CHENIERE ENERGY, INC. March 2018 CHENIERE ENERGY, INC. NYSE American: LNG CORPORATE PRESENTATION December 2018

Safe Harbor Statements Forward-Looking Statements This presentation contains certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical or present facts or conditions, included or incorporated by reference herein are “forward-looking statements.” Included among “forward-looking statements” are, among other things: • statements regarding the ability of Cheniere Energy Partners, L.P. to pay distributions to its unitholders or Cheniere Energy, Inc. to pay dividends to its shareholders or participate in share or unit buybacks; • statements regarding Cheniere Energy, Inc.’s or Cheniere Energy Partners, L.P.’s expected receipt of cash distributions from their respective subsidiaries; • statements that Cheniere Energy Partners, L.P. expects to commence or complete construction of its proposed liquefied natural gas (“LNG”) terminals, liquefaction facilities, pipeline facilities or other projects, or any expansions or portions thereof, by certain dates or at all; • statements that Cheniere Energy, Inc. expects to commence or complete construction of its proposed LNG terminals, liquefaction facilities, pipeline facilities or other projects, or any expansions or portions thereof, by certain dates or at all; • statements regarding future levels of domestic and international natural gas production, supply or consumption or future levels of LNG imports into or exports from North America and other countries worldwide, or purchases of natural gas, regardless of the source of such information, or the transportation or other infrastructure, or demand for and prices related to natural gas, LNG or other hydrocarbon products; • statements regarding any financing transactions or arrangements, or ability to enter into such transactions; • statements relating to the construction of our proposed liquefaction facilities and natural gas liquefaction trains (“Trains”) and the construction of our pipelines, including statements concerning the engagement of any engineering, procurement and construction ("EPC") contractor or other contractor and the anticipated terms and provisions of any agreement with any EPC or other contractor, and anticipated costs related thereto; • statements regarding any agreement to be entered into or performed substantially in the future, including any revenues anticipated to be received and the anticipated timing thereof, and statements regarding the amounts of total LNG regasification, natural gas, liquefaction or storage capacities that are, or may become, subject to contracts; • statements regarding counterparties to our commercial contracts, construction contracts and other contracts; • statements regarding our planned development and construction of additional Trains or pipelines, including the financing of such Trains or pipelines; • statements that our Trains, when completed, will have certain characteristics, including amounts of liquefaction capacities; • statements regarding our business strategy, our strengths, our business and operation plans or any other plans, forecasts, projections or objectives, including anticipated revenues, capital expenditures, maintenance and operating costs, run-rate SG&A estimates, cash flows, EBITDA, Adjusted EBITDA, distributable cash flow, distributable cash flow per share and unit, deconsolidated debt outstanding, and deconsolidated contracted EBITDA, any or all of which are subject to change; • statements regarding projections of revenues, expenses, earnings or losses, working capital or other financial items; • statements regarding legislative, governmental, regulatory, administrative or other public body actions, approvals, requirements, permits, applications, filings, investigations, proceedings or decisions; • statements regarding our anticipated LNG and natural gas marketing activities; and • any other statements that relate to non-historical or future information. These forward-looking statements are often identified by the use of terms and phrases such as “achieve,” “anticipate,” “believe,” “contemplate,” “develop,” “estimate,” “example,” “expect,” “forecast,” “goals,” ”guidance,” “opportunities,” “plan,” “potential,” “project,” “propose,” “subject to,” “strategy,” “target,” and similar terms and phrases, or by use of future tense. Although we believe that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in “Risk Factors” in the Cheniere Energy, Inc. and Cheniere Energy Partners, L.P. Annual Reports on Form 10-K filed with the SEC on February 21, 2018, which are incorporated by reference into this presentation. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these ”Risk Factors.” These forward-looking statements are made as of the date of this presentation, and other than as required by law, we undertake no obligation to update or revise any forward-looking statement or provide reasons why actual results may differ, whether as a result of new information, future events or otherwise. Reconciliation to U.S. GAAP Financial Information The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934, as amended. Schedules are included in the appendix hereto that reconcile the non-GAAP financial measures included in the following presentation to the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP. 2

COMPANY OVERVIEW

Cheniere Investment Thesis Premier LNG provider with substantial asset platform and proven track record of execution Full-service LNG offering enables solutions tailored to customer needs Significant stable long-term cash flows from take-or-pay style agreements with creditworthy counterparties Potential cash flow growth from portfolio volumes and economically attractive liquefaction expansions Strong global LNG demand fundamentals call for LNG supply growth Investments along LNG value chain support core liquefaction business 4

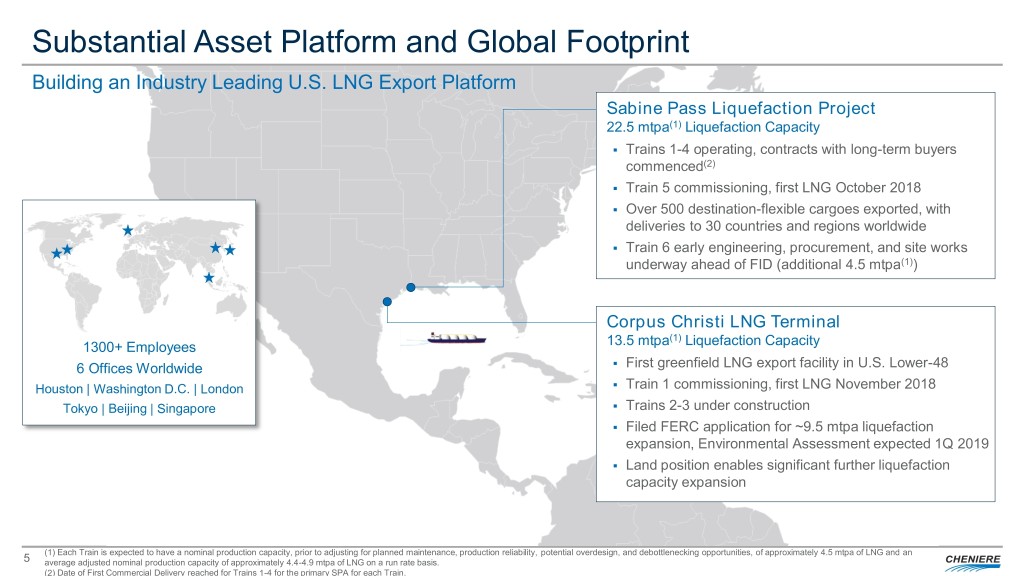

Substantial Asset Platform and Global Footprint Building an Industry Leading U.S. LNG Export Platform Sabine Pass Liquefaction Project 22.5 mtpa(1) Liquefaction Capacity . Trains 1-4 operating, contracts with long-term buyers commenced(2) . Train 5 commissioning, first LNG October 2018 . Over 500 destination-flexible cargoes exported, with deliveries to 30 countries and regions worldwide . Train 6 early engineering, procurement, and site works underway ahead of FID (additional 4.5 mtpa(1)) Corpus Christi LNG Terminal (1) 1300+ Employees 13.5 mtpa Liquefaction Capacity . 6 Offices Worldwide First greenfield LNG export facility in U.S. Lower-48 . Houston | Washington D.C. | London Train 1 commissioning, first LNG November 2018 . Tokyo | Beijing | Singapore Trains 2-3 under construction . Filed FERC application for ~9.5 mtpa liquefaction expansion, Environmental Assessment expected 1Q 2019 . Land position enables significant further liquefaction capacity expansion (1) Each Train is expected to have a nominal production capacity, prior to adjusting for planned maintenance, production reliability, potential overdesign, and debottlenecking opportunities, of approximately 4.5 mtpa of LNG and an 5 average adjusted nominal production capacity of approximately 4.4-4.9 mtpa of LNG on a run rate basis. (2) Date of First Commercial Delivery reached for Trains 1-4 for the primary SPA for each Train.

