CHENIERE ENERGY, INC. March 2018 CHENIERE ENERGY, INC. NYSE American: LNG INVESTOR UPDATE May 29-30, 2018

Safe Harbor Statements Forward-Looking Statements This presentation contains certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical or present facts or conditions, included or incorporated by reference herein are “forward-looking statements.” Included among “forward-looking statements” are, among other things: • statements regarding the ability of Cheniere Energy Partners, L.P. to pay distributions to its unitholders or Cheniere Energy Partners LP Holdings, LLC or Cheniere Energy, Inc. to pay dividends to its shareholders or participate in share or unit buybacks; • statements regarding Cheniere Energy, Inc.’s, Cheniere Energy Partners LP Holdings, LLC’s or Cheniere Energy Partners, L.P.’s expected receipt of cash distributions from their respective subsidiaries; • statements that Cheniere Energy Partners, L.P. expects to commence or complete construction of its proposed liquefied natural gas (“LNG”) terminals, liquefaction facilities, pipeline facilities or other projects, or any expansions or portions thereof, by certain dates or at all; • statements that Cheniere Energy, Inc. expects to commence or complete construction of its proposed LNG terminals, liquefaction facilities, pipeline facilities or other projects, or any expansions or portions then of, by certain dates or at all; • statements regarding future levels of domestic and international natural gas production, supply or consumption or future levels of LNG imports into or exports from North America and other countries worldwide, or purchases of natural gas, regardless of the source of such information, or the transportation or other infrastructure, or demand for and prices related to natural gas, LNG or other hydrocarbon products; • statements regarding any financing transactions or arrangements, or ability to enter into such transactions; • statements relating to the construction of our proposed liquefaction facilities and natural gas liquefaction trains (“Trains”) and the construction of the Corpus Christi Pipeline, including statements concerning the engagement of any engineering, procurement and construction ("EPC") contractor or other contractor and the anticipated terms and provisions of any agreement with any EPC or other contractor, and anticipated costs related thereto; • statements regarding any agreement to be entered into or performed substantially in the future, including any revenues anticipated to be received and the anticipated timing thereof, and statements regarding the amounts of total LNG regasification, natural gas, liquefaction or storage capacities that are, or may become, subject to contracts; • statements regarding counterparties to our commercial contracts, construction contracts and other contracts; • statements regarding our planned development and construction of additional Trains or pipelines, including the financing of such Trains or pipelines; • statements that our Trains, when completed, will have certain characteristics, including amounts of liquefaction capacities; • statements regarding our business strategy, our strengths, our business and operation plans or any other plans, forecasts, projections or objectives, including anticipated revenues, capital expenditures, maintenance and operating costs, run-rate SG&A estimates, cash flows, EBITDA, Adjusted EBITDA, distributable cash flow, distributable cash flow per share and unit, deconsolidated debt outstanding, and deconsolidated contracted EBITDA, any or all of which are subject to change; • statements regarding projections of revenues, expenses, earnings or losses, working capital or other financial items; • statements regarding legislative, governmental, regulatory, administrative or other public body actions, approvals, requirements, permits, applications, filings, investigations, proceedings or decisions; • statements regarding our anticipated LNG and natural gas marketing activities; and • any other statements that relate to non-historical or future information. These forward-looking statements are often identified by the use of terms and phrases such as “achieve,” “anticipate,” “believe,” “contemplate,” “develop,” “estimate,” “example,” “expect,” “forecast,” “goals,” ”guidance,” “opportunities,” “plan,” “potential,” “project,” “propose,” “subject to,” “strategy,” “target,” and similar terms and phrases, or by use of future tense. Although we believe that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in “Risk Factors” in the Cheniere Energy, Inc., Cheniere Energy Partners, L.P. and Cheniere Energy Partners LP Holdings, LLC Annual Reports on Form 10-K filed with the SEC on February 21, 2018, which are incorporated by reference into this presentation. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these ”Risk Factors.” These forward-looking statements are made as of the date of this presentation, and other than as required by law, we undertake no obligation to update or revise any forward-looking statement or provide reasons why actual results may differ, whether as a result of new information, future events or otherwise. Reconciliation to U.S. GAAP Financial Information The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934, as amended. Schedules are included in the appendix hereto that reconcile the non-GAAP financial measures included in the following presentation to the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP. 2

Safe Harbor Statements (cont’d) Additional Information and Where to Find It This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of a proxy or of any vote or approval. This presentation may be deemed to be solicitation material in respect of the proposed transaction between Cheniere Energy, Inc. and Cheniere Energy Partners LP Holdings, LLC. In the event that the parties enter into a definitive agreement with respect to the proposed transaction, the parties intend to file a registration statement on Form S-4, containing a proxy statement/prospectus (the “S-4”) with the SEC. This presentation is not a substitute for the registration statement, definitive proxy statement/prospectus or any other documents that Cheniere Energy, Inc. or Cheniere Energy Partners LP Holdings, LLC may file with the SEC or send to shareholders in connection with the proposed transaction. INVESTORS AND SHAREHOLDERS OF CHENIERE ENERGY PARTNERS LP HOLDINGS, LLC ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT/PROSPECTUS IF AND WHEN FILED, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. When available, investors and security holders will be able to obtain copies of the S-4, including the proxy statement/prospectus and any other documents that may be filed with the SEC in the event that the parties enter into a definitive agreement with respect to the proposed transaction free of charge at the SEC’s website at http://www.sec.gov. Copies of documents filed with the SEC by Cheniere Energy, Inc. will also be made available free of charge on its website at www.cheniere.com. Copies of documents filed with the SEC by Cheniere Energy Partners LP Holdings, LLC will also be made available free of charge on its website at www.cheniere.com. Participants in the Solicitation Cheniere Energy, Inc., Cheniere Energy Partners LP Holdings, LLC and their respective directors and executive officers may be deemed to be participants in any solicitation of proxies from Cheniere Energy Partners LP Holdings, LLC’s shareholders with respect to the proposed transaction. Information about Cheniere Energy Partners LP Holdings, LLC’s directors and executive officers is set forth in Cheniere Energy Partners LP Holdings, LLC’s 2017 annual report on Form 10-K, which was filed with the SEC on February 21, 2018. Information about Cheniere Energy, Inc.’s directors and executive officers is set forth in Cheniere Energy, Inc.’s proxy statement for its 2018 Annual Meeting of Shareholders, which was filed with the SEC on April 13, 2018. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction if and when they become available. Investors should read the proxy statement/prospectus carefully if and when it becomes available before making any voting or investment decisions. 3

Agenda Randy Bhatia Introduction Vice President, Investor Relations Company Highlights Jack Fusco and CCL T3 Overview President and Chief Executive Officer LNG Market and Anatol Feygin Strategic Update Executive Vice President and Chief Commercial Officer Michael Wortley Financial Update Executive Vice President and Chief Financial Officer Q & A 4

CCL Project COMPANY HIGHLIGHTS AND CCL T3 OVERVIEW | Jack Fusco, President and CEO

Cheniere Investment Thesis Full-service LNG offering, including gas procurement, transportation, liquefaction, and shipping enables flexible solutions tailored to customer needs Positioned as premier LNG provider, with a proven track record and low- cost advantage through capacity expansion at existing sites Liquefaction platform offers excellent visibility for long-term cash flows, with “take-or-pay” style agreements with creditworthy counterparties Opportunities for future cash flow growth at attractive returns, utilizing uncontracted incremental production and constructing additional Trains Supply/demand fundamentals support continued LNG demand growth worldwide, with forecast global LNG trade growth of >200 mtpa by 2030 Investments in additional infrastructure upstream and downstream of liquefaction along the LNG value chain Source: Cheniere Research, EIA, Cheniere interpretation of Wood Mackenzie data (Q1 2018), IHS, GIIGNL 6

Consistently Delivering on Our Promises Four Trains at Sabine Pass completed within 17 months safely, within budget, and ahead of schedule Anticipated completion of Sabine T5 and Corpus T1-T2 in “Cheniere is well-positioned for success as a global 2019, also within budget and ahead of schedule LNG market leader and I look forward to building Reached Date of First Commercial Delivery under SPAs(1) for upon the many successes achieved to date. Our the four Trains in operation priorities will be focused on continued execution and completion of the LNG trains, both under Produced more than 14 million tonnes of LNG in 2017 – 5% of construction and under development, and further global supply commercialization of our LNG portfolio.” Exported ~350 cumulative cargoes from Sabine Pass, with deliveries to 26 countries and regions worldwide Cheniere Energy, Inc. Announces Appointment Successfully sold and delivered more than 9 million tonnes of of Jack A. Fusco as President and Chief portfolio and commissioning volumes from Sabine Pass Executive Officer Managed a shipping portfolio of up to 25 vessels on the May 12, 2016 water simultaneously Captured optimization opportunities within the LNG market Commercialized, financed, and made positive Final Investment Decision (FID) for Corpus T3 (1) Date of First Commercial Delivery for Trains 1 through 4 for the primary SPA for each Train. 7

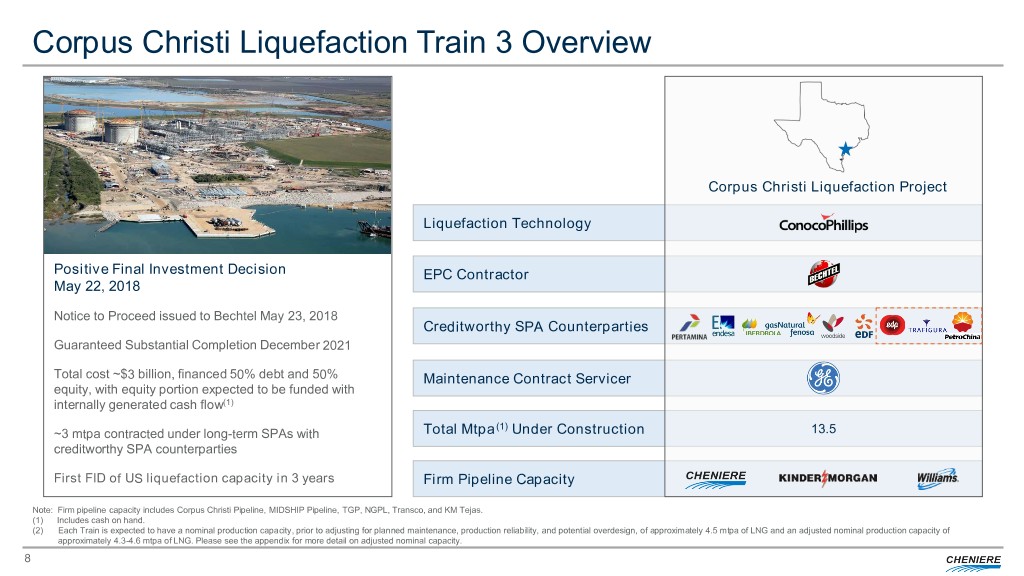

Corpus Christi Liquefaction Train 3 Overview Corpus Christi Liquefaction Project Liquefaction Technology Positive Final Investment Decision EPC Contractor May 22, 2018 Notice to Proceed issued to Bechtel May 23, 2018 Creditworthy SPA Counterparties Guaranteed Substantial Completion December 2021 Total cost ~$3 billion, financed 50% debt and 50% Maintenance Contract Servicer equity, with equity portion expected to be funded with internally generated cash flow(1) (1) ~3 mtpa contracted under long-term SPAs with Total Mtpa Under Construction 13.5 creditworthy SPA counterparties First FID of US liquefaction capacity in 3 years Firm Pipeline Capacity Note: Firm pipeline capacity includes Corpus Christi Pipeline, MIDSHIP Pipeline, TGP, NGPL, Transco, and KM Tejas. (1) Includes cash on hand. (2) Each Train is expected to have a nominal production capacity, prior to adjusting for planned maintenance, production reliability, and potential overdesign, of approximately 4.5 mtpa of LNG and an adjusted nominal production capacity of approximately 4.3-4.6 mtpa of LNG. Please see the appendix for more detail on adjusted nominal capacity. 8

