Cheniere Energy January 2014

Forward Looking Statements 2 This presentation contains certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, included herein are “forward-looking statements.” Included among “forward-looking statements” are, among other things: statements regarding the ability of Cheniere Energy Partners, L.P. to pay distributions to its unitholders or Cheniere Energy Partners LP Holdings, LLC to pay dividends to its shareholders; statements regarding Cheniere Energy Partners, L.P.’s expected receipt of cash distributions from Sabine Pass LNG, L.P., Sabine Pass Liquefaction, LLC or Cheniere Creole Trail Pipeline, L.P., or Cheniere Energy Partners LP Holding, LLC’s expected receipt of cash distributions from Cheniere Energy Partners, L.P.; statements that Cheniere Energy Partners, L.P. expects to commence or complete construction of its proposed liquefaction facilities, or any expansions thereof, by certain dates or at all; statements that Cheniere Energy, Inc. expects to commence or complete construction of its proposed liquefaction facilities or other projects by certain dates or at all; statements regarding future levels of domestic and international natural gas production, supply or consumption or future levels of liquefied natural gas (“LNG”) imports into or exports from North America and other countries worldwide, regardless of the source of such information, or the transportation or demand for and prices related to natural gas, LNG or other hydrocarbon products; statements regarding any financing transactions or arrangements, or ability to enter into such transactions; statements relating to the construction of our natural gas liquefaction trains (“Trains”), or modifications to the Creole Trail Pipeline, including statements concerning the engagement of any engineering, procurement and construction ("EPC") contractor or other contractor and the anticipated terms and provisions of any agreement with any EPC or other contractor, and anticipated costs related thereto; statements regarding any agreement to be entered into or performed substantially in the future, including any revenues anticipated to be received and the anticipated timing thereof, and statements regarding the amounts of total LNG regasification, liquefaction or storage capacities that are, or may become, subject to contracts; statements regarding counterparties to our commercial contracts, construction contracts and other contracts; statements regarding our planned construction of additional Trains, including the financing of such Trains; statements that our Trains, when completed, will have certain characteristics, including amounts of liquefaction capacities; statements regarding any business strategy, our strengths, our business and operation plans or any other plans, forecasts, projections or objectives, including anticipated revenues and capital expenditures and EBITDA, any or all of which are subject to change; statements regarding projections of revenues, expenses, earnings or losses, working capital or other financial items; statements regarding legislative, governmental, regulatory, administrative or other public body actions, approvals, requirements, permits, applications, filings, investigations, proceedings or decisions; statements regarding our anticipated LNG and natural gas marketing activities; and any other statements that relate to non-historical or future information. These forward-looking statements are often identified by the use of terms and phrases such as “achieve,” “anticipate,” “believe,” “contemplate,” “develop,” “estimate,” “example,” “expect,” “forecast,” “opportunities,” “plan,” “potential,” “project,” “propose,” “subject to,” “strategy,” and similar terms and phrases, or by use of future tense. Although we believe that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in “Risk Factors” in the Cheniere Energy, Inc. and Cheniere Energy Partners, L.P. Annual Reports on Form 10-K filed with the SEC on February 22, 2013, each as amended by Amendment No. 1 on Form 10-K/A filed with the SEC on March 1, 2013, the Cheniere Energy Partners, L.P. Current Report on Form 8-K filed with the SEC on May 29, 2013, and the final prospectus of Cheniere Energy Partners LP Holdings, LLC filed with the SEC on December 16, 2013, which are incorporated by reference into this presentation. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these ”Risk Factors”. These forward-looking statements are made as of the date of this presentation, and other than as required under the securities laws, we undertake no obligation to publicly update or revise any forward-looking statements.

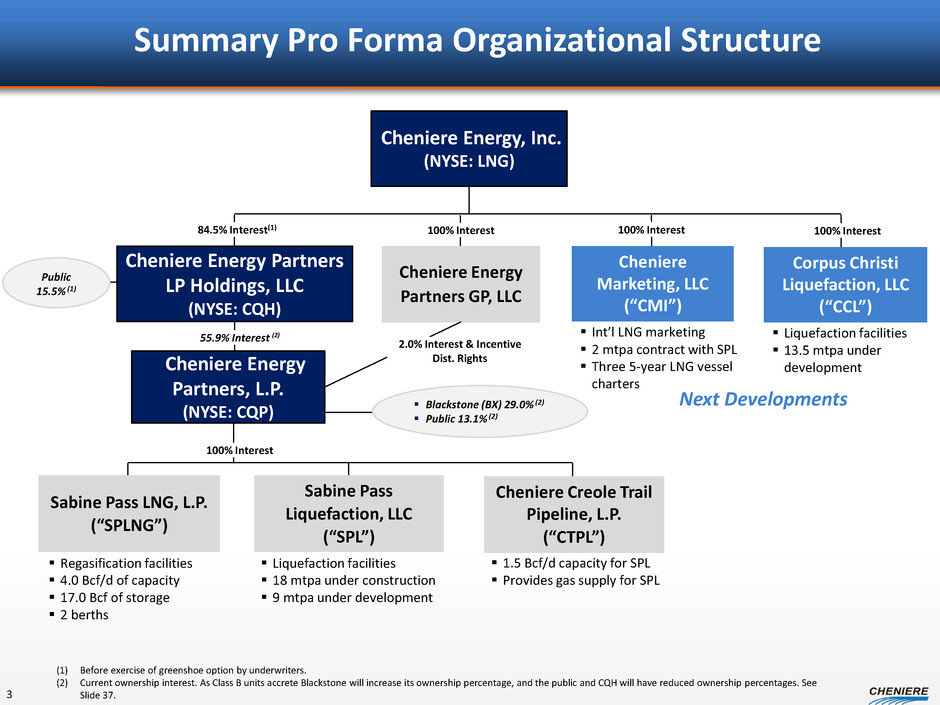

Cheniere Energy, Inc. (NYSE: LNG) Sabine Pass LNG, L.P. (“SPLNG”) Sabine Pass Liquefaction, LLC (“SPL”) Cheniere Energy Partners, L.P. (NYSE: CQP) Cheniere Creole Trail Pipeline, L.P. (“CTPL”) Corpus Christi Liquefaction, LLC (“CCL”) Cheniere Marketing, LLC (“CMI”) Cheniere Energy Partners GP, LLC 100% Interest 100% Interest 100% Interest 100% Interest (1) Before exercise of greenshoe option by underwriters. (2) Current ownership interest. As Class B units accrete Blackstone will increase its ownership percentage, and the public and CQH will have reduced ownership percentages. See Slide 37. Summary Pro Forma Organizational Structure Liquefaction facilities 13.5 mtpa under development Regasification facilities 4.0 Bcf/d of capacity 17.0 Bcf of storage 2 berths Liquefaction facilities 18 mtpa under construction 9 mtpa under development Cheniere Energy Partners LP Holdings, LLC (NYSE: CQH) 1.5 Bcf/d capacity for SPL Provides gas supply for SPL 84.5% Interest(1) 55.9% Interest (2) 2.0% Interest & Incentive Dist. Rights Int’l LNG marketing 2 mtpa contract with SPL Three 5-year LNG vessel charters 3 Blackstone (BX) 29.0% (2) Public 13.1% (2) Public 15.5% (1) Next Developments

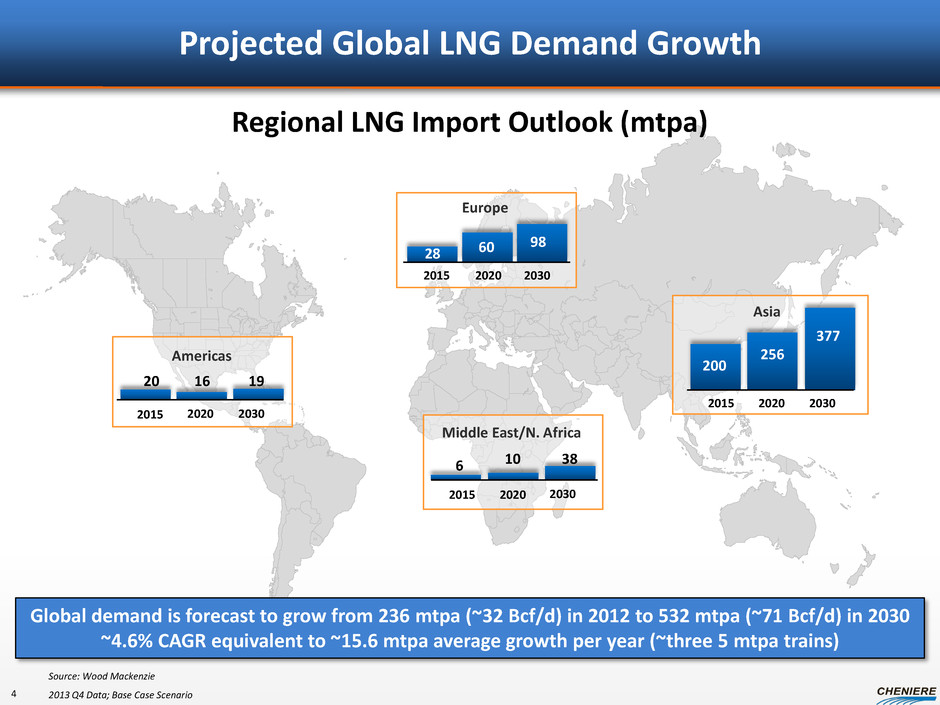

Projected Global LNG Demand Growth Regional LNG Import Outlook (mtpa) Source: Wood Mackenzie 2013 Q4 Data; Base Case Scenario 20 16 19 2015 2020 2030 2015 2020 2030 6 10 38 2015 2020 2030 2015 2020 2030 Americas Asia Middle East/N. Africa 200 256 377 28 60 98 4 Global demand is forecast to grow from 236 mtpa (~32 Bcf/d) in 2012 to 532 mtpa (~71 Bcf/d) in 2030 ~4.6% CAGR equivalent to ~15.6 mtpa average growth per year (~three 5 mtpa trains) Europe

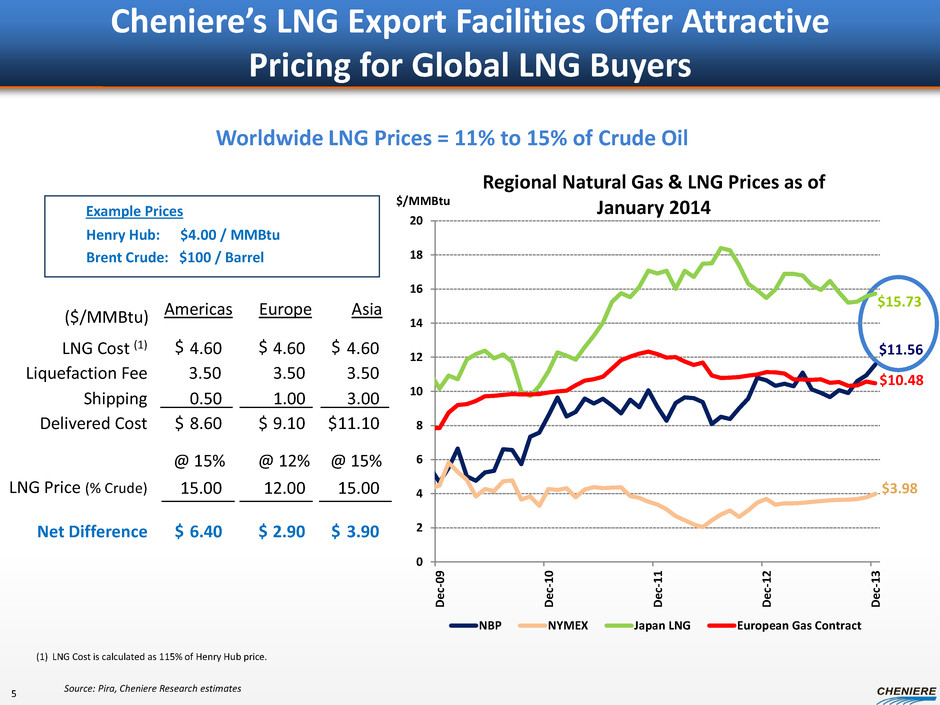

Example Prices Henry Hub: $4.00 / MMBtu Brent Crude: $100 / Barrel ($/MMBtu) Americas Europe Asia LNG Cost (1) 4.60 $ 4.60 4.60 Shipping 0.50 1.00 3.00 $ 8.60 9.10 11.10 3.90 LNG Price (% Crude) @ 15% 15.00 12.00 15.00 Net Difference 6.40 $ 2.90 Liquefaction Fee 3.50 3.50 3.50 Delivered Cost Source: Pira, Cheniere Research estimates Cheniere’s LNG Export Facilities Offer Attractive Pricing for Global LNG Buyers @ 12% @ 15% $ $ $ $ $ $ Worldwide LNG Prices = 11% to 15% of Crude Oil 5 $3.98 $11.56 $15.73 $10.48 (1) LNG Cost is calculated as 115% of Henry Hub price. 0 2 4 6 8 10 12 14 16 18 20 D e c- 0 9 D e c- 1 0 D e c- 1 1 D e c- 1 2 D e c- 1 3 Regional Natural Gas & LNG Prices as of January 2014 NBP NYMEX Japan LNG European Gas Contract $/MMBtu