Recent Execution Increases Cheniere’s Value Proposition Optimizing Existing Liquefaction Platform . Significant debottlenecking opportunities at leading economics ~$300/ton . Increased expected average adjusted nominal production capacity per train to 4.4 – 4.9 mtpa (previously 4.3 – 4.6 mtpa) . Increased run rate Consolidated Adjusted EBITDA and DCF guidance by ~$200MM Progressing Toward Sabine Pass T6 FID . Signed EPC contract with Bechtel at attractive economics, locking in cost and schedule . Bechtel commencing early engineering, procurement, and site works under a limited notice to proceed (LNTP) . Expected to add ~$400-600 million to run rate Consolidated Adjusted EBITDA . Continued commercial success with 20-year PETRONAS SPA for ~1.1 mtpa of LNG and 24-year PGNiG SPA for 1.45 mtpa of LNG . SPAs totaling >7 mtpa signed YTD Developing Additional Projects . FERC scheduling notice received for Corpus Christi Stage 3 in August . MIDSHIP received FERC order in August . Land position at Corpus Christi site enables significant further liquefaction capacity expansion Note: Run rate production includes expected impacts of planned maintenance, production reliability, potential overdesign, and debottlenecking opportunities. Consolidated Adjusted EBITDA and Distributable Cash Flow (DCF) are non-GAAP measures. A definition of these non-GAAP measures is included in the appendix. We have not made any forecast of net income on a run rate basis, which would be the most directly comparable financial measure under GAAP, and we are unable to reconcile differences between these run rate forecasts and income. 6

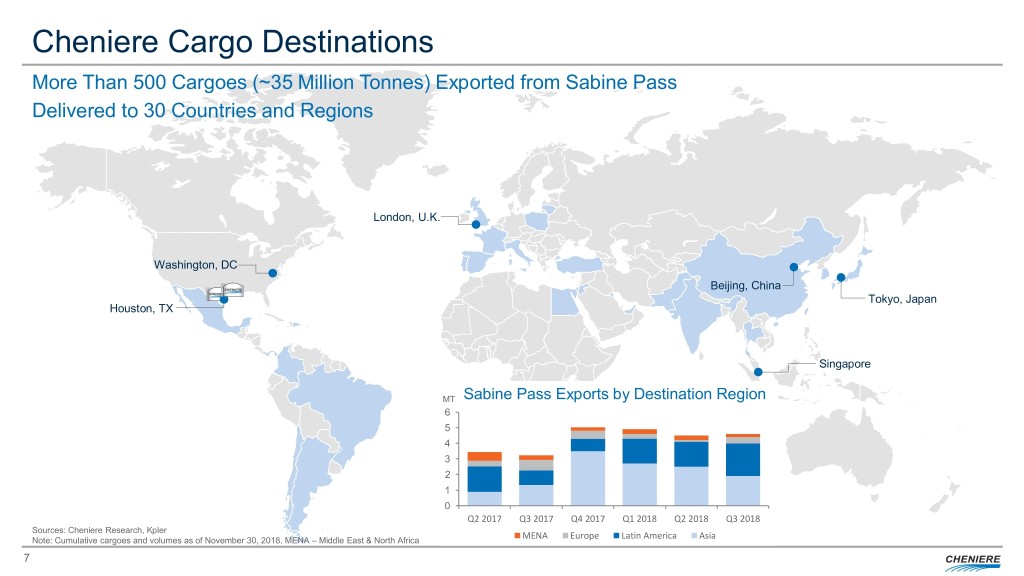

Cheniere Cargo Destinations More Than 500 Cargoes (~35 Million Tonnes) Exported from Sabine Pass Delivered to 30 Countries and Regions London, U.K. Washington, DC Beijing, China Tokyo, Japan Houston, TX Singapore MT Sabine Pass Exports by Destination Region 6 5 4 3 2 1 0 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Sources: Cheniere Research, Kpler Note: Cumulative cargoes and volumes as of November 30, 2018. MENA – Middle East & North Africa MENA Europe Latin America Asia 7

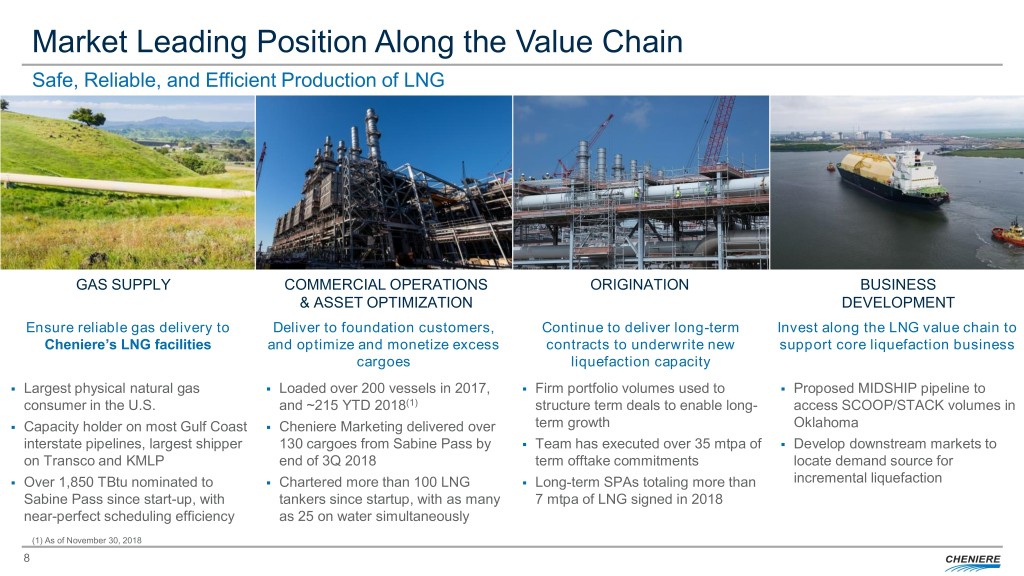

Market Leading Position Along the Value Chain Safe, Reliable, and Efficient Production of LNG GAS SUPPLY COMMERCIAL OPERATIONS ORIGINATION BUSINESS & ASSET OPTIMIZATION DEVELOPMENT Ensure reliable gas delivery to Deliver to foundation customers, Continue to deliver long-term Invest along the LNG value chain to Cheniere’s LNG facilities and optimize and monetize excess contracts to underwrite new support core liquefaction business cargoes liquefaction capacity . Largest physical natural gas . Loaded over 200 vessels in 2017, . Firm portfolio volumes used to . Proposed MIDSHIP pipeline to consumer in the U.S. and ~215 YTD 2018(1) structure term deals to enable long- access SCOOP/STACK volumes in . Capacity holder on most Gulf Coast . Cheniere Marketing delivered over term growth Oklahoma interstate pipelines, largest shipper 130 cargoes from Sabine Pass by . Team has executed over 35 mtpa of . Develop downstream markets to on Transco and KMLP end of 3Q 2018 term offtake commitments locate demand source for . Over 1,850 TBtu nominated to . Chartered more than 100 LNG . Long-term SPAs totaling more than incremental liquefaction Sabine Pass since start-up, with tankers since startup, with as many 7 mtpa of LNG signed in 2018 near-perfect scheduling efficiency as 25 on water simultaneously (1) As of November 30, 2018 8