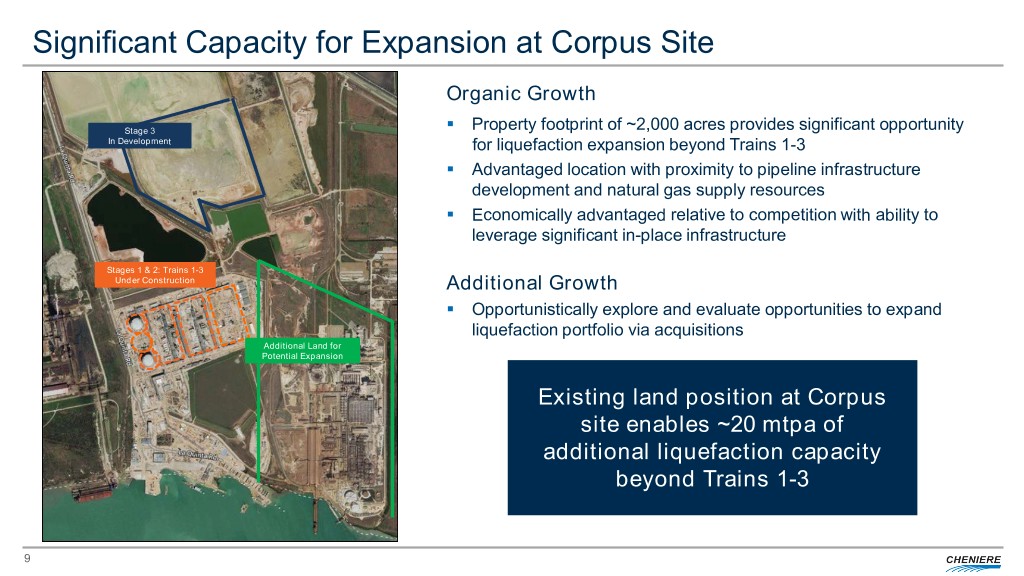

Significant Capacity for Expansion at Corpus Site Organic Growth Stage 3 . Property footprint of ~2,000 acres provides significant opportunity In Development for liquefaction expansion beyond Trains 1-3 . Advantaged location with proximity to pipeline infrastructure development and natural gas supply resources . Economically advantaged relative to competition with ability to leverage significant in-place infrastructure Stages 1 & 2: Trains 1-3 Under Construction Additional Growth . Opportunistically explore and evaluate opportunities to expand liquefaction portfolio via acquisitions Additional Land for Potential Expansion Existing land position at Corpus site enables ~20 mtpa of additional liquefaction capacity beyond Trains 1-3 9

CHENIERE OVERVIEW LNG MARKET AND STRATEGIC UPDATE | Anatol Feygin, EVP and CCO

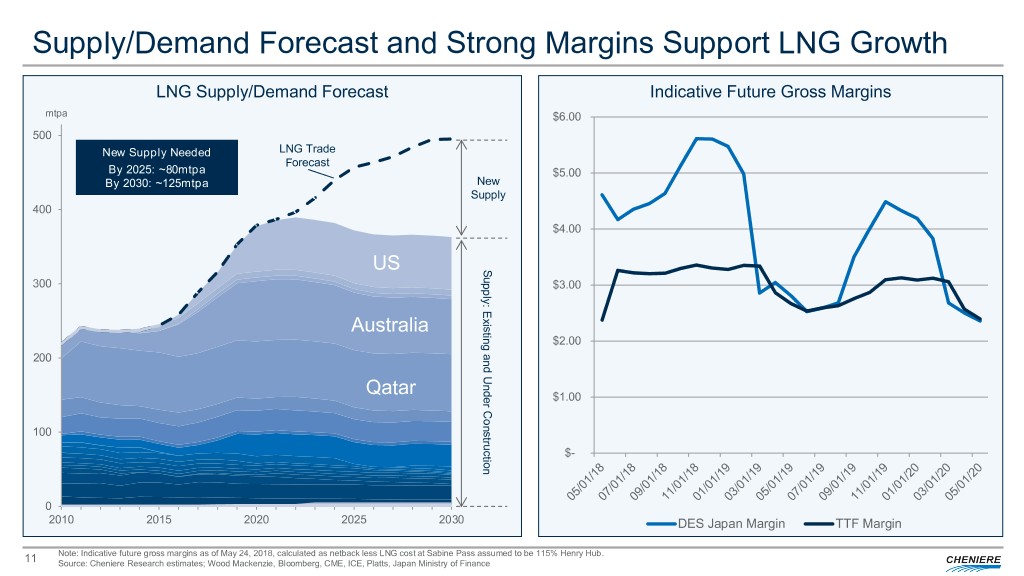

Supply/Demand Forecast and Strong Margins Support LNG Growth LNG Supply/Demand Forecast Indicative Future Gross Margins mtpa $6.00 500 New Supply Needed LNG Trade Forecast By 2025: ~80mtpa $5.00 By 2030: ~125mtpa New Supply 400 $4.00 US and Under Construction Existing Supply: 300 $3.00 Australia $2.00 200 Qatar $1.00 100 $- 0 2010 2015 2020 2025 2030 DES Japan Margin TTF Margin Note: Indicative future gross margins as of May 24, 2018, calculated as netback less LNG cost at Sabine Pass assumed to be 115% Henry Hub. 11 Source: Cheniere Research estimates; Wood Mackenzie, Bloomberg, CME, ICE, Platts, Japan Ministry of Finance

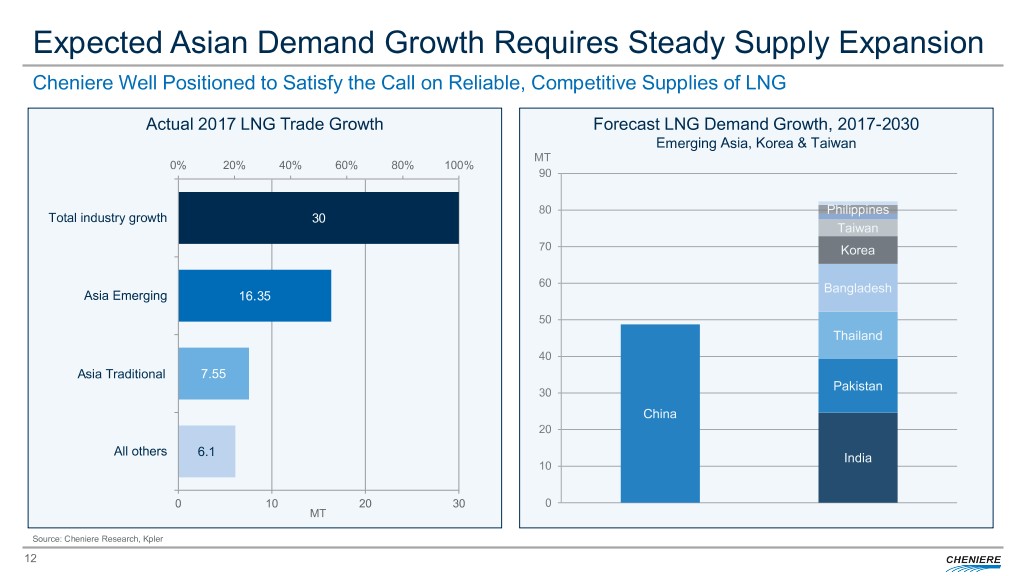

Expected Asian Demand Growth Requires Steady Supply Expansion Cheniere Well Positioned to Satisfy the Call on Reliable, Competitive Supplies of LNG Actual 2017 LNG Trade Growth Forecast LNG Demand Growth, 2017-2030 Emerging Asia, Korea & Taiwan MT 0% 20% 40% 60% 80% 100% 90 80 Philippines Total industry growth 30 Taiwan 70 Korea 60 Bangladesh Asia Emerging 16.35 50 Thailand 40 AsiaAsiaTradional Traditional 7.55 30 Pakistan China 20 All others 6.1 India 10 0 10 20 30 0 MT Source: Cheniere Research, Kpler 12

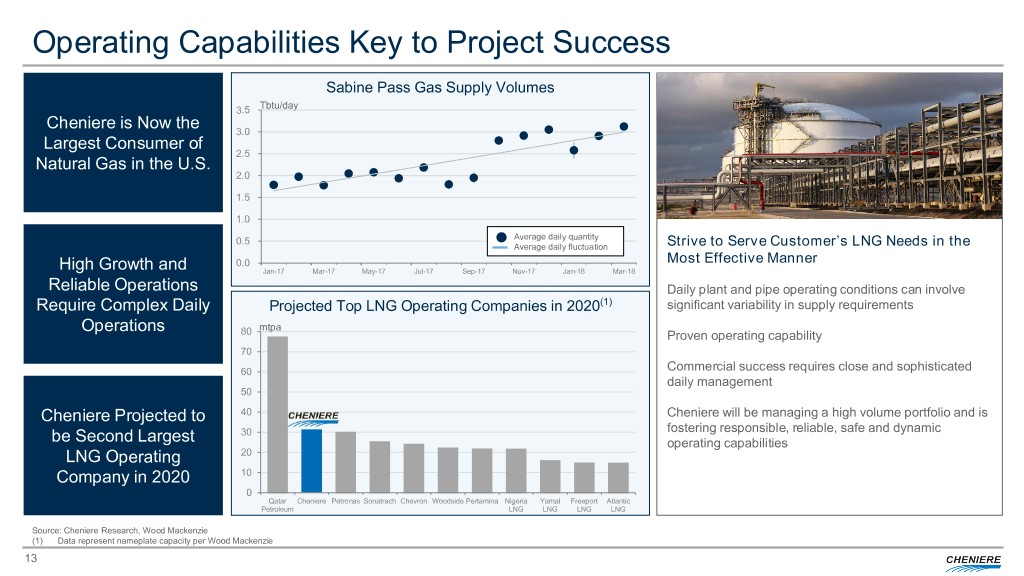

Operating Capabilities Key to Project Success Sabine Pass Gas Supply Volumes 3.5 Tbtu/day Cheniere is Now the 3.0 Largest Consumer of 2.5 Natural Gas in the U.S. 2.0 1.5 1.0 0.5 Average daily quantity Average daily fluctuation Strive to Serve Customer’s LNG Needs in the High Growth and 0.0 Most Effective Manner Jan-17 Mar-17 May-17 Jul-17 Sep-17 Nov-17 Jan-18 Mar-18 Reliable Operations Daily plant and pipe operating conditions can involve Require Complex Daily Projected Top LNG Operating Companies in 2020(1) significant variability in supply requirements Operations mtpa 80 Proven operating capability 70 60 Commercial success requires close and sophisticated daily management 50 Cheniere Projected to 40 Cheniere will be managing a high volume portfolio and is 30 fostering responsible, reliable, safe and dynamic be Second Largest operating capabilities 20 LNG Operating Company in 2020 10 0 Qatar Cheniere Petronas Sonatrach Chevron Woodside Pertamina Nigeria Yamal Freeport Atlantic Petroleum LNG LNG LNG LNG Source: Cheniere Research, Wood Mackenzie (1) Data represent nameplate capacity per Wood Mackenzie 13