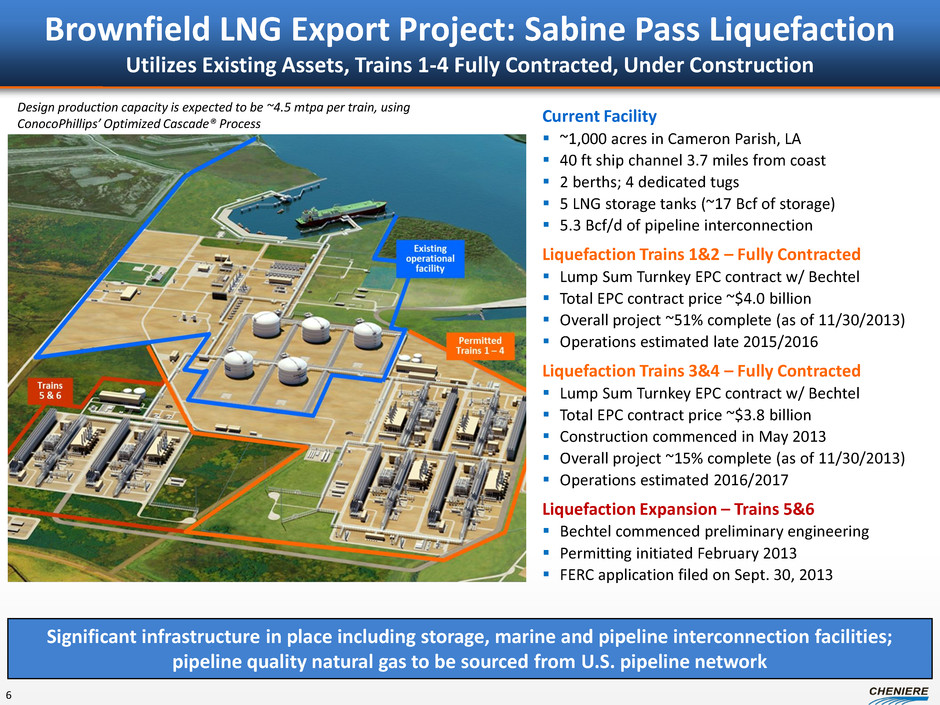

Brownfield LNG Export Project: Sabine Pass Liquefaction Utilizes Existing Assets, Trains 1-4 Fully Contracted, Under Construction Significant infrastructure in place including storage, marine and pipeline interconnection facilities; pipeline quality natural gas to be sourced from U.S. pipeline network Current Facility ~1,000 acres in Cameron Parish, LA 40 ft ship channel 3.7 miles from coast 2 berths; 4 dedicated tugs 5 LNG storage tanks (~17 Bcf of storage) 5.3 Bcf/d of pipeline interconnection Liquefaction Trains 1&2 – Fully Contracted Lump Sum Turnkey EPC contract w/ Bechtel Total EPC contract price ~$4.0 billion Overall project ~51% complete (as of 11/30/2013) Operations estimated late 2015/2016 Liquefaction Trains 3&4 – Fully Contracted Lump Sum Turnkey EPC contract w/ Bechtel Total EPC contract price ~$3.8 billion Construction commenced in May 2013 Overall project ~15% complete (as of 11/30/2013) Operations estimated 2016/2017 Liquefaction Expansion – Trains 5&6 Bechtel commenced preliminary engineering Permitting initiated February 2013 FERC application filed on Sept. 30, 2013 Design production capacity is expected to be ~4.5 mtpa per train, using ConocoPhillips’ Optimized Cascade® Process 6

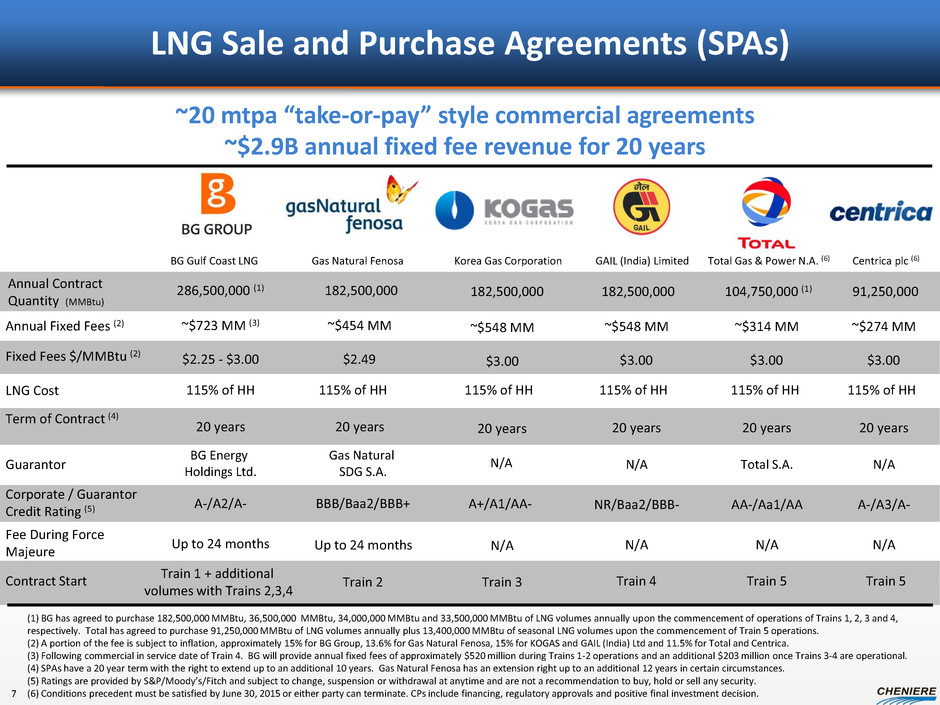

LNG Sale and Purchase Agreements (SPAs) (1) BG has agreed to purchase 182,500,000 MMBtu, 36,500,000 MMBtu, 34,000,000 MMBtu and 33,500,000 MMBtu of LNG volumes annually upon the commencement of operations of Trains 1, 2, 3 and 4, respectively. Total has agreed to purchase 91,250,000 MMBtu of LNG volumes annually plus 13,400,000 MMBtu of seasonal LNG volumes upon the commencement of Train 5 operations. (2) A portion of the fee is subject to inflation, approximately 15% for BG Group, 13.6% for Gas Natural Fenosa, 15% for KOGAS and GAIL (India) Ltd and 11.5% for Total and Centrica. (3) Following commercial in service date of Train 4. BG will provide annual fixed fees of approximately $520 million during Trains 1-2 operations and an additional $203 million once Trains 3-4 are operational. (4) SPAs have a 20 year term with the right to extend up to an additional 10 years. Gas Natural Fenosa has an extension right up to an additional 12 years in certain circumstances. (5) Ratings are provided by S&P/Moody’s/Fitch and subject to change, suspension or withdrawal at anytime and are not a recommendation to buy, hold or sell any security. (6) Conditions precedent must be satisfied by June 30, 2015 or either party can terminate. CPs include financing, regulatory approvals and positive final investment decision. BG Gulf Coast LNG Gas Natural Fenosa Annual Contract Quantity (MMBtu) 286,500,000 (1) Fixed Fees $/MMBtu (2) Annual Fixed Fees (2) ~$723 MM (3) ~$454 MM Term of Contract (4) Guarantor 20 years BG Energy Holdings Ltd. Gas Natural SDG S.A. Corporate / Guarantor Credit Rating (5) A-/A2/A- BBB/Baa2/BBB+ Fee During Force Majeure Up to 24 months Up to 24 months 20 years GAIL (India) Limited ~$548 MM 20 years NR/Baa2/BBB- N/A ~20 mtpa “take-or-pay” style commercial agreements ~$2.9B annual fixed fee revenue for 20 years N/A Contract Start Train 1 + additional volumes with Trains 2,3,4 Train 2 Train 4 $2.25 - $3.00 $2.49 $3.00 182,500,000 182,500,000 20 years N/A N/A A+/A1/AA- Train 3 $3.00 ~$548 MM Korea Gas Corporation 182,500,000 ~$314 MM 20 years AA-/Aa1/AA N/A Total S.A. Train 5 $3.00 104,750,000 (1) Total Gas & Power N.A. (6) ~$274 MM 20 years A-/A3/A- N/A N/A $3.00 91,250,000 Centrica plc (6) 7 Train 5 LNG Cost 115% of HH 115% of HH 115% of HH 115% of HH 115% of HH 115% of HH

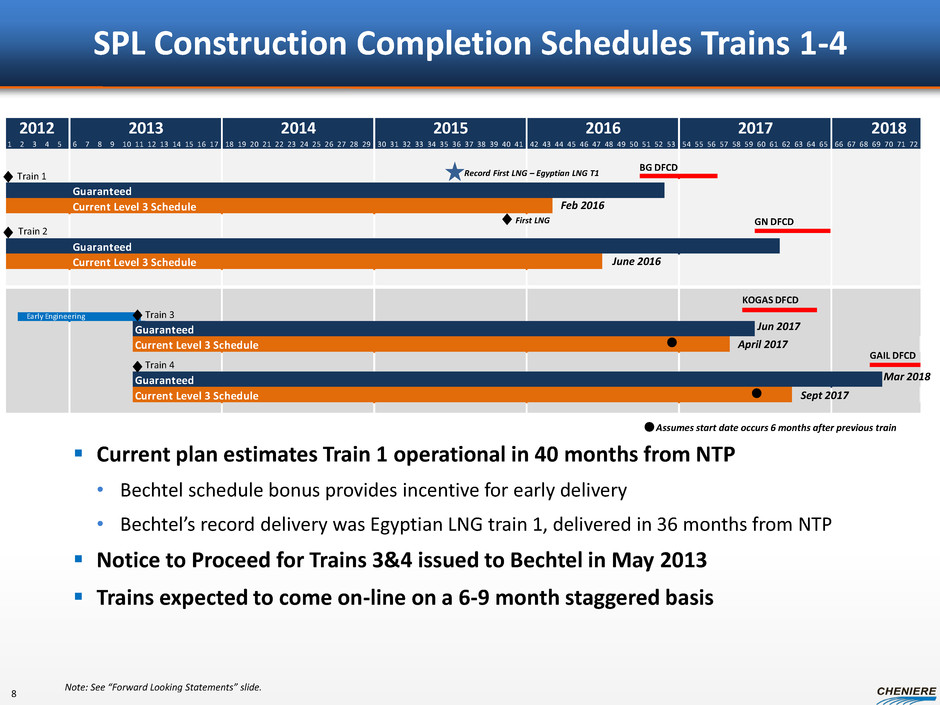

2012 2013 2014 2015 2016 2017 2018 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 Guaranteed Current Level 3 Schedule Guaranteed Current Level 3 Schedule Early Engineering Guaranteed Current Level 3 Schedule Guaranteed Current Level 3 Schedule SPL Construction Completion Schedules Trains 1-4 Note: See “Forward Looking Statements” slide. Current plan estimates Train 1 operational in 40 months from NTP • Bechtel schedule bonus provides incentive for early delivery • Bechtel’s record delivery was Egyptian LNG train 1, delivered in 36 months from NTP Notice to Proceed for Trains 3&4 issued to Bechtel in May 2013 Trains expected to come on-line on a 6-9 month staggered basis BG DFCD GN DFCD KOGAS DFCD GAIL DFCD Record First LNG – Egyptian LNG T1 First LNG Train 1 Train 2 Train 3 Train 4 Feb 2016 April 2017 Jun 2017 Mar 2018 8 June 2016 Sept 2017 Assumes start date occurs 6 months after previous train

Aerial View of SPL Construction Progress – November 2013 9 Train 2 Train 1 Cold Box Area Train 3 Train 4 Compressor Area Air Coolers Compressor Area Cold Box Area Propane Condenser Area Propane Condenser Area Air Coolers

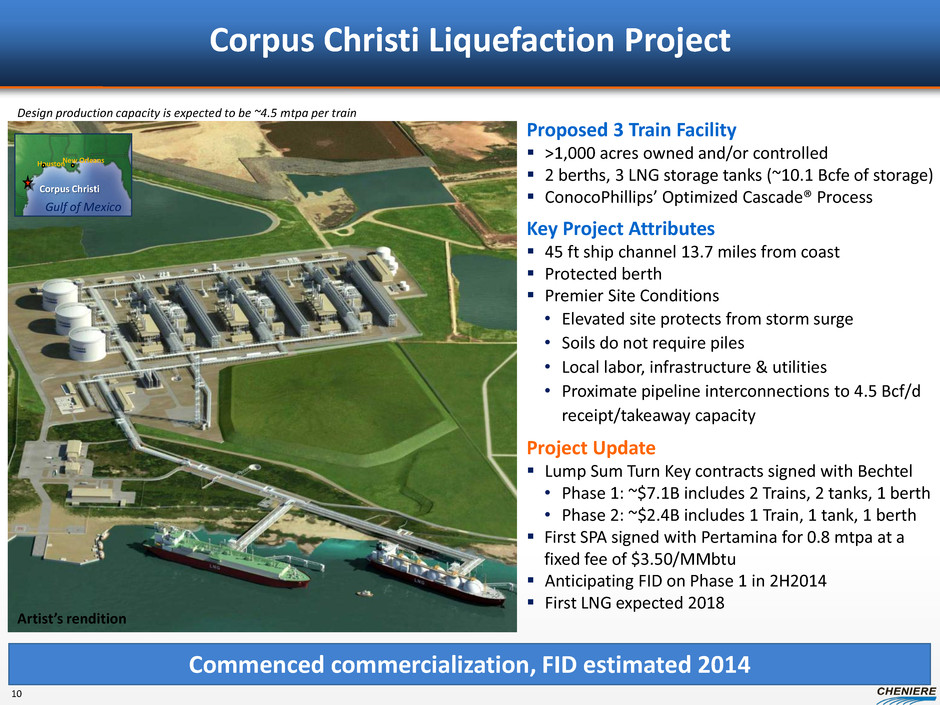

Corpus Christi Liquefaction Project Proposed 3 Train Facility >1,000 acres owned and/or controlled 2 berths, 3 LNG storage tanks (~10.1 Bcfe of storage) ConocoPhillips’ Optimized Cascade® Process Key Project Attributes 45 ft ship channel 13.7 miles from coast Protected berth Premier Site Conditions • Elevated site protects from storm surge • Soils do not require piles • Local labor, infrastructure & utilities • Proximate pipeline interconnections to 4.5 Bcf/d receipt/takeaway capacity Project Update Lump Sum Turn Key contracts signed with Bechtel • Phase 1: ~$7.1B includes 2 Trains, 2 tanks, 1 berth • Phase 2: ~$2.4B includes 1 Train, 1 tank, 1 berth First SPA signed with Pertamina for 0.8 mtpa at a fixed fee of $3.50/MMbtu Anticipating FID on Phase 1 in 2H2014 First LNG expected 2018 Houston New Orleans Gulf of Mexico Corpus Christi Commenced commercialization, FID estimated 2014 10 Artist’s rendition Design production capacity is expected to be ~4.5 mtpa per train

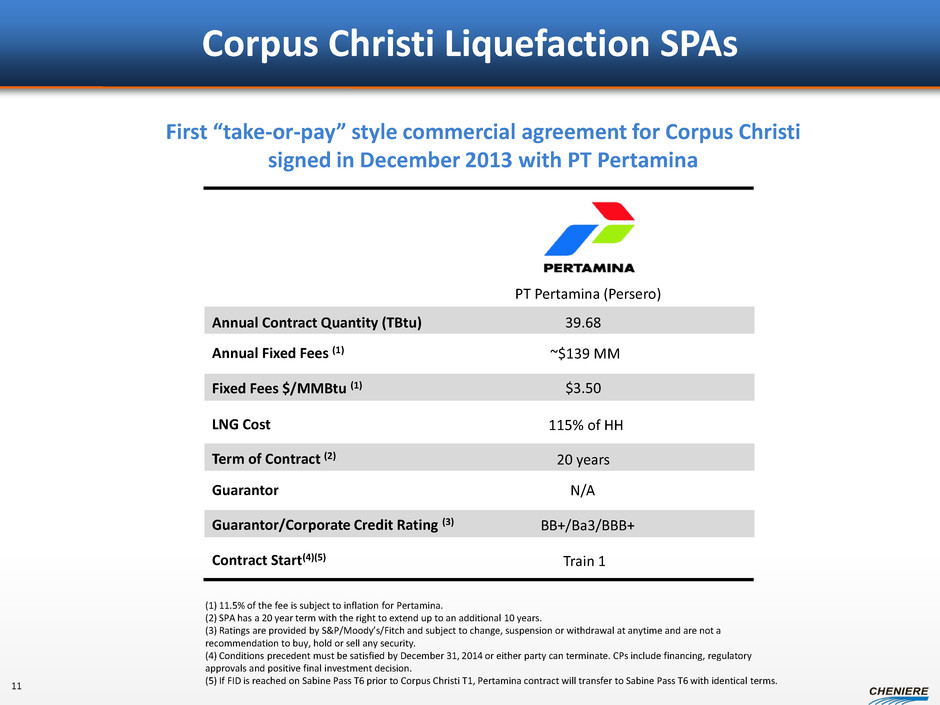

Corpus Christi Liquefaction SPAs Annual Contract Quantity (TBtu) Fixed Fees $/MMBtu (1) Annual Fixed Fees (1) Term of Contract (2) Guarantor Guarantor/Corporate Credit Rating (3) Contract Start(4)(5) First “take-or-pay” style commercial agreement for Corpus Christi signed in December 2013 with PT Pertamina PT Pertamina (Persero) ~$139 MM 20 years BB+/Ba3/BBB+ N/A Train 1 $3.50 39.68 (1) 11.5% of the fee is subject to inflation for Pertamina. (2) SPA has a 20 year term with the right to extend up to an additional 10 years. (3) Ratings are provided by S&P/Moody’s/Fitch and subject to change, suspension or withdrawal at anytime and are not a recommendation to buy, hold or sell any security. (4) Conditions precedent must be satisfied by December 31, 2014 or either party can terminate. CPs include financing, regulatory approvals and positive final investment decision. (5) If FID is reached on Sabine Pass T6 prior to Corpus Christi T1, Pertamina contract will transfer to Sabine Pass T6 with identical terms. LNG Cost 115% of HH 11

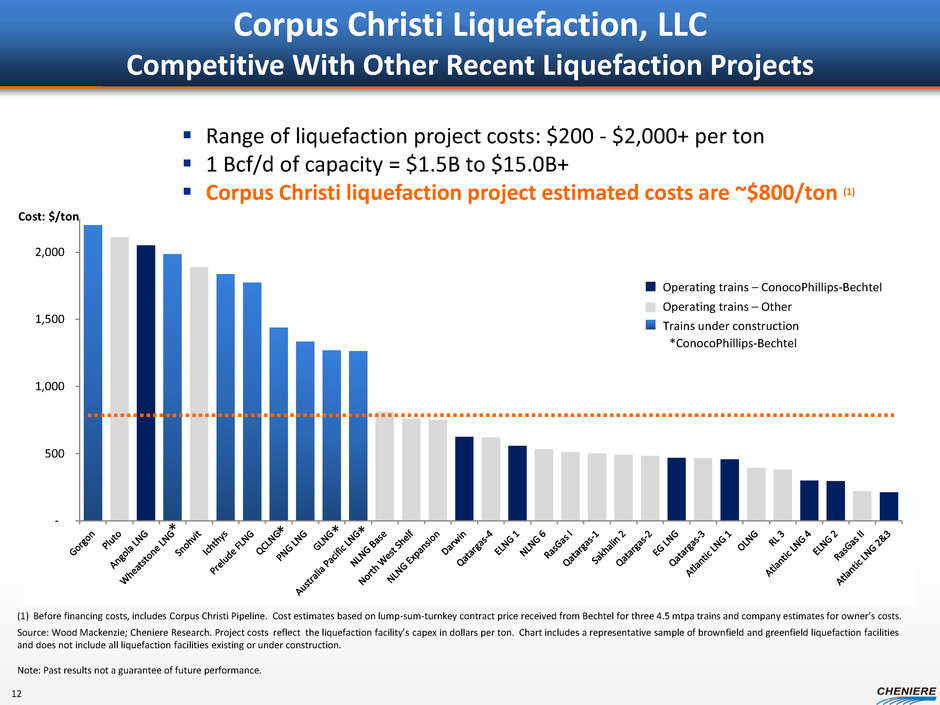

- 500 1,000 1,500 2,000 * * * * Range of liquefaction project costs: $200 - $2,000+ per ton 1 Bcf/d of capacity = $1.5B to $15.0B+ Corpus Christi liquefaction project estimated costs are ~$800/ton (1) Corpus Christi Liquefaction, LLC Competitive With Other Recent Liquefaction Projects (1) Before financing costs, includes Corpus Christi Pipeline. Cost estimates based on lump-sum-turnkey contract price received from Bechtel for three 4.5 mtpa trains and company estimates for owner’s costs. Source: Wood Mackenzie; Cheniere Research. Project costs reflect the liquefaction facility’s capex in dollars per ton. Chart includes a representative sample of brownfield and greenfield liquefaction facilities and does not include all liquefaction facilities existing or under construction. Note: Past results not a guarantee of future performance. *ConocoPhillips-Bechtel Cost: $/ton Trains under construction Operating trains – ConocoPhillips-Bechtel Operating trains – Other 12

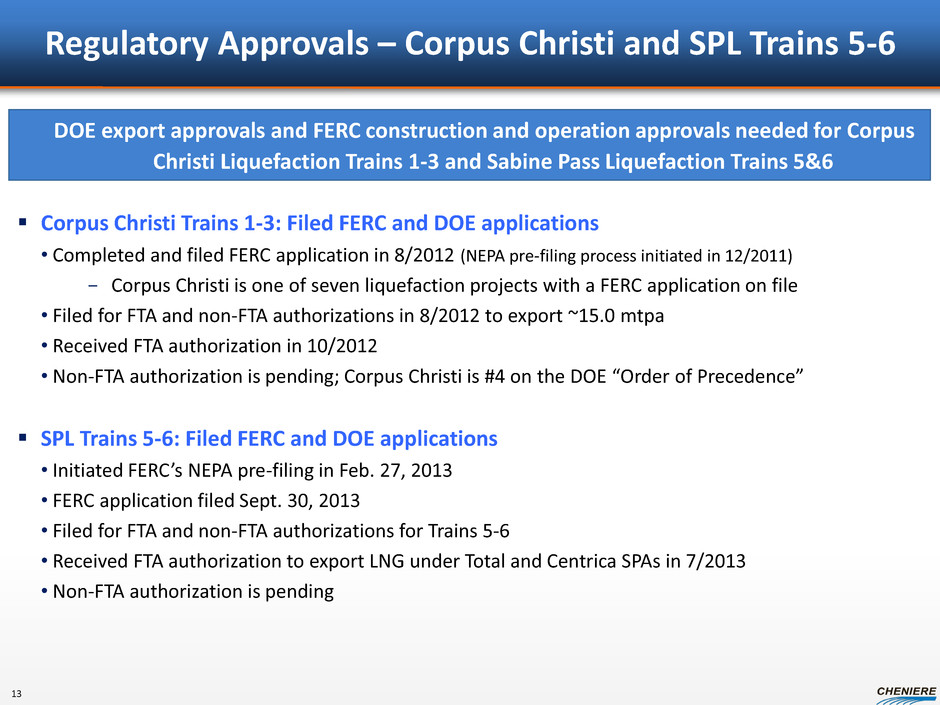

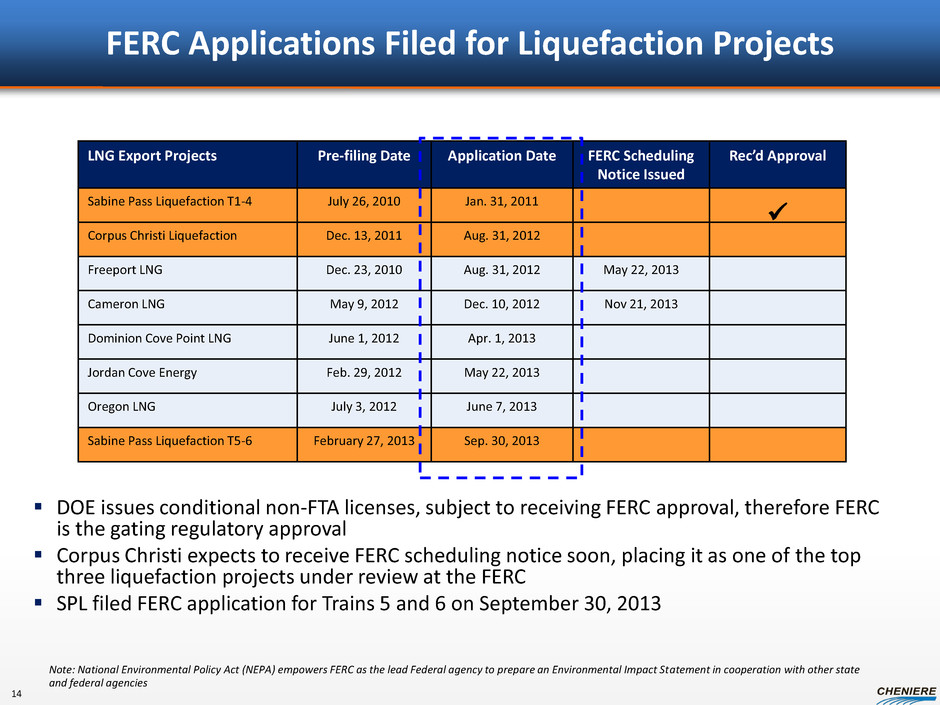

Regulatory Approvals – Corpus Christi and SPL Trains 5-6 Corpus Christi Trains 1-3: Filed FERC and DOE applications • Completed and filed FERC application in 8/2012 (NEPA pre-filing process initiated in 12/2011) − Corpus Christi is one of seven liquefaction projects with a FERC application on file • Filed for FTA and non-FTA authorizations in 8/2012 to export ~15.0 mtpa • Received FTA authorization in 10/2012 • Non-FTA authorization is pending; Corpus Christi is #4 on the DOE “Order of Precedence” SPL Trains 5-6: Filed FERC and DOE applications • Initiated FERC’s NEPA pre-filing in Feb. 27, 2013 • FERC application filed Sept. 30, 2013 • Filed for FTA and non-FTA authorizations for Trains 5-6 • Received FTA authorization to export LNG under Total and Centrica SPAs in 7/2013 • Non-FTA authorization is pending DOE export approvals and FERC construction and operation approvals needed for Corpus Christi Liquefaction Trains 1-3 and Sabine Pass Liquefaction Trains 5&6 13

FERC Applications Filed for Liquefaction Projects Note: National Environmental Policy Act (NEPA) empowers FERC as the lead Federal agency to prepare an Environmental Impact Statement in cooperation with other state and federal agencies LNG Export Projects Pre-filing Date Application Date FERC Scheduling Notice Issued Rec’d Approval Sabine Pass Liquefaction T1-4 July 26, 2010 Jan. 31, 2011 Corpus Christi Liquefaction Dec. 13, 2011 Aug. 31, 2012 Freeport LNG Dec. 23, 2010 Aug. 31, 2012 May 22, 2013 Cameron LNG May 9, 2012 Dec. 10, 2012 Nov 21, 2013 Dominion Cove Point LNG June 1, 2012 Apr. 1, 2013 Jordan Cove Energy Feb. 29, 2012 May 22, 2013 Oregon LNG July 3, 2012 June 7, 2013 Sabine Pass Liquefaction T5-6 February 27, 2013 Sep. 30, 2013 DOE issues conditional non-FTA licenses, subject to receiving FERC approval, therefore FERC is the gating regulatory approval Corpus Christi expects to receive FERC scheduling notice soon, placing it as one of the top three liquefaction projects under review at the FERC SPL filed FERC application for Trains 5 and 6 on September 30, 2013 14

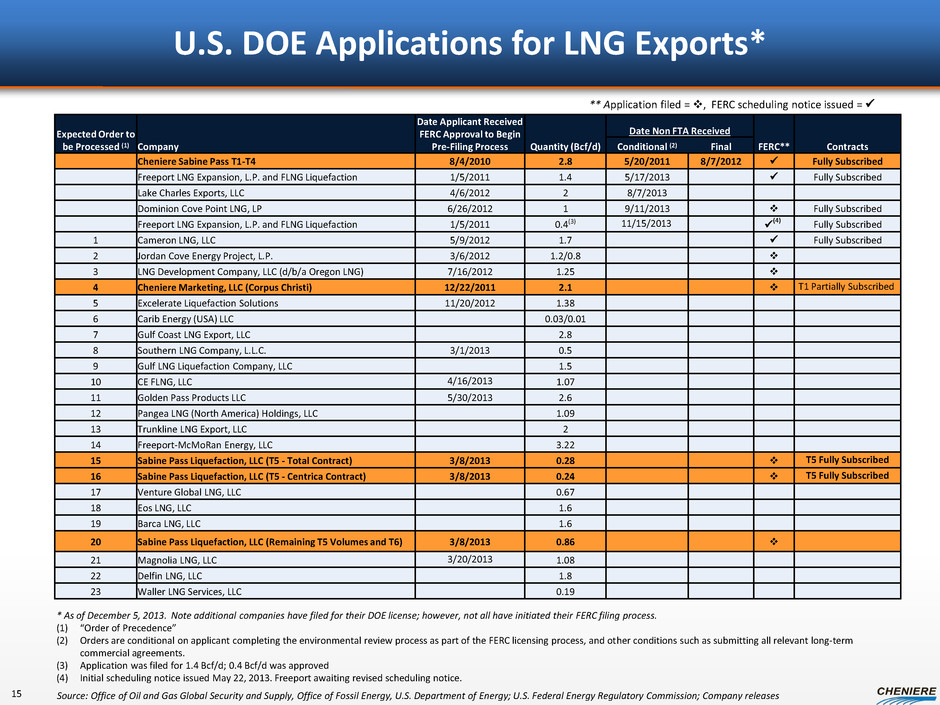

Source: Office of Oil and Gas Global Security and Supply, Office of Fossil Energy, U.S. Department of Energy; U.S. Federal Energy Regulatory Commission; Company releases U.S. DOE Applications for LNG Exports* ** Application filed = v, FERC scheduling notice issued = * As of December 5, 2013. Note additional companies have filed for their DOE license; however, not all have initiated their FERC filing process. (1) “Order of Precedence” (2) Orders are conditional on applicant completing the environmental review process as part of the FERC licensing process, and other conditions such as submitting all relevant long-term commercial agreements. (3) Application was filed for 1.4 Bcf/d; 0.4 Bcf/d was approved (4) Initial scheduling notice issued May 22, 2013. Freeport awaiting revised scheduling notice. 15 Expected Order to be Processed (1) Company Date Applicant Received FERC Approval to Begin Pre-Filing Process Quantity (Bcf/d) Date Non FTA Received FERC** Contracts Conditional (2) Final Cheniere Sabine Pass T1-T4 8/4/2010 2.8 5/20/2011 8/7/2012 Fully Subscribed Freeport LNG Expansion, L.P. and FLNG Liquefaction 1/5/2011 1.4 5/17/2013 Fully Subscribed Lake Charles Exports, LLC 4/6/2012 2 8/7/2013 Dominion Cove Point LNG, LP 6/26/2012 1 9/11/2013 v Fully Subscribed Freeport LNG Expansion, L.P. and FLNG Liquefaction 1/5/2011 0.4(3) 11/15/2013 (4) Fully Subscribed 1 Cameron LNG, LLC 5/9/2012 1.7 Fully Subscribed 2 Jordan Cove Energy Project, L.P. 3/6/2012 1.2/0.8 v 3 LNG Development Company, LLC (d/b/a Oregon LNG) 7/16/2012 1.25 v 4 Cheniere Marketing, LLC (Corpus Christi) 12/22/2011 2.1 v T1 Partially Subscribed 5 Excelerate Liquefaction Solutions 11/20/2012 1.38 6 Carib Energy (USA) LLC 0.03/0.01 7 Gulf Coast LNG Export, LLC 2.8 8 Southern LNG Company, L.L.C. 3/1/2013 0.5 9 Gulf LNG Liquefaction Company, LLC 1.5 10 CE FLNG, LLC 4/16/2013 1.07 11 Golden Pass Products LLC 5/30/2013 2.6 12 Pangea LNG (North America) Holdings, LLC 1.09 13 Trunkline LNG Export, LLC 2 14 Freeport-McMoRan Energy, LLC 3.22 15 Sabine Pass Liquefaction, LLC (T5 - Total Contract) 3/8/2013 0.28 v T5 Fully Subscribed 16 Sabine Pass Liquefaction, LLC (T5 - Centrica Contract) 3/8/2013 0.24 v T5 Fully Subscribed 17 Venture Global LNG, LLC 0.67 18 Eos LNG, LLC 1.6 19 Barca LNG, LLC 1.6 20 Sabine Pass Liquefaction, LLC (Remaining T5 Volumes and T6) 3/8/2013 0.86 v 21 Magnolia LNG, LLC 3/20/2013 1.08 22 Delfin LNG, LLC 1.8 23 Waller LNG Services, LLC 0.19

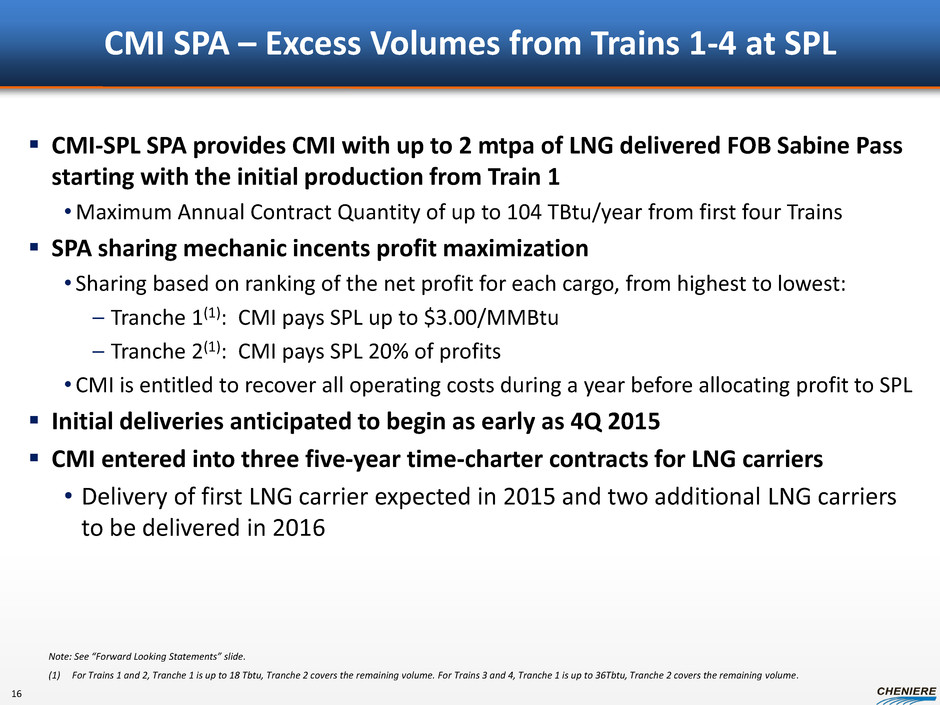

CMI SPA – Excess Volumes from Trains 1-4 at SPL CMI-SPL SPA provides CMI with up to 2 mtpa of LNG delivered FOB Sabine Pass starting with the initial production from Train 1 •Maximum Annual Contract Quantity of up to 104 TBtu/year from first four Trains SPA sharing mechanic incents profit maximization • Sharing based on ranking of the net profit for each cargo, from highest to lowest: – Tranche 1(1): CMI pays SPL up to $3.00/MMBtu – Tranche 2(1): CMI pays SPL 20% of profits •CMI is entitled to recover all operating costs during a year before allocating profit to SPL Initial deliveries anticipated to begin as early as 4Q 2015 CMI entered into three five-year time-charter contracts for LNG carriers • Delivery of first LNG carrier expected in 2015 and two additional LNG carriers to be delivered in 2016 Note: See “Forward Looking Statements” slide. (1) For Trains 1 and 2, Tranche 1 is up to 18 Tbtu, Tranche 2 covers the remaining volume. For Trains 3 and 4, Tranche 1 is up to 36Tbtu, Tranche 2 covers the remaining volume. 16

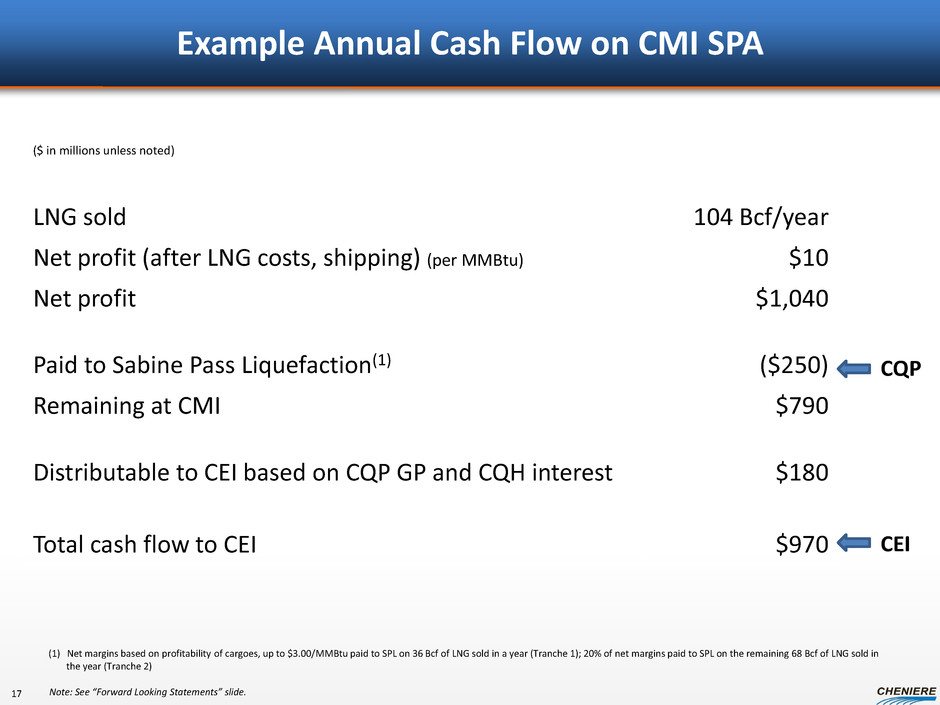

Example Annual Cash Flow on CMI SPA (1) Net margins based on profitability of cargoes, up to $3.00/MMBtu paid to SPL on 36 Bcf of LNG sold in a year (Tranche 1); 20% of net margins paid to SPL on the remaining 68 Bcf of LNG sold in the year (Tranche 2) LNG sold 104 Bcf/year Net profit (after LNG costs, shipping) (per MMBtu) $10 Net profit $1,040 Paid to Sabine Pass Liquefaction(1) ($250) Remaining at CMI $790 Distributable to CEI based on CQP GP and CQH interest $180 Total cash flow to CEI $970 ($ in millions unless noted) Note: See “Forward Looking Statements” slide. CQP CEI 17

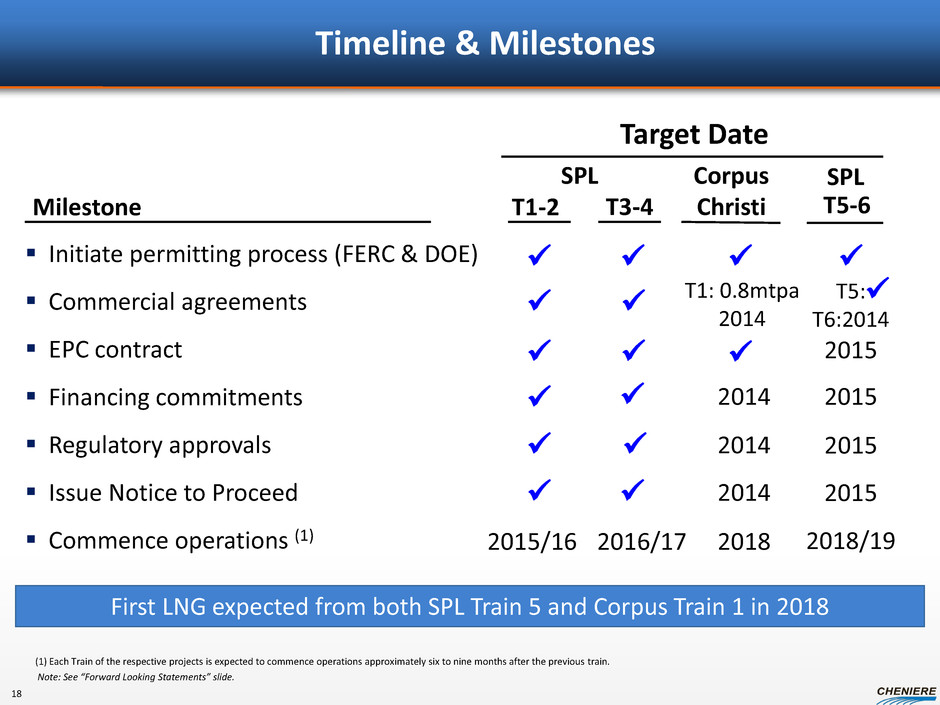

Timeline & Milestones Initiate permitting process (FERC & DOE) Commercial agreements EPC contract Financing commitments Regulatory approvals Issue Notice to Proceed Commence operations (1) Milestone Corpus Christi (1) Each Train of the respective projects is expected to commence operations approximately six to nine months after the previous train. Note: See “Forward Looking Statements” slide. T3-4 T1-2 Target Date 2015/16 First LNG expected from both SPL Train 5 and Corpus Train 1 in 2018 SPL 18 2016/17 2014 2018/19 2014 2014 T5-6 2015 2015 2015 2015 2018 SPL T5: T6:2014 T1: 0.8mtpa 2014

Financial Estimates (includes SPL Trains 1-4 and Trains 1-6)

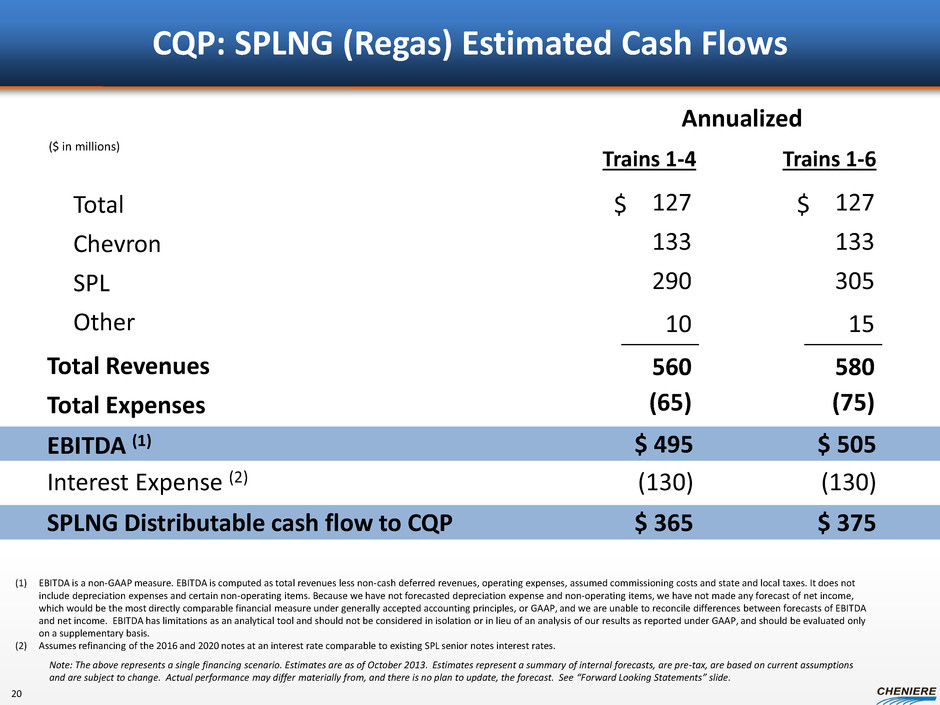

CQP: SPLNG (Regas) Estimated Cash Flows Total Revenues Total Expenses Total Chevron SPL Other EBITDA (1) 127 133 290 10 560 (65) $ 495 $ SPLNG Distributable cash flow to CQP $ 365 ($ in millions) Interest Expense (2) (130) Annualized (1) EBITDA is a non-GAAP measure. EBITDA is computed as total revenues less non-cash deferred revenues, operating expenses, assumed commissioning costs and state and local taxes. It does not include depreciation expenses and certain non-operating items. Because we have not forecasted depreciation expense and non-operating items, we have not made any forecast of net income, which would be the most directly comparable financial measure under generally accepted accounting principles, or GAAP, and we are unable to reconcile differences between forecasts of EBITDA and net income. EBITDA has limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of our results as reported under GAAP, and should be evaluated only on a supplementary basis. (2) Assumes refinancing of the 2016 and 2020 notes at an interest rate comparable to existing SPL senior notes interest rates. Note: The above represents a single financing scenario. Estimates are as of October 2013. Estimates represent a summary of internal forecasts, are pre-tax, are based on current assumptions and are subject to change. Actual performance may differ materially from, and there is no plan to update, the forecast. See “Forward Looking Statements” slide. 20 Trains 1-4 Trains 1-6 127 133 305 15 580 (75) $ 505 $ $ 375 (130)

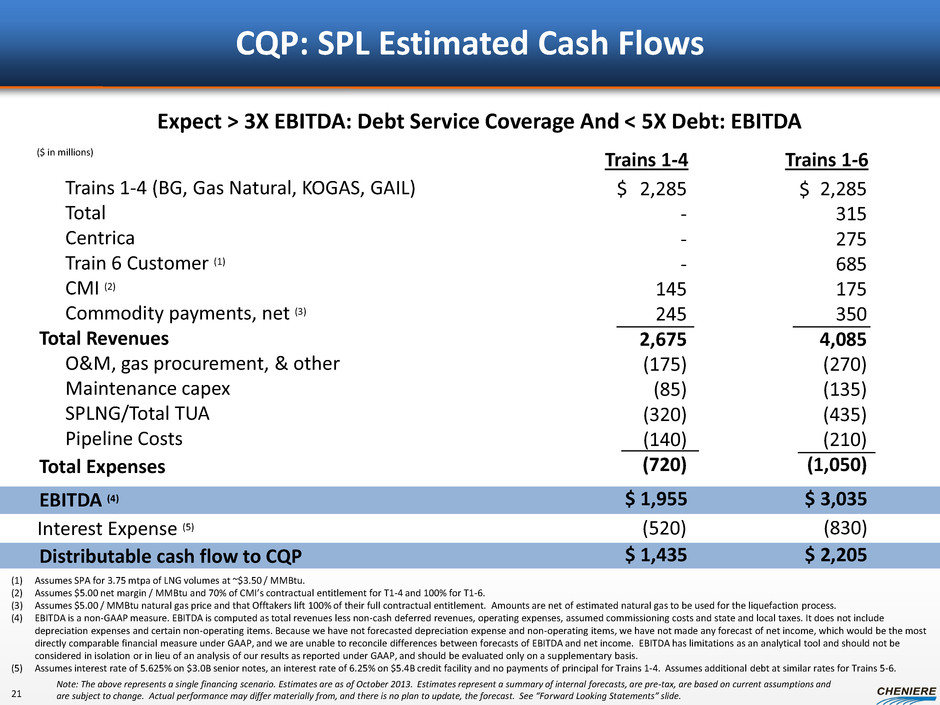

CQP: SPL Estimated Cash Flows Trains 1-4 Total Revenues Trains 1-4 (BG, Gas Natural, KOGAS, GAIL) Total Centrica Train 6 Customer (1) CMI (2) Commodity payments, net (3) O&M, gas procurement, & other Maintenance capex SPLNG/Total TUA Pipeline Costs EBITDA (4) 2,285 - - - 145 245 2,675 (175) (85) (320) (140) (720) $ 1,955 $ ($ in millions) Total Expenses (1) Assumes SPA for 3.75 mtpa of LNG volumes at ~$3.50 / MMBtu. (2) Assumes $5.00 net margin / MMBtu and 70% of CMI’s contractual entitlement for T1-4 and 100% for T1-6. (3) Assumes $5.00 / MMBtu natural gas price and that Offtakers lift 100% of their full contractual entitlement. Amounts are net of estimated natural gas to be used for the liquefaction process. (4) EBITDA is a non-GAAP measure. EBITDA is computed as total revenues less non-cash deferred revenues, operating expenses, assumed commissioning costs and state and local taxes. It does not include depreciation expenses and certain non-operating items. Because we have not forecasted depreciation expense and non-operating items, we have not made any forecast of net income, which would be the most directly comparable financial measure under GAAP, and we are unable to reconcile differences between forecasts of EBITDA and net income. EBITDA has limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of our results as reported under GAAP, and should be evaluated only on a supplementary basis. (5) Assumes interest rate of 5.625% on $3.0B senior notes, an interest rate of 6.25% on $5.4B credit facility and no payments of principal for Trains 1-4. Assumes additional debt at similar rates for Trains 5-6. Note: The above represents a single financing scenario. Estimates are as of October 2013. Estimates represent a summary of internal forecasts, are pre-tax, are based on current assumptions and are subject to change. Actual performance may differ materially from, and there is no plan to update, the forecast. See “Forward Looking Statements” slide. Expect > 3X EBITDA: Debt Service Coverage And < 5X Debt: EBITDA Trains 1-6 2,285 315 275 685 175 350 4,085 (270) (135) (435) (210) (1,050) $ 3,035 $ Interest Expense (5) (520) Distributable cash flow to CQP $ 1,435 $ 2,205 (830) 21

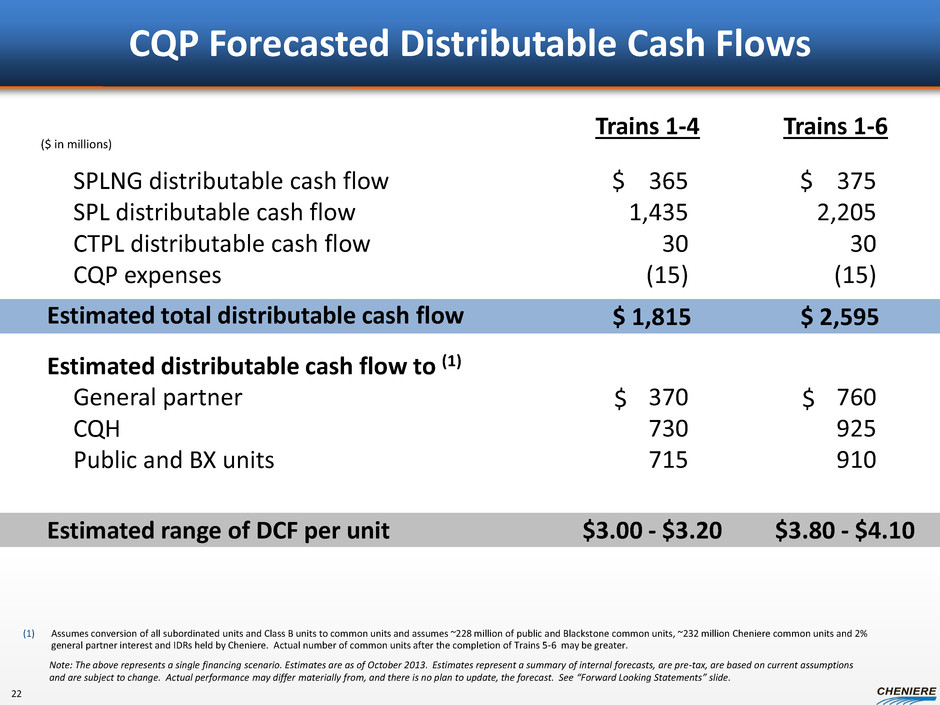

CQP Forecasted Distributable Cash Flows Trains 1-4 Estimated distributable cash flow to (1) General partner CQH Public and BX units Estimated range of DCF per unit 370 730 715 $3.00 - $3.20 $ Estimated total distributable cash flow $ 1,815 ($ in millions) SPLNG distributable cash flow SPL distributable cash flow CTPL distributable cash flow CQP expenses $ 365 1,435 30 (15) (1) Assumes conversion of all subordinated units and Class B units to common units and assumes ~228 million of public and Blackstone common units, ~232 million Cheniere common units and 2% general partner interest and IDRs held by Cheniere. Actual number of common units after the completion of Trains 5-6 may be greater. Note: The above represents a single financing scenario. Estimates are as of October 2013. Estimates represent a summary of internal forecasts, are pre-tax, are based on current assumptions and are subject to change. Actual performance may differ materially from, and there is no plan to update, the forecast. See “Forward Looking Statements” slide. 22 Trains 1-6 760 925 910 $ $ 2,595 $ 375 2,205 30 (15) $3.80 - $4.10

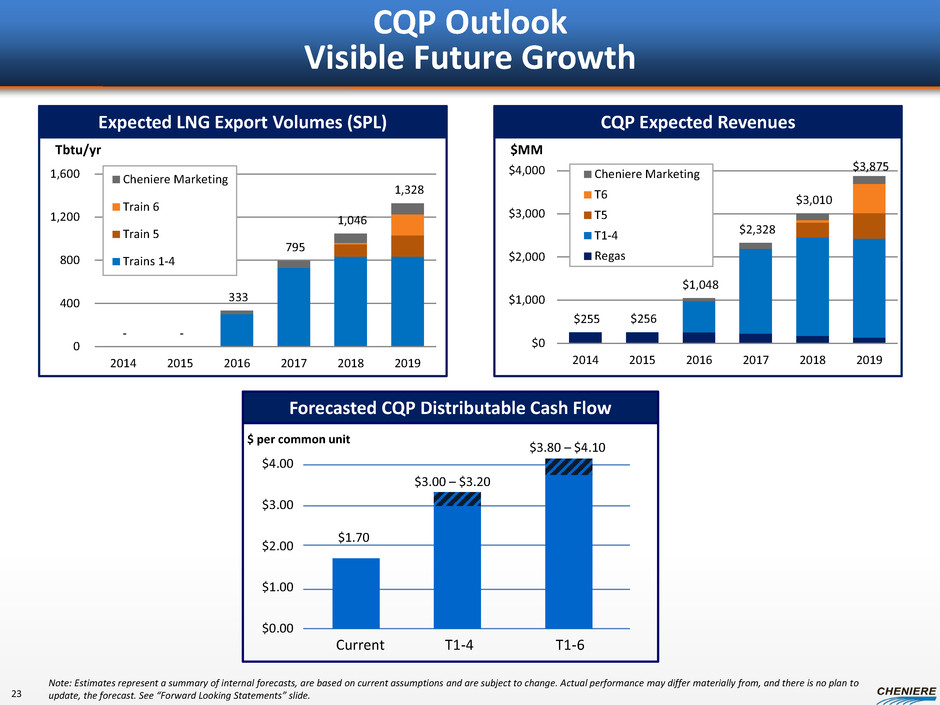

CQP Outlook Visible Future Growth Expected LNG Export Volumes (SPL) Tbtu/yr CQP Expected Revenues $MM Forecasted CQP Distributable Cash Flow $ per common unit Note: Estimates represent a summary of internal forecasts, are based on current assumptions and are subject to change. Actual performance may differ materially from, and there is no plan to update, the forecast. See “Forward Looking Statements” slide. $4.00 $3.00 $2.00 $1.00 $0.00 Current T1-4 T1-6 $1.70 $3.00 – $3.20 $3.80 – $4.10 - - 333 795 1,046 1,328 0 400 800 1,200 1,600 2014 2015 2016 2017 2018 2019 Cheniere Marketing Train 6 Train 5 Trains 1-4 $255 $256 $1,048 $2,328 $3,010 $3,875 $0 $1,000 $2,000 $3,000 $4,000 2014 2015 2016 2017 2018 2019 Cheniere Marketing T6 T5 T1-4 Regas 23

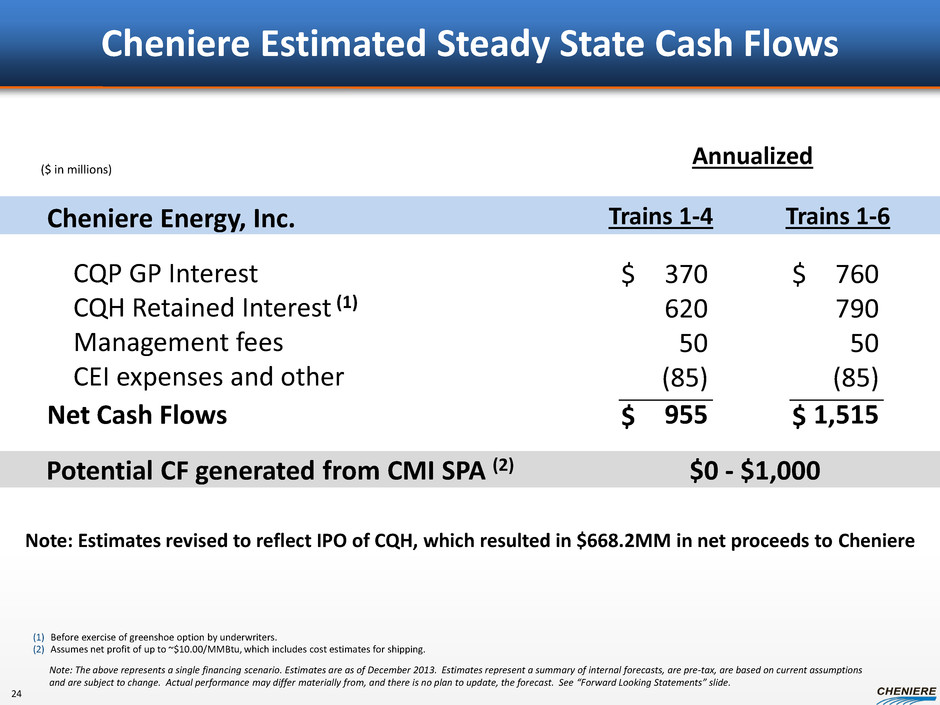

Cheniere Estimated Steady State Cash Flows ($ in millions) Net Cash Flows Cheniere Energy, Inc. CQP GP Interest CQH Retained Interest (1) Management fees CEI expenses and other 370 620 50 (85) 955 $ $ Potential CF generated from CMI SPA (2) $0 - $1,000 (1) Before exercise of greenshoe option by underwriters. (2) Assumes net profit of up to ~$10.00/MMBtu, which includes cost estimates for shipping. Note: The above represents a single financing scenario. Estimates are as of December 2013. Estimates represent a summary of internal forecasts, are pre-tax, are based on current assumptions and are subject to change. Actual performance may differ materially from, and there is no plan to update, the forecast. See “Forward Looking Statements” slide. Annualized 24 760 790 50 (85) 1,515 $ $ Trains 1-4 Trains 1-6 Note: Estimates revised to reflect IPO of CQH, which resulted in $668.2MM in net proceeds to Cheniere

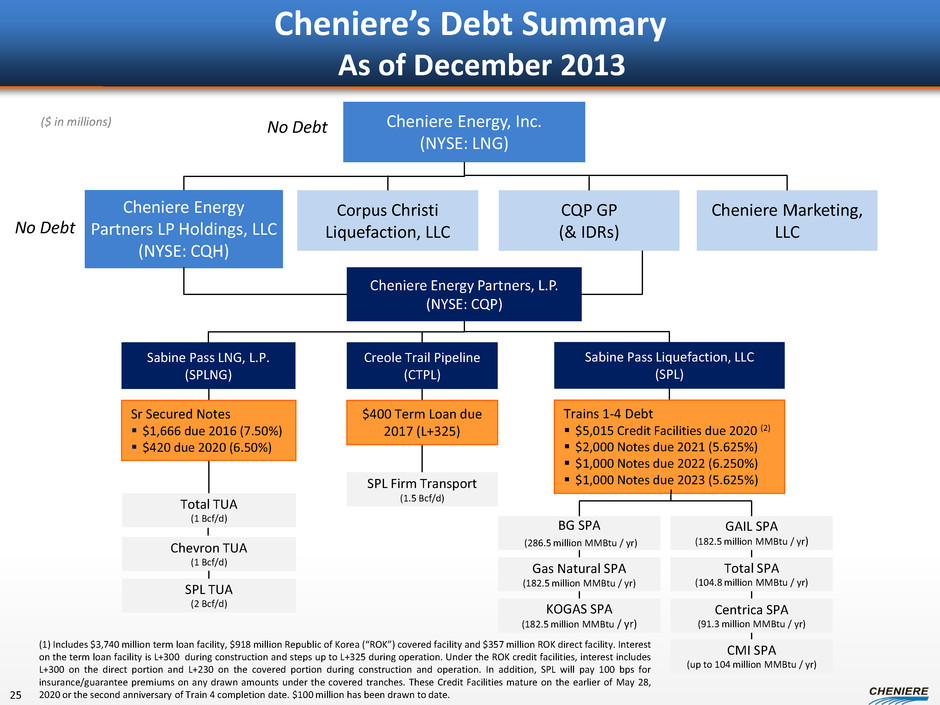

Cheniere’s Debt Summary As of December 2013 Cheniere Energy, Inc. (NYSE: LNG) Cheniere Energy Partners, L.P. (NYSE: CQP) Sabine Pass LNG, L.P. (SPLNG) BG SPA (286.5 million MMBtu / yr) Gas Natural SPA (182.5 million MMBtu / yr) KOGAS SPA (182.5 million MMBtu / yr) GAIL SPA (182.5 million MMBtu / yr) Total TUA (1 Bcf/d) Chevron TUA (1 Bcf/d) SPL TUA (2 Bcf/d) Sr Secured Notes $1,666 due 2016 (7.50%) $420 due 2020 (6.50%) ($ in millions) No Debt Cheniere Marketing, LLC Corpus Christi Liquefaction, LLC Trains 1-4 Debt $5,015 Credit Facilities due 2020 (2) $2,000 Notes due 2021 (5.625%) $1,000 Notes due 2022 (6.250%) $1,000 Notes due 2023 (5.625%) CMI SPA (up to 104 million MMBtu / yr) Total SPA (104.8 million MMBtu / yr) Sabine Pass Liquefaction, LLC (SPL) Centrica SPA (91.3 million MMBtu / yr) Creole Trail Pipeline (CTPL) SPL Firm Transport (1.5 Bcf/d) $400 Term Loan due 2017 (L+325) CQP GP (& IDRs) (1) Includes $3,740 million term loan facility, $918 million Republic of Korea (“ROK”) covered facility and $357 million ROK direct facility. Interest on the term loan facility is L+300 during construction and steps up to L+325 during operation. Under the ROK credit facilities, interest includes L+300 on the direct portion and L+230 on the covered portion during construction and operation. In addition, SPL will pay 100 bps for insurance/guarantee premiums on any drawn amounts under the covered tranches. These Credit Facilities mature on the earlier of May 28, 2020 or the second anniversary of Train 4 completion date. $100 million has been drawn to date. Cheniere Energy Partners LP Holdings, LLC (NYSE: CQH) 25 No Debt

Appendix

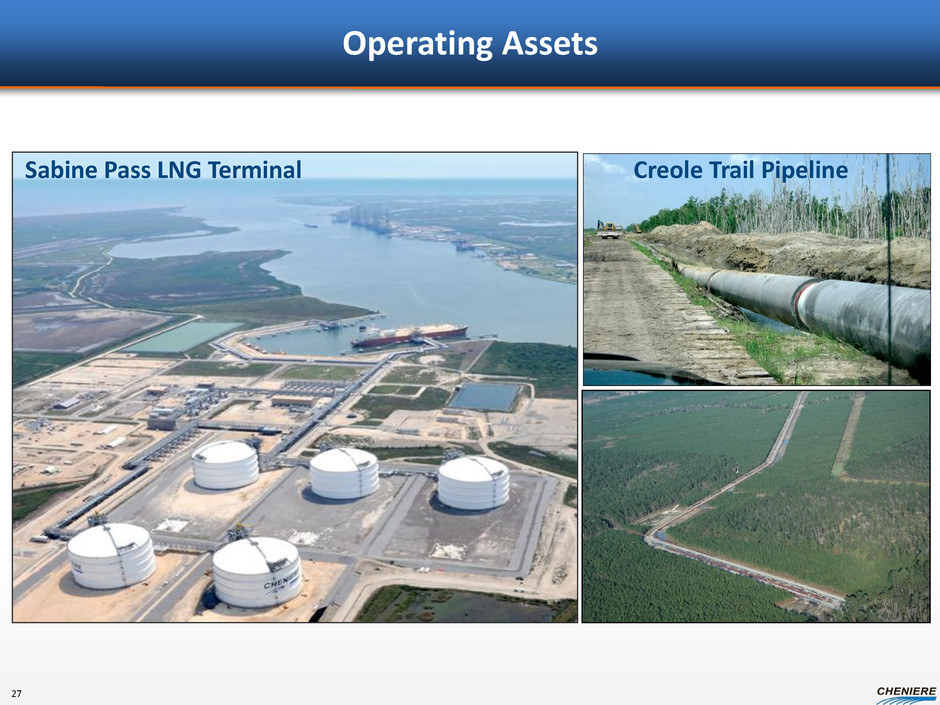

Operating Assets Sabine Pass LNG Terminal Creole Trail Pipeline 27

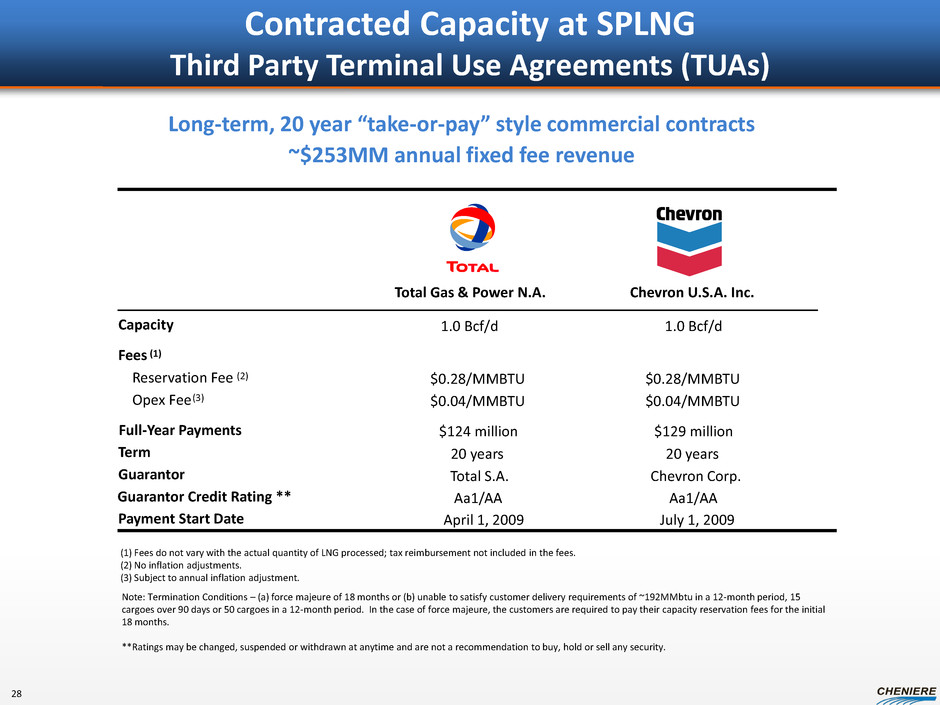

Contracted Capacity at SPLNG Third Party Terminal Use Agreements (TUAs) Long-term, 20 year “take-or-pay” style commercial contracts ~$253MM annual fixed fee revenue Total Gas & Power N.A. Chevron U.S.A. Inc. Capacity 1.0 Bcf/d 1.0 Bcf/d Fees (1) Reservation Fee (2) $0.28/MMBTU $0.28/MMBTU Opex Fee (3) $0.04/MMBTU $0.04/MMBTU Full-Year Payments $124 million $129 million Term 20 years 20 years Guarantor Total S.A. Chevron Corp. Guarantor Credit Rating ** Aa1/AA Aa1/AA Payment Start Date April 1, 2009 July 1, 2009 (1) Fees do not vary with the actual quantity of LNG processed; tax reimbursement not included in the fees. (2) No inflation adjustments. (3) Subject to annual inflation adjustment. Note: Termination Conditions – (a) force majeure of 18 months or (b) unable to satisfy customer delivery requirements of ~192MMbtu in a 12-month period, 15 cargoes over 90 days or 50 cargoes in a 12-month period. In the case of force majeure, the customers are required to pay their capacity reservation fees for the initial 18 months. **Ratings may be changed, suspended or withdrawn at anytime and are not a recommendation to buy, hold or sell any security. 28

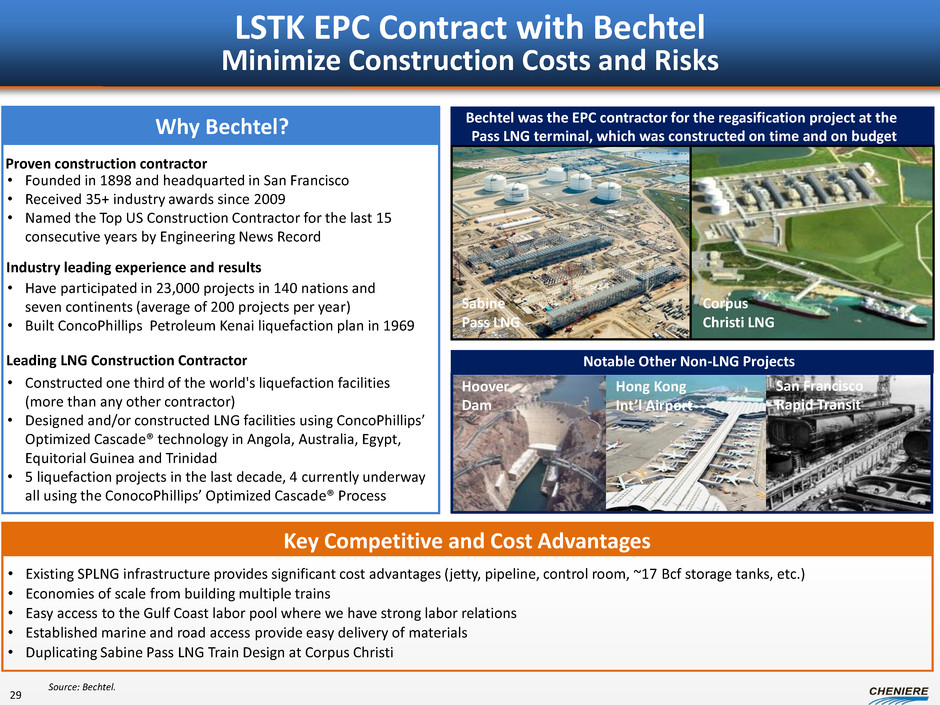

LSTK EPC Contract with Bechtel Minimize Construction Costs and Risks Hoover Dam Hong Kong Int’l Airport San Francisco Rapid Transit Source: Bechtel. Bechtel was the EPC contractor for the regasification project at the Pass LNG terminal, which was constructed on time and on budget Proven construction contractor • Founded in 1898 and headquarted in San Francisco • Received 35+ industry awards since 2009 • Named the Top US Construction Contractor for the last 15 consecutive years by Engineering News Record Industry leading experience and results • Have participated in 23,000 projects in 140 nations and seven continents (average of 200 projects per year) • Built ConcoPhillips Petroleum Kenai liquefaction plan in 1969 Leading LNG Construction Contractor Notable Other Non-LNG Projects Key Competitive and Cost Advantages • Existing SPLNG infrastructure provides significant cost advantages (jetty, pipeline, control room, ~17 Bcf storage tanks, etc.) • Economies of scale from building multiple trains • Easy access to the Gulf Coast labor pool where we have strong labor relations • Established marine and road access provide easy delivery of materials • Duplicating Sabine Pass LNG Train Design at Corpus Christi Why Bechtel? • Constructed one third of the world's liquefaction facilities (more than any other contractor) • Designed and/or constructed LNG facilities using ConcoPhillips’ Optimized Cascade® technology in Angola, Australia, Egypt, Equitorial Guinea and Trinidad • 5 liquefaction projects in the last decade, 4 currently underway all using the ConocoPhillips’ Optimized Cascade® Process 29 Sabine Pass LNG Corpus Christi LNG

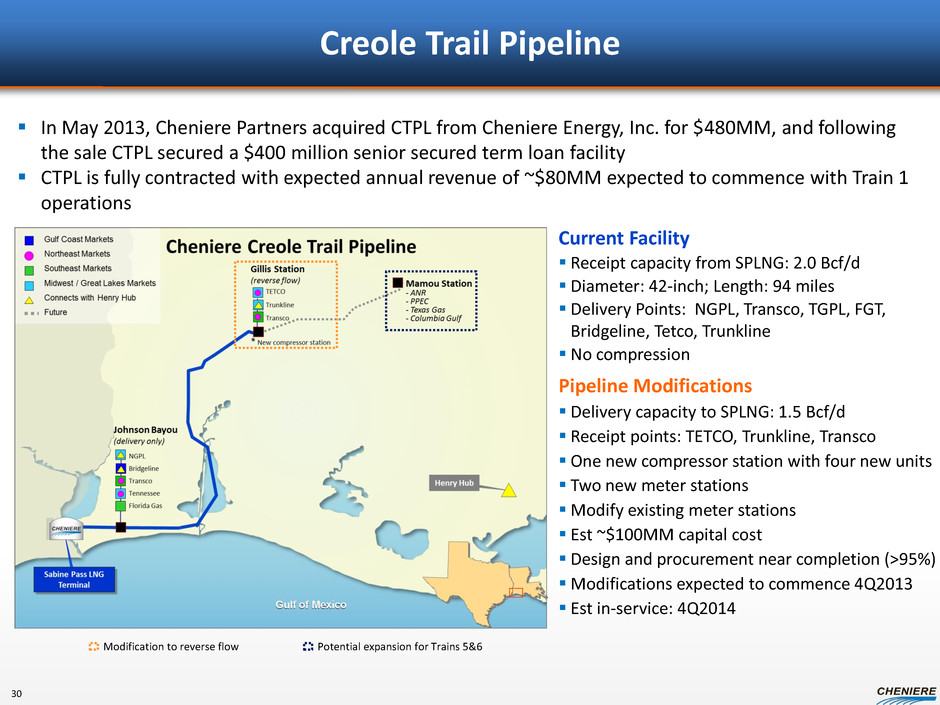

Current Facility Receipt capacity from SPLNG: 2.0 Bcf/d Diameter: 42-inch; Length: 94 miles Delivery Points: NGPL, Transco, TGPL, FGT, Bridgeline, Tetco, Trunkline No compression Pipeline Modifications Delivery capacity to SPLNG: 1.5 Bcf/d Receipt points: TETCO, Trunkline, Transco One new compressor station with four new units Two new meter stations Modify existing meter stations Est ~$100MM capital cost Design and procurement near completion (>95%) Modifications expected to commence 4Q2013 Est in-service: 4Q2014 Creole Trail Pipeline In May 2013, Cheniere Partners acquired CTPL from Cheniere Energy, Inc. for $480MM, and following the sale CTPL secured a $400 million senior secured term loan facility CTPL is fully contracted with expected annual revenue of ~$80MM expected to commence with Train 1 operations 30 Potential expansion for Trains 5&6 Modification to reverse flow

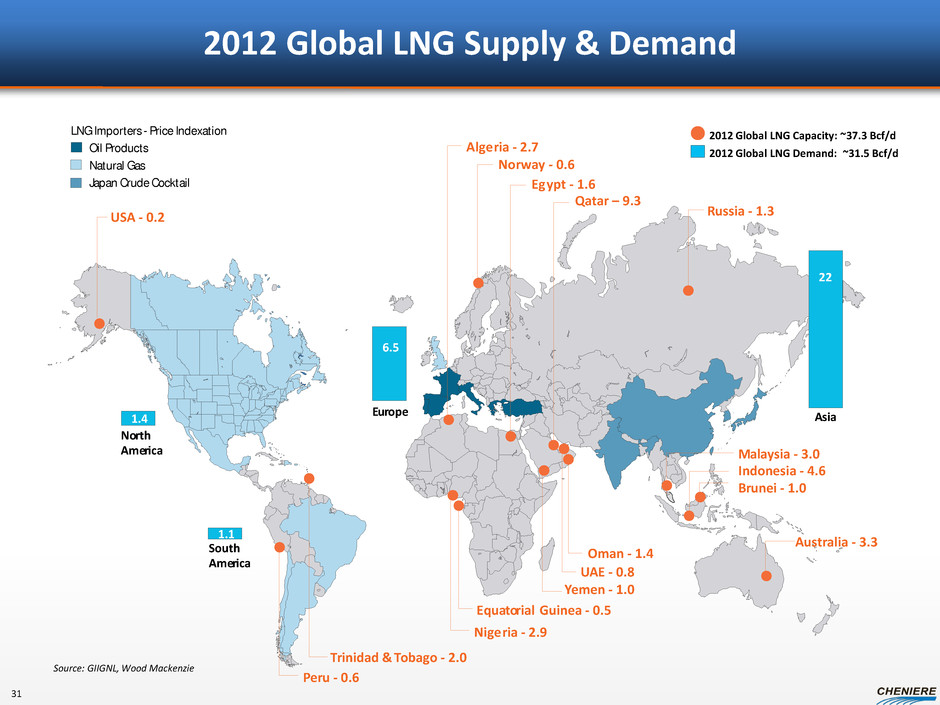

2012 Global LNG Supply & Demand 2012 Global LNG Capacity: ~37.3 Bcf/d Natural Gas Oil Products LNG Importers - Price Indexation Japan Crude Cocktail 2012 Global LNG Demand: ~31.5 Bcf/d No r th Ame r ica S outh Ame r ica E u r ope A sia 6.5 1.4 1.1 22 A ust r alia - 3.3 B r unei - 1.0 Indonesia - 4.6 M al a y sia - 3.0 A lge r ia - 2.7 N o r w a y - 0.6 Q a tar – 9.3 R ussia - 1.3 E g ypt - 1.6 Y emen - 1.0 Nige r ia - 2.9 T r inidad & T obago - 2.0 E qua t o r ial G uinea - 0.5 Oman - 1.4 U AE - 0.8 USA - 0.2 P e r u - 0.6 Source: GIIGNL, Wood Mackenzie 31

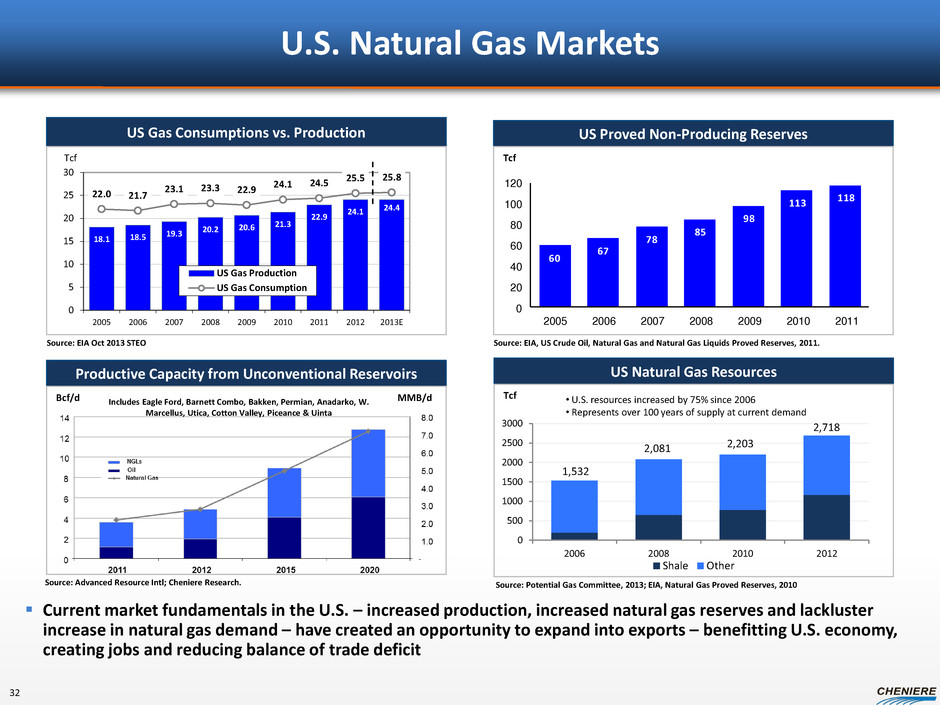

US Proved Non-Producing Reserves Productive Capacity from Unconventional Reservoirs Tcf Bcf/d MMB/d Current market fundamentals in the U.S. – increased production, increased natural gas reserves and lackluster increase in natural gas demand – have created an opportunity to expand into exports – benefitting U.S. economy, creating jobs and reducing balance of trade deficit 60 67 78 85 98 113 118 0 20 40 60 80 100 120 2005 2006 2007 2008 2009 2010 2011 Source: EIA, US Crude Oil, Natural Gas and Natural Gas Liquids Proved Reserves, 2011. Source: Advanced Resource Intl; Cheniere Research. U.S. Natural Gas Markets 32 Includes Eagle Ford, Barnett Combo, Bakken, Permian, Anadarko, W. Marcellus, Utica, Cotton Valley, Piceance & Uinta US Natural Gas Resources Tcf Source: Potential Gas Committee, 2013; EIA, Natural Gas Proved Reserves, 2010 US Gas Consumptions vs. Production Source: EIA Oct 2013 STEO Tcf • U.S. resources increased by 75% since 2006 • Represents over 100 years of supply at current demand 0 500 1000 1500 2000 2500 3000 2006 2008 2010 2012 Shale Other 2,718 2,203 2,081 1,532 18.1 18.5 19.3 20.2 20.6 21.3 22.9 24.1 24.4 22.0 21.7 23.1 23.3 22.9 24.1 24.5 25.5 25.8 0 5 10 15 20 25 30 2005 2006 2007 2008 2009 2010 2011 2012 2013E US Gas Production US Gas Consumption

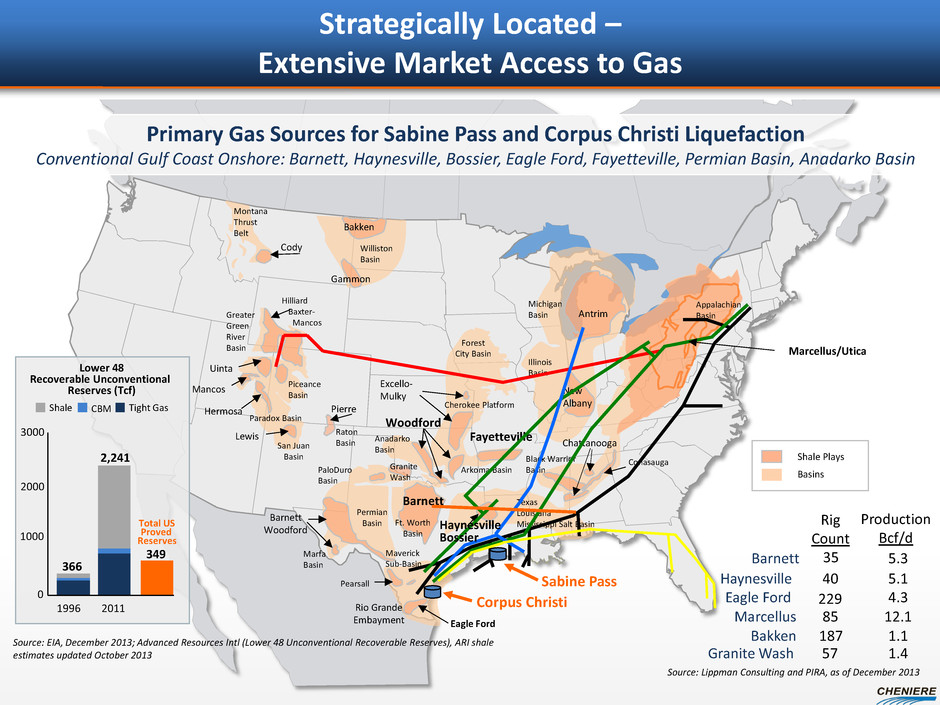

Montana Thrust Belt Cody Gammon Hilliard Baxter- Mancos Greater Green River Basin Forest City Basin Pierre Illinois Basin Piceance Basin Lewis San Juan Basin Raton Basin Anadarko Basin PaloDuro Basin Permian Basin Barnett Woodford Pearsall Eagle Ford Rio Grande Embayment Barnett Woodford Michigan Basin Antrim New Albany Chattanooga Texas Louisiana Mississippi Salt Basin Fayetteville Ft. Worth Basin Arkoma Basin Conasauga Black Warrior Basin Marfa Basin Paradox Basin Maverick Sub-Basin Hermosa Mancos Cherokee Platform Excello- Mulky Appalachian Basin Marcellus/Utica Shale Plays Basins Sabine Pass Haynesville Bossier Granite Wash Williston Basin Bakken Primary Gas Sources for Sabine Pass and Corpus Christi Liquefaction Conventional Gulf Coast Onshore: Barnett, Haynesville, Bossier, Eagle Ford, Fayetteville, Permian Basin, Anadarko Basin Source: EIA, December 2013; Advanced Resources Intl (Lower 48 Unconventional Recoverable Reserves), ARI shale estimates updated October 2013 Rig Count Production Bcf/d Barnett 35 5.3 Haynesville 40 5.1 Eagle Ford 229 4.3 Granite Wash 57 1.4 Bakken 187 1.1 Marcellus 85 12.1 Source: Lippman Consulting and PIRA, as of December 2013 Uinta Strategically Located – Extensive Market Access to Gas 366 2,241 Lower 48 Recoverable Unconventional Reserves (Tcf) 0 1000 2000 1996 2011 Shale CBM Tight Gas Total US Proved Reserves 3000 349 Corpus Christi

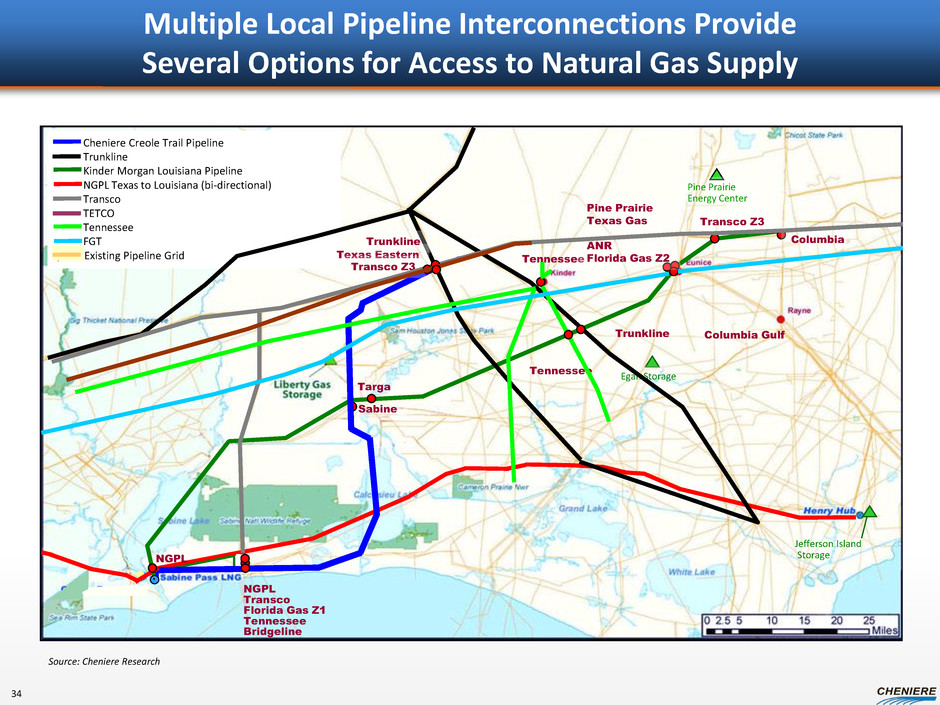

Multiple Local Pipeline Interconnections Provide Several Options for Access to Natural Gas Supply Targa Columbia Gulf Tennessee Cheniere Creole Trail Pipeline Trunkline Kinder Morgan Louisiana Pipeline NGPL Texas to Louisiana (bi-directional) Transco TETCO Tennessee FGT ) Existing Pipeline Grid Transco Z3 Sabine Pine Prairie Energy Center Egan Storage Jefferson Island Storage Pine Prairie Texas Gas ANR Florida Gas Z2 Tennessee Trunkline Columbia NGPL Transco Florida Gas Z1 Tennessee Bridgeline . NGPL Texas Eastern Trunkline Transco Z3 34 Source: Cheniere Research

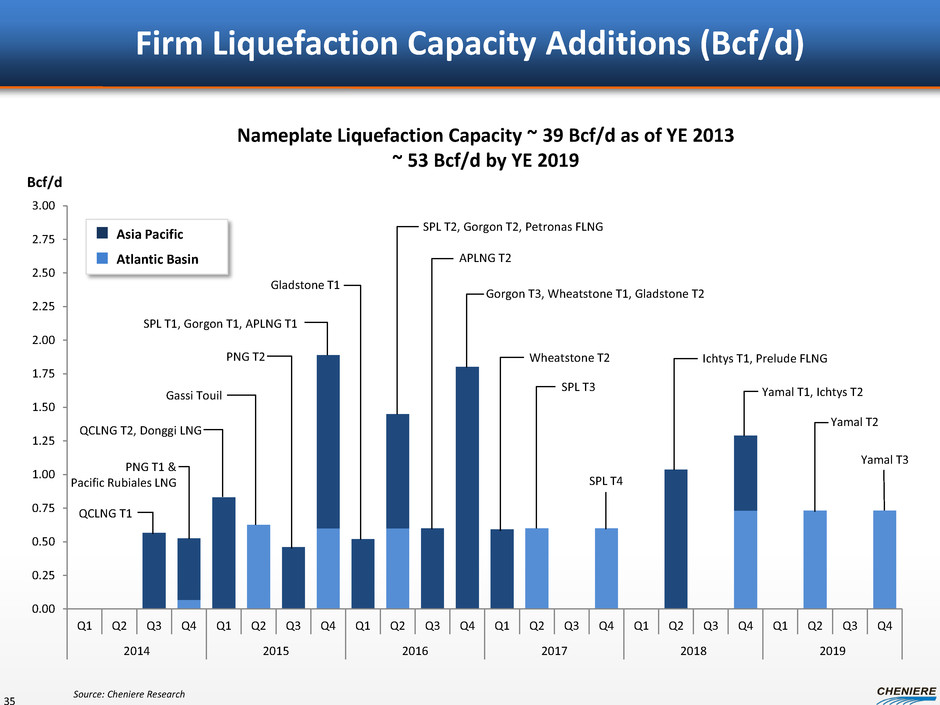

0.00 0.25 0.50 0.75 1.00 1.25 1.50 1.75 2.00 2.25 2.50 2.75 3.00 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2014 2015 2016 2017 2018 2019 Firm Liquefaction Capacity Additions (Bcf/d) 35 Asia Pacific Atlantic Basin Bcf/d Nameplate Liquefaction Capacity ~ 39 Bcf/d as of YE 2013 ~ 53 Bcf/d by YE 2019 Source: Cheniere Research QCLNG T1 PNG T1 & Pacific Rubiales LNG SPL T1, Gorgon T1, APLNG T1 Gassi Touil PNG T2 Gorgon T3, Wheatstone T1, Gladstone T2 Gladstone T1 Wheatstone T2 APLNG T2 SPL T3 Yamal T1, Ichtys T2 Ichtys T1, Prelude FLNG Yamal T2 QCLNG T2, Donggi LNG SPL T2, Gorgon T2, Petronas FLNG SPL T4 Yamal T3

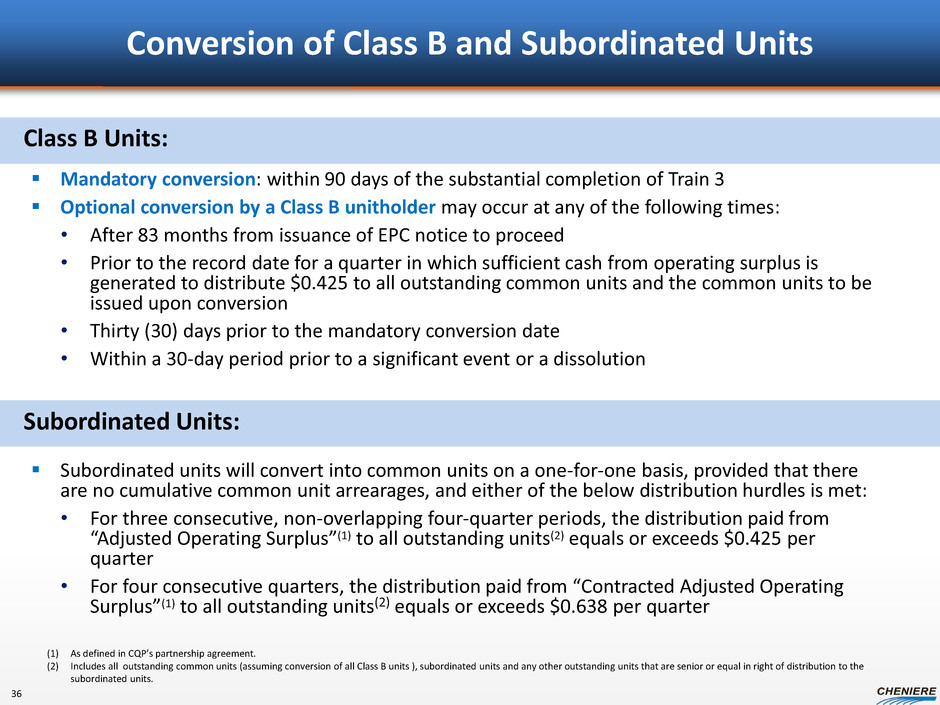

Conversion of Class B and Subordinated Units Mandatory conversion: within 90 days of the substantial completion of Train 3 Optional conversion by a Class B unitholder may occur at any of the following times: • After 83 months from issuance of EPC notice to proceed • Prior to the record date for a quarter in which sufficient cash from operating surplus is generated to distribute $0.425 to all outstanding common units and the common units to be issued upon conversion • Thirty (30) days prior to the mandatory conversion date • Within a 30-day period prior to a significant event or a dissolution Subordinated units will convert into common units on a one-for-one basis, provided that there are no cumulative common unit arrearages, and either of the below distribution hurdles is met: • For three consecutive, non-overlapping four-quarter periods, the distribution paid from “Adjusted Operating Surplus”(1) to all outstanding units(2) equals or exceeds $0.425 per quarter • For four consecutive quarters, the distribution paid from “Contracted Adjusted Operating Surplus”(1) to all outstanding units(2) equals or exceeds $0.638 per quarter Class B Units: Subordinated Units: (1) As defined in CQP’s partnership agreement. (2) Includes all outstanding common units (assuming conversion of all Class B units ), subordinated units and any other outstanding units that are senior or equal in right of distribution to the subordinated units. 36

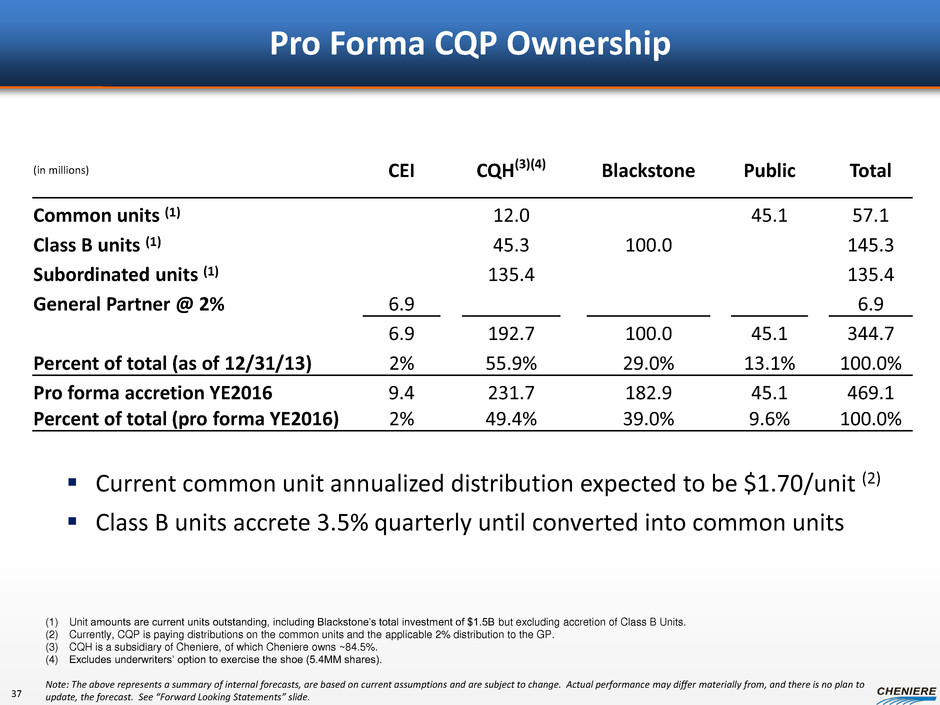

Pro Forma CQP Ownership Current common unit annualized distribution expected to be $1.70/unit (2) Class B units accrete 3.5% quarterly until converted into common units (1) Unit amounts are current units outstanding, including Blackstone’s total investment of $1.5B but excluding accretion of Class B Units. (2) Currently, CQP is paying distributions on the common units and the applicable 2% distribution to the GP. (3) CQH is a subsidiary of Cheniere, of which Cheniere owns ~84.5%. (4) Excludes underwriters’ option to exercise the shoe (5.4MM shares). Note: The above represents a summary of internal forecasts, are based on current assumptions and are subject to change. Actual performance may differ materially from, and there is no plan to update, the forecast. See “Forward Looking Statements” slide. 37 (in millions) CEI CQH(3)(4) Blackstone Public Total Common units (1) 12.0 45.1 57.1 Class B units (1) 45.3 100.0 145.3 Subordinated units (1) 135.4 135.4 General Partner @ 2% 6.9 6.9 6.9 192.7 100.0 45.1 344.7 Percent of total (as of 12/31/13) 2% 55.9% 29.0% 13.1% 100.0% Pro forma accretion YE2016 9.4 231.7 182.9 45.1 469.1 Percent of total (pro forma YE2016) 2% 49.4% 39.0% 9.6% 100.0%

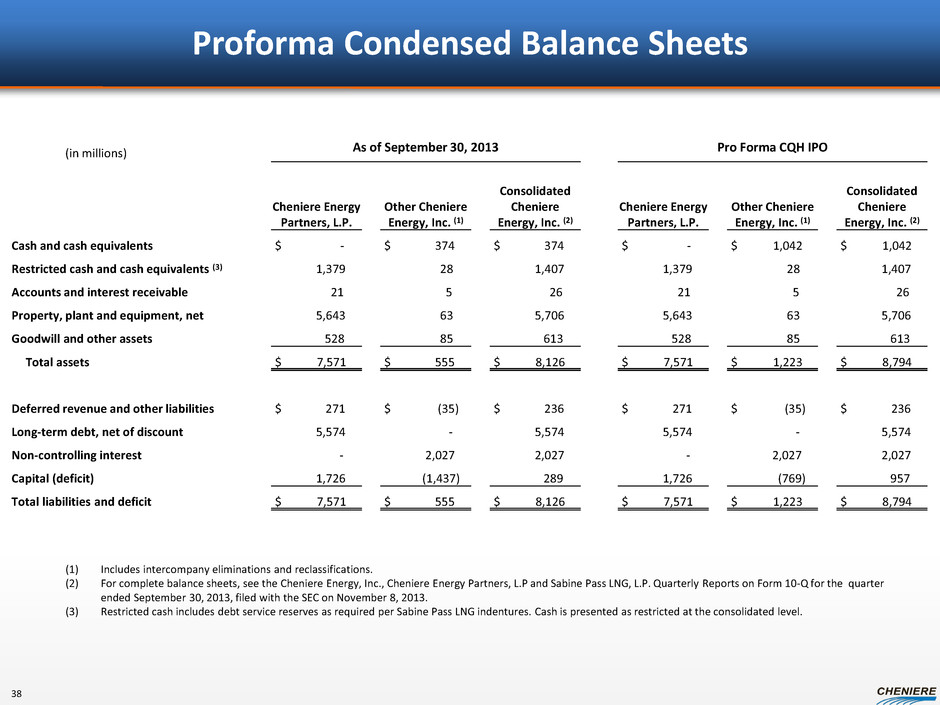

Proforma Condensed Balance Sheets (1) Includes intercompany eliminations and reclassifications. (2) For complete balance sheets, see the Cheniere Energy, Inc., Cheniere Energy Partners, L.P and Sabine Pass LNG, L.P. Quarterly Reports on Form 10-Q for the quarter ended September 30, 2013, filed with the SEC on November 8, 2013. (3) Restricted cash includes debt service reserves as required per Sabine Pass LNG indentures. Cash is presented as restricted at the consolidated level. 38 (in millions) As of September 30, 2013 Pro Forma CQH IPO Cheniere Energy Partners, L.P. Other Cheniere Energy, Inc. (1) Consolidated Cheniere Energy, Inc. (2) Cheniere Energy Partners, L.P. Other Cheniere Energy, Inc. (1) Consolidated Cheniere Energy, Inc. (2) Cash and cash equivalents $ - $ 374 $ 374 $ - $ 1,042 $ 1,042 Restricted cash and cash equivalents (3) 1,379 28 1,407 1,379 28 1,407 Accounts and interest receivable 21 5 26 21 5 26 Property, plant and equipment, net 5,643 63 5,706 5,643 63 5,706 Goodwill and other assets 528 85 613 528 85 613 Total assets $ 7,571 $ 555 $ 8,126 $ 7,571 $ 1,223 $ 8,794 Deferred revenue and other liabilities $ 271 $ (35) $ 236 $ 271 $ (35) $ 236 Long-term debt, net of discount 5,574 - 5,574 5,574 - 5,574 Non-controlling interest - 2,027 2,027 - 2,027 2,027 Capital (deficit) 1,726 (1,437) 289 1,726 (769) 957 Total liabilities and deficit $ 7,571 $ 555 $ 8,126 $ 7,571 $ 1,223 $ 8,794

Randy Bhatia: Director, Finance and Investor Relations – (713) 375-5479, randy.bhatia@cheniere.com Christina Burke: Manager, Investor Relations – (713) 375-5104, christina.burke@cheniere.com Investor Relations Contacts