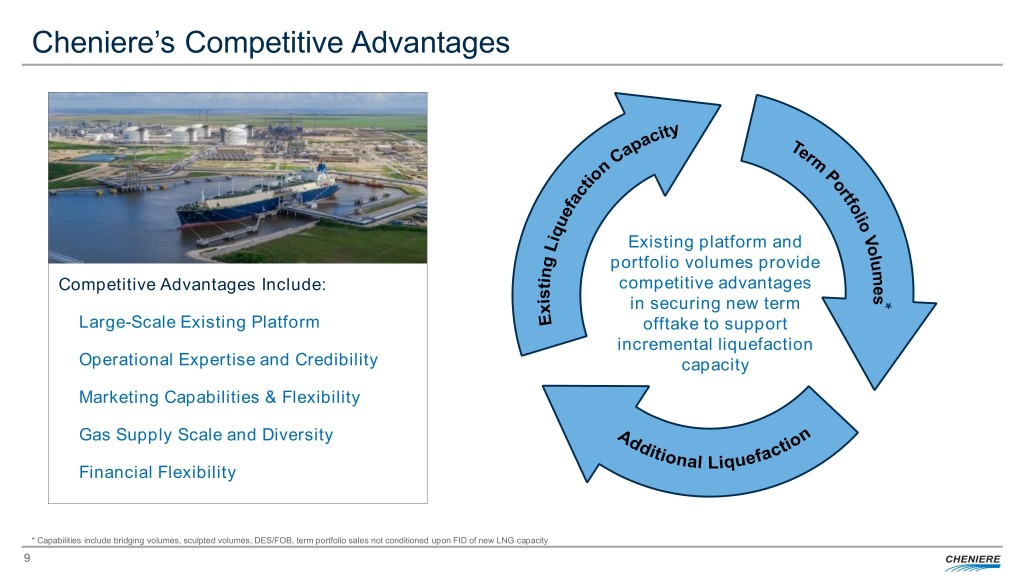

Cheniere’s Competitive Advantages Existing platform and portfolio volumes provide Competitive Advantages Include: competitive advantages in securing new term Large-Scale Existing Platform offtake to support incremental liquefaction Operational Expertise and Credibility capacity Marketing Capabilities & Flexibility Gas Supply Scale and Diversity Financial Flexibility * Capabilities include bridging volumes, sculpted volumes, DES/FOB, term portfolio sales not conditioned upon FID of new LNG capacity 9

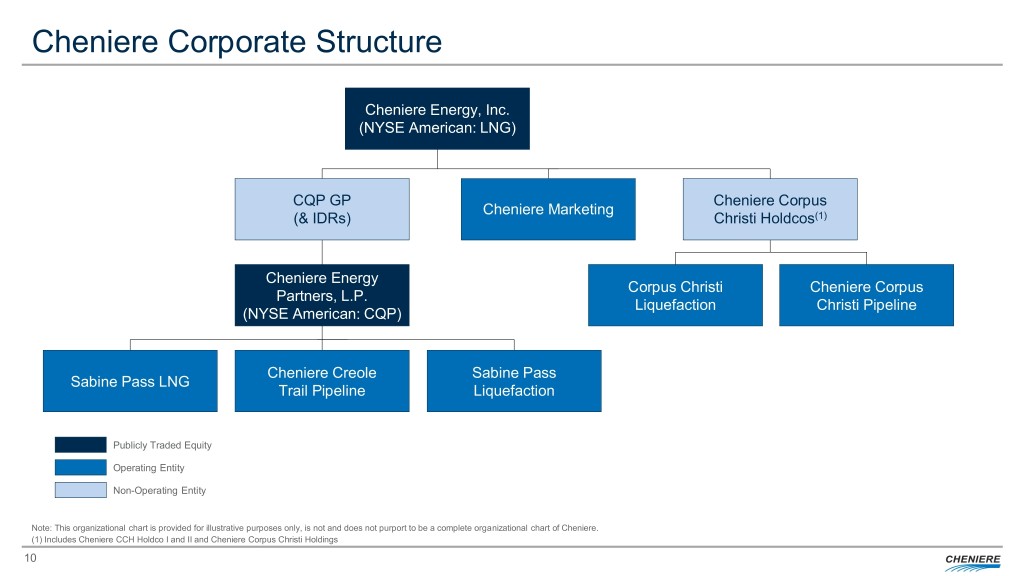

Cheniere Corporate Structure Cheniere Energy, Inc. (NYSE American: LNG) CQP GP Cheniere Corpus Cheniere Marketing (& IDRs) Christi Holdcos(1) Cheniere Energy Corpus Christi Cheniere Corpus Partners, L.P. Liquefaction Christi Pipeline (NYSE American: CQP) Cheniere Creole Sabine Pass Sabine Pass LNG Trail Pipeline Liquefaction Publicly Traded Equity Operating Entity Non-Operating Entity Note: This organizational chart is provided for illustrative purposes only, is not and does not purport to be a complete organizational chart of Cheniere. (1) Includes Cheniere CCH Holdco I and II and Cheniere Corpus Christi Holdings 10

CCL Project LIQUEFACTION PROJECTS UPDATE

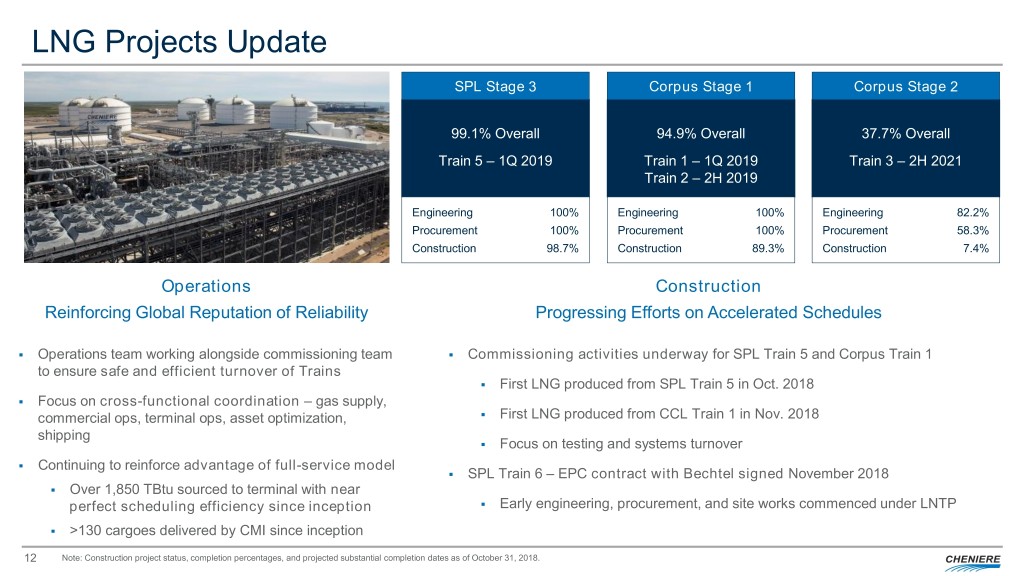

LNG Projects Update SPL Stage 3 Corpus Stage 1 Corpus Stage 2 99.1% Overall 94.9% Overall 37.7% Overall Train 5 – 1Q 2019 Train 1 – 1Q 2019 Train 3 – 2H 2021 Train 2 – 2H 2019 Engineering 100% Engineering 100% Engineering 82.2% Procurement 100% Procurement 100% Procurement 58.3% Construction 98.7% Construction 89.3% Construction 7.4% Operations Construction Reinforcing Global Reputation of Reliability Progressing Efforts on Accelerated Schedules . Operations team working alongside commissioning team . Commissioning activities underway for SPL Train 5 and Corpus Train 1 to ensure safe and efficient turnover of Trains . First LNG produced from SPL Train 5 in Oct. 2018 . Focus on cross-functional coordination – gas supply, . commercial ops, terminal ops, asset optimization, First LNG produced from CCL Train 1 in Nov. 2018 shipping . Focus on testing and systems turnover . Continuing to reinforce advantage of full-service model . SPL Train 6 – EPC contract with Bechtel signed November 2018 . Over 1,850 TBtu sourced to terminal with near perfect scheduling efficiency since inception . Early engineering, procurement, and site works commenced under LNTP . >130 cargoes delivered by CMI since inception 12 Note: Construction project status, completion percentages, and projected substantial completion dates as of October 31, 2018.