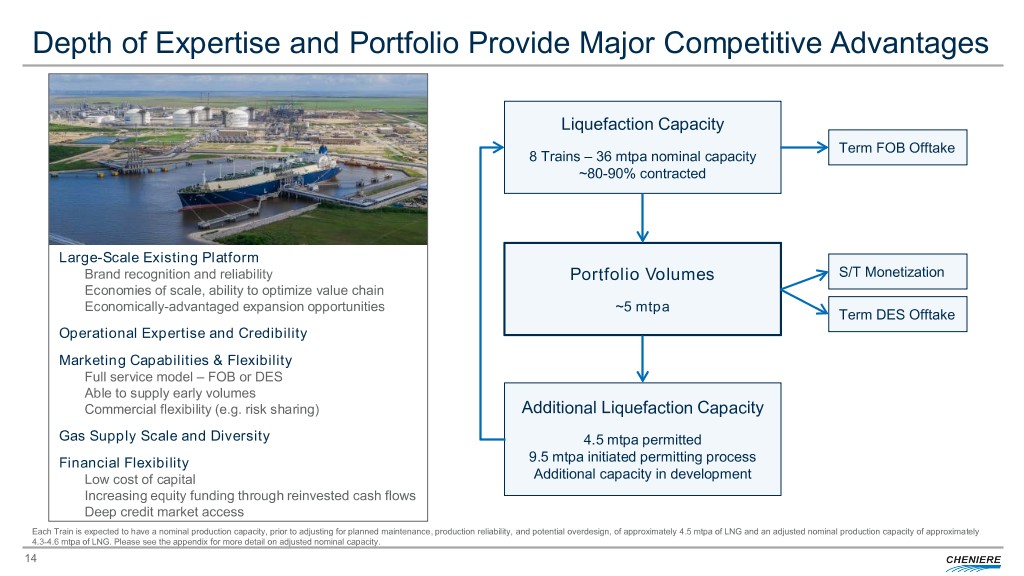

Depth of Expertise and Portfolio Provide Major Competitive Advantages Liquefaction Capacity Term FOB Offtake 8 Trains – 36 mtpa nominal capacity ~80-90% contracted Large-Scale Existing Platform Brand recognition and reliability Portfolio Volumes S/T Monetization Economies of scale, ability to optimize value chain Economically-advantaged expansion opportunities ~5 mtpa Term DES Offtake Operational Expertise and Credibility Marketing Capabilities & Flexibility Full service model – FOB or DES Able to supply early volumes Commercial flexibility (e.g. risk sharing) Additional Liquefaction Capacity Gas Supply Scale and Diversity 4.5 mtpa permitted Financial Flexibility 9.5 mtpa initiated permitting process Low cost of capital Additional capacity in development Increasing equity funding through reinvested cash flows Deep credit market access Each Train is expected to have a nominal production capacity, prior to adjusting for planned maintenance, production reliability, and potential overdesign, of approximately 4.5 mtpa of LNG and an adjusted nominal production capacity of approximately 4.3-4.6 mtpa of LNG. Please see the appendix for more detail on adjusted nominal capacity. 14

CHENIERE OVERVIEW FINANCIAL UPDATE | Michael Wortley, EVP and CFO

2018 Investor Update . 2017 Finance Priorities Revisited . CCL Train 3 Financing . Run-Rate Guidance Update . Five-Year Available Cash Update 16

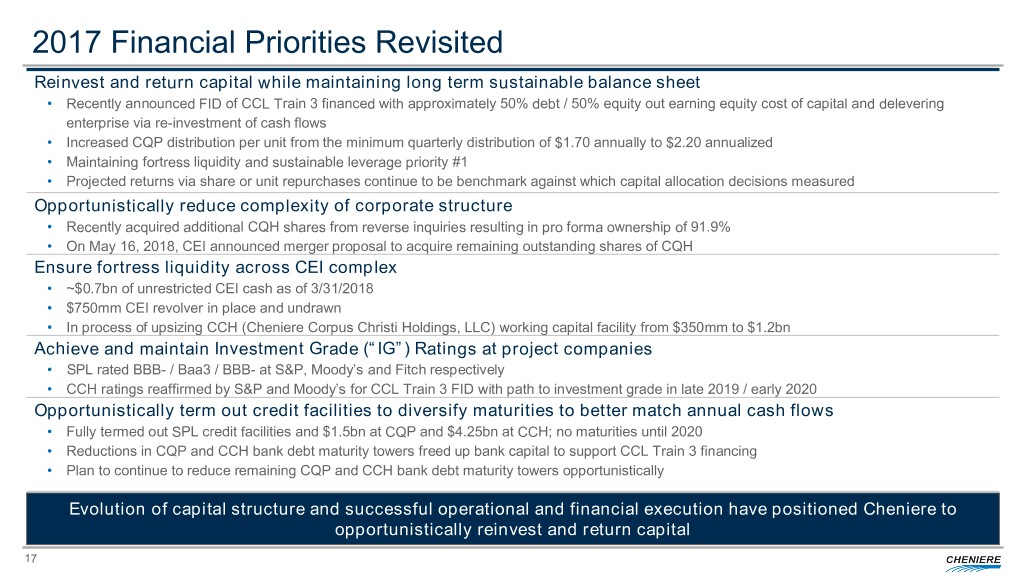

2017 Financial Priorities Revisited Reinvest and return capital while maintaining long term sustainable balance sheet • Recently announced FID of CCL Train 3 financed with approximately 50% debt / 50% equity out earning equity cost of capital and delevering enterprise via re-investment of cash flows • Increased CQP distribution per unit from the minimum quarterly distribution of $1.70 annually to $2.20 annualized • Maintaining fortress liquidity and sustainable leverage priority #1 • Projected returns via share or unit repurchases continue to be benchmark against which capital allocation decisions measured Opportunistically reduce complexity of corporate structure • Recently acquired additional CQH shares from reverse inquiries resulting in pro forma ownership of 91.9% • On May 16, 2018, CEI announced merger proposal to acquire remaining outstanding shares of CQH Ensure fortress liquidity across CEI complex • ~$0.7bn of unrestricted CEI cash as of 3/31/2018 • $750mm CEI revolver in place and undrawn • In process of upsizing CCH (Cheniere Corpus Christi Holdings, LLC) working capital facility from $350mm to $1.2bn Achieve and maintain Investment Grade (“IG”) Ratings at project companies • SPL rated BBB- / Baa3 / BBB- at S&P, Moody’s and Fitch respectively • CCH ratings reaffirmed by S&P and Moody’s for CCL Train 3 FID with path to investment grade in late 2019 / early 2020 Opportunistically term out credit facilities to diversify maturities to better match annual cash flows • Fully termed out SPL credit facilities and $1.5bn at CQP and $4.25bn at CCH; no maturities until 2020 • Reductions in CQP and CCH bank debt maturity towers freed up bank capital to support CCL Train 3 financing • Plan to continue to reduce remaining CQP and CCH bank debt maturity towers opportunistically Evolution of capital structure and successful operational and financial execution have positioned Cheniere to opportunistically reinvest and return capital 17

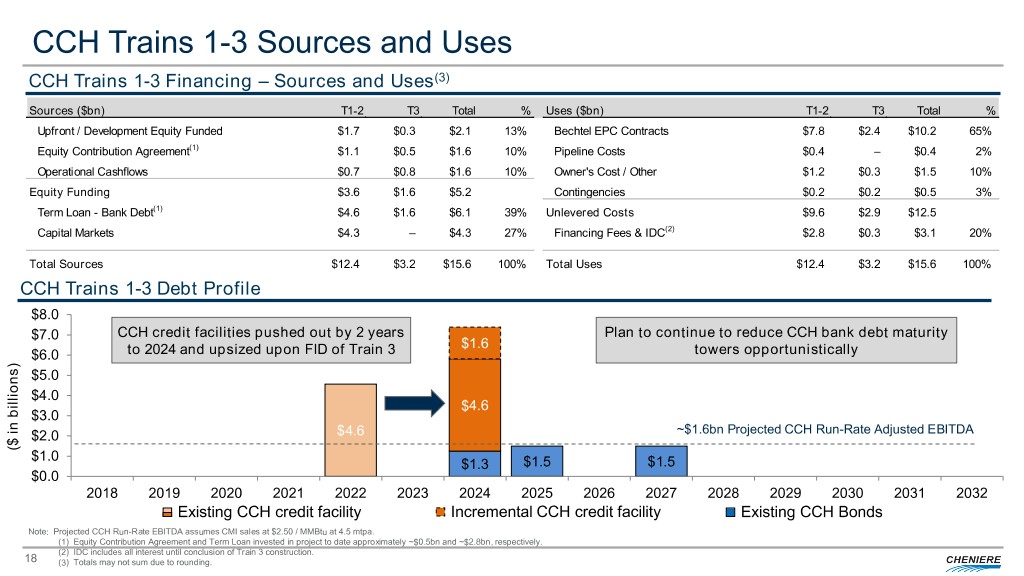

CCH Trains 1-3 Sources and Uses CCH Trains 1-3 Financing – Sources and Uses(3) Sources ($bn) T1-2 T3 Total % Uses ($bn) T1-2 T3 Total % Upfront / Development Equity Funded $1.7 $0.3 $2.1 13% Bechtel EPC Contracts $7.8 $2.4 $10.2 65% Equity Contribution Agreement(1) $1.1 $0.5 $1.6 10% Pipeline Costs $0.4 – $0.4 2% Operational Cashflows $0.7 $0.8 $1.6 10% Owner's Cost / Other $1.2 $0.3 $1.5 10% Equity Funding $3.6 $1.6 $5.2 Contingencies $0.2 $0.2 $0.5 3% Term Loan - Bank Debt(1) $4.6 $1.6 $6.1 39% Unlevered Costs $9.6 $2.9 $12.5 Capital Markets $4.3 – $4.3 27% Financing Fees & IDC(2) $2.8 $0.3 $3.1 20% Total Sources $12.4 $3.2 $15.6 100% Total Uses $12.4 $3.2 $15.6 100% CCH Trains 1-3 Debt Profile $8.0 $7.0 CCH credit facilities pushed out by 2 years Plan to continue to reduce CCH bank debt maturity $1.6 $6.0 to 2024 and upsized upon FID of Train 3 towers opportunistically $5.0 $4.0 $4.6 $3.0 ~$1.6bn Projected CCH Run-Rate Adjusted EBITDA $2.0 $4.6 ($ in billions) $1.0 $1.3 $1.5 $1.5 $0.0 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 Existing CCH credit facility Incremental CCH credit facility Existing CCH Bonds Note: Projected CCH Run-Rate EBITDA assumes CMI sales at $2.50 / MMBtu at 4.5 mtpa. (1) Equity Contribution Agreement and Term Loan invested in project to date approximately ~$0.5bn and ~$2.8bn, respectively. (2) IDC includes all interest until conclusion of Train 3 construction. 18 (3) Totals may not sum due to rounding.

