke@cheniere.com Investor Relations Contacts: