0001383650false--12-312023Q21,4152,9593,5215,4474691,1351,2301,892—4—41,8844,0984,7517,3436033,1449165,7061571862—1—16043,2029345,7692631914693613841827914153027315247581467336—2424464727215247http://fasb.org/us-gaap/2023#RelatedPartyMemberhttp://fasb.org/us-gaap/2023#RelatedPartyMemberhttp://fasb.org/us-gaap/2023#RelatedPartyMemberhttp://fasb.org/us-gaap/2023#RelatedPartyMemberhttp://fasb.org/us-gaap/2023#DerivativeAssetsCurrenthttp://fasb.org/us-gaap/2023#DerivativeAssetsCurrenthttp://fasb.org/us-gaap/2023#DerivativeAssetsNoncurrenthttp://fasb.org/us-gaap/2023#DerivativeAssetsNoncurrenthttp://fasb.org/us-gaap/2023#DerivativeLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#DerivativeLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#DerivativeLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#DerivativeLiabilitiesNoncurrent75501—76505561,3785638745991,45897144—39714726—23234923http://fasb.org/us-gaap/2023#DerivativeAssetsCurrenthttp://fasb.org/us-gaap/2023#DerivativeAssetsCurrenthttp://fasb.org/us-gaap/2023#DerivativeAssetsNoncurrenthttp://fasb.org/us-gaap/2023#DerivativeAssetsNoncurrenthttp://fasb.org/us-gaap/2023#DerivativeLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#DerivativeLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#DerivativeLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#DerivativeLiabilitiesNoncurrentSOFR or base rateSOFR or base rate00013836502023-01-012023-06-3000013836502023-07-27xbrli:shares0001383650us-gaap:NonrelatedPartyMembercqp:LiquefiedNaturalGasMember2023-04-012023-06-30iso4217:USD0001383650us-gaap:NonrelatedPartyMembercqp:LiquefiedNaturalGasMember2022-04-012022-06-300001383650us-gaap:NonrelatedPartyMembercqp:LiquefiedNaturalGasMember2023-01-012023-06-300001383650us-gaap:NonrelatedPartyMembercqp:LiquefiedNaturalGasMember2022-01-012022-06-300001383650cqp:LiquefiedNaturalGasMemberus-gaap:RelatedPartyMember2023-04-012023-06-300001383650cqp:LiquefiedNaturalGasMemberus-gaap:RelatedPartyMember2022-04-012022-06-300001383650cqp:LiquefiedNaturalGasMemberus-gaap:RelatedPartyMember2023-01-012023-06-300001383650cqp:LiquefiedNaturalGasMemberus-gaap:RelatedPartyMember2022-01-012022-06-300001383650cqp:RelatedParty2Membercqp:LiquefiedNaturalGasMember2023-04-012023-06-300001383650cqp:RelatedParty2Membercqp:LiquefiedNaturalGasMember2022-04-012022-06-300001383650cqp:RelatedParty2Membercqp:LiquefiedNaturalGasMember2023-01-012023-06-300001383650cqp:RelatedParty2Membercqp:LiquefiedNaturalGasMember2022-01-012022-06-300001383650cqp:RegasificationServiceMember2023-04-012023-06-300001383650cqp:RegasificationServiceMember2022-04-012022-06-300001383650cqp:RegasificationServiceMember2023-01-012023-06-300001383650cqp:RegasificationServiceMember2022-01-012022-06-300001383650us-gaap:ProductAndServiceOtherMember2023-04-012023-06-300001383650us-gaap:ProductAndServiceOtherMember2022-04-012022-06-300001383650us-gaap:ProductAndServiceOtherMember2023-01-012023-06-300001383650us-gaap:ProductAndServiceOtherMember2022-01-012022-06-3000013836502023-04-012023-06-3000013836502022-04-012022-06-3000013836502022-01-012022-06-300001383650us-gaap:NonrelatedPartyMember2023-04-012023-06-300001383650us-gaap:NonrelatedPartyMember2022-04-012022-06-300001383650us-gaap:NonrelatedPartyMember2023-01-012023-06-300001383650us-gaap:NonrelatedPartyMember2022-01-012022-06-300001383650us-gaap:RelatedPartyMember2023-04-012023-06-300001383650us-gaap:RelatedPartyMember2022-04-012022-06-300001383650us-gaap:RelatedPartyMember2023-01-012023-06-300001383650us-gaap:RelatedPartyMember2022-01-012022-06-300001383650cqp:RelatedParty2Member2023-04-012023-06-300001383650cqp:RelatedParty2Member2022-04-012022-06-300001383650cqp:RelatedParty2Member2023-01-012023-06-300001383650cqp:RelatedParty2Member2022-01-012022-06-30iso4217:USDxbrli:shares0001383650cqp:LiquefiedNaturalGasMember2023-04-012023-06-300001383650cqp:LiquefiedNaturalGasMember2022-04-012022-06-300001383650cqp:LiquefiedNaturalGasMember2023-01-012023-06-300001383650cqp:LiquefiedNaturalGasMember2022-01-012022-06-3000013836502023-06-3000013836502022-12-310001383650us-gaap:NonrelatedPartyMember2023-06-300001383650us-gaap:NonrelatedPartyMember2022-12-310001383650us-gaap:RelatedPartyMember2023-06-300001383650us-gaap:RelatedPartyMember2022-12-310001383650cqp:RelatedParty2Member2023-06-300001383650cqp:RelatedParty2Member2022-12-310001383650cqp:CommonUnitsMember2022-12-310001383650cqp:CommonUnitsMember2023-06-300001383650cqp:CheniereEnergyPartnersLPMember2022-01-012022-06-30xbrli:pure0001383650cqp:CheniereEnergyPartnersLPMember2023-01-012023-06-300001383650us-gaap:GeneralPartnerMember2022-12-310001383650us-gaap:GeneralPartnerMember2023-06-300001383650cqp:CommonUnitsMember2023-01-012023-03-310001383650us-gaap:GeneralPartnerMember2023-01-012023-03-3100013836502023-01-012023-03-310001383650cqp:CommonUnitsMember2023-03-310001383650us-gaap:GeneralPartnerMember2023-03-3100013836502023-03-310001383650cqp:CommonUnitsMember2023-04-012023-06-300001383650us-gaap:GeneralPartnerMember2023-04-012023-06-300001383650cqp:CommonUnitsMember2021-12-310001383650us-gaap:GeneralPartnerMember2021-12-3100013836502021-12-310001383650cqp:CommonUnitsMember2022-01-012022-03-310001383650us-gaap:GeneralPartnerMember2022-01-012022-03-3100013836502022-01-012022-03-310001383650cqp:CommonUnitsMember2022-03-310001383650us-gaap:GeneralPartnerMember2022-03-3100013836502022-03-310001383650cqp:CommonUnitsMember2022-04-012022-06-300001383650us-gaap:GeneralPartnerMember2022-04-012022-06-300001383650cqp:CommonUnitsMember2022-06-300001383650us-gaap:GeneralPartnerMember2022-06-3000013836502022-06-300001383650cqp:SabinePassLNGTerminalMember2023-01-012023-06-30cqp:trainscqp:milliontonnesutr:Ycqp:unitcqp:item0001383650cqp:CreoleTrailPipelineMember2023-01-012023-06-30utr:mi0001383650cqp:SabinePassLNGTerminalExpansionMember2023-01-012023-06-300001383650cqp:CheniereEnergyPartnersLPMembercqp:CheniereEnergyIncMember2023-01-012023-06-300001383650cqp:CheniereEnergyPartnersLPMembercqp:CheniereEnergyIncMembercqp:CommonUnitsMember2023-06-300001383650us-gaap:GeneralPartnerMembersrt:MinimumMember2023-01-012023-06-300001383650srt:MaximumMemberus-gaap:GeneralPartnerMember2023-01-012023-06-300001383650srt:MaximumMember2023-01-012023-06-300001383650cqp:CheniereEnergyPartnersLPMembercqp:BXCQPTargetHoldcoLLCAndOtherBlackstoneAndBrookfieldAffiliatesMember2023-01-012023-06-300001383650cqp:PublicMembercqp:CheniereEnergyPartnersLPMember2023-01-012023-06-300001383650cqp:BIPChinookHoldcoLLCMembercqp:BXCQPTargetHoldcoLLCMember2023-01-012023-06-300001383650cqp:BXCQPTargetHoldcoLLCMembercqp:BIFIVCypressAggregatorDelawareLLCMember2023-01-012023-06-300001383650cqp:SPLProjectMember2023-06-300001383650cqp:SPLProjectMember2022-12-310001383650us-gaap:TradeAccountsReceivableMember2023-06-300001383650us-gaap:TradeAccountsReceivableMember2022-12-310001383650cqp:OtherReceivablesMember2023-06-300001383650cqp:OtherReceivablesMember2022-12-310001383650cqp:MaterialsInventoryMember2023-06-300001383650cqp:MaterialsInventoryMember2022-12-310001383650cqp:LiquefiedNaturalGasInventoryMember2023-06-300001383650cqp:LiquefiedNaturalGasInventoryMember2022-12-310001383650cqp:NaturalGasInventoryMember2023-06-300001383650cqp:NaturalGasInventoryMember2022-12-310001383650cqp:OtherInventoryMember2023-06-300001383650cqp:OtherInventoryMember2022-12-310001383650cqp:LngTerminalMember2023-06-300001383650cqp:LngTerminalMember2022-12-310001383650us-gaap:ConstructionInProgressMember2023-06-300001383650us-gaap:ConstructionInProgressMember2022-12-310001383650cqp:LngTerminalCostsMember2023-06-300001383650cqp:LngTerminalCostsMember2022-12-310001383650cqp:FixedAssetsMember2023-06-300001383650cqp:FixedAssetsMember2022-12-310001383650us-gaap:AssetsHeldUnderCapitalLeasesMember2023-06-300001383650us-gaap:AssetsHeldUnderCapitalLeasesMember2022-12-310001383650us-gaap:FairValueInputsLevel1Member2023-06-300001383650us-gaap:FairValueInputsLevel2Member2023-06-300001383650us-gaap:FairValueInputsLevel3Member2023-06-300001383650us-gaap:FairValueInputsLevel1Member2022-12-310001383650us-gaap:FairValueInputsLevel2Member2022-12-310001383650us-gaap:FairValueInputsLevel3Member2022-12-310001383650us-gaap:FairValueInputsLevel3Membercqp:PhysicalLiquefactionSupplyDerivativesMember2023-06-300001383650us-gaap:MarketApproachValuationTechniqueMembersrt:MinimumMemberus-gaap:FairValueInputsLevel3Membercqp:PhysicalLiquefactionSupplyDerivativesMember