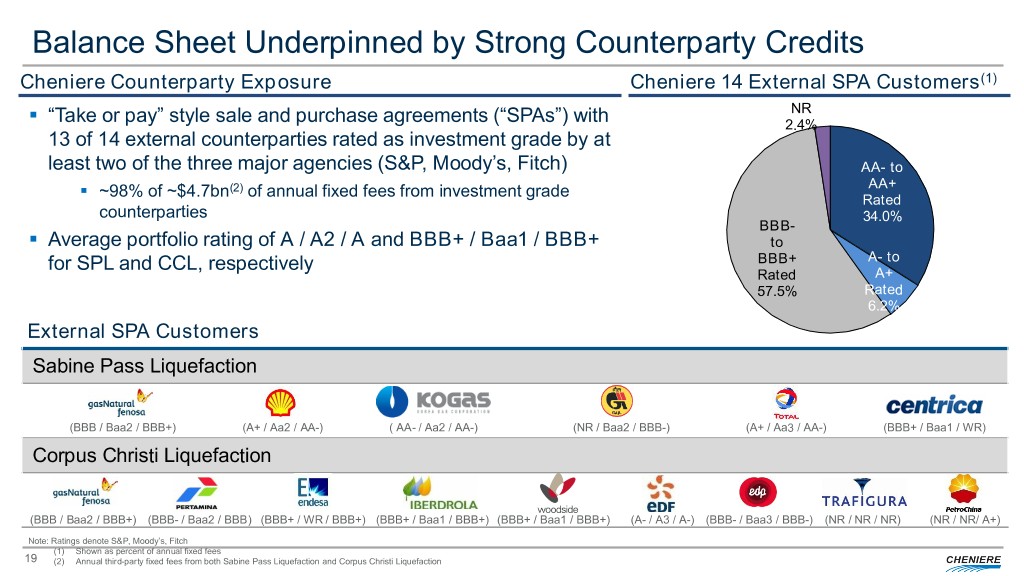

Balance Sheet Underpinned by Strong Counterparty Credits Cheniere Counterparty Exposure Cheniere 14 External SPA Customers(1) . NR “Take or pay” style sale and purchase agreements (“SPAs”) with 2.4% 13 of 14 external counterparties rated as investment grade by at least two of the three major agencies (S&P, Moody’s, Fitch) AA- to . ~98% of ~$4.7bn(2) of annual fixed fees from investment grade AA+ Rated counterparties 34.0% BBB- . Average portfolio rating of A / A2 / A and BBB+ / Baa1 / BBB+ to for SPL and CCL, respectively BBB+ A- to Rated A+ 57.5% Rated 6.2% External SPA Customers Sabine Pass Liquefaction (BBB / Baa2 / BBB+) (A+ / Aa2 / AA-) ( AA- / Aa2 / AA-) (NR / Baa2 / BBB-) (A+ / Aa3 / AA-) (BBB+ / Baa1 / WR) Corpus Christi Liquefaction (BBB / Baa2 / BBB+) (BBB- / Baa2 / BBB) (BBB+ / WR / BBB+) (BBB+ / Baa1 / BBB+) (BBB+ / Baa1 / BBB+) (A- / A3 / A-) (BBB- / Baa3 / BBB-) (NR / NR / NR) (NR / NR/ A+) Note: Ratings denote S&P, Moody’s, Fitch (1) Shown as percent of annual fixed fees 19 (2) Annual third-party fixed fees from both Sabine Pass Liquefaction and Corpus Christi Liquefaction

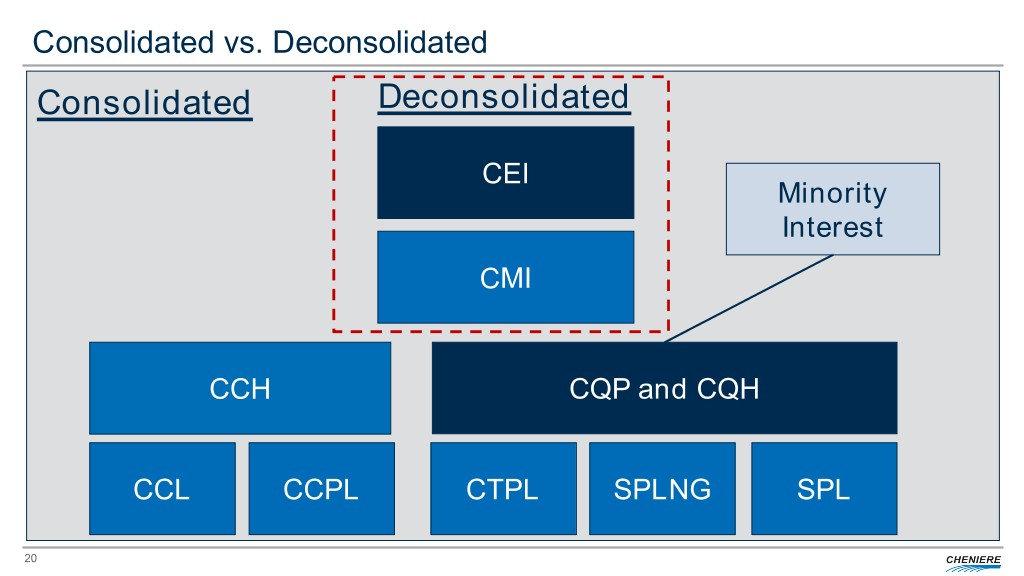

Consolidated vs. Deconsolidated Consolidated Deconsolidated CEI Minority Interest CMI CCH CQP and CQH CCL CCPL CTPL SPLNG SPL 20

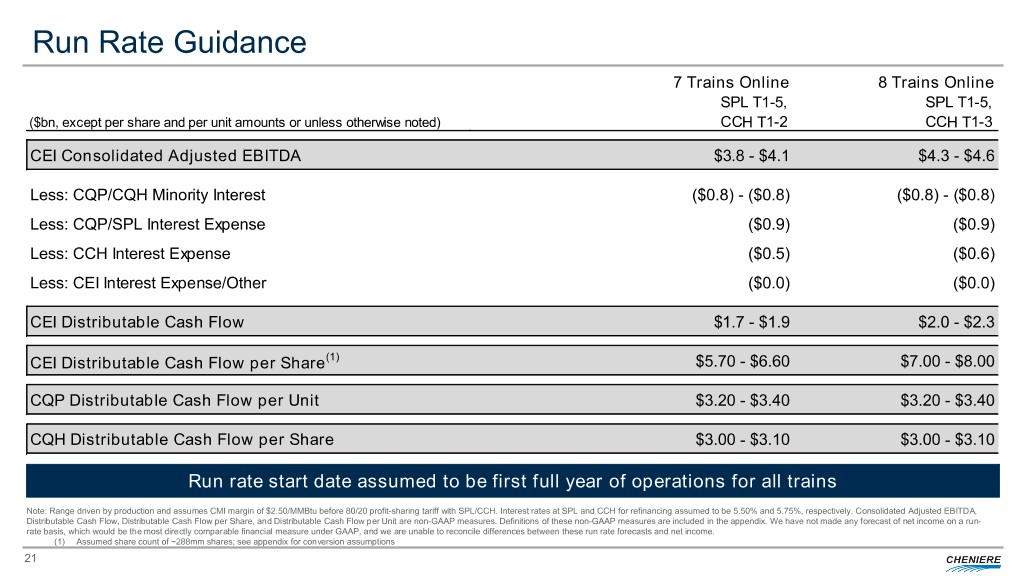

Run Rate Guidance 7 Trains Online 8 Trains Online SPL T1-5, SPL T1-5, ($bn, except per share and per unit amounts or unless otherwise noted) CCH T1-2 CCH T1-3 CEI Consolidated Adjusted EBITDA $3.8 - $4.1 $4.3 - $4.6 Less: CQP/CQH Minority Interest ($0.8) - ($0.8) ($0.8) - ($0.8) Less: CQP/SPL Interest Expense ($0.9) ($0.9) Less: CCH Interest Expense ($0.5) ($0.6) Less: CEI Interest Expense/Other ($0.0) ($0.0) CEI Distributable Cash Flow $1.7 - $1.9 $2.0 - $2.3 CEI Distributable Cash Flow per Share(1) $5.70 - $6.60 $7.00 - $8.00 CQP Distributable Cash Flow per Unit $3.20 - $3.40 $3.20 - $3.40 CQH Distributable Cash Flow per Share $3.00 - $3.10 $3.00 - $3.10 Run rate start date assumed to be first full year of operations for all trains Note: Range driven by production and assumes CMI margin of $2.50/MMBtu before 80/20 profit-sharing tariff with SPL/CCH. Interest rates at SPL and CCH for refinancing assumed to be 5.50% and 5.75%, respectively. Consolidated Adjusted EBITDA, Distributable Cash Flow, Distributable Cash Flow per Share, and Distributable Cash Flow per Unit are non-GAAP measures. Definitions of these non-GAAP measures are included in the appendix. We have not made any forecast of net income on a run- rate basis, which would be the most directly comparable financial measure under GAAP, and we are unable to reconcile differences between these run rate forecasts and net income. (1) Assumed share count of ~288mm shares; see appendix for conversion assumptions 21

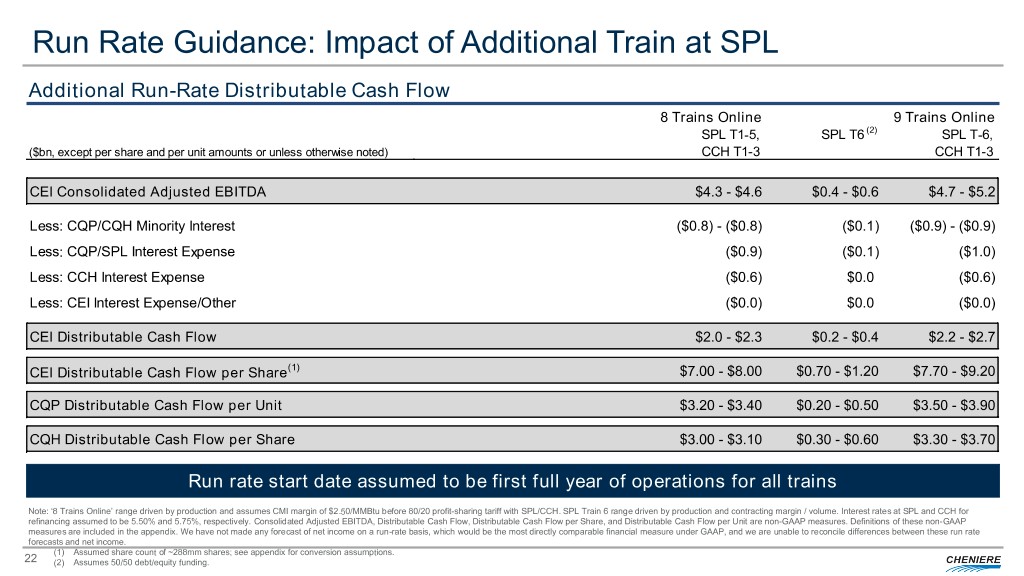

Run Rate Guidance: Impact of Additional Train at SPL Additional Run-Rate Distributable Cash Flow 8 Trains Online 9 Trains Online SPL T1-5, SPL T6 (2) SPL T-6, ($bn, except per share and per unit amounts or unless otherwise noted) CCH T1-3 CCH T1-3 CEI Consolidated Adjusted EBITDA $4.3 - $4.6 $0.4 - $0.6 $4.7 - $5.2 Less: CQP/CQH Minority Interest ($0.8) - ($0.8) ($0.1) ($0.9) - ($0.9) Less: CQP/SPL Interest Expense ($0.9) ($0.1) ($1.0) Less: CCH Interest Expense ($0.6) $0.0 ($0.6) Less: CEI Interest Expense/Other ($0.0) $0.0 ($0.0) CEI Distributable Cash Flow $2.0 - $2.3 $0.2 - $0.4 $2.2 - $2.7 CEI Distributable Cash Flow per Share(1) $7.00 - $8.00 $0.70 - $1.20 $7.70 - $9.20 CQP Distributable Cash Flow per Unit $3.20 - $3.40 $0.20 - $0.50 $3.50 - $3.90 CQH Distributable Cash Flow per Share $3.00 - $3.10 $0.30 - $0.60 $3.30 - $3.70 Run rate start date assumed to be first full year of operations for all trains Note: ‘8 Trains Online’ range driven by production and assumes CMI margin of $2.50/MMBtu before 80/20 profit-sharing tariff with SPL/CCH. SPL Train 6 range driven by production and contracting margin / volume. Interest rates at SPL and CCH for refinancing assumed to be 5.50% and 5.75%, respectively. Consolidated Adjusted EBITDA, Distributable Cash Flow, Distributable Cash Flow per Share, and Distributable Cash Flow per Unit are non-GAAP measures. Definitions of these non-GAAP measures are included in the appendix. We have not made any forecast of net income on a run-rate basis, which would be the most directly comparable financial measure under GAAP, and we are unable to reconcile differences between these run rate forecasts and net income. (1) Assumed share count of ~288mm shares; see appendix for conversion assumptions. 22 (2) Assumes 50/50 debt/equity funding.

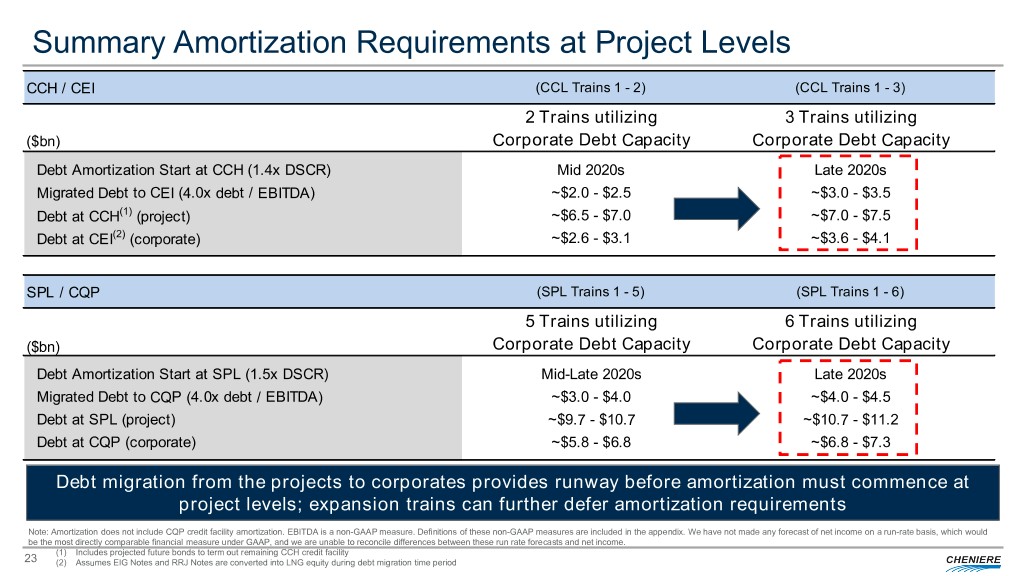

Summary Amortization Requirements at Project Levels CCH / CEI (CCL Trains 1 - 2) (CCL Trains 1 - 3) 2 Trains utilizing 3 Trains utilizing ($bn) Corporate Debt Capacity Corporate Debt Capacity Debt Amortization Start at CCH (1.4x DSCR) Mid 2020s Late 2020s Migrated Debt to CEI (4.0x debt / EBITDA) ~$2.0 - $2.5 ~$3.0 - $3.5 Debt at CCH(1) (project) ~$6.5 - $7.0 ~$7.0 - $7.5 Debt at CEI(2) (corporate) ~$2.6 - $3.1 ~$3.6 - $4.1 SPL / CQP (SPL Trains 1 - 5) (SPL Trains 1 - 6) 5 Trains utilizing 6 Trains utilizing ($bn) Corporate Debt Capacity Corporate Debt Capacity Debt Amortization Start at SPL (1.5x DSCR) Mid-Late 2020s Late 2020s Migrated Debt to CQP (4.0x debt / EBITDA) ~$3.0 - $4.0 ~$4.0 - $4.5 Debt at SPL (project) ~$9.7 - $10.7 ~$10.7 - $11.2 Debt at CQP (corporate) ~$5.8 - $6.8 ~$6.8 - $7.3 Debt migration from the projects to corporates provides runway before amortization must commence at project levels; expansion trains can further defer amortization requirements Note: Amortization does not include CQP credit facility amortization. EBITDA is a non-GAAP measure. Definitions of these non-GAAP measures are included in the appendix. We have not made any forecast of net income on a run-rate basis, which would be the most directly comparable financial measure under GAAP, and we are unable to reconcile differences between these run rate forecasts and net income. (1) Includes projected future bonds to term out remaining CCH credit facility 23 (2) Assumes EIG Notes and RRJ Notes are converted into LNG equity during debt migration time period

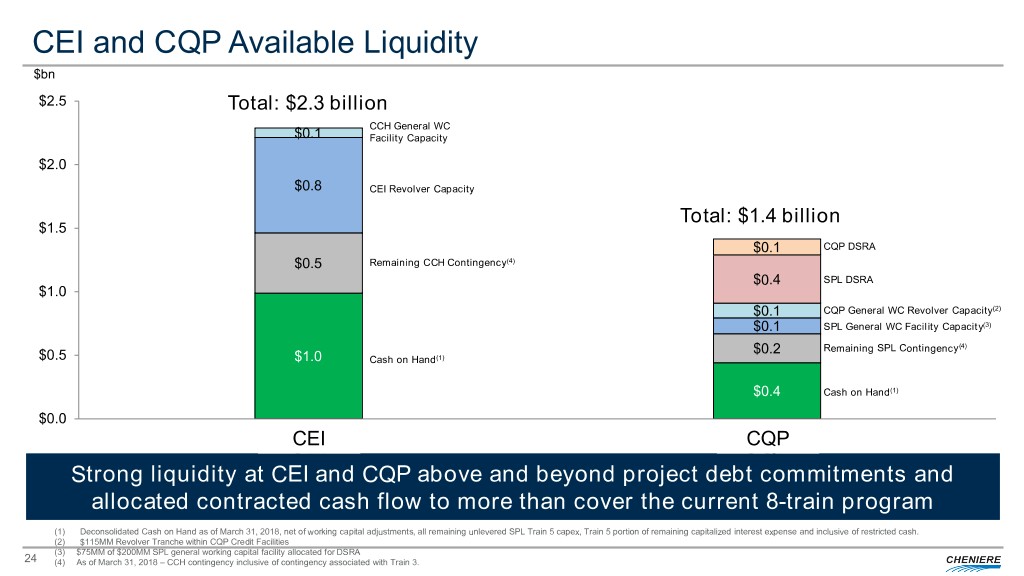

CEI and CQP Available Liquidity $bn $2.5 Total: $2.3 billion CCH General WC $0.1 Facility Capacity $2.0 $0.8 CEI Revolver Capacity Total: $1.4 billion $1.5 $0.1 CQP DSRA $0.5 Remaining CCH Contingency(4) $0.4 SPL DSRA $1.0 $0.1 CQP General WC Revolver Capacity(2) $0.1 SPL General WC Facility Capacity(3) $0.2 Remaining SPL Contingency(4) $0.5 $1.0 Cash on Hand(1) $0.4 Cash on Hand(1) $0.0 CEICEI CQPCQP Strong liquidity at CEI and CQP above and beyond project debt commitments and allocated contracted cash flow to more than cover the current 8-train program (1) Deconsolidated Cash on Hand as of March 31, 2018, net of working capital adjustments, all remaining unlevered SPL Train 5 capex, Train 5 portion of remaining capitalized interest expense and inclusive of restricted cash. (2) $115MM Revolver Tranche within CQP Credit Facilities (3) $75MM of $200MM SPL general working capital facility allocated for DSRA 24 (4) As of March 31, 2018 – CCH contingency inclusive of contingency associated with Train 3.

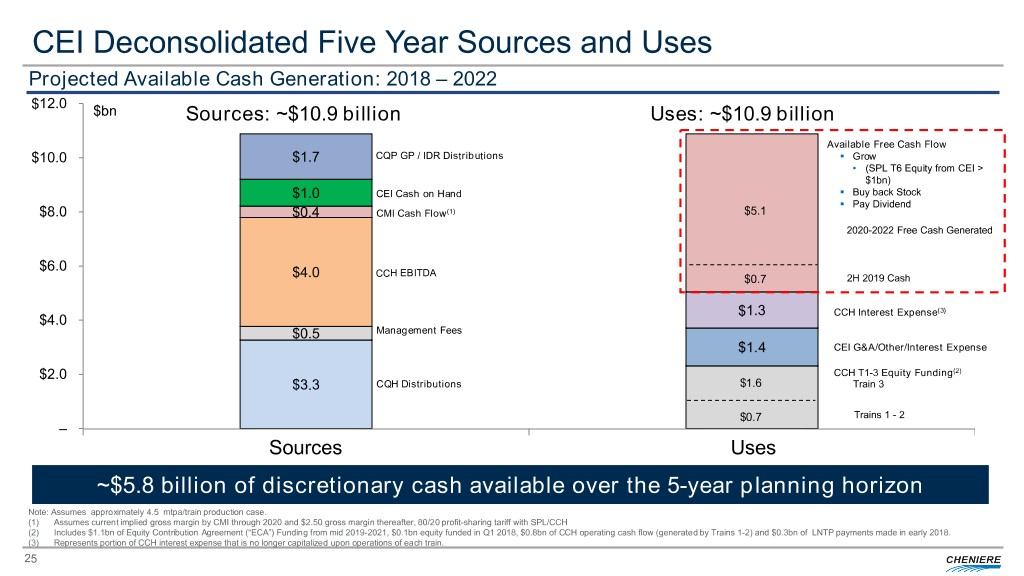

CEI Deconsolidated Five Year Sources and Uses Projected Available Cash Generation: 2018 – 2022 $12.0 $bn Sources: ~$10.9 billion Uses: ~$10.9 billion Available Free Cash Flow $10.0 $1.7 CQP GP / IDR Distributions . Grow • (SPL T6 Equity from CEI > $1bn) $1.0 CEI Cash on Hand . Buy back Stock . Pay Dividend $8.0 $0.4 CMI Cash Flow(1) $5.1 2020-2022 Free Cash Generated $6.0 CCH EBITDA $4.0 $0.7 2H 2019 Cash $1.3 CCH Interest Expense(3) $4.0 $0.5 Management Fees $1.4 CEI G&A/Other/Interest Expense $2.0 CCH T1-3 Equity Funding(2) $3.3 CQH Distributions $1.6 Train 3 $0.7 Trains 1 - 2 – SourcesSources UsesUses ~$5.8 billion of discretionary cash available over the 5-year planning horizon Note: Assumes approximately 4.5 mtpa/train production case. (1) Assumes current implied gross margin by CMI through 2020 and $2.50 gross margin thereafter, 80/20 profit-sharing tariff with SPL/CCH (2) Includes $1.1bn of Equity Contribution Agreement (“ECA”) Funding from mid 2019-2021, $0.1bn equity funded in Q1 2018, $0.8bn of CCH operating cash flow (generated by Trains 1-2) and $0.3bn of LNTP payments made in early 2018. (3) Represents portion of CCH interest expense that is no longer capitalized upon operations of each train. 25

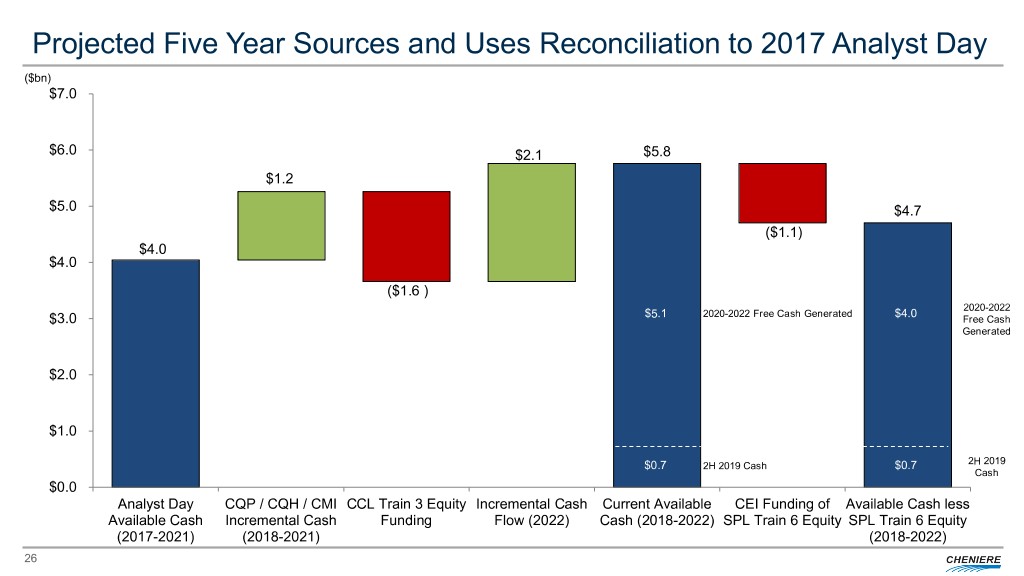

Projected Five Year Sources and Uses Reconciliation to 2017 Analyst Day ($bn) $7.0 $6.0 $2.1 $5.8 $1.2 $5.0 $4.7 ($1.1) $4.0 $4.0 ($1.6 ) 2020-2022 $5.1 2020-2022 Free Cash Generated $4.0 $3.0 Free Cash Generated $2.0 $1.0 2H 2019 $0.7 2H 2019 Cash $0.7 Cash $0.0 Analyst Day CQP / CQH / CMI CCL Train 3 Equity Incremental Cash Current Available CEI Funding of Available Cash less Available Cash Incremental Cash Funding Flow (2022) Cash (2018-2022) SPL Train 6 Equity SPL Train 6 Equity (2017-2021) (2018-2021) (2018-2022) 26

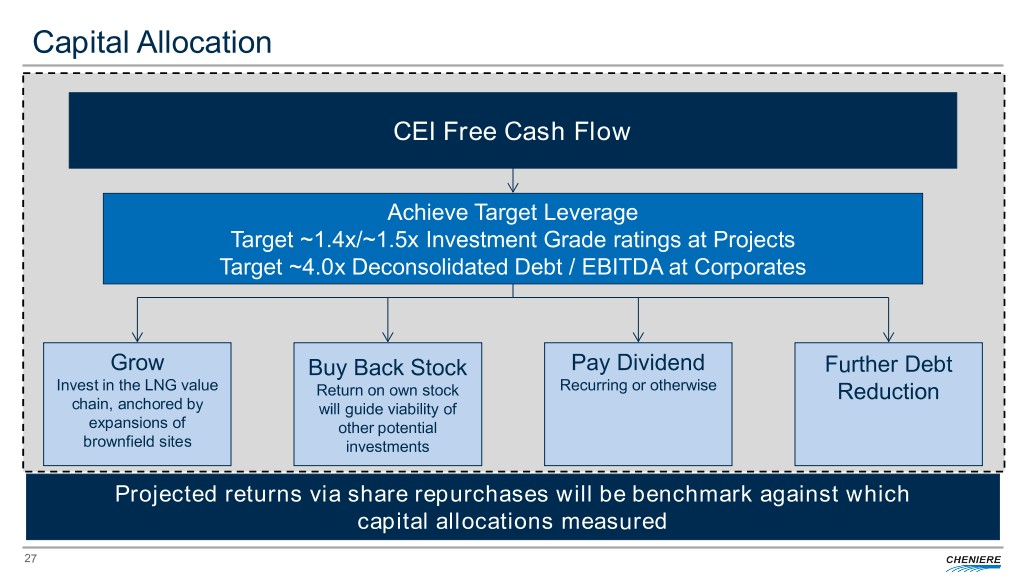

Capital Allocation CEI Free Cash Flow Achieve Target Leverage Target ~1.4x/~1.5x Investment Grade ratings at Projects Target ~4.0x Deconsolidated Debt / EBITDA at Corporates Grow Buy Back Stock Pay Dividend Further Debt Invest in the LNG value Return on own stock Recurring or otherwise Reduction chain, anchored by will guide viability of expansions of other potential brownfield sites investments Projected returns via share repurchases will be benchmark against which capital allocations measured 27

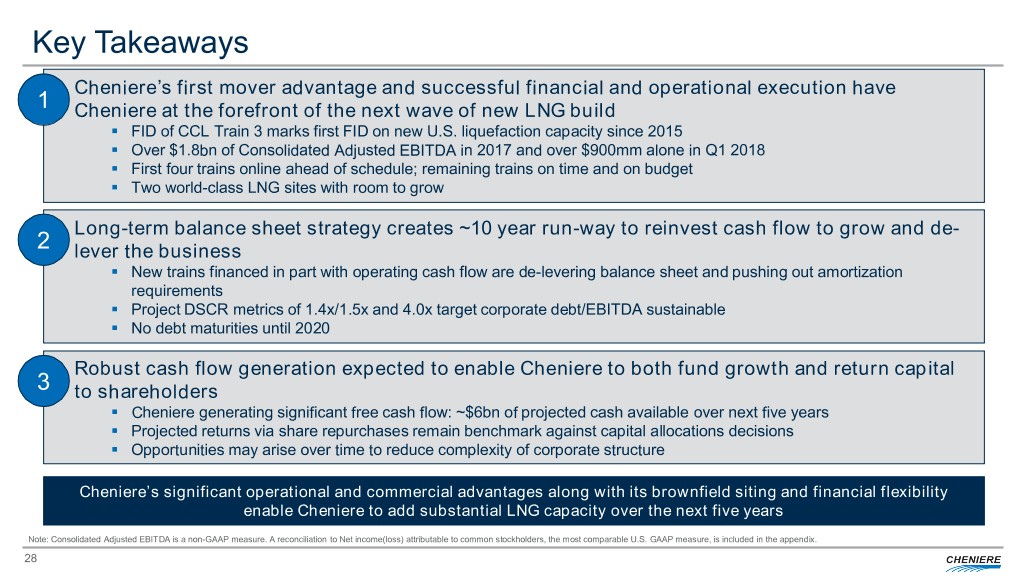

Key Takeaways Cheniere’s first mover advantage and successful financial and operational execution have 1 Cheniere at the forefront of the next wave of new LNG build . FID of CCL Train 3 marks first FID on new U.S. liquefaction capacity since 2015 . Over $1.8bn of Consolidated Adjusted EBITDA in 2017 and over $900mm alone in Q1 2018 . First four trains online ahead of schedule; remaining trains on time and on budget . Two world-class LNG sites with room to grow Long-term balance sheet strategy creates ~10 year run-way to reinvest cash flow to grow and de- 2 lever the business . New trains financed in part with operating cash flow are de-levering balance sheet and pushing out amortization requirements . Project DSCR metrics of 1.4x/1.5x and 4.0x target corporate debt/EBITDA sustainable . No debt maturities until 2020 Robust cash flow generation expected to enable Cheniere to both fund growth and return capital 3 to shareholders . Cheniere generating significant free cash flow: ~$6bn of projected cash available over next five years . Projected returns via share repurchases remain benchmark against capital allocations decisions . Opportunities may arise over time to reduce complexity of corporate structure Cheniere’s significant operational and commercial advantages along with its brownfield siting and financial flexibility enable Cheniere to add substantial LNG capacity over the next five years Note: Consolidated Adjusted EBITDA is a non-GAAP measure. A reconciliation to Net income(loss) attributable to common stockholders, the most comparable U.S. GAAP measure, is included in the appendix. 28

Q&A 29

SPL Project, Train 5 CHENIERE OVERVIEW APPENDIX

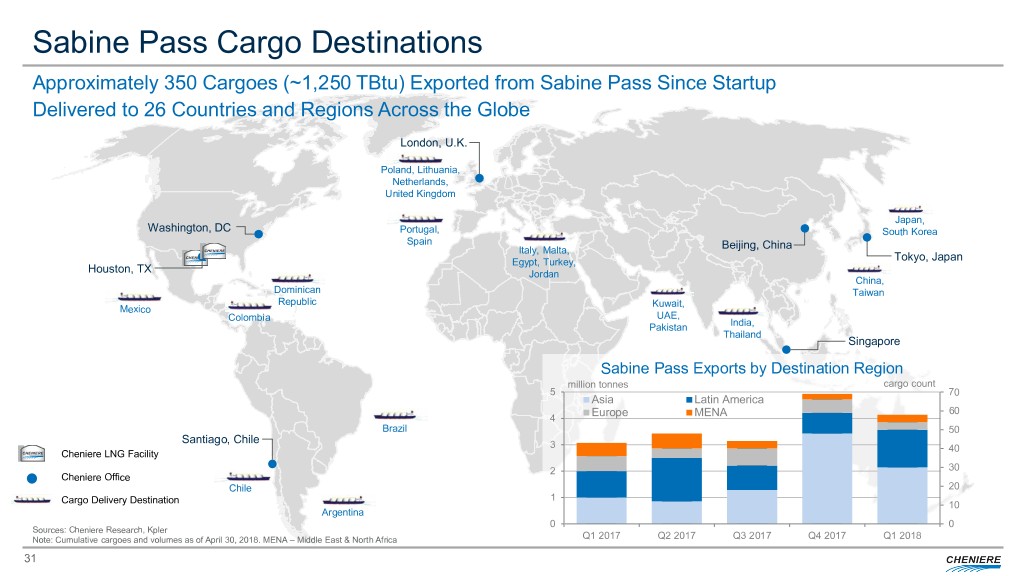

Sabine Pass Cargo Destinations Approximately 350 Cargoes (~1,250 TBtu) Exported from Sabine Pass Since Startup Delivered to 26 Countries and Regions Across the Globe London, U.K. Poland, Lithuania, Netherlands, United Kingdom Japan, Washington, DC Portugal, South Korea Spain Italy, Malta, Beijing, China Egypt, Turkey, Tokyo, Japan Houston, TX Jordan China, Dominican Taiwan Republic Kuwait, Mexico Colombia UAE, Pakistan India, Thailand Singapore Sabine Pass Exports by Destination Region million tonnes cargo count 5 70 Asia Latin America 60 4 Europe MENA Brazil 50 Santiago, Chile 3 40 Cheniere LNG Facility 2 30 Cheniere Office Chile 20 1 Cargo Delivery Destination 10 Argentina 0 0 Sources: Cheniere Research, Kpler Note: Cumulative cargoes and volumes as of April 30, 2018. MENA – Middle East & North Africa Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 31