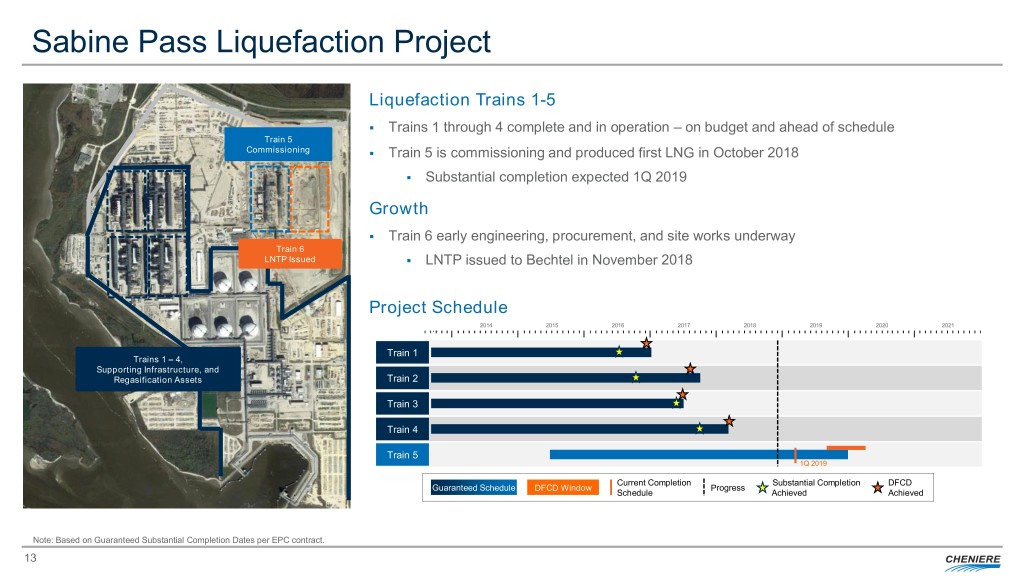

Sabine Pass Liquefaction Project Liquefaction Trains 1-5 . Trains 1 through 4 complete and in operation – on budget and ahead of schedule Train 5 Commissioning . Train 5 is commissioning and produced first LNG in October 2018 . Substantial completion expected 1Q 2019 Growth . Train 6 early engineering, procurement, and site works underway Train 6 LNTP Issued . LNTP issued to Bechtel in November 2018 Project Schedule … 2014 2015 2016 2017 2018 2019 2020 2021 Train 1 Trains 1 – 4, Supporting Infrastructure, and Regasification Assets Train 2 Train 3 Train 4 Train 5 1Q 2019 Current Completion Substantial Completion DFCD Guaranteed Schedule DFCD Window Progress Schedule Achieved Achieved Note: Based on Guaranteed Substantial Completion Dates per EPC contract. 13

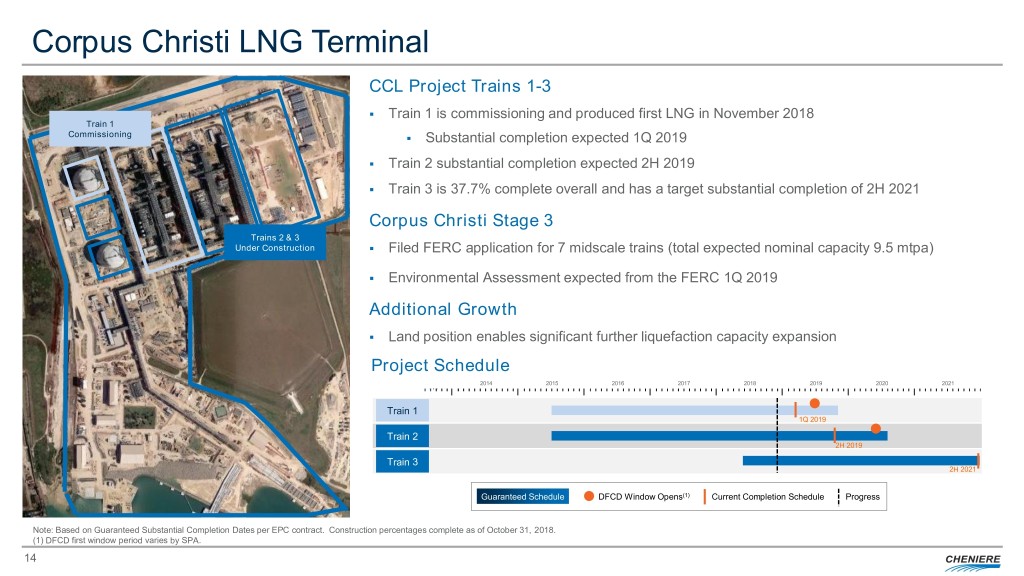

Corpus Christi LNG Terminal CCL Project Trains 1-3 . Train 1 is commissioning and produced first LNG in November 2018 Train 1 Commissioning . Substantial completion expected 1Q 2019 . Train 2 substantial completion expected 2H 2019 . Train 3 is 37.7% complete overall and has a target substantial completion of 2H 2021 Corpus Christi Stage 3 Trains 2 & 3 Under Construction . Filed FERC application for 7 midscale trains (total expected nominal capacity 9.5 mtpa) . Environmental Assessment expected from the FERC 1Q 2019 Additional Growth . Land position enables significant further liquefaction capacity expansion Project Schedule … 2014 2015 2016 2017 2018 2019 2020 2021 Train 1 1Q 2019 Train 2 2H 2019 Train 3 2H 2021 Guaranteed Schedule DFCD Window Opens(1) Current Completion Schedule Progress Note: Based on Guaranteed Substantial Completion Dates per EPC contract. Construction percentages complete as of October 31, 2018. (1) DFCD first window period varies by SPA. 14

Leading Project Partners Sabine Pass Liquefaction Project (Louisiana) Corpus Christi Liquefaction Project (Texas) Reliable, Proven Partners Creditworthy Counterparties 15 Note: SPA counterparties exclude SPAs with Cheniere Marketing, which may or may not be used to provide commercial support for Train 6 of the SPL Project.

CHENIERE OVERVIEW LNG MARKET OUTLOOK

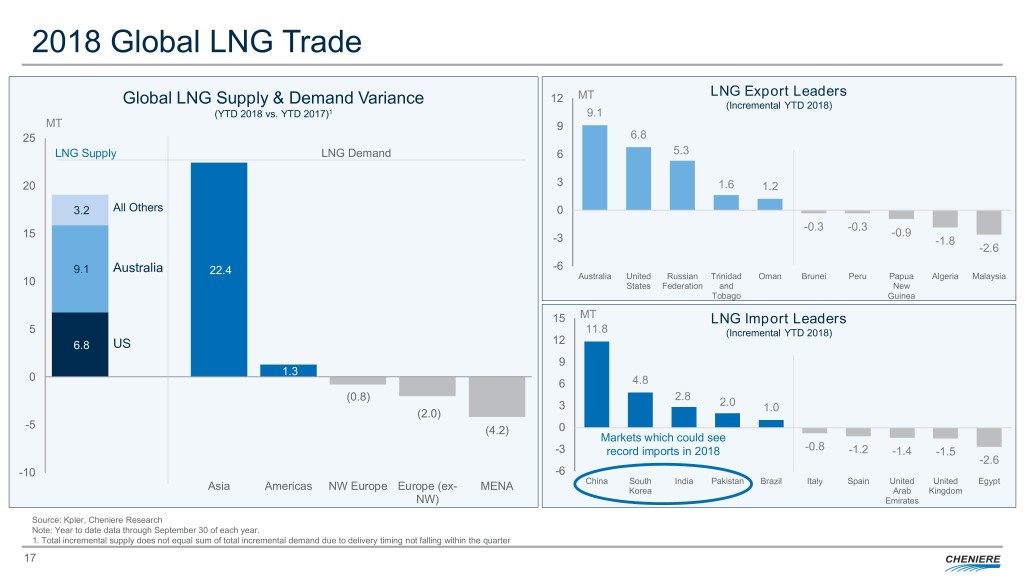

2018 Global LNG Trade 12 MT LNG Export Leaders Global LNG Supply & Demand Variance (Incremental YTD 2018) (YTD 2018 vs. YTD 2017)1 9.1 MT 9 25 6.8 LNG Supply LNG Demand 6 5.3 20 3 1.6 1.2 3.2 All Others 0 -0.3 -0.3 15 -0.9 -3 -1.8 -2.6 9.1 Australia 22.4 -6 Australia United Russian Trinidad Oman Brunei Peru Papua Algeria Malaysia 10 States Federation and New Tobago Guinea 15 MT LNG Import Leaders 5 11.8 (Incremental YTD 2018) 6.8 US 12 9 0 1.3 6 4.8 (0.8) 2.8 3 2.0 1.0 (2.0) -5 (4.2) 0 Markets which could see -3 record imports in 2018 -0.8 -1.2 -1.4 -1.5 -2.6 -10 -6 China South India Pakistan Brazil Italy Spain United United Egypt Asia Americas NW Europe Europe (ex- MENA Korea Arab Kingdom NW) Emirates Source: Kpler, Cheniere Research Note: Year to date data through September 30 of each year. 1. Total incremental supply does not equal sum of total incremental demand due to delivery timing not falling within the quarter 17

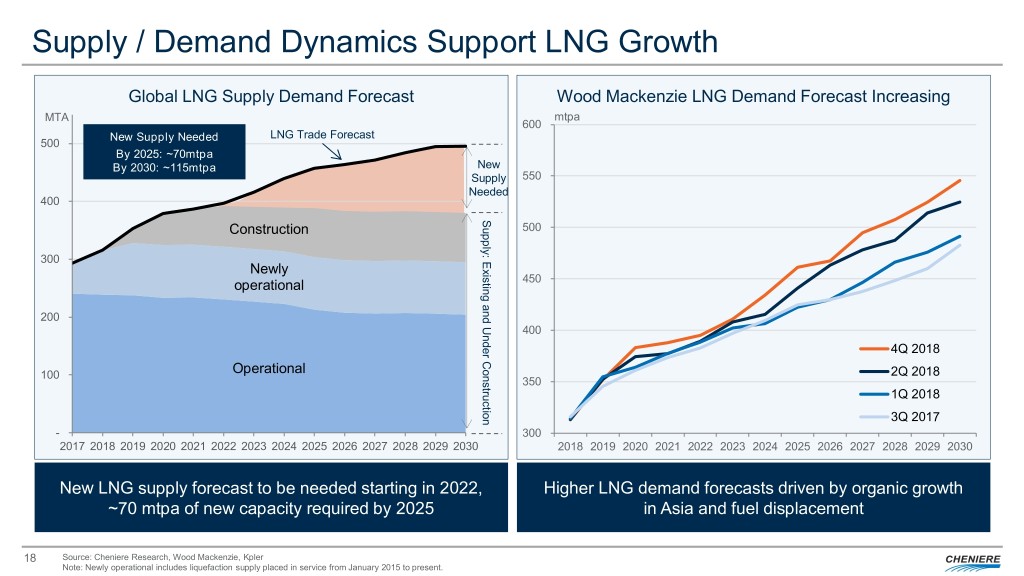

Supply / Demand Dynamics Support LNG Growth Global LNG Supply Demand Forecast Wood Mackenzie LNG Demand Forecast Increasing MTA mtpa 600 New Supply Needed LNG Trade Forecast 500 By 2025: ~70mtpa By 2030: ~115mtpa New Supply 550 Needed 400 Supply: Existing and UnderExistingConstruction and Supply: Construction 500 300 Newly operational 450 200 400 4Q 2018 100 Operational 2Q 2018 350 1Q 2018 3Q 2017 - 300 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 New LNG supply forecast to be needed starting in 2022, Higher LNG demand forecasts driven by organic growth ~70 mtpa of new capacity required by 2025 in Asia and fuel displacement 18 Source: Cheniere Research, Wood Mackenzie, Kpler Note: Newly operational includes liquefaction supply placed in service from January 2015 to present.

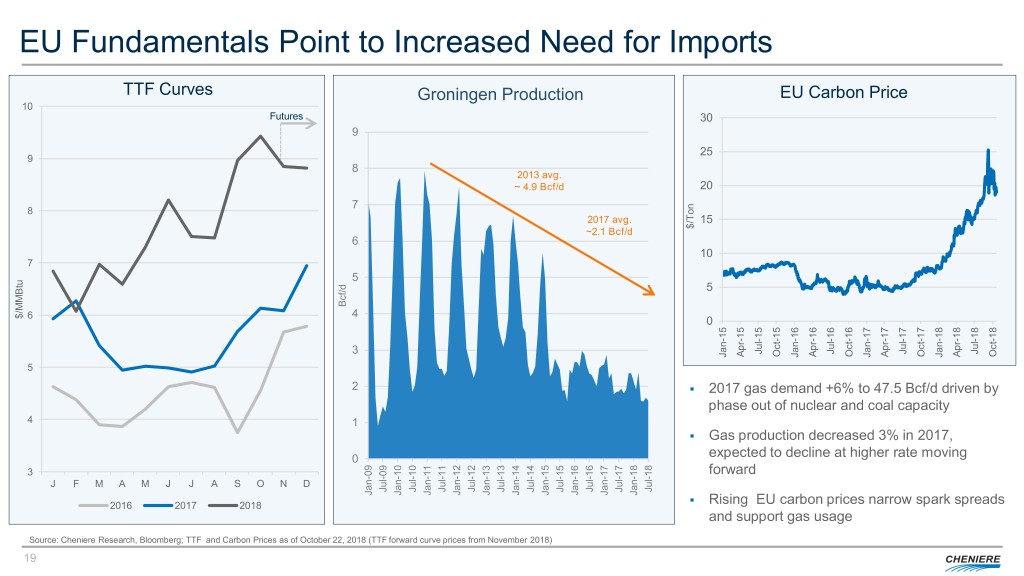

EU Fundamentals Point to Increased Need for Imports TTF Curves Groningen Production EU Carbon Price 10 Futures 30 9 25 9 8 2013 avg. ~ 4.9 Bcf/d 20 7 8 2017 avg. 15 ~2.1 Bcf/d $/Ton 6 10 7 5 d / 5 Bcf $/MMBtu 4 6 0 Jul-16 Jul-17 Jul-18 3 Jul-15 Apr-15 Oct-15 Apr-16 Oct-16 Apr-17 Oct-17 Apr-18 Oct-18 Jan-15 Jan-16 Jan-17 Jan-18 5 2 . 2017 gas demand +6% to 47.5 Bcf/d driven by phase out of nuclear and coal capacity 4 1 . Gas production decreased 3% in 2017, 0 expected to decline at higher rate moving 3 forward J F M A M J J A S O N D Jul-09 Jul-10 Jul-11 Jul-12 Jul-13 Jul-14 Jul-15 Jul-16 Jul-17 Jul-18 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17 Jan-18 Jan-09 . 2016 2017 2018 Rising EU carbon prices narrow spark spreads and support gas usage Source: Cheniere Research, Bloomberg; TTF and Carbon Prices as of October 22, 2018 (TTF forward curve prices from November 2018) 19

SPL Project CHENIERE OVERVIEW FINANCIAL UPDATE

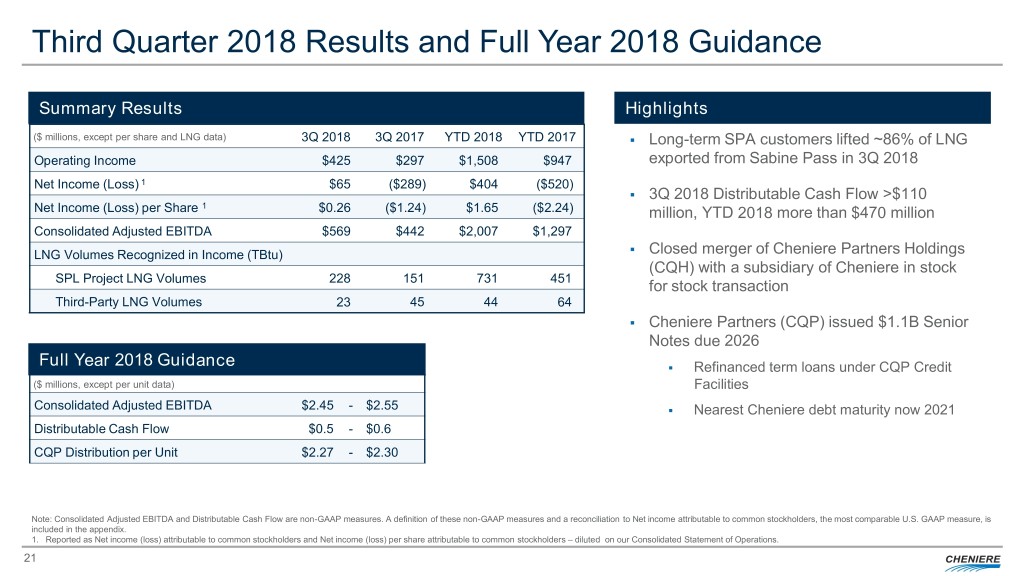

Third Quarter 2018 Results and Full Year 2018 Guidance Summary Results Highlights ($ millions, except per share and LNG data) 3Q 2018 3Q 2017 YTD 2018 YTD 2017 . Long-term SPA customers lifted ~86% of LNG Operating Income $425 $297 $1,508 $947 exported from Sabine Pass in 3Q 2018 Net Income (Loss) 1 $65 ($289) $404 ($520) . 3Q 2018 Distributable Cash Flow >$110 Net Income (Loss) per Share 1 $0.26 ($1.24) $1.65 ($2.24) million, YTD 2018 more than $470 million Consolidated Adjusted EBITDA $569 $442 $2,007 $1,297 . LNG Volumes Recognized in Income (TBtu) Closed merger of Cheniere Partners Holdings (CQH) with a subsidiary of Cheniere in stock SPL Project LNG Volumes 228 151 731 451 for stock transaction Third-Party LNG Volumes 23 45 44 64 . Cheniere Partners (CQP) issued $1.1B Senior Notes due 2026 Full Year 2018 Guidance . Refinanced term loans under CQP Credit ($ millions, except per unit data) Facilities Consolidated Adjusted EBITDA $2.45 - $2.55 . Nearest Cheniere debt maturity now 2021 Distributable Cash Flow $0.5 - $0.6 CQP Distribution per Unit $2.27 - $2.30 Note: Consolidated Adjusted EBITDA and Distributable Cash Flow are non-GAAP measures. A definition of these non-GAAP measures and a reconciliation to Net income attributable to common stockholders, the most comparable U.S. GAAP measure, is included in the appendix. 1. Reported as Net income (loss) attributable to common stockholders and Net income (loss) per share attributable to common stockholders – diluted on our Consolidated Statement of Operations. 21

Cheniere Investment Thesis Premier LNG provider with substantial asset platform and proven track record of execution Full-service LNG offering enables solutions tailored to customer needs Significant stable long-term cash flows from take-or-pay style agreements with creditworthy counterparties Potential cash flow growth from portfolio volumes and economically attractive liquefaction expansions Strong global LNG demand fundamentals call for LNG supply growth Investments along LNG value chain support core liquefaction business 22

CHENIERE OVERVIEW APPENDIX

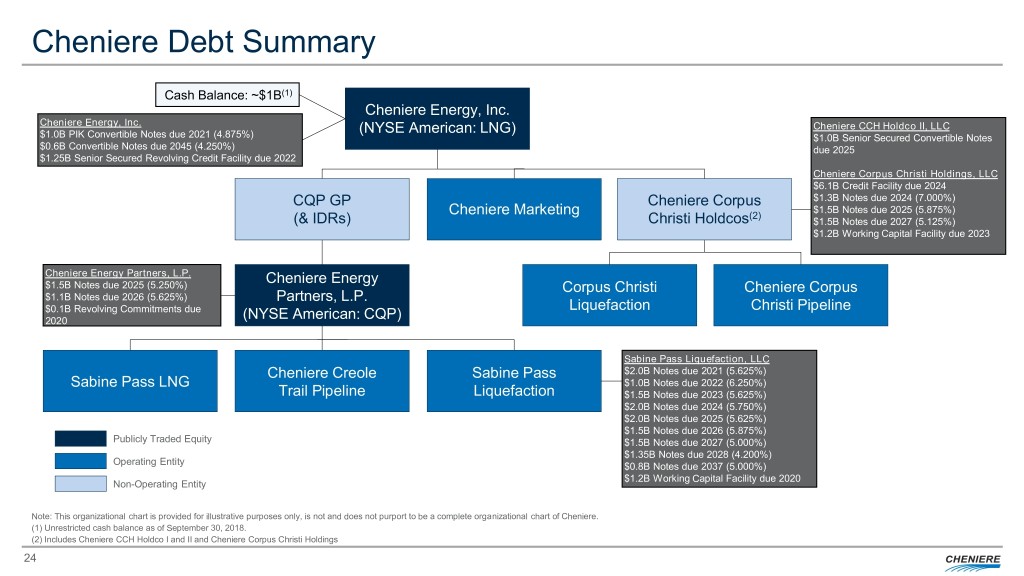

Cheniere Debt Summary Cash Balance: ~$1B(1) Cheniere Energy, Inc. Cheniere Energy, Inc. (NYSE American: LNG) Cheniere CCH Holdco II, LLC $1.0B PIK Convertible Notes due 2021 (4.875%) $1.0B Senior Secured Convertible Notes $0.6B Convertible Notes due 2045 (4.250%) due 2025 $1.25B Senior Secured Revolving Credit Facility due 2022 Cheniere Corpus Christi Holdings, LLC $6.1B Credit Facility due 2024 CQP GP Cheniere Corpus $1.3B Notes due 2024 (7.000%) $1.5B Notes due 2025 (5.875%) Cheniere Marketing (2) (& IDRs) Christi Holdcos $1.5B Notes due 2027 (5.125%) $1.2B Working Capital Facility due 2023 Cheniere Energy Partners, L.P. Cheniere Energy $1.5B Notes due 2025 (5.250%) Corpus Christi Cheniere Corpus $1.1B Notes due 2026 (5.625%) Partners, L.P. $0.1B Revolving Commitments due Liquefaction Christi Pipeline 2020 (NYSE American: CQP) Sabine Pass Liquefaction, LLC Cheniere Creole Sabine Pass $2.0B Notes due 2021 (5.625%) Sabine Pass LNG $1.0B Notes due 2022 (6.250%) Trail Pipeline Liquefaction $1.5B Notes due 2023 (5.625%) $2.0B Notes due 2024 (5.750%) $2.0B Notes due 2025 (5.625%) $1.5B Notes due 2026 (5.875%) Publicly Traded Equity $1.5B Notes due 2027 (5.000%) $1.35B Notes due 2028 (4.200%) Operating Entity $0.8B Notes due 2037 (5.000%) $1.2B Working Capital Facility due 2020 Non-Operating Entity Note: This organizational chart is provided for illustrative purposes only, is not and does not purport to be a complete organizational chart of Cheniere. (1) Unrestricted cash balance as of September 30, 2018. (2) Includes Cheniere CCH Holdco I and II and Cheniere Corpus Christi Holdings 24

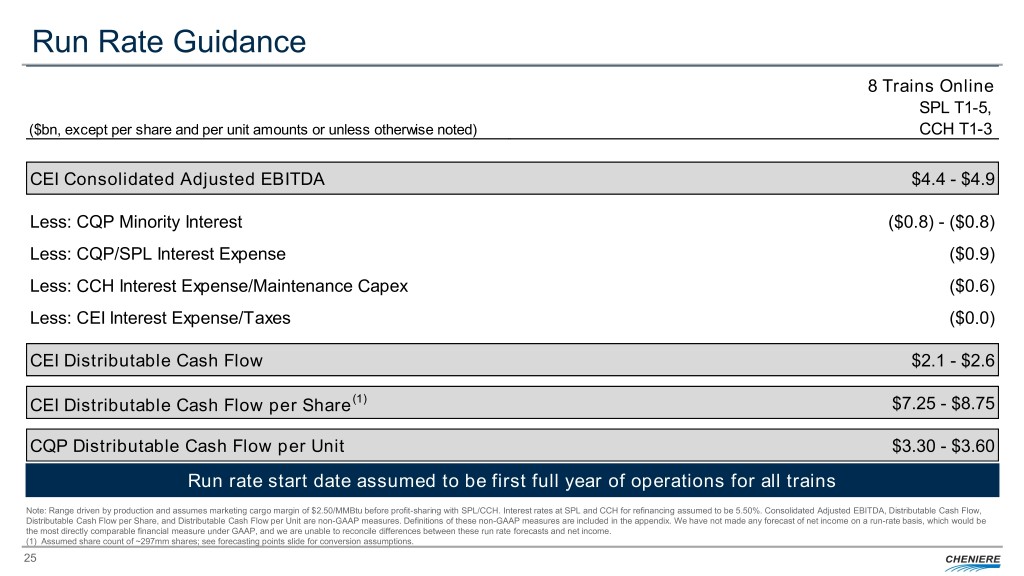

Run Rate Guidance 8 Trains Online SPL T1-5, ($bn, except per share and per unit amounts or unless otherwise noted) CCH T1-3 CEI Consolidated Adjusted EBITDA $4.4 - $4.9 Less: CQP Minority Interest ($0.8) - ($0.8) Less: CQP/SPL Interest Expense ($0.9) Less: CCH Interest Expense/Maintenance Capex ($0.6) Less: CEI Interest Expense/Taxes ($0.0) CEI Distributable Cash Flow $2.1 - $2.6 CEI Distributable Cash Flow per Share(1) $7.25 - $8.75 CQP Distributable Cash Flow per Unit $3.30 - $3.60 Run rate start date assumed to be first full year of operations for all trains Note: Range driven by production and assumes marketing cargo margin of $2.50/MMBtu before profit-sharing with SPL/CCH. Interest rates at SPL and CCH for refinancing assumed to be 5.50%. Consolidated Adjusted EBITDA, Distributable Cash Flow, Distributable Cash Flow per Share, and Distributable Cash Flow per Unit are non-GAAP measures. Definitions of these non-GAAP measures are included in the appendix. We have not made any forecast of net income on a run-rate basis, which would be the most directly comparable financial measure under GAAP, and we are unable to reconcile differences between these run rate forecasts and net income. (1) Assumed share count of ~297mm shares; see forecasting points slide for conversion assumptions. 25

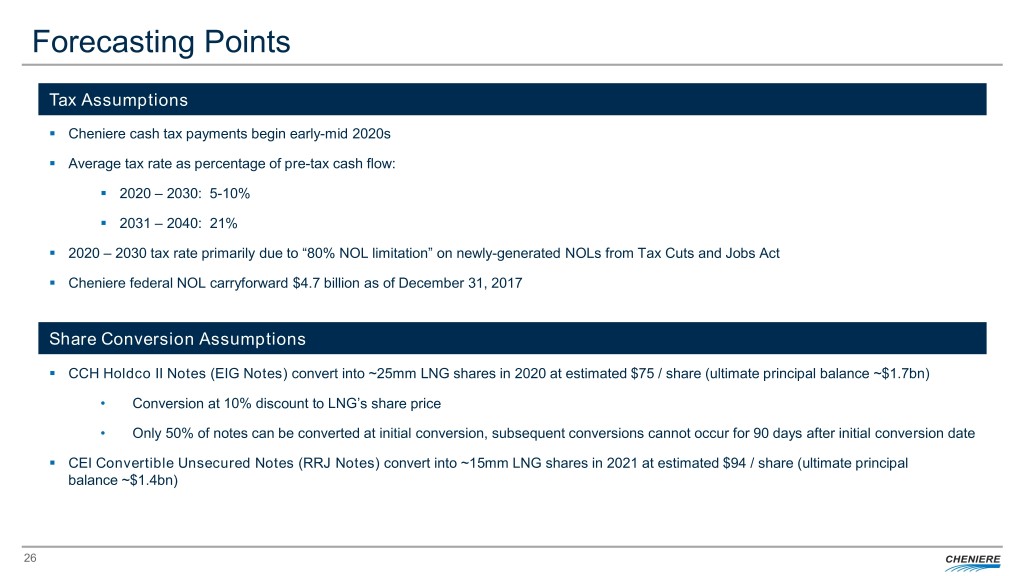

Forecasting Points Tax Assumptions . Cheniere cash tax payments begin early-mid 2020s . Average tax rate as percentage of pre-tax cash flow: . 2020 – 2030: 5-10% . 2031 – 2040: 21% . 2020 – 2030 tax rate primarily due to “80% NOL limitation” on newly-generated NOLs from Tax Cuts and Jobs Act . Cheniere federal NOL carryforward $4.7 billion as of December 31, 2017 Share Conversion Assumptions . CCH Holdco II Notes (EIG Notes) convert into ~25mm LNG shares in 2020 at estimated $75 / share (ultimate principal balance ~$1.7bn) • Conversion at 10% discount to LNG’s share price • Only 50% of notes can be converted at initial conversion, subsequent conversions cannot occur for 90 days after initial conversion date . CEI Convertible Unsecured Notes (RRJ Notes) convert into ~15mm LNG shares in 2021 at estimated $94 / share (ultimate principal balance ~$1.4bn) 26