2023-01-012023-06-300001383650srt:MaximumMemberus-gaap:MarketApproachValuationTechniqueMemberus-gaap:FairValueInputsLevel3Membercqp:PhysicalLiquefactionSupplyDerivativesMember2023-01-012023-06-300001383650us-gaap:MarketApproachValuationTechniqueMembersrt:WeightedAverageMemberus-gaap:FairValueInputsLevel3Membercqp:PhysicalLiquefactionSupplyDerivativesMember2023-01-012023-06-300001383650us-gaap:ValuationTechniqueOptionPricingModelMembersrt:MinimumMemberus-gaap:FairValueInputsLevel3Membercqp:PhysicalLiquefactionSupplyDerivativesMember2023-01-012023-06-300001383650srt:MaximumMemberus-gaap:ValuationTechniqueOptionPricingModelMemberus-gaap:FairValueInputsLevel3Membercqp:PhysicalLiquefactionSupplyDerivativesMember2023-01-012023-06-300001383650us-gaap:ValuationTechniqueOptionPricingModelMembersrt:WeightedAverageMemberus-gaap:FairValueInputsLevel3Membercqp:PhysicalLiquefactionSupplyDerivativesMember2023-01-012023-06-300001383650cqp:PhysicalLiquefactionSupplyDerivativesMember2023-03-310001383650cqp:PhysicalLiquefactionSupplyDerivativesMember2022-03-310001383650cqp:PhysicalLiquefactionSupplyDerivativesMember2022-12-310001383650cqp:PhysicalLiquefactionSupplyDerivativesMember2021-12-310001383650cqp:PhysicalLiquefactionSupplyDerivativesMember2023-04-012023-06-300001383650cqp:PhysicalLiquefactionSupplyDerivativesMember2022-04-012022-06-300001383650cqp:PhysicalLiquefactionSupplyDerivativesMember2023-01-012023-06-300001383650cqp:PhysicalLiquefactionSupplyDerivativesMember2022-01-012022-06-300001383650cqp:PhysicalLiquefactionSupplyDerivativesMember2023-06-300001383650cqp:PhysicalLiquefactionSupplyDerivativesMember2022-06-300001383650srt:MaximumMembercqp:SabinePassLiquefactionMembercqp:PhysicalLiquefactionSupplyDerivativesMember2023-01-012023-06-300001383650cqp:SabinePassLiquefactionMember2023-06-30cqp:tbtu0001383650cqp:SabinePassLiquefactionMember2022-12-310001383650us-gaap:SalesMember2023-04-012023-06-300001383650us-gaap:SalesMember2022-04-012022-06-300001383650us-gaap:SalesMember2023-01-012023-06-300001383650us-gaap:SalesMember2022-01-012022-06-300001383650us-gaap:CostOfSalesMember2023-04-012023-06-300001383650us-gaap:CostOfSalesMember2022-04-012022-06-300001383650us-gaap:CostOfSalesMember2023-01-012023-06-300001383650us-gaap:CostOfSalesMember2022-01-012022-06-300001383650cqp:PriceRiskDerivativeAssetMember2023-06-300001383650cqp:PriceRiskDerivativeAssetMember2022-12-310001383650cqp:PriceRiskDerivativeLiabilityMember2023-06-300001383650cqp:PriceRiskDerivativeLiabilityMember2022-12-310001383650cqp:A2024SabinePassLiquefactionSeniorNotesMember2023-06-300001383650cqp:A2024SabinePassLiquefactionSeniorNotesMember2022-12-310001383650cqp:A2025SabinePassLiquefactionSeniorNotesMember2023-06-300001383650cqp:A2025SabinePassLiquefactionSeniorNotesMember2022-12-310001383650cqp:A2026SabinePassLiquefactionSeniorNotesMember2023-06-300001383650cqp:A2026SabinePassLiquefactionSeniorNotesMember2022-12-310001383650cqp:A2027SabinePassLiquefactionSeniorNotesMember2023-06-300001383650cqp:A2027SabinePassLiquefactionSeniorNotesMember2022-12-310001383650cqp:A2028SabinePassLiquefactionSeniorNotesMember2023-06-300001383650cqp:A2028SabinePassLiquefactionSeniorNotesMember2022-12-310001383650cqp:A2030SabinePassLiquefactionSeniorNotesMember2023-06-300001383650cqp:A2030SabinePassLiquefactionSeniorNotesMember2022-12-310001383650cqp:A2037SabinePassLiquefactionNotesMembersrt:WeightedAverageMember2023-06-300001383650cqp:A2037SabinePassLiquefactionNotesMember2023-06-300001383650cqp:A2037SabinePassLiquefactionNotesMember2022-12-310001383650cqp:SabinePassLiquefactionSeniorNotesMember2023-06-300001383650cqp:SabinePassLiquefactionSeniorNotesMember2022-12-310001383650cqp:A2020SPLWorkingCapitalFacilityMember2023-06-300001383650cqp:A2020SPLWorkingCapitalFacilityMember2022-12-310001383650cqp:SPLRevolvingCreditFacilityMember2023-06-300001383650cqp:SPLRevolvingCreditFacilityMember2022-12-310001383650cqp:A2029CheniereEnergyPartnersSeniorNotesMember2023-06-300001383650cqp:A2029CheniereEnergyPartnersSeniorNotesMember2022-12-310001383650cqp:A2031CheniereEnergyPartnersSeniorNotesMember2023-06-300001383650cqp:A2031CheniereEnergyPartnersSeniorNotesMember2022-12-310001383650cqp:A2032CheniereEnergyPartnersSeniorNotesMember2023-06-300001383650cqp:A2032CheniereEnergyPartnersSeniorNotesMember2022-12-310001383650cqp:A2033CheniereEnergyPartnersSeniorNotesMember2023-06-300001383650cqp:A2033CheniereEnergyPartnersSeniorNotesMember2022-12-310001383650cqp:CheniereEnergyPartnersSeniorNotesMember2023-06-300001383650cqp:CheniereEnergyPartnersSeniorNotesMember2022-12-310001383650cqp:A2019CQPCreditFacilitiesMember2023-06-300001383650cqp:A2019CQPCreditFacilitiesMember2022-12-310001383650cqp:CQPRevolvingCreditFacilityMember2023-06-300001383650cqp:CQPRevolvingCreditFacilityMember2022-12-310001383650srt:ParentCompanyMember2023-06-300001383650srt:ParentCompanyMember2022-12-310001383650cqp:A2024SabinePassLiquefactionSeniorNotesMemberus-gaap:SubsequentEventMember2023-07-010001383650cqp:SPLRevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-012023-06-30utr:Rate0001383650cqp:SPLRevolvingCreditFacilityMembersrt:MinimumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-012023-06-300001383650srt:MaximumMembercqp:SPLRevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-012023-06-300001383650cqp:SPLRevolvingCreditFacilityMembersrt:MinimumMemberus-gaap:BaseRateMember2023-01-012023-06-300001383650srt:MaximumMembercqp:SPLRevolvingCreditFacilityMemberus-gaap:BaseRateMember2023-01-012023-06-300001383650cqp:CQPRevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-012023-06-300001383650cqp:CQPRevolvingCreditFacilityMembersrt:MinimumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-012023-06-300001383650srt:MaximumMembercqp:CQPRevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-012023-06-300001383650cqp:CQPRevolvingCreditFacilityMembersrt:MinimumMemberus-gaap:BaseRateMember2023-01-012023-06-300001383650srt:MaximumMembercqp:CQPRevolvingCreditFacilityMemberus-gaap:BaseRateMember2023-01-012023-06-300001383650cqp:SPLRevolvingCreditFacilityMembersrt:MinimumMember2023-01-012023-06-300001383650srt:MaximumMembercqp:SPLRevolvingCreditFacilityMember2023-01-012023-06-300001383650cqp:CQPRevolvingCreditFacilityMembersrt:MinimumMember2023-01-012023-06-300001383650srt:MaximumMembercqp:CQPRevolvingCreditFacilityMember2023-01-012023-06-300001383650cqp:SPLRevolvingCreditFacilityMember2023-01-012023-06-300001383650cqp:CQPRevolvingCreditFacilityMember2023-01-012023-06-300001383650cqp:SPLRevolvingCreditFacilityAndCQPRevolvingCreditFacilityMember2023-01-012023-06-300001383650cqp:SPLRevolvingCreditFacilityAndCQPRevolvingCreditFacilityMember2023-04-012023-06-300001383650us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMembercqp:FairValueInputsLevel2AndLevel3Member2023-06-300001383650us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMembercqp:FairValueInputsLevel2AndLevel3Member2023-06-300001383650us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMembercqp:FairValueInputsLevel2AndLevel3Member2022-12-310001383650us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMembercqp:FairValueInputsLevel2AndLevel3Member2022-12-310001383650us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel3Member2023-06-300001383650us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel3Member2022-12-3100013836502023-07-01cqp:LiquefiedNaturalGasMember2023-06-300001383650cqp:LiquefiedNaturalGasMember2023-01-012022-12-3100013836502023-07-01cqp:LiquefiedNaturalGasMemberus-gaap:RelatedPartyMember2023-06-300001383650cqp:LiquefiedNaturalGasMemberus-gaap:RelatedPartyMember2023-01-012022-12-3100013836502023-07-01cqp:RegasificationServiceMember2023-06-300001383650cqp:RegasificationServiceMember2023-01-012022-12-3100013836502023-07-012023-06-3000013836502023-01-012022-12-310001383650cqp:CheniereMarketingAgreementsMembercqp:LiquefiedNaturalGasMemberus-gaap:RelatedPartyMember2023-04-012023-06-300001383650cqp:CheniereMarketingAgreementsMembercqp:LiquefiedNaturalGasMemberus-gaap:RelatedPartyMember2022-04-012022-06-300001383650cqp:CheniereMarketingAgreementsMembercqp:LiquefiedNaturalGasMemberus-gaap:RelatedPartyMember2023-01-012023-06-300001383650cqp:CheniereMarketingAgreementsMembercqp:LiquefiedNaturalGasMemberus-gaap:RelatedPartyMember2022-01-012022-06-300001383650cqp:ContractsforSaleandPurchaseofNaturalGasAndLNGMembercqp:LiquefiedNaturalGasMemberus-gaap:RelatedPartyMember2023-04-012023-06-300001383650cqp:ContractsforSaleandPurchaseofNaturalGasAndLNGMembercqp:LiquefiedNaturalGasMemberus-gaap:RelatedPartyMember2022-04-012022-06-300001383650cqp:ContractsforSaleandPurchaseofNaturalGasAndLNGMembercqp:LiquefiedNaturalGasMemberus-gaap:RelatedPartyMember2023-01-012023-06-300001383650cqp:ContractsforSaleandPurchaseofNaturalGasAndLNGMembercqp:LiquefiedNaturalGasMemberus-gaap:RelatedPartyMember2022-01-012022-06-300001383650cqp:RelatedParty2Membercqp:LiquefiedNaturalGasMembercqp:NaturalGasTransportationAndStorageAgreementsMember2023-04-012023-06-300001383650cqp:RelatedParty2Membercqp:LiquefiedNaturalGasMembercqp:NaturalGasTransportationAndStorageAgreementsMember2022-04-012022-06-300001383650cqp:RelatedParty2Membercqp:LiquefiedNaturalGasMembercqp:NaturalGasTransportationAndStorageAgreementsMember2023-01-012023-06-300001383650cqp:RelatedParty2Membercqp:LiquefiedNaturalGasMembercqp:NaturalGasTransportationAndStorageAgreementsMember2022-01-012022-06-300001383650cqp:ContractsforSaleandPurchaseofNaturalGasAndLNGMemberus-gaap:RelatedPartyMember2023-04-012023-06-300001383650cqp:ContractsforSaleandPurchaseofNaturalGasAndLNGMemberus-gaap:RelatedPartyMember2022-04-012022-06-300001383650cqp:ContractsforSaleandPurchaseofNaturalGasAndLNGMemberus-gaap:RelatedPartyMember2023-01-012023-06-300001383650cqp:ContractsforSaleandPurchaseofNaturalGasAndLNGMemberus-gaap:RelatedPartyMember2022-01-012022-06-300001383650cqp:RelatedParty2Membercqp:NaturalGasTransportationAndStorageAgreementsMember2023-04-012023-06-300001383650cqp:RelatedParty2Membercqp:NaturalGasTransportationAndStorageAgreementsMember2022-04-012022-06-300001383650cqp:RelatedParty2Membercqp:NaturalGasTransportationAndStorageAgreementsMember2023-01-012023-06-300001383650cqp:RelatedParty2Membercqp:NaturalGasTransportationAndStorageAgreementsMember2022-01-012022-06-300001383650us-gaap:ServiceAgreementsMemberus-gaap:RelatedPartyMember2023-04-012023-06-300001383650us-gaap:ServiceAgreementsMemberus-gaap:RelatedPartyMember2022-04-012022-06-300001383650us-gaap:ServiceAgreementsMemberus-gaap:RelatedPartyMember2023-01-012023-06-300001383650us-gaap:ServiceAgreementsMemberus-gaap:RelatedPartyMember2022-01-012022-06-300001383650cqp:SabinePassTugServicesLLCMembercqp:TerminalMarineServicesAgreementMembercqp:CheniereLNGTerminalsLLCMember2023-04-012023-06-300001383650cqp:SabinePassTugServicesLLCMembercqp:TerminalMarineServicesAgreementMembercqp:CheniereLNGTerminalsLLCMember2022-04-012022-06-300001383650cqp:SabinePassTugServicesLLCMembercqp:TerminalMarineServicesAgreementMembercqp:CheniereLNGTerminalsLLCMember2023-01-012023-06-300001383650cqp:SabinePassTugServicesLLCMembercqp:TerminalMarineServicesAgreementMembercqp:CheniereLNGTerminalsLLCMember2022-01-012022-06-300001383650cqp:CooperativeEndeavorAgreementsMembercqp:SabinePassLNGLPMember2023-06-300001383650cqp:CooperativeEndeavorAgreementsMembercqp:SabinePassLNGLPMember2023-01-012023-06-300001383650cqp:CooperativeEndeavorAgreementsMembercqp:SabinePassLNGLPMember2018-12-310001383650cqp:CooperativeEndeavorAgreementsMembercqp:SabinePassLNGLPMember2022-12-310001383650cqp:CheniereMarketingInternationalLLPMembercqp:CooperativeEndeavorAgreementsMemberus-gaap:RelatedPartyMembercqp:SabinePassLNGLPMember2023-06-300001383650cqp:CheniereMarketingInternationalLLPMembercqp:CooperativeEndeavorAgreementsMemberus-gaap:RelatedPartyMembercqp:SabinePassLNGLPMember2022-12-310001383650us-gaap:SubsequentEventMembercqp:CommonUnitsMember2023-07-282023-07-280001383650cqp:BaseAmountMemberus-gaap:SubsequentEventMembercqp:CommonUnitsMember2023-07-282023-07-280001383650cqp:VariableAmountMemberus-gaap:SubsequentEventMembercqp:CommonUnitsMember2023-07-282023-07-280001383650cqp:IncentiveDistributionRightsMember2023-04-012023-06-300001383650cqp:IncentiveDistributionRightsMember2022-04-012022-06-300001383650cqp:CommonUnitsMember2023-01-012023-06-300001383650us-gaap:GeneralPartnerMember2023-01-012023-06-300001383650cqp:IncentiveDistributionRightsMember2023-01-012023-06-300001383650cqp:CommonUnitsMember2022-01-012022-06-300001383650us-gaap:GeneralPartnerMember2022-01-012022-06-300001383650cqp:IncentiveDistributionRightsMember2022-01-012022-06-300001383650us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembercqp:CustomerAMember2023-04-012023-06-300001383650us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembercqp:CustomerAMember2022-04-012022-06-300001383650us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembercqp:CustomerAMember2023-01-012023-06-300001383650us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembercqp:CustomerAMember2022-01-012022-06-300001383650us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMembercqp:CustomerAMember2023-01-012023-06-300001383650us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMembercqp:CustomerAMember2022-01-012022-12-310001383650us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembercqp:CustomerBMember2023-04-012023-06-300001383650us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembercqp:CustomerBMember2022-04-012022-06-300001383650us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembercqp:CustomerBMember2023-01-012023-06-300001383650us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembercqp:CustomerBMember2022-01-012022-06-300001383650us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMembercqp:CustomerBMember2023-01-012023-06-300001383650us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMembercqp:CustomerBMember2022-01-012022-12-310001383650us-gaap:CustomerConcentrationRiskMembercqp:CustomerCMemberus-gaap:SalesRevenueNetMember2023-04-012023-06-300001383650us-gaap:CustomerConcentrationRiskMembercqp:CustomerCMemberus-gaap:SalesRevenueNetMember2022-04-012022-06-300001383650us-gaap:CustomerConcentrationRiskMembercqp:CustomerCMemberus-gaap:SalesRevenueNetMember2023-01-012023-06-300001383650us-gaap:CustomerConcentrationRiskMembercqp:CustomerCMemberus-gaap:SalesRevenueNetMember2022-01-012022-06-300001383650us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMembercqp:CustomerCMember2023-01-012023-06-300001383650cqp:CustomerDMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-04-012023-06-300001383650cqp:CustomerDMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-04-012022-06-300001383650cqp:CustomerDMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-06-300001383650cqp:CustomerDMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-06-300001383650cqp:CustomerDMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2023-01-012023-06-300001383650cqp:CustomerDMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2022-01-012022-12-310001383650us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembercqp:CustomerEMember2023-04-012023-06-300001383650us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembercqp:CustomerEMember2022-04-012022-06-300001383650us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembercqp:CustomerEMember2023-01-012023-06-300001383650us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembercqp:CustomerEMember2022-01-012022-06-300001383650us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMembercqp:CustomerEMember2023-01-012023-06-300001383650cqp:CustomerFMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2023-01-012023-06-300001383650cqp:CustomerFMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2022-01-012022-12-310001383650cqp:CustomerGMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-04-012022-06-300001383650cqp:CustomerGMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-06-300001383650cqp:CustomerGMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2023-01-012023-06-300001383650cqp:CustomerGMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2022-01-012022-12-310001383650cqp:CustomerHMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-04-012022-06-300001383650cqp:CustomerHMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-06-300001383650cqp:CustomerHMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2023-01-012023-06-300001383650cqp:CustomerHMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2022-01-012022-12-310001383650cqp:NovationOfIPMAgreementMembercqp:CheniereCorpusChristiLiquefactionStageIIIMember2022-03-012022-03-31utr:MMBTU0001383650cqp:NovationOfIPMAgreementMember2022-03-152022-03-150001383650cqp:NovationOfIPMAgreementMember2022-03-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-33366