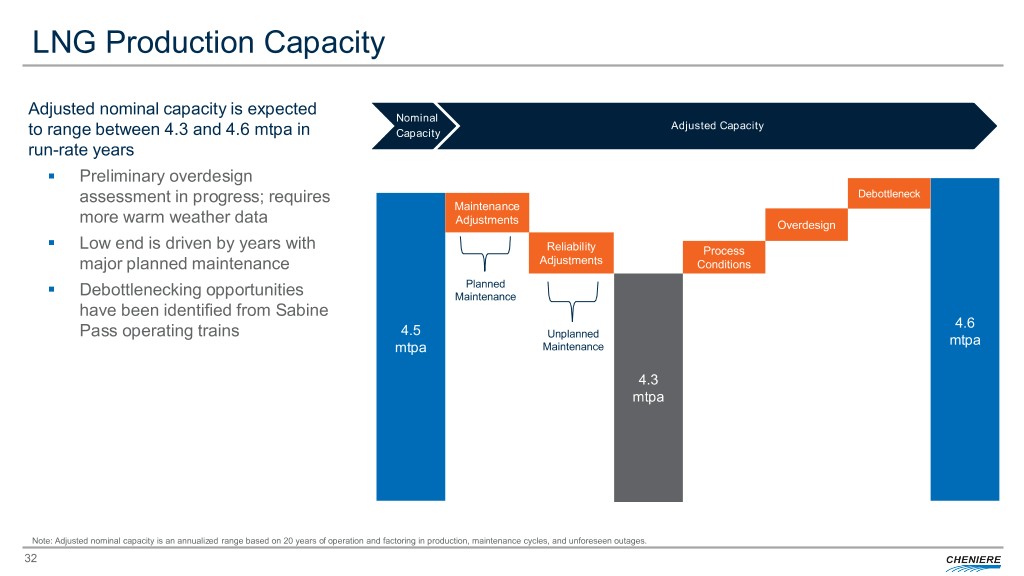

LNG Production Capacity Adjusted nominal capacity is expected Nominal Adjusted Capacity to range between 4.3 and 4.6 mtpa in Capacity run-rate years . Preliminary overdesign assessment in progress; requires Debottleneck Maintenance more warm weather data Adjustments Overdesign . Low end is driven by years with Reliability Process major planned maintenance Adjustments Conditions Planned . Debottlenecking opportunities Maintenance have been identified from Sabine 4.6 Pass operating trains 4.5 Unplanned mtpa mtpa Maintenance 4.3 mtpa Note: Adjusted nominal capacity is an annualized range based on 20 years of operation and factoring in production, maintenance cycles, and unforeseen outages. 32

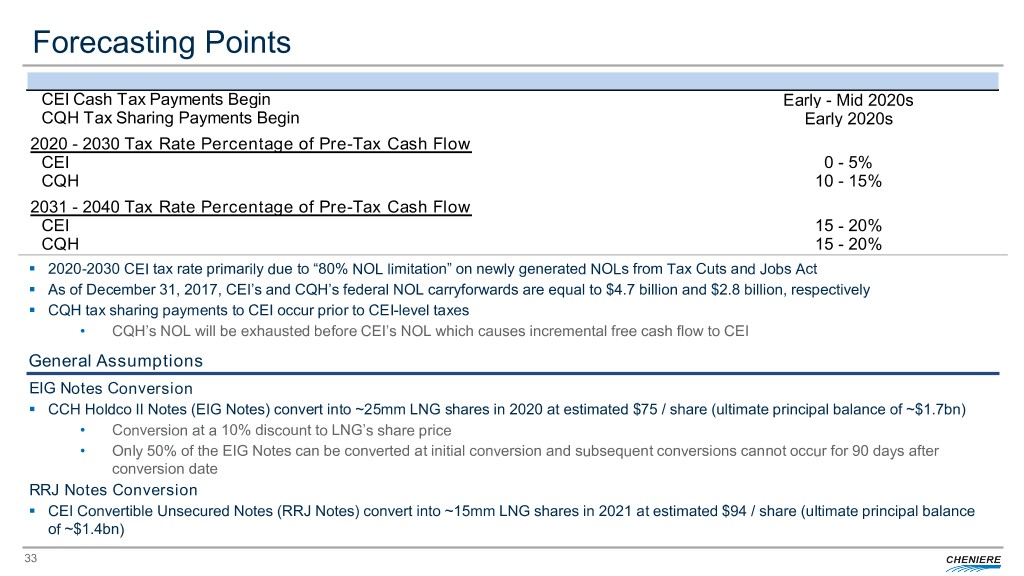

Forecasting Points CEI Cash Tax Payments Begin Early - Mid 2020s CQH Tax Sharing Payments Begin Early 2020s 2020 - 2030 Tax Rate Percentage of Pre-Tax Cash Flow CEI 0 - 5% CQH 10 - 15% 2031 - 2040 Tax Rate Percentage of Pre-Tax Cash Flow CEI 15 - 20% CQH 15 - 20% . 2020-2030 CEI tax rate primarily due to “80% NOL limitation” on newly generated NOLs from Tax Cuts and Jobs Act . As of December 31, 2017, CEI’s and CQH’s federal NOL carryforwards are equal to $4.7 billion and $2.8 billion, respectively . CQH tax sharing payments to CEI occur prior to CEI-level taxes • CQH’s NOL will be exhausted before CEI’s NOL which causes incremental free cash flow to CEI General Assumptions EIG Notes Conversion . CCH Holdco II Notes (EIG Notes) convert into ~25mm LNG shares in 2020 at estimated $75 / share (ultimate principal balance of ~$1.7bn) • Conversion at a 10% discount to LNG’s share price • Only 50% of the EIG Notes can be converted at initial conversion and subsequent conversions cannot occur for 90 days after conversion date RRJ Notes Conversion . CEI Convertible Unsecured Notes (RRJ Notes) convert into ~15mm LNG shares in 2021 at estimated $94 / share (ultimate principal balance of ~$1.4bn) 33

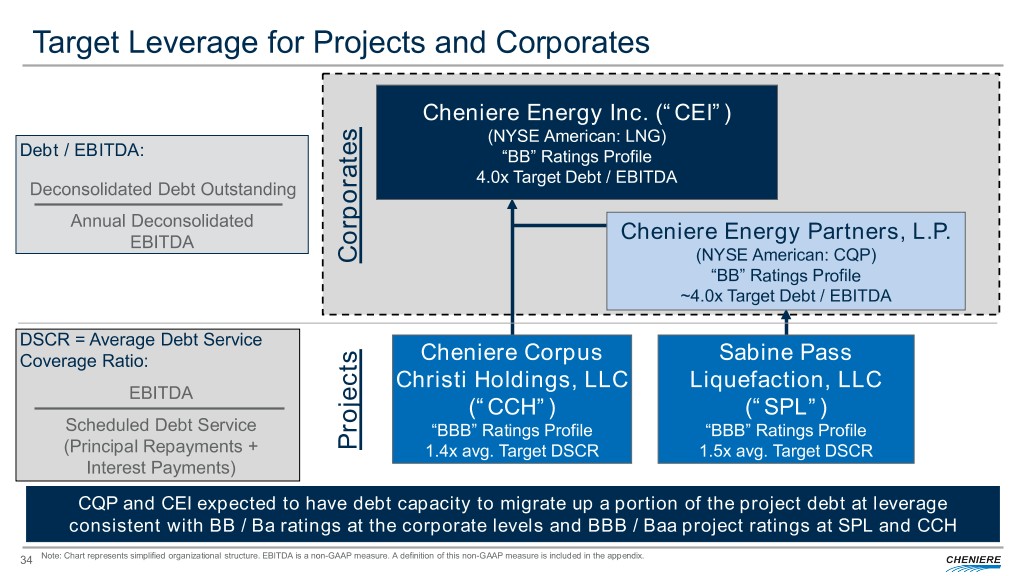

Target Leverage for Projects and Corporates Cheniere Energy Inc. (“CEI”) (NYSE American: LNG) Debt / EBITDA: “BB” Ratings Profile 4.0x Target Debt / EBITDA Deconsolidated Debt Outstanding Annual Deconsolidated EBITDA Cheniere Energy Partners, L.P. Corporates (NYSE American: CQP) “BB” Ratings Profile ~4.0x Target Debt / EBITDA DSCR = Average Debt Service Coverage Ratio: Cheniere Corpus Sabine Pass Christi Holdings, LLC Liquefaction, LLC EBITDA (“CCH”) (“SPL”) Scheduled Debt Service “BBB” Ratings Profile “BBB” Ratings Profile (Principal Repayments + Projects 1.4x avg. Target DSCR 1.5x avg. Target DSCR Interest Payments) CQP and CEI expected to have debt capacity to migrate up a portion of the project debt at leverage consistent with BB / Ba ratings at the corporate levels and BBB / Baa project ratings at SPL and CCH 34 Note: Chart represents simplified organizational structure. EBITDA is a non-GAAP measure. A definition of this non-GAAP measure is included in the appendix.

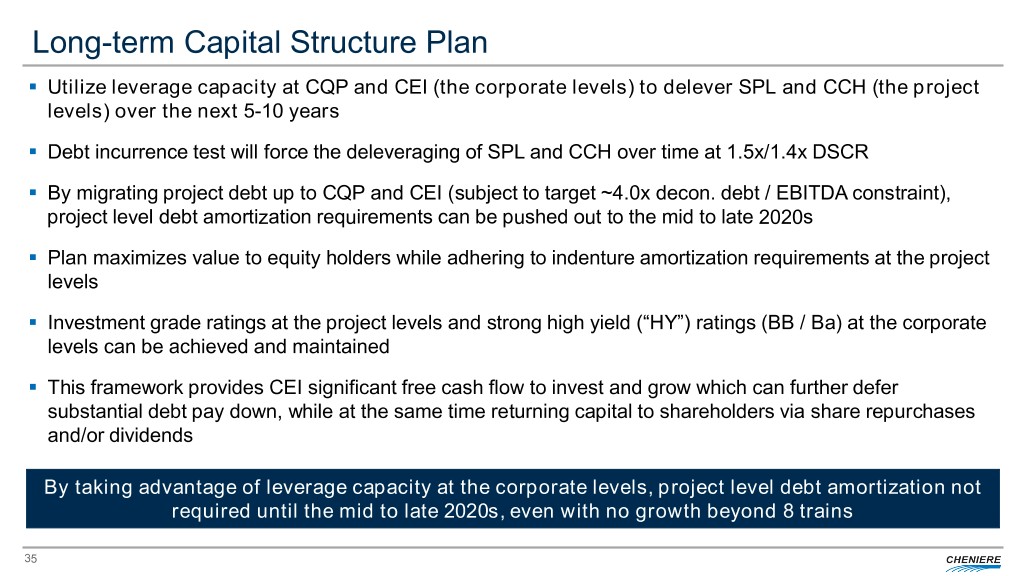

Long-term Capital Structure Plan . Utilize leverage capacity at CQP and CEI (the corporate levels) to delever SPL and CCH (the project levels) over the next 5-10 years . Debt incurrence test will force the deleveraging of SPL and CCH over time at 1.5x/1.4x DSCR . By migrating project debt up to CQP and CEI (subject to target ~4.0x decon. debt / EBITDA constraint), project level debt amortization requirements can be pushed out to the mid to late 2020s . Plan maximizes value to equity holders while adhering to indenture amortization requirements at the project levels . Investment grade ratings at the project levels and strong high yield (“HY”) ratings (BB / Ba) at the corporate levels can be achieved and maintained . This framework provides CEI significant free cash flow to invest and grow which can further defer substantial debt pay down, while at the same time returning capital to shareholders via share repurchases and/or dividends By taking advantage of leverage capacity at the corporate levels, project level debt amortization not required until the mid to late 2020s, even with no growth beyond 8 trains 35

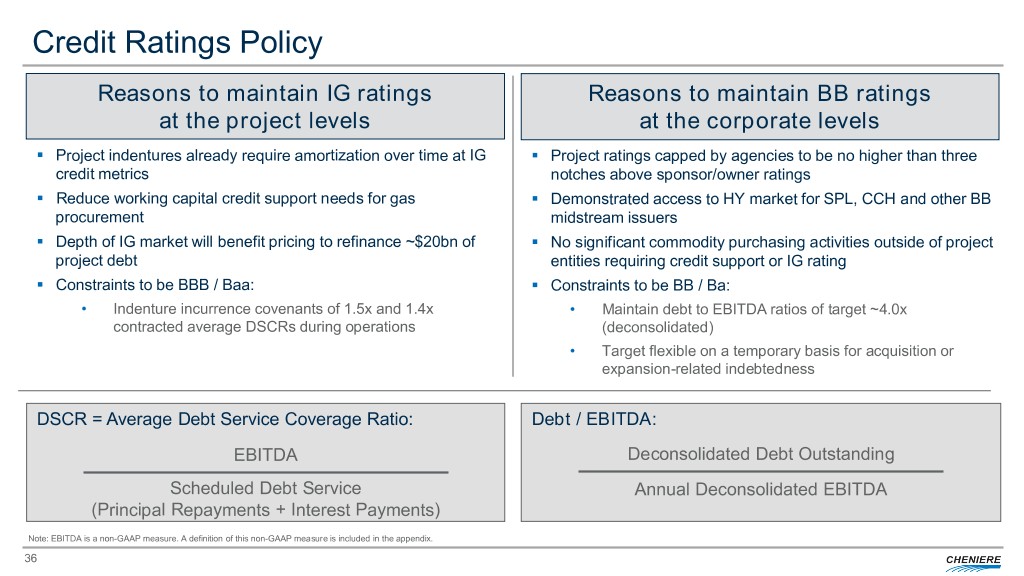

Credit Ratings Policy Reasons to maintain IG ratings Reasons to maintain BB ratings at the project levels at the corporate levels . Project indentures already require amortization over time at IG . Project ratings capped by agencies to be no higher than three credit metrics notches above sponsor/owner ratings . Reduce working capital credit support needs for gas . Demonstrated access to HY market for SPL, CCH and other BB procurement midstream issuers . Depth of IG market will benefit pricing to refinance ~$20bn of . No significant commodity purchasing activities outside of project project debt entities requiring credit support or IG rating . Constraints to be BBB / Baa: . Constraints to be BB / Ba: • Indenture incurrence covenants of 1.5x and 1.4x • Maintain debt to EBITDA ratios of target ~4.0x contracted average DSCRs during operations (deconsolidated) • Target flexible on a temporary basis for acquisition or expansion-related indebtedness DSCR = Average Debt Service Coverage Ratio: Debt / EBITDA: Deconsolidated Debt Outstanding EBITDA Scheduled Debt Service Annual Deconsolidated EBITDA (Principal Repayments + Interest Payments) Note: EBITDA is a non-GAAP measure. A definition of this non-GAAP measure is included in the appendix. 36

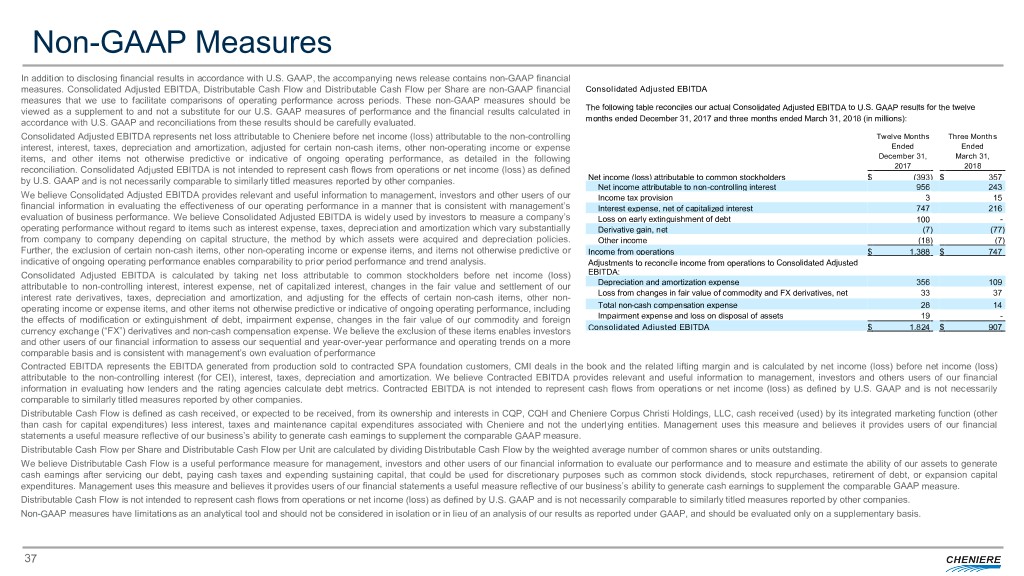

Non-GAAP Measures In addition to disclosing financial results in accordance with U.S. GAAP, the accompanying news release contains non-GAAP financial measures. Consolidated Adjusted EBITDA, Distributable Cash Flow and Distributable Cash Flow per Share are non-GAAP financial Consolidated Adjusted EBITDA measures that we use to facilitate comparisons of operating performance across periods. These non-GAAP measures should be viewed as a supplement to and not a substitute for our U.S. GAAP measures of performance and the financial results calculated in The following table reconciles our actual Consolidated Adjusted EBITDA to U.S. GAAP results for the twelve accordance with U.S. GAAP and reconciliations from these results should be carefully evaluated. months ended December 31, 2017 and three months ended March 31, 2018 (in millions): Consolidated Adjusted EBITDA represents net loss attributable to Cheniere before net income (loss) attributable to the non-controlling Twelve Months Three Months interest, interest, taxes, depreciation and amortization, adjusted for certain non-cash items, other non-operating income or expense Ended Ended items, and other items not otherwise predictive or indicative of ongoing operating performance, as detailed in the following December 31, March 31, reconciliation. Consolidated Adjusted EBITDA is not intended to represent cash flows from operations or net income (loss) as defined 2017 2018 by U.S. GAAP and is not necessarily comparable to similarly titled measures reported by other companies. Net income (loss) attributable to common stockholders $ (393 ) $ 357 Net income attributable to non-controlling interest 956 243 We believe Consolidated Adjusted EBITDA provides relevant and useful information to management, investors and other users of our Income tax provision 3 15 financial information in evaluating the effectiveness of our operating performance in a manner that is consistent with management’s Interest expense, net of capitalized interest 747 216 evaluation of business performance. We believe Consolidated Adjusted EBITDA is widely used by investors to measure a company’s Loss on early extinguishment of debt 100 - operating performance without regard to items such as interest expense, taxes, depreciation and amortization which vary substantially Derivative gain, net (7) (77) from company to company depending on capital structure, the method by which assets were acquired and depreciation policies. Other income (18 ) (7) Further, the exclusion of certain non-cash items, other non-operating income or expense items, and items not otherwise predictive or Income from operations $ 1,388 $ 747 indicative of ongoing operating performance enables comparability to prior period performance and trend analysis. Adjustments to reconcile income from operations to Consolidated Adjusted Consolidated Adjusted EBITDA is calculated by taking net loss attributable to common stockholders before net income (loss) EBITDA: attributable to non-controlling interest, interest expense, net of capitalized interest, changes in the fair value and settlement of our Depreciation and amortization expense 356 109 Loss from changes in fair value of commodity and FX derivatives, net 33 37 interest rate derivatives, taxes, depreciation and amortization, and adjusting for the effects of certain non-cash items, other non- operating income or expense items, and other items not otherwise predictive or indicative of ongoing operating performance, including Total non-cash compensation expense 28 14 the effects of modification or extinguishment of debt, impairment expense, changes in the fair value of our commodity and foreign Impairment expense and loss on disposal of assets 19 - currency exchange (“FX”) derivatives and non-cash compensation expense. We believe the exclusion of these items enables investors Consolidated Adjusted EBITDA $ 1,824 $ 907 and other users of our financial information to assess our sequential and year-over-year performance and operating trends on a more comparable basis and is consistent with management’s own evaluation of performance Contracted EBITDA represents the EBITDA generated from production sold to contracted SPA foundation customers, CMI deals in the book and the related lifting margin and is calculated by net income (loss) before net income (loss) attributable to the non-controlling interest (for CEI), interest, taxes, depreciation and amortization. We believe Contracted EBITDA provides relevant and useful information to management, investors and others users of our financial information in evaluating how lenders and the rating agencies calculate debt metrics. Contracted EBITDA is not intended to represent cash flows from operations or net income (loss) as defined by U.S. GAAP and is not necessarily comparable to similarly titled measures reported by other companies. Distributable Cash Flow is defined as cash received, or expected to be received, from its ownership and interests in CQP, CQH and Cheniere Corpus Christi Holdings, LLC, cash received (used) by its integrated marketing function (other than cash for capital expenditures) less interest, taxes and maintenance capital expenditures associated with Cheniere and not the underlying entities. Management uses this measure and believes it provides users of our financial statements a useful measure reflective of our business’s ability to generate cash earnings to supplement the comparable GAAP measure. Distributable Cash Flow per Share and Distributable Cash Flow per Unit are calculated by dividing Distributable Cash Flow by the weighted average number of common shares or units outstanding. We believe Distributable Cash Flow is a useful performance measure for management, investors and other users of our financial information to evaluate our performance and to measure and estimate the ability of our assets to generate cash earnings after servicing our debt, paying cash taxes and expending sustaining capital, that could be used for discretionary purposes such as common stock dividends, stock repurchases, retirement of debt, or expansion capital expenditures. Management uses this measure and believes it provides users of our financial statements a useful measure reflective of our business’s ability to generate cash earnings to supplement the comparable GAAP measure. Distributable Cash Flow is not intended to represent cash flows from operations or net income (loss) as defined by U.S. GAAP and is not necessarily comparable to similarly titled measures reported by other companies. Non-GAAP measures have limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of our results as reported under GAAP, and should be evaluated only on a supplementary basis. 37

CHENIERE ENERGY, INC. INVESTOR RELATIONS CONTACTS Randy Bhatia Vice President, Investor Relations – (713) 375-5479, randy.bhatia@cheniere.com Megan Light Manager, Investor Relations – (713) 375-5492, megan.light@cheniere.com