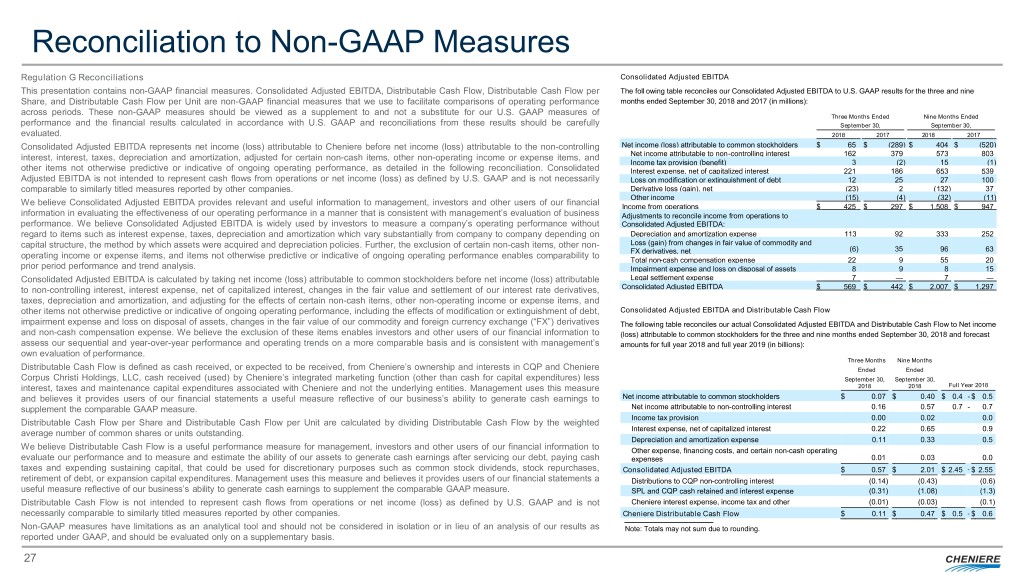

Reconciliation to Non-GAAP Measures Regulation G Reconciliations Consolidated Adjusted EBITDA This presentation contains non-GAAP financial measures. Consolidated Adjusted EBITDA, Distributable Cash Flow, Distributable Cash Flow per The foll owing table reconciles our Consolidated Adjusted EBITDA to U.S. GAAP results for the three and nine Share, and Distributable Cash Flow per Unit are non-GAAP financial measures that we use to facilitate comparisons of operating performance months ended September 30, 2018 and 2017 (in millions): across periods. These non-GAAP measures should be viewed as a supplement to and not a substitute for our U.S. GAAP measures of Three Months Ended Nine Months Ended performance and the financial results calculated in accordance with U.S. GAAP and reconciliations from these results should be carefully September 30, September 30, evaluated. 2018 2017 2018 2017 Consolidated Adjusted EBITDA represents net income (loss) attributable to Cheniere before net income (loss) attributable to the non-controlling Net income (loss) attributable to common stockholders $ 65 $ (289 ) $ 404 $ (520 ) interest, interest, taxes, depreciation and amortization, adjusted for certain non-cash items, other non-operating income or expense items, and Net income attributable to non-controlling interest 162 379 573 803 Income tax provision (benefit) 3 (2 ) 15 (1 ) other items not otherwise predictive or indicative of ongoing operating performance, as detailed in the following reconciliation. Consolidated Interest expense, net of capitalized interest 221 186 653 539 Adjusted EBITDA is not intended to represent cash flows from operations or net income (loss) as defined by U.S. GAAP and is not necessarily Loss on modification or extinguishment of debt 12 25 27 100 comparable to similarly titled measures reported by other companies. Derivative loss (gain), net (23 ) 2 (132 ) 37 Other income (15 ) (4 ) (32 ) (11 ) We believe Consolidated Adjusted EBITDA provides relevant and useful information to management, investors and other users of our financial Income from operations $ 425 $ 297 $ 1,508 $ 947 information in evaluating the effectiveness of our operating performance in a manner that is consistent with management’s evaluation of business Adjustments to reconcile income from operations to performance. We believe Consolidated Adjusted EBITDA is widely used by investors to measure a company’s operating performance without Consolidated Adjusted EBITDA: regard to items such as interest expense, taxes, depreciation and amortization which vary substantially from company to company depending on Depreciation and amortization expense 113 92 333 252 Loss (gain) from changes in fair value of commodity and capital structure, the method by which assets were acquired and depreciation policies. Further, the exclusion of certain non-cash items, other non- (6 ) 35 96 63 operating income or expense items, and items not otherwise predictive or indicative of ongoing operating performance enables comparability to FX derivatives, net Total non-cash compensation expense 22 9 55 20 prior period performance and trend analysis. Impairment expense and loss on disposal of assets 8 9 8 15 Consolidated Adjusted EBITDA is calculated by taking net income (loss) attributable to common stockholders before net income (loss) attributable Legal settlement expense 7 — 7 — to non-controlling interest, interest expense, net of capitalized interest, changes in the fair value and settlement of our interest rate derivatives, Consolidated Adjusted EBITDA $ 569 $ 442 $ 2,007 $ 1,297 taxes, depreciation and amortization, and adjusting for the effects of certain non-cash items, other non-operating income or expense items, and other items not otherwise predictive or indicative of ongoing operating performance, including the effects of modification or extinguishment of debt, Consolidated Adjusted EBITDA and Distributable Cash Flow impairment expense and loss on disposal of assets, changes in the fair value of our commodity and foreign currency exchange (“FX”) derivatives The following table reconciles our actual Consolidated Adjusted EBITDA and Distributable Cash Flow to Net income and non-cash compensation expense. We believe the exclusion of these items enables investors and other users of our financial information to (loss) attributable to common stockholders for the three and nine months ended September 30, 2018 and forecast assess our sequential and year-over-year performance and operating trends on a more comparable basis and is consistent with management’s amounts for full year 2018 and full year 2019 (in billions): own evaluation of performance. Three Months Nine Months Distributable Cash Flow is defined as cash received, or expected to be received, from Cheniere’s ownership and interests in CQP and Cheniere Ended Ended Corpus Christi Holdings, LLC, cash received (used) by Cheniere’s integrated marketing function (other than cash for capital expenditures) less September 30, September 30, interest, taxes and maintenance capital expenditures associated with Cheniere and not the underlying entities. Management uses this measure 2018 2018 Full Year 2018 and believes it provides users of our financial statements a useful measure reflective of our business’s ability to generate cash earnings to Net income attributable to common stockholders $ 0.07 $ 0.40 $ 0.4 - $ 0.5 supplement the comparable GAAP measure. Net income attributable to non-controlling interest 0.16 0.57 0.7 - 0.7 Income tax provision 0.00 0.02 0.0 Distributable Cash Flow per Share and Distributable Cash Flow per Unit are calculated by dividing Distributable Cash Flow by the weighted Interest expense, net of capitalized interest 0.22 0.65 0.9 average number of common shares or units outstanding. Depreciation and amortization expense 0.11 0.33 0.5 We believe Distributable Cash Flow is a useful performance measure for management, investors and other users of our financial information to Other expense, financing costs, and certain non-cash operating evaluate our performance and to measure and estimate the ability of our assets to generate cash earnings after servicing our debt, paying cash expenses 0.01 0.03 0.0 taxes and expending sustaining capital, that could be used for discretionary purposes such as common stock dividends, stock repurchases, Consolidated Adjusted EBITDA $ 0.57 $ 2.01 $ 2.45 - $ 2.55 retirement of debt, or expansion capital expenditures. Management uses this measure and believes it provides users of our financial statements a Distributions to CQP non-controlling interest (0.14 ) (0.43 ) (0.6) useful measure reflective of our business’s ability to generate cash earnings to supplement the comparable GAAP measure. SPL and CQP cash retained and interest expense (0.31 ) (1.08 ) (1.3) Distributable Cash Flow is not intended to represent cash flows from operations or net income (loss) as defined by U.S. GAAP and is not Cheniere interest expense, income tax and other (0.01 ) (0.03 ) (0.1) necessarily comparable to similarly titled measures reported by other companies. Cheniere Distributable Cash Flow $ 0.11 $ 0.47 $ 0.5 - $ 0.6 Non-GAAP measures have limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of our results as Note: Totals may not sum due to rounding. CQH non-controlling interest reflects an approximate 91.9% ownership by Cheniere. reported under GAAP, and should be evaluated only on a supplementary basis. 27

CHENIERE ENERGY, INC. INVESTOR RELATIONS CONTACTS Randy Bhatia Vice President, Investor Relations – (713) 375-5479, randy.bhatia@cheniere.com Megan Light Manager, Investor Relations – (713) 375-5492, megan.light@cheniere.com