Cheniere Energy Partners, L.P.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 20-5913059 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

700 Milam Street, Suite 1900

Houston, Texas 77002

(Address of principal executive offices) (Zip Code)

(713) 375-5000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Units Representing Limited Partner Interests | CQP | NYSE American |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of July 27, 2023, the registrant had 484,036,123 common units outstanding.

CHENIERE ENERGY PARTNERS, L.P.

TABLE OF CONTENTS

DEFINITIONS

As used in this quarterly report, the terms listed below have the following meanings:

Common Industry and Other Terms

| | | | | | | | |

| ASU | | Accounting Standards Update |

| Bcf | | billion cubic feet |

| Bcf/d | | billion cubic feet per day |

| Bcf/yr | | billion cubic feet per year |

| Bcfe | | billion cubic feet equivalent |

| DOE | | U.S. Department of Energy |

| EPC | | engineering, procurement and construction |

| FASB | | Financial Accounting Standards Board |

| FERC | | Federal Energy Regulatory Commission |

| FTA countries | | countries with which the United States has a free trade agreement providing for national treatment for trade in natural gas |

| GAAP | | generally accepted accounting principles in the United States |

| Henry Hub | | the final settlement price (in USD per MMBtu) for the New York Mercantile Exchange’s Henry Hub natural gas futures contract for the month in which a relevant cargo’s delivery window is scheduled to begin |

| IPM agreements | | integrated production marketing agreements in which the gas producer sells to us gas on a global LNG index price, less a fixed liquefaction fee, shipping and other costs |

| LIBOR | | London Interbank Offered Rate |

| LNG | | liquefied natural gas, a product of natural gas that, through a refrigeration process, has been cooled to a liquid state, which occupies a volume that is approximately 1/600th of its gaseous state |

| MMBtu | | million British thermal units; one British thermal unit measures the amount of energy required to raise the temperature of one pound of water by one degree Fahrenheit |

| mtpa | | million tonnes per annum |

| non-FTA countries | | countries with which the United States does not have a free trade agreement providing for national treatment for trade in natural gas and with which trade is permitted |

| SEC | | U.S. Securities and Exchange Commission |

| SOFR | | Secured Overnight Financing Rate |

| SPA | | LNG sale and purchase agreement |

| TBtu | | trillion British thermal units; one British thermal unit measures the amount of energy required to raise the temperature of one pound of water by one degree Fahrenheit |

| Train | | an industrial facility comprised of a series of refrigerant compressor loops used to cool natural gas into LNG |

| TUA | | terminal use agreement |

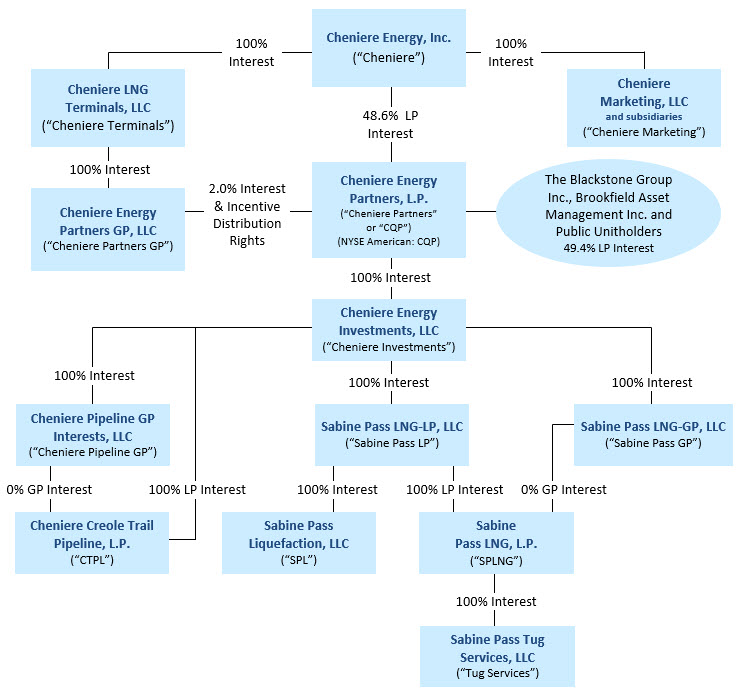

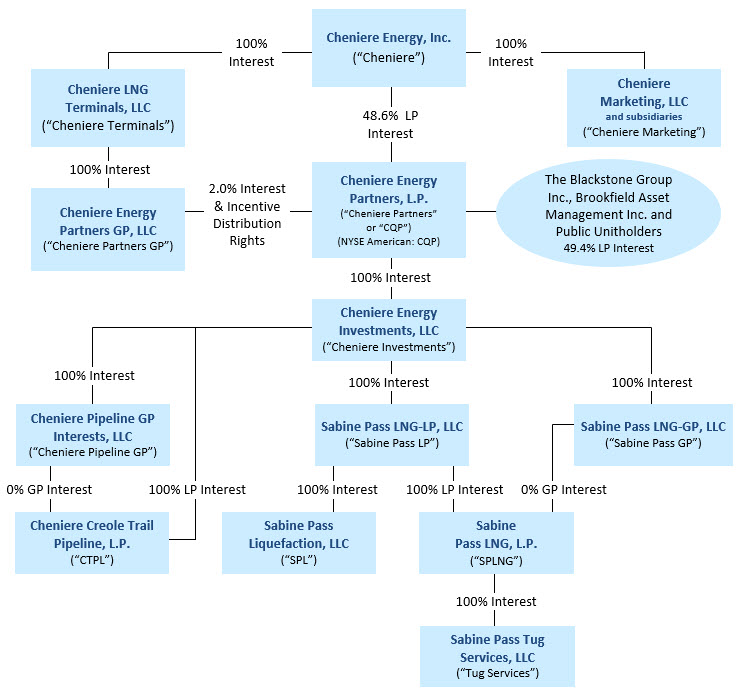

Abbreviated Legal Entity Structure

The following diagram depicts our abbreviated legal entity structure as of June 30, 2023, including our ownership of certain subsidiaries, and the references to these entities used in this quarterly report:

Unless the context requires otherwise, references to “CQP,” “the Partnership,” “we,” “us” and “our” refer to Cheniere Energy Partners, L.P. and its consolidated subsidiaries.

PART I. FINANCIAL INFORMATION

ITEM I. CONSOLIDATED FINANCIAL STATEMENTS

CHENIERE ENERGY PARTNERS, L.P. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(in millions, except per unit data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 | | |

| Revenues | | | | | | | | | | |

| LNG revenues | | $ | 1,415 | | | $ | 2,959 | | | $ | 3,521 | | | $ | 5,447 | | | |

| LNG revenues—affiliate | | 469 | | | 1,135 | | | 1,230 | | | 1,892 | | | |

| LNG revenues—related party | | — | | | 4 | | | — | | | 4 | | | |

| Regasification revenues | | 33 | | | 68 | | | 67 | | | 136 | | | |

| | | | | | | | | | |

| Other revenues | | 16 | | | 15 | | | 32 | | | 30 | | | |

| | | | | | | | | | |

| Total revenues | | 1,933 | | | 4,181 | | | 4,850 | | | 7,509 | | | |

| | | | | | | | | | |

| Operating costs and expenses (recoveries) | | | | | | | | | | |

| Cost of sales (excluding items shown separately below) | | 603 | | | 3,144 | | | 916 | | | 5,706 | | | |

| Cost of sales—affiliate | | 1 | | | 57 | | | 18 | | | 62 | | | |

| Cost of sales—related party | | — | | | 1 | | | — | | | 1 | | | |

| Operating and maintenance expense | | 263 | | | 191 | | | 469 | | | 361 | | | |

| Operating and maintenance expense—affiliate | | 38 | | | 41 | | | 82 | | | 79 | | | |

| Operating and maintenance expense—related party | | 14 | | | 15 | | | 30 | | | 27 | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| General and administrative expense (recovery) | | 3 | | | (3) | | | 6 | | | — | | | |

| General and administrative expense—affiliate | | 24 | | | 24 | | | 46 | | | 47 | | | |

| Depreciation and amortization expense | | 167 | | | 156 | | | 334 | | | 309 | | | |

| Other | | 2 | | | — | | | 2 | | | — | | | |

| | | | | | | | | | |

| Total operating costs and expenses | | 1,115 | | | 3,626 | | | 1,903 | | | 6,592 | | | |

| | | | | | | | | | |

| Income from operations | | 818 | | | 555 | | | 2,947 | | | 917 | | | |

| | | | | | | | | | |

| Other income (expense) | | | | | | | | | | |

| Interest expense, net of capitalized interest | | (207) | | | (216) | | | (415) | | | (419) | | | |

| Loss on modification or extinguishment of debt | | (2) | | | — | | | (2) | | | — | | | |

| Other income, net | | 13 | | | 3 | | | 27 | | | 3 | | | |

| | | | | | | | | | |

| Total other expense | | (196) | | | (213) | | | (390) | | | (416) | | | |

| | | | | | | | | | |

| Net income | | $ | 622 | | | $ | 342 | | | $ | 2,557 | | | $ | 501 | | | |

| | | | | | | | | | |

Basic and diluted net income per common unit (1) | | $ | 0.84 | | | $ | 0.25 | | | $ | 4.35 | | | $ | 0.13 | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Weighted average basic and diluted number of common units outstanding | | 484.0 | | | 484.0 | | | 484.0 | | | 484.0 | | | |

(1)In computing basic and diluted net income per common unit, net income is reduced by the amount of undistributed net income allocated to participating securities other than common units, as required under the two-class method. See Note 12—Net Income per Common Unit.

The accompanying notes are an integral part of these consolidated financial statements.

3

CHENIERE ENERGY PARTNERS, L.P. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in millions, except unit data)

| | | | | | | | | | | | | | |

| | |

| | June 30, | | December 31, |

| | 2023 | | 2022 |

| ASSETS | | (unaudited) | | |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 1,834 | | | $ | 904 | |

| Restricted cash and cash equivalents | | 241 | | | 92 | |

| Trade and other receivables, net of current expected credit losses | | 189 | | | 627 | |

| Trade receivables—affiliate | | 134 | | | 551 | |

| | | | |

| Advances to affiliate | | 154 | | | 177 | |

| Inventory | | 130 | | | 160 | |

| Current derivative assets | | 32 | | | 24 | |

| Margin deposits | | 3 | | | 35 | |

| | | | |

| Other current assets | | 75 | | | 50 | |

| Other current assets—affiliate | | 1 | | | — | |

| Total current assets | | 2,793 | | | 2,620 | |

| | | | |

| | | | |

| Property, plant and equipment, net of accumulated depreciation | | 16,463 | | | 16,725 | |

| Operating lease assets | | 85 | | | 89 | |

| Debt issuance costs, net of accumulated amortization | | 18 | | | 8 | |

| Derivative assets | | 29 | | | 28 | |

| Other non-current assets, net | | 169 | | | 163 | |

| | | | |

| Total assets | | $ | 19,557 | | | $ | 19,633 | |

| | | | |

LIABILITIES AND PARTNERS’ DEFICIT | | | | |

| Current liabilities | | | | |

| Accounts payable | | $ | 60 | | | $ | 32 | |

| Accrued liabilities | | 556 | | | 1,378 | |

| Accrued liabilities—related party | | 5 | | | 6 | |

| Current debt, net of discount and debt issuance costs | | 1,796 | | | — | |

| Due to affiliates | | 38 | | | 74 | |

| Deferred revenue | | 97 | | | 144 | |

| Deferred revenue—affiliate | | — | | | 3 | |

| Current operating lease liabilities | | 10 | | | 10 | |

| Current derivative liabilities | | 366 | | | 769 | |

| Other current liabilities | | 4 | | | 5 | |

| Total current liabilities | | 2,932 | | | 2,421 | |

| | | | |

| Long-term debt, net of premium, discount and debt issuance costs | | 15,595 | | | 16,198 | |

| | | | |

| Operating lease liabilities | | 75 | | | 80 | |

| Finance lease liabilities | | 16 | | | 18 | |

| Derivative liabilities | | 1,936 | | | 3,024 | |

| Other non-current liabilities | | 26 | | | — | |

| Other non-current liabilities—affiliate | | 23 | | | 23 | |

| | | | |

| | | | |

| | | | |

Partners’ deficit | | | | |

Common unitholders’ interest (484.0 million units issued and outstanding at both June 30, 2023 and December 31, 2022) | | 372 | | | (1,118) | |

| | | | |

General partner’s interest (2% interest with 9.9 million units issued and outstanding at both June 30, 2023 and December 31, 2022) | | (1,418) | | | (1,013) | |

Total partners’ deficit | | (1,046) | | | (2,131) | |

Total liabilities and partners’ deficit | | $ | 19,557 | | | $ | 19,633 | |

The accompanying notes are an integral part of these consolidated financial statements.

4

CHENIERE ENERGY PARTNERS, L.P. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF PARTNERS’ EQUITY (DEFICIT)

(in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three and Six Months Ended June 30, 2023 |

| Common Unitholders’ Interest | | | | | | General Partner’s Interest | | Total Partners’ Deficit |

| Units | | Amount | | | | | | | | | | Units | | Amount | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Balance at December 31, 2022 | 484.0 | | | $ | (1,118) | | | | | | | | | | | 9.9 | | | $ | (1,013) | | | $ | (2,131) | |

| Net income | — | | | 1,897 | | | | | | | | | | | — | | | 38 | | | 1,935 | |

| | | | | | | | | | | | | | | | | |

| Distributions | | | | | | | | | | | | | | | | | |

Common units, $1.070/unit | — | | | (518) | | | | | | | | | | | — | | | — | | | (518) | |

| | | | | | | | | | | | | | | | | |

| General partner units | — | | | — | | | | | | | | | | | — | | | (236) | | | (236) | |

| Balance at March 31, 2023 | 484.0 | | | 261 | | | | | | | | | | | 9.9 | | | (1,211) | | | (950) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Net income | — | | | 610 | | | | | | | | | | | — | | | 12 | | | 622 | |

| | | | | | | | | | | | | | | | | |

| Distributions | | | | | | | | | | | | | | | | | |

Common units, $1.03/unit | — | | | (499) | | | | | | | | | | | — | | | — | | | (499) | |

| General partner units | — | | | — | | | | | | | | | | | — | | | (219) | | | (219) | |

| | | | | | | | | | | | | | | | | |

| Balance at June 30, 2023 | 484.0 | | | $ | 372 | | | | | | | | | | | 9.9 | | | $ | (1,418) | | | $ | (1,046) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three and Six Months Ended June 30, 2022 |

| Common Unitholders’ Interest | | | | | | General Partner’s Interest | | Total Partners’ Equity (Deficit) |

| Units | | Amount | | | | | | | | | | Units | | Amount | |

| Balance at December 31, 2021 | 484.0 | | | $ | 1,024 | | | | | | | | | | | 9.9 | | | $ | (306) | | | $ | 718 | |

| Net income | — | | | 157 | | | | | | | | | | | — | | | 2 | | | 159 | |

Novated IPM agreement (see Note 14) | — | | | (2,712) | | | | | | | | | | | — | | | — | | | (2,712) | |

| Distributions | | | | | | | | | | | | | | | | | |

Common units, $0.700/unit | — | | | (339) | | | | | | | | | | | — | | | — | | | (339) | |

| General partner units | — | | | — | | | | | | | | | | | — | | | (56) | | | (56) | |

| Balance at March 31, 2022 | 484.0 | | | (1,870) | | | | | | | | | | | 9.9 | | | (360) | | | (2,230) | |

| Net income | — | | | 335 | | | | | | | | | | | — | | | 7 | | | 342 | |

| Distributions | | | | | | | | | | | | | | | | | |

Common units, $1.05/unit | — | | | (508) | | | | | | | | | | | — | | | — | | | (508) | |

| General partner units | — | | | — | | | | | | | | | | | — | | | (229) | | | (229) | |

| Balance at June 30, 2022 | 484.0 | | | $ | (2,043) | | | | | | | | | | | 9.9 | | | $ | (582) | | | $ | (2,625) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

5

CHENIERE ENERGY PARTNERS, L.P. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(unaudited)

| | | | | | | | | | | | | |

| | Six Months Ended June 30, |

| 2023 | | 2022 | | |

| Cash flows from operating activities | | | | | |

Net income | $ | 2,557 | | | $ | 501 | | | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | |

| Depreciation and amortization expense | 334 | | | 309 | | | |

| Amortization of debt issuance costs, premium and discount | 15 | | | 15 | | | |

| Loss on modification or extinguishment of debt | 2 | | | — | | | |

Total losses (gains) on derivative instruments, net | (1,502) | | | 819 | | | |

| | | | | |

Net cash provided by (used for) settlement of derivative instruments | 2 | | | (37) | | | |

| | | | | |

| Other | 11 | | | 16 | | | |

| | | | | |

| Changes in operating assets and liabilities: | | | | | |

| Trade and other receivables | 450 | | | (208) | | | |

| Trade receivables—affiliate | 417 | | | (269) | | | |

| | | | | |

| Advances to affiliate | 21 | | | 7 | | | |

| Inventory | 30 | | | 4 | | | |

| Margin deposits | 32 | | | 2 | | | |

| | | | | |

| Accounts payable and accrued liabilities | (739) | | | 491 | | | |

| Accrued liabilities—related party | (2) | | | 2 | | | |

| Due to affiliates | (34) | | | 5 | | | |

| Total deferred revenue | (21) | | | (28) | | | |

| Other, net | (31) | | | (41) | | | |

| Other, net—affiliate | (4) | | | (2) | | | |

Net cash provided by operating activities | 1,538 | | | 1,586 | | | |

| | | | | |

| Cash flows from investing activities | | | | | |

| Property, plant and equipment, net | (149) | | | (239) | | | |

| Other | (6) | | | — | | | |

Net cash used in investing activities | (155) | | | (239) | | | |

| | | | | |

| Cash flows from financing activities | | | | | |

| Proceeds from issuances of debt | 1,397 | | | — | | | |

| Redemptions and repayments of debt | (200) | | | — | | | |

| Debt issuance and other financing costs | (27) | | | — | | | |

| Debt extinguishment costs | (1) | | | — | | | |

| | | | | |

| Distributions | (1,472) | | | (1,132) | | | |

| Other | (1) | | | — | | | |

Net cash used in financing activities | (304) | | | (1,132) | | | |

| | | | | |

Net increase in cash, cash equivalents and restricted cash and cash equivalents | 1,079 | | | 215 | | | |

| Cash, cash equivalents and restricted cash and cash equivalents—beginning of period | 996 | | | 974 | | | |

| Cash, cash equivalents and restricted cash and cash equivalents—end of period | $ | 2,075 | | | $ | 1,189 | | | |

Balances per Consolidated Balance Sheet:

| | | | | | | |

| June 30, |

| 2023 | | |

| Cash and cash equivalents | $ | 1,834 | | | |

| Restricted cash and cash equivalents | 241 | | | |

| | | |

| Total cash, cash equivalents and restricted cash and cash equivalents | $ | 2,075 | | | |

The accompanying notes are an integral part of these consolidated financial statements.

6

CHENIERE ENERGY PARTNERS, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

NOTE 1—NATURE OF OPERATIONS AND BASIS OF PRESENTATION

We own the natural gas liquefaction and export facility located in Cameron Parish, Louisiana at Sabine Pass (the “Sabine Pass LNG Terminal”) which has six operational Trains, for a total production capacity of approximately 30 mtpa of LNG (the “Liquefaction Project”). The Sabine Pass LNG Terminal also has operational regasification facilities that include five LNG storage tanks, vaporizers and three marine berths. Additionally, the Sabine Pass LNG Terminal includes a 94-mile pipeline owned by our subsidiary, CTPL, that interconnects the Sabine Pass LNG Terminal with a number of large interstate and intrastate pipelines (the “Creole Trail Pipeline”).

We have increased available liquefaction capacity at our Liquefaction Project as a result of debottlenecking and other optimization projects. We hold a significant land position at the Sabine Pass LNG Terminal, which provides opportunity for further liquefaction capacity expansion. In May 2023, certain of our subsidiaries entered the pre-filing review process with the FERC under the National Environmental Policy Act for an expansion adjacent to the Liquefaction Project consisting of up to three Trains with an expected total production capacity of approximately 20 mtpa of LNG. The development of this site or other projects, including infrastructure projects in support of natural gas supply and LNG demand, will require, among other things, acceptable commercial and financing arrangements before we make a positive final investment decision.

We do not have employees and thus we and our subsidiaries have various services agreements with affiliates of Cheniere in the ordinary course of business, including services required to construct, operate and maintain the Liquefaction Project, and administrative services. See Note 11—Related Party Transactions for additional details of the activity under these services agreements during the three and six months ended June 30, 2023 and 2022.

As of June 30, 2023, Cheniere owned 48.6% of our limited partner interest in the form of 239.9 million of our common units. Cheniere also owns 100% of our general partner interest and our incentive distribution rights (“IDRs”).

Basis of Presentation

The accompanying unaudited Consolidated Financial Statements of CQP have been prepared in accordance with GAAP for interim financial information and in accordance with Rule 10-01 of Regulation S-X and reflect all normal recurring adjustments which are, in the opinion of management, necessary for a fair statement of the financial results for the interim periods presented. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements and should be read in conjunction with the Consolidated Financial Statements and accompanying notes included in our annual report on Form 10-K for the fiscal year ended December 31, 2022.

Results of operations for the three and six months ended June 30, 2023 are not necessarily indicative of the results of operations that will be realized for the year ending December 31, 2023.

We are not subject to either federal or state income tax, as our partners are taxed individually on their allocable share of our taxable income.

Recent Accounting Standards

ASU 2020-04

In March 2020, the FASB issued ASU 2020-04, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting. This guidance primarily provides temporary optional expedients which simplify the accounting for contract modifications to existing debt agreements expected to arise from the market transition from LIBOR to alternative reference rates. The temporary optional expedients under the standard became effective March 12, 2020 and will be available until December 31, 2024 following a subsequent amendment to the standard.

As further detailed in Note 9—Debt, our existing credit facilities include a variable interest rate indexed to SOFR, incorporated through replacements of previous credit facilities subsequent to the effective date of ASU 2020-04. We elected to apply the optional expedients as applicable to certain replaced facilities; however, the impact of applying the optional expedients was not material, and the transition to SOFR did not have a material impact on our cash flows.

CHENIERE ENERGY PARTNERS, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

NOTE 2—UNITHOLDERS’ EQUITY

The common units represent limited partner interests in us, which entitle the unitholders to participate in partnership distributions and exercise the rights and privileges available to limited partners under our partnership agreement. Although common unitholders are not obligated to fund losses of the Partnership, their capital account, which would be considered in allocating the net assets of the Partnership were it to be liquidated, continues to share in losses.

The general partner interest is entitled to at least 2% of all distributions made by us. In addition, the general partner holds IDRs, which allow the general partner to receive a higher percentage of quarterly distributions of available cash from operating surplus as additional target levels are met, but may transfer these rights separately from its general partner interest. The higher percentages range from 15% to 50%, inclusive of the general partner interest.

Our partnership agreement requires that, within 45 days after the end of each quarter, we distribute all of our available cash (as defined in our partnership agreement). Generally, our available cash is our cash on hand at the end of a quarter less the amount of any reserves established by our general partner. All distributions we have paid to date have been made from accumulated operating surplus as defined in the partnership agreement.

As of June 30, 2023, our total securities beneficially owned in the form of common units were held 48.6% by Cheniere, 41.5% by CQP Target Holdco L.L.C. (“CQP Target Holdco”) and other affiliates of Blackstone Inc. (“Blackstone”) and Brookfield Asset Management Inc. (“Brookfield”) and 7.9% by the public. All of our 2% general partner interest was held by Cheniere. CQP Target Holdco’s equity interests are 50.0% owned by BIP Chinook Holdco L.L.C., an affiliate of Blackstone, and 50.0% owned by BIF IV Cypress Aggregator (Delaware) LLC, an affiliate of Brookfield. The ownership of CQP Target Holdco, Blackstone and Brookfield are based on their most recent filings with the SEC.

NOTE 3—RESTRICTED CASH AND CASH EQUIVALENTS

Pursuant to the accounts agreement entered into with the collateral trustee for the benefit of SPL’s debt holders, SPL is required to deposit all cash received into reserve accounts controlled by the collateral trustee. The usage or withdrawal of such cash is restricted to the payment of liabilities related to the Liquefaction Project and other restricted payments.

As of June 30, 2023 and December 31, 2022, we had $241 million and $92 million of restricted cash and cash equivalents, respectively, as required under the above agreement.

NOTE 4—TRADE AND OTHER RECEIVABLES, NET OF CURRENT EXPECTED CREDIT LOSSES

Trade and other receivables, net of current expected credit losses consisted of the following (in millions):

| | | | | | | | | | | | | | |

| | |

| | June 30, | | December 31, |

| | 2023 | | 2022 |

| Trade receivables | | $ | 158 | | | $ | 603 | |

| Other receivables | | 31 | | | 24 | |

| Total trade and other receivables, net of current expected credit losses | | $ | 189 | | | $ | 627 | |

NOTE 5—INVENTORY

Inventory consisted of the following (in millions):

| | | | | | | | | | | | | | |

| | |

| | June 30, | | December 31, |

| | 2023 | | 2022 |

| Materials | | $ | 101 | | | $ | 103 | |

| LNG | | 8 | | | 27 | |

| Natural gas | | 19 | | | 28 | |

| Other | | 2 | | | 2 | |

| Total inventory | | $ | 130 | | | $ | 160 | |

CHENIERE ENERGY PARTNERS, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

NOTE 6—PROPERTY, PLANT AND EQUIPMENT, NET OF ACCUMULATED DEPRECIATION

Property, plant and equipment, net of accumulated depreciation consisted of the following (in millions):

| | | | | | | | | | | | | | |

| | |

| | June 30, | | December 31, |

| | 2023 | | 2022 |

| LNG terminal | | | | |

| Terminal and interconnecting pipeline facilities | | $ | 20,131 | | | $ | 20,072 | |

| | | | |

| Construction-in-process | | 149 | | | 140 | |

| Accumulated depreciation | | (3,840) | | | (3,512) | |

| Total LNG terminal, net of accumulated depreciation | | 16,440 | | | 16,700 | |

| Fixed assets | | | | |

| Fixed assets | | 29 | | | 29 | |

| Accumulated depreciation | | (25) | | | (25) | |

| Total fixed assets, net of accumulated depreciation | | 4 | | | 4 | |

| Assets under finance leases | | | | |

| Tug vessels | | 23 | | | 23 | |

| Accumulated depreciation | | (4) | | | (2) | |

| Total assets under finance lease, net of accumulated depreciation | | 19 | | | 21 | |

| Property, plant and equipment, net of accumulated depreciation | | $ | 16,463 | | | $ | 16,725 | |

The following table shows depreciation expense and offsets to LNG terminal costs (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 | | |

| Depreciation expense | | $ | 166 | | | $ | 155 | | | $ | 331 | | | $ | 307 | | | |

| Offsets to LNG terminal costs (1) | | — | | | — | | | — | | | 148 | | | |

(1)We recognize offsets to LNG terminal costs related to the sale of commissioning cargoes because these amounts were earned or loaded prior to the start of commercial operations of the respective Trains of the Liquefaction Project during the testing phase for its construction.

NOTE 7—DERIVATIVE INSTRUMENTS

SPL has commodity derivatives consisting of natural gas supply contracts, including those under the IPM agreement, for the operation of the Liquefaction Project and associated economic hedges (collectively, “Liquefaction Supply Derivatives”).

We recognize SPL’s derivative instruments as either assets or liabilities and measure those instruments at fair value. None of SPL’s derivative instruments are designated as cash flow or fair value hedging instruments, and changes in fair value are recorded within our Consolidated Statements of Income to the extent not utilized for the commissioning process, in which case such changes are capitalized.

The following table shows the fair value of the derivative instruments that are required to be measured at fair value on a recurring basis (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fair Value Measurements as of |

| June 30, 2023 | | December 31, 2022 |

| Quoted Prices in Active Markets

(Level 1) | | Significant Other Observable Inputs

(Level 2) | | Significant Unobservable Inputs

(Level 3) | | Total | | Quoted Prices in Active Markets

(Level 1) | | Significant Other Observable Inputs

(Level 2) | | Significant Unobservable Inputs

(Level 3) | | Total |

| | | | | | | | | | | | | | | |

Liquefaction Supply Derivatives asset (liability) | $ | 10 | | | $ | 4 | | | $ | (2,255) | | | $ | (2,241) | | | $ | (12) | | | $ | (10) | | | $ | (3,719) | | | $ | (3,741) | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

We value the Liquefaction Supply Derivatives using a market or option-based approach incorporating present value techniques, as needed, using observable commodity price curves, when available, and other relevant data.

CHENIERE ENERGY PARTNERS, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

The fair value of the Liquefaction Supply Derivatives is predominantly driven by observable and unobservable market commodity prices and, as applicable to our natural gas supply contracts, our assessment of the associated events deriving fair value including, but not limited to, evaluation of whether the respective market exists from the perspective of market participants as infrastructure is developed.

We include a significant portion of the Liquefaction Supply Derivatives as Level 3 within the valuation hierarchy as the fair value is developed through the use of internal models which incorporate significant unobservable inputs. In instances where observable data is unavailable, consideration is given to the assumptions that market participants would use in valuing the asset or liability. This includes assumptions about market risks, such as future prices of energy units for unobservable periods, liquidity and volatility.

The Level 3 fair value measurements of the natural gas positions within the Liquefaction Supply Derivatives could be materially impacted by a significant change in certain natural gas and international LNG prices. The following table includes quantitative information for the unobservable inputs for the Level 3 Liquefaction Supply Derivatives as of June 30, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Net Fair Value Liability (in millions) | | Valuation Approach | | Significant Unobservable Input | | Range of Significant Unobservable Inputs / Weighted Average (1) |

| Liquefaction Supply Derivatives | | $(2,255) | | Market approach incorporating present value techniques | | Henry Hub basis spread | | $(1.733) - $0.585 / $(0.002) |

| | | | Option pricing model | | International LNG pricing spread, relative to Henry Hub (2) | | 119% - 484% / 224% |

(1)Unobservable inputs were weighted by the relative fair value of the instruments.

(2)Spread contemplates U.S. dollar-denominated pricing.

Increases or decreases in basis or pricing spreads, in isolation, would decrease or increase, respectively, the fair value of the Liquefaction Supply Derivatives.

The following table shows the changes in the fair value of the Level 3 Liquefaction Supply Derivatives (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 | | |

| Balance, beginning of period | | $ | (2,502) | | | $ | (3,162) | | | $ | (3,719) | | | $ | 38 | | | |

Realized and change in fair value gains (losses) included in net income (1): | | | | | | | | | | |

| Included in cost of sales, existing deals (2) | | 173 | | | (309) | | | 1,116 | | | 63 | | | |

| Included in cost of sales, new deals (3) | | 3 | | | — | | | 5 | | | — | | | |

| Purchases and settlements: | | | | | | | | | | |

| Purchases (4) | | — | | | 8 | | | — | | | (3,549) | | | |

| Settlements (5) | | 71 | | | 7 | | | 340 | | | (8) | | | |

| Transfers in and/or out of level 3 | | | | | | | | | | |

| | | | | | | | | | |

| Transfers out of level 3 (6) | | — | | | — | | | 3 | | | — | | | |

| Balance, end of period | | $ | (2,255) | | | $ | (3,456) | | | $ | (2,255) | | | $ | (3,456) | | | |

Favorable (unfavorable) changes in fair value relating to instruments still held at the end of the period | | $ | 176 | | | $ | (309) | | | $ | 1,121 | | | $ | 63 | | | |

(1)Does not include the realized value associated with derivative instruments that settle through physical delivery, as settlement is equal to contractually fixed price from trade date multiplied by contractual volume. See settlements line item in this table.

(2)Impact to earnings on deals that existed at the beginning of the period and continue to exist at the end of the period.

(3)Impact to earnings on deals that were entered into during the reporting period and continue to exist at the end of the period.

(4)Includes any day one gain (loss) recognized during the reporting period on deals that were entered into during the reporting period which continue to exist at the end of the period, in addition to any derivative contracts acquired from

CHENIERE ENERGY PARTNERS, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

entities at a value other than zero on acquisition date, such as derivatives assigned or novated during the reporting period and continuing to exist at the end of the period.

(5)Roll-off in the current period of amounts recognized in our Consolidated Balance Sheets at the end of the previous period due to settlement of the underlying instruments in the current period.

(6)Transferred out of Level 3 as a result of observable market for the underlying natural gas purchase agreements.

All counterparty derivative contracts provide for the unconditional right of set-off in the event of default. We have elected to report derivative assets and liabilities arising from those derivative contracts with the same counterparty and the unconditional contractual right of set-off on a net basis. The use of derivative instruments exposes SPL to counterparty credit risk, or the risk that a counterparty will be unable to meet its commitments, in instances when the derivative instruments are in an asset position. Additionally, counterparties are at risk that SPL will be unable to meet its commitments in instances where the derivative instruments are in a liability position. We incorporate both SPL’s nonperformance risk and the respective counterparty’s nonperformance risk in fair value measurements depending on the position of the derivative. In adjusting the fair value of the derivative contracts for the effect of nonperformance risk, we have considered the impact of any applicable credit enhancements, such as collateral postings, set-off rights and guarantees.

Liquefaction Supply Derivatives

SPL holds Liquefaction Supply Derivatives which are primarily indexed to the natural gas market and international LNG indices. The terms of the Liquefaction Supply Derivatives range up to approximately 15 years, some of which commence upon the satisfaction of certain events or states of affairs.

The forward notional amount for the Liquefaction Supply Derivatives was approximately 5,831 TBtu and 5,972 TBtu as of June 30, 2023 and December 31, 2022, respectively, excluding notional amounts associated with extension options that were uncertain to be taken as of June 30, 2023.

The following table shows the effect and location of the Liquefaction Supply Derivatives recorded on our Consolidated Statements of Income (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Gain (Loss) Recognized in Consolidated Statements of Income |

Consolidated Statements of Income Location (1) | | Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 | | |

| LNG revenues | | $ | — | | | $ | 4 | | | $ | — | | | $ | 4 | | | |

| Cost of sales | | 242 | | | (298) | | | 1,502 | | | (823) | | | |

| | | | | | | | | | |

| | | | | | | | | | |

(1)Does not include the realized value associated with Liquefaction Supply Derivatives that settle through physical delivery. Fair value fluctuations associated with commodity derivative activities are classified and presented consistently with the item economically hedged and the nature and intent of the derivative instrument.

CHENIERE ENERGY PARTNERS, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

Fair Value and Location of Derivative Assets and Liabilities on the Consolidated Balance Sheets

The following table shows the fair value and location of the Liquefaction Supply Derivatives on our Consolidated Balance Sheets (in millions):

| | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | |

| | Fair Value Measurements as of (1) | | | | |

| Consolidated Balance Sheets Location | | June 30, 2023 | | | | | | December 31, 2022 | | | | |

| Current derivative assets | | $ | 32 | | | | | | | $ | 24 | | | | | |

| Derivative assets | | 29 | | | | | | | 28 | | | | | |

| Total derivative assets | | 61 | | | | | | | 52 | | | | | |

| | | | | | | | | | | | |

| Current derivative liabilities | | (366) | | | | | | | (769) | | | | | |

| Derivative liabilities | | (1,936) | | | | | | | (3,024) | | | | | |

| Total derivative liabilities | | (2,302) | | | | | | | (3,793) | | | | | |

| | | | | | | | | | | | |

| Derivative liability, net | | $ | (2,241) | | | | | | | $ | (3,741) | | | | | |

(1)Does not include collateral posted with counterparties by us of $3 million and $35 million as of June 30, 2023 and December 31, 2022, respectively, which are included in margin deposits on our Consolidated Balance Sheets.

Consolidated Balance Sheets Presentation

The following table shows the fair value of the derivatives outstanding on a gross and net basis (in millions) for the derivative instruments that are presented on a net basis on our Consolidated Balance Sheets:

| | | | | | | | | | | | | | |

| | Liquefaction Supply Derivatives |

| | June 30, 2023 | | December 31, 2022 |

| Gross assets | | $ | 68 | | | $ | 57 | |

| Offsetting amounts | | (7) | | | (5) | |

| Net assets | | $ | 61 | | | $ | 52 | |

| | | | |

| Gross liabilities | | $ | (2,325) | | | $ | (3,814) | |

| Offsetting amounts | | 23 | | | 21 | |

| Net liabilities | | $ | (2,302) | | | $ | (3,793) | |

NOTE 8—ACCRUED LIABILITIES

Accrued liabilities consisted of the following (in millions):

| | | | | | | | | | | | | | |

| | |

| | June 30, | | December 31, |

| | 2023 | | 2022 |

| Natural gas purchases | | $ | 241 | | | $ | 1,017 | |

| Interest costs and related debt fees | | 181 | | | 218 | |

| LNG terminal and related pipeline costs | | 105 | | | 137 | |

| Other accrued liabilities | | 29 | | | 6 | |

| Total accrued liabilities | | $ | 556 | | | $ | 1,378 | |

CHENIERE ENERGY PARTNERS, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

NOTE 9—DEBT

Debt consisted of the following (in millions):

| | | | | | | | | | | | | | |

| | |

| | June 30, | | December 31, |

| | 2023 | | 2022 |

| SPL: | | | | |

| Senior Secured Notes: | | | | |

| | | | |

| | | | |

5.75% due 2024 (the “2024 SPL Senior Notes”) (1) | | $ | 1,800 | | | $ | 2,000 | |

5.625% due 2025 | | 2,000 | | | 2,000 | |

5.875% due 2026 | | 1,500 | | | 1,500 | |

5.00% due 2027 | | 1,500 | | | 1,500 | |

4.200% due 2028 | | 1,350 | | | 1,350 | |

4.500% due 2030 | | 2,000 | | | 2,000 | |

4.746% weighted average rate due 2037 | | 1,782 | | | 1,782 | |

| Total SPL Senior Secured Notes | | 11,932 | | | 12,132 | |

Working capital revolving credit and letter of credit reimbursement agreement (the “SPL Working Capital Facility”) | | — | | | — | |

Revolving credit and guaranty agreement (the “SPL Revolving Credit Facility”) | | — | | | — | |

| Total debt - SPL | | 11,932 | | | 12,132 | |

| | | | |

| CQP: | | | | |

| Senior Notes: | | | | |

| | | | |

| | | | |

4.500% due 2029 | | 1,500 | | | 1,500 | |

4.000% due 2031 | | 1,500 | | | 1,500 | |

3.25% due 2032 | | 1,200 | | | 1,200 | |

5.95% due 2033 (the “2033 CQP Senior Notes”) | | 1,400 | | | — | |

| Total CQP Senior Notes | | 5,600 | | | 4,200 | |

Credit facilities (the “CQP Credit Facilities”) | | — | | | — | |

Revolving credit and guaranty agreement (the “CQP Revolving Credit Facility”) | | — | | | — | |

| Total debt - CQP | | 5,600 | | | 4,200 | |

| Total debt | | 17,532 | | | 16,332 | |

| | | | |

| Current portion of long-term debt | | (1,796) | | | — | |

| | | | |

| Long-term portion of unamortized premium, discount and debt issuance costs, net | | (141) | | | (134) | |

| Total long-term debt, net of premium, discount and debt issuance costs | | $ | 15,595 | | | $ | 16,198 | |

(1)In July 2023, SPL redeemed $1.4 billion aggregate principal amount outstanding of the 2024 SPL Senior Notes using contributed proceeds from the 2033 CQP Senior Notes and cash on hand.

CHENIERE ENERGY PARTNERS, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

Credit Facilities

Below is a summary of our credit facilities outstanding as of June 30, 2023 (in millions):

| | | | | | | | | | | | | | | | | |

| | | | SPL Revolving Credit Facility (1) | | CQP Revolving Credit Facility (1) | |

| Total facility size | | | | $ | 1,000 | | | $ | 1,000 | | |

| Less: | | | | | | | |

| Outstanding balance | | | | — | | | — | | |

| | | | | | | |

| Letters of credit issued | | | | 329 | | | — | | |

| Available commitment | | | | $ | 671 | | | $ | 1,000 | | |

| | | | | | | |

| Priority ranking | | | | Senior secured | | Senior unsecured | |

| Interest rate on available balance (2) | | | | SOFR plus credit spread adjustment of 0.1%, plus margin of 1.0% - 1.75% or base rate plus 0.0% - 0.75% | | SOFR plus credit spread adjustment of 0.1%, plus margin of 1.125% - 2.0% or base rate plus 0.125% - 1.0% | |

| | | | | | | |

| Commitment fees on undrawn balance (2) | | | | 0.075% - 0.30% | | 0.10% - 0.30% | |

| Maturity date | | | | June 23, 2028 | | June 23, 2028 | |

(1)In June 2023, we and SPL refinanced and replaced the CQP Credit Facilities and the SPL Working Capital Facility with the CQP Revolving Credit Facility and the SPL Revolving Credit Facility, respectively, resulting in extended maturity dates, revised borrowing capacities, reduced rate of interest and commitment fees applicable thereunder and certain other changes to terms and conditions.

(2)The margin on the interest rate and the commitment fees is subject to change based on the applicable entity’s credit rating.

The refinancing and the replacement of the CQP Credit Facilities and the SPL Working Capital Facility resulted in an aggregate of $1 million of debt extinguishment and modification costs.

Restrictive Debt Covenants

The indentures governing our senior notes and other agreements underlying our debt contain customary terms and events of default and certain covenants that, among other things, may limit us and our restricted subsidiaries’ ability to make certain investments or pay dividends or distributions. SPL is restricted from making distributions under agreements governing its indebtedness generally until, among other requirements, appropriate reserves have been established for debt service using cash or letters of credit and a historical debt service coverage ratio and projected debt service coverage ratio of at least 1.25:1.00 is satisfied.

As of June 30, 2023, we and SPL were in compliance with all covenants related to our respective debt agreements.

Interest Expense

Total interest expense, net of capitalized interest, consisted of the following (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 | | |

| Total interest cost | | $ | 209 | | | $ | 223 | | | $ | 419 | | | $ | 447 | | | |

| Capitalized interest | | (2) | | | (7) | | | (4) | | | (28) | | | |

| Total interest expense, net of capitalized interest | | $ | 207 | | | $ | 216 | | | $ | 415 | | | $ | 419 | | | |

CHENIERE ENERGY PARTNERS, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

Fair Value Disclosures

The following table shows the carrying amount and estimated fair value of our senior notes (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2023 | | December 31, 2022 |

| | | Carrying

Amount | | Estimated

Fair Value (1) | | Carrying

Amount | | Estimated

Fair Value (1) |

| Senior notes | | $ | 17,532 | | | $ | 16,748 | | | $ | 16,332 | | | $ | 15,386 | |

| | | | | | | | |

| | | | | | | | |

(1)As of both June 30, 2023 and December 31, 2022, $1.2 billion of the fair value of our senior notes included an illiquidity adjustment which qualified as a Level 3 fair value measurement. The remainder of our senior notes are classified as Level 2, based on prices derived from trades or indicative bids of the instruments or instruments with similar terms, maturities and credit standing.

The estimated fair value of our credit facilities approximates the principal amount outstanding because the interest rates are variable and reflective of market rates and the debt may be repaid, in full or in part, at any time without penalty.

NOTE 10—REVENUES

The following table represents a disaggregation of revenue earned (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 | | |

| Revenues from contracts with customers | | | | | | | | | | |

| LNG revenues | | $ | 1,415 | | | $ | 2,955 | | | $ | 3,521 | | | $ | 5,443 | | | |

| LNG revenues—affiliate | | 469 | | | 1,135 | | | 1,230 | | | 1,892 | | | |

| LNG revenues—related party | | — | | | 4 | | | — | | | 4 | | | |

| Regasification revenues | | 33 | | | 68 | | | 67 | | | 136 | | | |

| Other revenues | | 16 | | | 15 | | | 32 | | | 30 | | | |

| | | | | | | | | | |

| Total revenues from contracts with customers | | 1,933 | | | 4,177 | | | 4,850 | | | 7,505 | | | |

Net derivative gain (1) | | — | | | 4 | | | — | | | 4 | | | |

| Total revenues | | $ | 1,933 | | | $ | 4,181 | | | $ | 4,850 | | | $ | 7,509 | | | |

Contract Assets and Liabilities

The following table shows our contract assets, net of current expected credit losses, which are classified as other current assets and other non-current assets, net on our Consolidated Balance Sheets (in millions):

| | | | | | | | | | | | | | |

| | |

| | June 30, | | December 31, |

| | 2023 | | 2022 |

| Contract assets, net of current expected credit losses | | $ | 1 | | | $ | 1 | |

The following table reflects the changes in our contract liabilities, which we classify as deferred revenue and other non-current liabilities on our Consolidated Balance Sheets (in millions):

| | | | | | | | |

| | Six Months Ended June 30, 2023 |

| | |

| Deferred revenue, beginning of period | | $ | 144 | |

| Cash received but not yet recognized in revenue | | 123 | |

| Revenue recognized from prior period deferral | | (144) | |

| Deferred revenue, end of period | | $ | 123 | |

CHENIERE ENERGY PARTNERS, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

The following table reflects the changes in our contract liabilities to affiliate, which we classify as deferred revenue—affiliate and other non-current liabilities—affiliate on our Consolidated Balance Sheets (in millions):

| | | | | | | | |

| | Six Months Ended June 30, 2023 |

| | |

| Deferred revenue—affiliate, beginning of period | | $ | 8 | |

| Cash received but not yet recognized in revenue | | 5 | |

| Revenue recognized from prior period deferral | | (8) | |

| Deferred revenue—affiliate, end of period | | $ | 5 | |

Transaction Price Allocated to Future Performance Obligations

Because many of our sales contracts have long-term durations, we are contractually entitled to significant future consideration which we have not yet recognized as revenue. The following table discloses the aggregate amount of the transaction price that is allocated to performance obligations that have not yet been satisfied:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2023 | | December 31, 2022 |

| | Unsatisfied

Transaction Price

(in billions) | | Weighted Average Recognition Timing (years) (1) | | Unsatisfied

Transaction Price

(in billions) | | Weighted Average Recognition Timing (years) (1) |

| LNG revenues | | $ | 49.2 | | | 8 | | $ | 50.8 | | | 8 |

| LNG revenues—affiliate | | 1.6 | | | 2 | | 2.0 | | | 2 |

| Regasification revenues | | 0.7 | | | 3 | | 0.8 | | | 4 |

| Total revenues | | $ | 51.5 | | | | | $ | 53.6 | | | |

(1)The weighted average recognition timing represents an estimate of the number of years during which we shall have recognized half of the unsatisfied transaction price.